PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842490

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842490

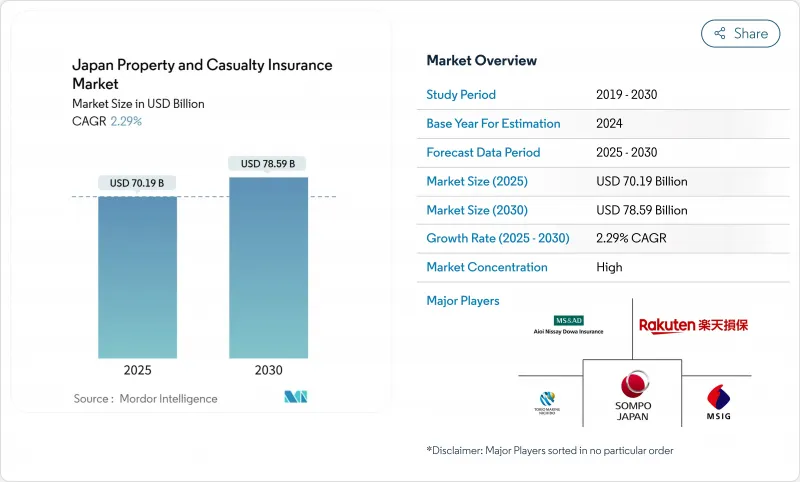

Japan Property And Casualty Insurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Japan property and casualty insurance market reached USD 70.19 billion in 2025 and is forecast to climb to USD 78.59 billion by 2030, translating into a 2.29% CAGR.

Even with modest top-line growth, the sector is recalibrating around three intertwined forces: capital adequacy reforms, climate-linked catastrophe exposure, and rapid digitalization of distribution. The Financial Services Agency's economic-value solvency regime is forcing carriers to mark cross-shareholdings to market, rethink reinsurance layers, and channel surplus capital into technology that sharpens underwriting accuracy.

Heightened typhoon frequency and the 2024 Noto Peninsula earthquake have reignited demand for property and business interruption covers while also accelerating risk-model enhancements that leverage high-resolution hazard data. Meanwhile, younger consumers and budget-conscious SMEs are flocking to direct platforms, compelling incumbents to refine omnichannel playbooks that preserve face-to-face advice for complex products. As a result, the Japanese property and casualty insurance market is transitioning from scale-driven efficiency toward analytics-driven precision and capital-light growth, even as demographic headwinds curb headline premium expansion.

Japan Property And Casualty Insurance Market Trends and Insights

Increasing frequency and severity of typhoon-linked CAT losses

Typhoon-related hazards are redefining baseline catastrophe assumptions in the Japan property and casualty insurance market, even though modern building codes have reduced absolute claim counts. The 2024 Typhoon Shanshan triggered sub-USD 1 billion in paid losses, yet floodplain exposure revealed vulnerabilities that carriers had underpriced. Parallel stresses emerged after the Noto Peninsula earthquake, where insured losses approached USD 6 billion. In response, the FSA has pushed carriers to integrate multi-peril stochastic models and to cede higher layers to global reinsurers, protecting solvency margins while containing rate spikes for households.

The aging population is driving asset-protection demand.

Japan's senior-heavy demographic is reshaping the portfolio mix rather than shrinking it. Older policyholders are clustering in urban condominiums and favoring broader perils coverage, higher limits, and add-on services such as telehealth liability and wellness coaching. Sompo Holdings' 2024 alliance with RIZAP embeds health-monitoring data into property policies, illustrating how insurers can cross-sell preventive services that appeal to affluent retirees. These hybrid offerings lift premiums per policy even as absolute dwelling counts decline outside metro areas.

Prolonged ultra-low interest rates compress investment returns.

Despite incremental Bank of Japan tightening, 10-year yields are still hovering below 1.5%. This trend is diminishing the investment income that once provided a buffer against underwriting volatility. While there is a noticeable shift in portfolios leaning towards overseas credit and alternative assets, the FSA's risk-charge matrix imposes penalties for excessive illiquidity. In a bid to counteract the yield drag, insurers are now emphasizing fee-based revenues, particularly from risk-engineering and claims-management services. However, the challenge lies in the execution, as there's a scarcity of staff equipped with the necessary data science expertise, which could hinder the successful implementation of these strategies.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory capital reforms (FSA ESR, ICS 2.0) push risk transfer.

- SME demand for cyber insurance amid digitalization

- Direct-to-consumer InsurTech is cannibalizing agent margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Auto covers generated 58.5% of the Japan property and casualty insurance market size in 2024 on the back of compulsory liability and stable vehicle stock. Electric vehicles and autonomous driving are redefining liability distribution between drivers, software vendors, and OEMs, prompting provisional policy wording updates. Personal lines remain the volume engine, yet logistics-led e-commerce growth is expanding commercial fleet exposure. At the opposite end of the risk spectrum, marine, aviation & transit insurance, while holding a small base, is on track for a 14.40% CAGR, the sharpest in the Japan property and casualty insurance market because mandatory breach-notification laws and cloud-migration grants leave SMEs little option but to transfer cyber risk. Property, marine, aviation, transit, and liability lines continue to rely on Japan's manufacturing and trading prowess, though climatic volatility and ESG-driven governance oversight are nudging average indemnity values higher.

Second-order effects cascade through actuarial pricing. EV uptake lowers the frequency of minor collisions but spikes the average severity of battery-related claims, testing traditional loss triangles. Additionally, ransomware attacks that paralyze supply chains carry knock-on effects for contingent business interruption covers. As these exposures evolve, reinsurers are demanding more granular telematics and cybersecurity metrics before extending aggregate capacity, embedding data-sharing routines that further transform underwriting workflows across the Japan property and casualty insurance market.

The agency network remains pivotal, yet its 44.2% slice of the Japan property and casualty insurance market share is inching downward every renewal cycle. The unwinding of keiretsu equity ties is fraying long-standing loyalties and opening space for digitally enabled independent brokers. Mitsui Sumitomo Card's 2024 purchase of 70% of Nexsol marked a shift toward multi-carrier professional agencies that wield CRM analytics to upsell multiline packages. In contrast, direct online channels, growing at 13.43% CAGR, exploit lower acquisition costs to attract price-sensitive young drivers and micro-business owners. Bancassurance leverages Japan's concentrated banking network to cross-sell, while affinity schemes with e-commerce platforms foreshadow an ecosystem where insurance is bought, not sold, inside non-insurance journeys.

Operational economics accentuate the divide. Carriers pay agents an average of 12% commission on auto lines; direct portals slash this to 3% equivalent marketing spend. Yet complex risks, from earthquake-exposed condominiums to multinational casualty programs, still rely on human expertise. The emerging hybrid play stitches robo-advice for simple products with human risk consultants for high-severity exposures, a blend designed to preserve customer satisfaction while lowering unit costs across the Japan property and casualty insurance market.

The Japan Property and Casualty Insurance Market is Segmented Into Insurance Type (Property Insurance (Residential, Commercial, and More), Auto Insurance (Personal and Commercial Auto), Liability Insurance (Marine, Aviation and Transit, and More)), Distribution Channel (Direct, Agency Network, and More), End User (Individuals, Smes, Large Corporations, and More), and Region. The Market Forecasts are Provided in Value (USD).

List of Companies Covered in this Report:

- Tokio Marine & Nichido Fire Insurance Co., Ltd.

- Sompo Japan Insurance Inc.

- Mitsui Sumitomo Insurance Co., Ltd.

- Aioi Nissay Dowa Insurance Co., Ltd.

- Rakuten General Insurance Co., Ltd.

- Saison Automobile & Fire Insurance Co., Ltd.

- SECOM General Insurance Co., Ltd.

- Hitachi Capital Insurance Corp.

- Nisshin Fire & Marine Insurance Co., Ltd.

- Kyoei Fire & Marine Insurance Co., Ltd.

- Mitsui Direct General Insurance Co., Ltd.

- Sony Assurance Inc.

- SBI Insurance Co., Ltd.

- AIG General Insurance Company Ltd.

- JA Kyosai (National Mutual Insurance Federation)

- Zurich Insurance Company Ltd. (Japan)

- Chubb Insurance Japan Ltd.

- Sompo Japan DC1 Digital

- Tokio Marine dR Co.

- MS&AD InterRisk Research & Consulting

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing frequency and severity of typhoon-linked CAT losses

- 4.2.2 The aging population is driving asset-protection demand.

- 4.2.3 Regulatory capital reforms (FSA ESR, ICS 2.0) pushing risk transfer

- 4.2.4 Rising motorisation & EV uptake

- 4.2.5 SME demand for cyber insurance amid digitalisation (under-the-radar)

- 4.2.6 Embedded insurance in smart-home / e-commerce ecosystems (under-the-radar)

- 4.3 Market Restraints

- 4.3.1 Prolonged ultra-low interest rates compress investment returns

- 4.3.2 Saturated market fueling price competition

- 4.3.3 Rural depopulation shrinking property portfolios (under-the-radar)

- 4.3.4 Direct to consumer InsurTech cannibalising agent margins (under-the-radar)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Digitalisation & InsurTech Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD Bn)

- 5.1 Segmentation by Insurance Type

- 5.1.1 Property Insurance

- 5.1.1.1 Residential Property

- 5.1.1.2 Commercial & Industrial Property

- 5.1.2 Auto Insurance

- 5.1.2.1 Personal Auto

- 5.1.2.2 Commercial Auto

- 5.1.3 Liability Insurance

- 5.1.4 Marine, Aviation & Transit Insurance

- 5.1.5 Personal Accident & Miscellaneous Casualty

- 5.1.6 Other P&C Lines

- 5.1.1 Property Insurance

- 5.2 Segmentation by Distribution Channel

- 5.2.1 Direct (Online & Call-centres)

- 5.2.2 Agency Network

- 5.2.3 Bancassurance

- 5.2.4 Brokers

- 5.2.5 Affinity & Embedded Partnerships

- 5.2.6 Other Channels

- 5.3 Segmentation by End User

- 5.3.1 Individuals

- 5.3.2 SMEs

- 5.3.3 Large Corporations

- 5.3.4 Government & Public Sector

- 5.4 Segmentation by Region

- 5.4.1 Hokkaido

- 5.4.2 Tohoku

- 5.4.3 Kanto

- 5.4.4 Chubu

- 5.4.5 Kansai

- 5.4.6 Chugoku

- 5.4.7 Shikoku

- 5.4.8 Kyushu-Okinawa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Tokio Marine & Nichido Fire Insurance Co., Ltd.

- 6.4.2 Sompo Japan Insurance Inc.

- 6.4.3 Mitsui Sumitomo Insurance Co., Ltd.

- 6.4.4 Aioi Nissay Dowa Insurance Co., Ltd.

- 6.4.5 Rakuten General Insurance Co., Ltd.

- 6.4.6 Saison Automobile & Fire Insurance Co., Ltd.

- 6.4.7 SECOM General Insurance Co., Ltd.

- 6.4.8 Hitachi Capital Insurance Corp.

- 6.4.9 Nisshin Fire & Marine Insurance Co., Ltd.

- 6.4.10 Kyoei Fire & Marine Insurance Co., Ltd.

- 6.4.11 Mitsui Direct General Insurance Co., Ltd.

- 6.4.12 Sony Assurance Inc.

- 6.4.13 SBI Insurance Co., Ltd.

- 6.4.14 AIG General Insurance Company Ltd.

- 6.4.15 JA Kyosai (National Mutual Insurance Federation)

- 6.4.16 Zurich Insurance Company Ltd. (Japan)

- 6.4.17 Chubb Insurance Japan Ltd.

- 6.4.18 Sompo Japan DC1 Digital

- 6.4.19 Tokio Marine dR Co.

- 6.4.20 MS&AD InterRisk Research & Consulting

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment