PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842707

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842707

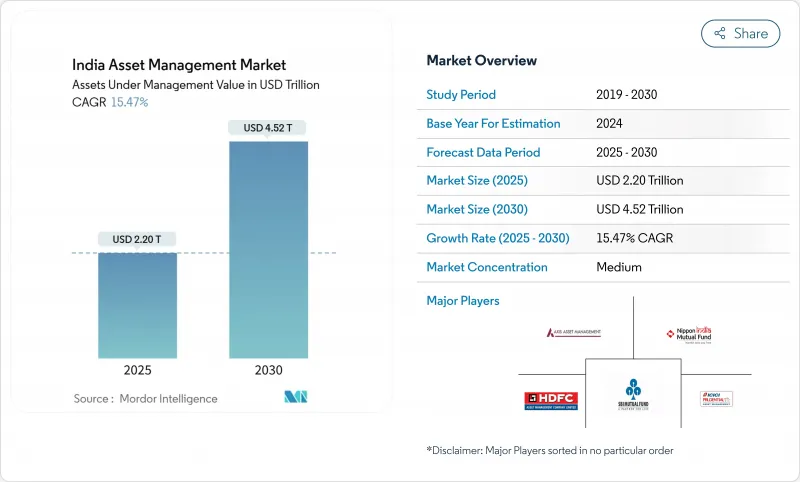

India Asset Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The India asset management market's current assets under management stand at USD 2.20 trillion in 2025 and are projected to reach USD 4.52 trillion by 2030, reflecting a robust 15.47% CAGR.

The India asset management market is benefiting from the spread of systematic investment plans, pension reform-driven institutional inflows, and digital-first distribution that reaches investors beyond the top metropolitan cities. Regulatory clarity from SEBI and the International Financial Services Centres Authority (IFSCA) is drawing both domestic and cross-border managers, while tokenisation pilots in GIFT City signal the next wave of product innovation. Fee compression is pushing firms toward scale, alternatives, and data-driven advice, yet rising household financial assets and the tax regime shift continue to enlarge the retail wallet. Portfolio diversification by corporate treasuries and insurance companies offers another durable growth vector for the India asset management market.

India Asset Management Market Trends and Insights

Retail SIP boom & digital on-boarding

Monthly SIP contributions climbed significantly to INR 26,632 crore by December 2024, giving asset managers a predictable cash pipeline that cushions foreign outflows. Smartphone penetration and Aadhaar-based e-KYC have shrunk account-opening time from weeks to minutes, enabling first-time buyers across smaller cities. SIP assets now represent a considerable share of industry AUM, highlighting structural stickiness that anchors the India asset management market during volatile cycles. Rising disposable income and the simplified personal-income tax regime support projections of INR 40,000 crore in monthly inflows within two years. AMFI investor awareness campaigns reinforce this momentum.

Surge in alternatives (AIF & PMS)

Total AIF commitments have grown significantly in recent years, driven by Category II private equity and private credit strategies that offer stronger risk-adjusted returns compared to public markets. Category III funds, although smaller, demonstrate superior capital churn, while Category I infrastructure vehicles align with national capex priorities. Average AIF holding periods of six-plus years elevate liquidity risk, yet high-net-worth investors accept these constraints for potential alpha. Regulatory sandboxes in GIFT City lower setup frictions, positioning the India asset management market for deeper alternative penetration.

Fee compression from passives

Low-cost index funds and ETFs captured INR 33,000 crore in Q1 2025 inflows, while active debt funds saw INR 8,000 crore outflows. Expense ratios in broad-market equity index funds have fallen below 10 basis points, intensifying pressure on active managers to produce persistent alpha. Global precedents of 60% fee declines over two decades serve as a cautionary benchmark. As passives reach 17% of AUM, managers must pivot toward factor, thematic, or private-market niches to defend margins within the India asset management market.

Other drivers and restraints analyzed in the detailed report include:

- Pension reforms driving NPS inflows

- GIFT City cross-border fund passporting

- Volatility & rich equity valuations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Equity retained a sizeable 47.9% slice of the India asset management market in 2024, energised by the SIP engine and long-horizon retail savings. Despite this dominance, alternatives are sprinting ahead with a 16.85% CAGR, signalling an appetite for differentiated risk-return profiles. Family offices and corporate treasuries are lifting allocations to private equity, private credit, and real-estate investment trusts, chasing low-correlation yields. Fixed income allocations are underweight due to rate-cycle uncertainty, while gold and commodity funds enjoy tactical inflows as inflation hedges. Tokenisation pilots may soon allow fractionalisation of alternative pools, lowering ticket sizes for accredited investors and adding depth to the India asset management market.

The bifurcation widens: retail investors stick with low-cost diversified equity funds using SIPs, whereas wealthy cohorts leverage bespoke AIF structures. Regulatory guardrails limiting leverage and mandating portfolio transparency in Category III funds promote risk management without stifling innovation. As infrastructure remains a national priority, Category I AIFs bridge public spending gaps, establishing a policy-capital feedback loop. Collectively, alternatives are forecast to form 15% of the India asset management market size for this asset class by 2030, compressing the equity share by a modest two percentage points while broadening overall product choice.

Banks owned 56.5% of the India asset management market size in 2024 on the back of branch distribution and bundled retail relationships. Yet registered investment advisers and specialised wealth firms are expanding at 17.27% CAGR, harnessing transparent fee-only models and tailored asset allocation. Banks' universal-banking advantage meets competition from discount brokers that convert trading clients into long-term fund investors via goal-based nudges. Meanwhile, family offices outsource product due diligence to boutique advisory shops that promise open-architecture selection. Consolidation has begun: HSBC's acquisition of L&T Mutual Fund reflects global entrants seeking instant scale. Six fresh licence approvals for 2025-including Jio BlackRock and Angel One-will drag pricing lower, even as technology investment rises. Diversification across advice channels ensures the India asset management market remains contestable rather than monopolistic.

Digital advice platforms push hyper-personalised nudges through data analytics, eroding cross-sell inertia enjoyed by incumbents. Banks respond with robotic process automation in back-office functions and partnership models that integrate fintech interfaces while retaining custody. Broker-dealers hover in the middle, converting order-flow income into advisory subscriptions. Over the next five years, the top 10 firms may still hold half of the assets, but the long tail of niche firms and digital pure-plays will collectively enlarge the pie rather than simply cannibalise bank share.

The India Asset Management Market is Segmented by Asset Class (Equity, Fixed Income, Alternative Assets, and Other Asset Classes), by Firm Type (Broker-Dealers, Banks, Wealth Advisory Firms, and Other Firm Types), by Mode of Advisory (Human Advisory and Robo-Advisory), by Client Type (Retail and Institutional), and by Management Source (Offshore and Onshore). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- SBI Mutual Fund

- ICICI Prudential AMC

- HDFC AMC

- Nippon India AMC

- Axis AMC

- UTI AMC

- Mirae Asset MF

- Franklin Templeton India

- Kotak AMC

- Aditya Birla Sun Life AMC

- Tata AMC

- Motilal Oswal AMC & PMS

- Edelweiss AMC & AIF

- Invesco India

- Canara Robeco MF

- HSBC AMC India

- Groww Mutual Fund

- Bajaj Finserv MF

- WhiteOak Capital MF & PMS

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Retail SIP boom & digital on-boarding

- 4.2.2 Surge in Alternatives (AIF & PMS)

- 4.2.3 Pension reforms driving NPS inflows

- 4.2.4 GIFT City cross-border fund passporting (under-the-radar)

- 4.2.5 Tokenized funds & DLT-enabled operations (under-the-radar)

- 4.2.6 SEBI risk-based supervision lowers compliance cost (under-the-radar)

- 4.3 Market Restraints

- 4.3.1 Fee compression from passives

- 4.3.2 Volatility & rich equity valuations

- 4.3.3 Analytics/AI talent shortage (under-the-radar)

- 4.3.4 Liquidity mismatch in privately-placed alts (under-the-radar)

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Asset Class

- 5.1.1 Equity

- 5.1.2 Fixed Income

- 5.1.3 Alternative Assets

- 5.1.4 Other Asset Classes

- 5.2 By Firm Type

- 5.2.1 Broker-Dealers

- 5.2.2 Banks

- 5.2.3 Wealth Advisory Firms

- 5.2.4 Other Firm Types

- 5.3 By Mode of Advisory

- 5.3.1 Human Advisory

- 5.3.2 Robo-Advisory

- 5.4 By Client Type

- 5.4.1 Retail

- 5.4.2 Institutional

- 5.5 By Management Source

- 5.5.1 Offshore

- 5.5.2 Onshore

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 SBI Mutual Fund

- 6.4.2 ICICI Prudential AMC

- 6.4.3 HDFC AMC

- 6.4.4 Nippon India AMC

- 6.4.5 Axis AMC

- 6.4.6 UTI AMC

- 6.4.7 Mirae Asset MF

- 6.4.8 Franklin Templeton India

- 6.4.9 Kotak AMC

- 6.4.10 Aditya Birla Sun Life AMC

- 6.4.11 Tata AMC

- 6.4.12 Motilal Oswal AMC & PMS

- 6.4.13 Edelweiss AMC & AIF

- 6.4.14 Invesco India

- 6.4.15 Canara Robeco MF

- 6.4.16 HSBC AMC India

- 6.4.17 Groww Mutual Fund

- 6.4.18 Bajaj Finserv MF

- 6.4.19 WhiteOak Capital MF & PMS

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment