PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842586

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842586

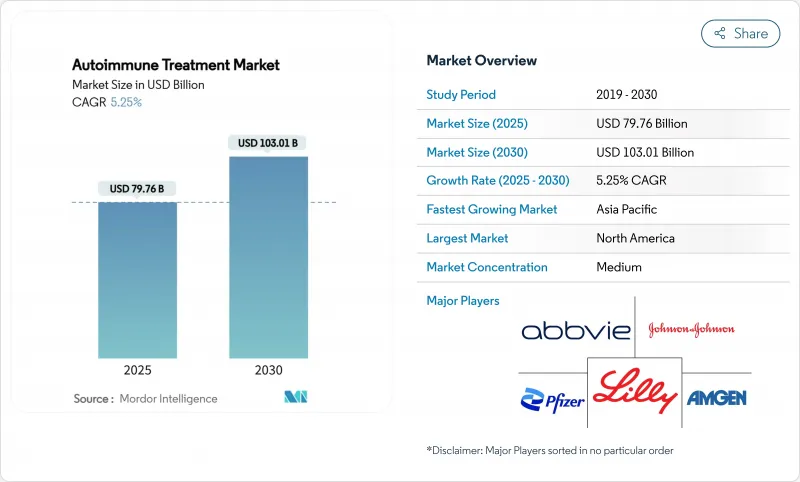

Autoimmune Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The autoimmune disease therapeutics market reached USD 79.76 billion in 2025 and is on track to hit USD 103.01 billion by 2030, advancing at a 5.25% CAGR.

Rising early-onset incidence, rapid biosimilar uptake, and accelerated approvals of cell-based therapies are shifting the treatment model from broad immunosuppression to precision intervention. Breakthrough CAR-T applications in lupus and multiple sclerosis, combined with payer acceptance of outcome-based pricing, signal a reset in value perception across the autoimmune disease therapeutics market. At the same time, digital therapeutics tighten adherence and lower relapse rates, adding a behavioral dimension to disease control. Regional dynamics remain pronounced; North America accounts for the largest revenue pool, while Asia-Pacific delivers the fastest incremental growth on the back of expanding specialty-care infrastructure.

Global Autoimmune Treatment Market Trends and Insights

Age-standardised rise in early-onset autoimmune incidence

Incidence among individuals aged 15-39 has climbed across rheumatoid arthritis, inflammatory bowel disease, and multiple sclerosis, extending lifetime therapy needs and magnifying the long-run value of safer chronic regimens. Screening programs now target adolescents, while payers prioritise treatments with proven durability. Manufacturers positioned with low-toxicity mechanisms gain larger cumulative revenue because patients initiate therapy earlier. The trend enlarges the addressable population for next-generation biologics and cell therapies, pushing the autoimmune disease therapeutics market toward higher long-term volumes.

Biosimilar wave lowering therapy cost-barriers

Adalimumab biosimilars seized 85% of dispensed volume within 18 months of launch, yielding projected system savings of USD 38.4 billion through 2025. Savings free payer budgets for novel assets such as bispecific antibodies or CAR-T constructs. Originators respond with value-added formulations and service packages, raising competitive intensity. Emerging markets that once relied on steroids now integrate advanced biologics, widening global penetration of the autoimmune disease therapeutics market.

Payer budget fatigue amid oncology biologic spend

Median oncology CAR-T invoice prices exceed USD 400,000 per course, diverting funds from chronic autoimmune lines. US and EU formularies tighten prior-authorisation criteria for high-cost biologics, introducing step-therapy hurdles that slow uptake. Manufacturers counter with outcomes-based rebates, but near-term volume can lag forecasts, shaving growth from the autoimmune disease therapeutics market.

Other drivers and restraints analyzed in the detailed report include:

- Oral biologics achieving Phase III read-outs

- Digital-therapeutic-plus-drug adherence programs

- Slow guideline updates for novel MOAs in emerging markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The autoimmune disease therapeutics market allocates 47.35% of 2024 revenue to rheumatic disorders such as rheumatoid and psoriatic arthritis, supported by clear diagnostic criteria and long clinical experience. Disease-modifying antirheumatic drugs, TNF-a inhibitors, and JAK inhibitors sustain joint integrity, making rheumatology a predictable revenue pillar. Yet inflammatory bowel disease grows at an 8.25% CAGR through 2030, outpacing all other indications as biologics and novel gut-targeted small molecules gain traction. Positive long-term remission data and expanded reimbursement widen clinical adoption. The autoimmune disease market size for IBD is projected to reach USD 22 billion by 2030, reflecting sustained double-digit uptake in Asia-Pacific urban centres. CAR-T investigations in refractory systemic lupus add a breakthrough narrative, as Adicet Bio's ADI-100 won FDA Fast Track in February 2025. Emerging sub-segments such as autoimmune hepatitis and myasthenia gravis remain niche, yet they underscore continuous broadening of the autoimmune disease therapeutics market.

A parallel shift emerges in multiple sclerosis, where high-efficacy B-cell depleters prolong relapse-free intervals. Although legacy interferon regimens persist, payer preference tilts toward agents with MRI-confirmed neuroprotection. Advanced imaging and blood-based biomarkers refine cohort selection, creating a foundation for precision dosing. These trends collectively stabilise overall indication diversity, cushioning revenue even when single lines face biosimilar erosion. As a result, the autoimmune disease therapeutics market sustains balanced exposure across high-volume and high-growth conditions.

The Autoimmune Treatment Market Report is Segmented by Indication (Rheumatic Disease, Type 1 Diabetes, Multiple Sclerosis, Inflammatory Bowel Disease, and More), Drug Class (Anti-Inflammatory, Anti-Hyperglycemics, Interferons, and More), Sales Channel (Hospital Pharmacy, Online, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America delivered 42.82% of global revenue in 2024, supported by rapid diffusion of innovative modes of action, favourable reimbursement, and a dense clinical-trial ecosystem. The region's flexible accelerated-approval frameworks placed nine autoimmune biologics on the market in the past two years, cementing first-mover advantage. Breakthrough CAR-T programs progress swiftly under FDA Fast Track designations, catalysing investor capital toward next-wave immunomodulation. Digital-health reimbursement parity laws encourage co-prescription of behaviour-change apps, reinforcing medication adherence and lowering relapse-associated costs.

Europe maintains balanced growth as price-volume agreements offset rising treatment intensity. The European Medicines Agency's PRIME pathway shortens approval timelines for high-need assets such as bispecific antibodies, yet national health systems still impose budget caps that lengthen access negotiations. Biosimilar penetration tempers spending, freeing capacity for advanced options. Cross-country consortiums now aggregate demand for niche autoimmune indications, enhancing negotiating leverage and smoothing supply continuity.

Asia-Pacific stands out with an 8.61% CAGR through 2030, driven by demographic expansion, urbanisation, and regulatory harmonisation. China's volume-based procurement slashes biologic prices, yet adds clauses for originators to supply real-world data, fostering evidence-led adoption. Japan's early implementation of cell-processing standards underpins regional CAR-T trials beyond oncology. India and South-East Asia progress slower due to reimbursement fragmentation, but public-private partnerships invest in biologic manufacturing parks that promise local supply resilience. By 2030 the autoimmune disease therapeutics market in Asia-Pacific is forecast to reach USD 28 billion, providing a vital counterweight to mature regions.

South America and the Middle East & Africa contribute smaller revenue, yet steady health-budget growth and guideline modernisation improve uptake of biosimilars and select originator biologics. Strategies that bundle drug supply with physician-training modules accelerate diffusion in these price-sensitive settings. As a result, the global autoimmune disease therapeutics market achieves broader geographic balance, lowering dependence on single-region performance.

- Abbvie

- Amgen

- Johnson & Johnson

- Eli Lilly and Company

- Pfizer

- Roche

- AstraZeneca

- Bristol-Myers Squibb

- Lupin

- GlaxoSmithKline

- Novartis Inc

- Sanofi

- Biocon

- CSL Behring

- Grifols

- Takeda Pharmaceuticals

- UCB

- Regeneron

- Incyte

- Horizon Therapeutics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Age-Standardised Rise In Early-Onset Autoimmune Incidence

- 4.2.2 Biosimilar Wave Lowering Therapy Cost-Barriers

- 4.2.3 Oral Biologics Achieving Phase III Read-Outs

- 4.2.4 Digital-Therapeutic-Plus-Drug Adherence Programs

- 4.2.5 Bispecific Antibody Approvals For Multi-Pathway Control

- 4.3 Market Restraints

- 4.3.1 Payer Budget Fatigue Amid Oncology Biologic Spend

- 4.3.2 Slow Guideline Updates For Novel Moas In Emerging Markets

- 4.3.3 Biomanufacturing Capacity Crunch For Cell-Based Therapies

- 4.4 Porter's Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Indication

- 5.1.1 Rheumatic Disease

- 5.1.2 Type 1 Diabetes

- 5.1.3 Multiple Sclerosis

- 5.1.4 Inflammatory Bowel Disease

- 5.1.5 Other Indications

- 5.2 By Drug Class

- 5.2.1 Anti-Inflammatory

- 5.2.2 Anti-Hyperglycemics

- 5.2.3 NSAIDs

- 5.2.4 Interferons

- 5.2.5 Other Drugs

- 5.3 By Sales Channel

- 5.3.1 Hospital Pharmacy

- 5.3.2 Online

- 5.3.3 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 AbbVie Inc

- 6.3.2 Amgen Inc

- 6.3.3 Johnson & Johnson (Janssen)

- 6.3.4 Eli Lilly & Co.

- 6.3.5 Pfizer Inc

- 6.3.6 F. Hoffmann-La Roche

- 6.3.7 AstraZeneca plc

- 6.3.8 Bristol-Myers Squibb

- 6.3.9 Lupin Ltd

- 6.3.10 GSK plc

- 6.3.11 Novartis Inc

- 6.3.12 Sanofi SA

- 6.3.13 Biocon

- 6.3.14 CSL Behring

- 6.3.15 Grifols

- 6.3.16 Takeda

- 6.3.17 UCB Pharma

- 6.3.18 Regeneron

- 6.3.19 Incyte

- 6.3.20 Horizon Therapeutics

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment