PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844454

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844454

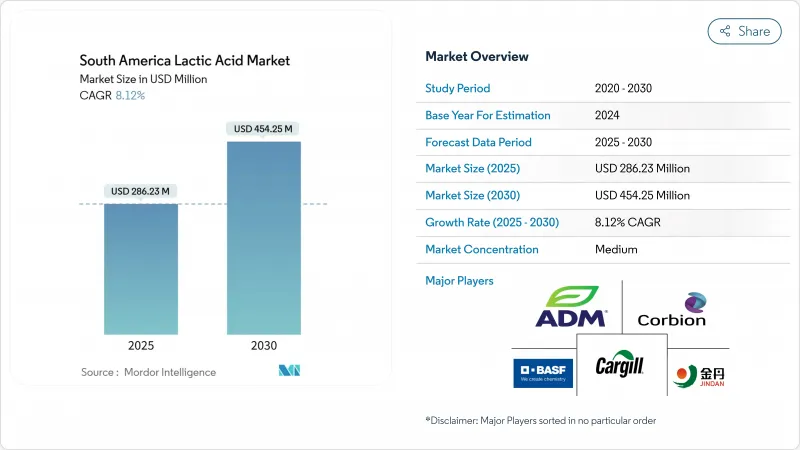

South America Lactic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

Projected to grow from a valuation of USD 286.23 million in 2025 to USD 454.25 million by 2030, the South America lactic acid market size is set to expand at a CAGR of 8.12%.

This surge is largely driven by a rising demand for bio-based chemicals, bolstered by the region's rich reserves of sugarcane and corn feedstocks. Additionally, Brazil's supportive energy and industrial policies play a pivotal role. The food processing sector is gravitating towards clean-label formulations, while the pharmaceutical and personal care industries are broadening their application spectrum, fueling the market's growth. Geographical nuances significantly influence the market dynamics. Brazil's integrated sugarcane complex stands as the backbone of the regional supply, guaranteeing a consistent feedstock. Colombia is rapidly emerging as the quickest-growing consumer market, spurred by heightened demand across diverse sectors. In contrast, Argentina and Chile are honing in on premium-priced niches, catering to specific applications. The competitive arena is moderately intense, presenting avenues for both regional entities and global corporations to stake their claim. Companies are zeroing in on high-value grades and applications, aiming to solidify their presence in this burgeoning market.

South America Lactic Acid Market Trends and Insights

Growth of plant-based food processing in brazil boosting demand for natural acidulants

Brazil's plant-based food sector is witnessing significant regulatory advancements, which are expected to drive the adoption of natural acidulants in manufacturing processes. Regulatory bodies such as ANVISA and MAPA are actively refining their frameworks for plant-based products. These updates aim to eliminate consumer confusion while establishing clear minimum identity and quality standards. This regulatory shift is fostering a standardized demand for natural preservatives, with lactic acid emerging as a key solution. The proposed regulations mandate clear labeling to distinguish plant-based products from animal-based ones, encouraging manufacturers to adopt natural acidulants that align with clean-label and sustainability-focused strategies. Processing facilities are increasingly integrating lactic acid into their operations, leveraging its benefits for pH control and shelf-life extension across various applications, including plant-based meat alternatives, dairy substitutes, and fermented products. The sector's emphasis on innovation, particularly in developing plant-based and clean-label offerings, is further fueling the demand for natural acidulants. These ingredients not only comply with evolving regulatory requirements but also meet growing consumer expectations for sustainable and transparent product formulations. This dual alignment with regulatory and market trends positions natural acidulants as essential components in the continued growth of Brazil's plant-based food sector.

Rising consumer preference for clean-label preservatives in bakery segment

The clean-label movement is driving significant changes in South American bakery formulations as consumers increasingly demand transparency and natural ingredients over synthetic alternatives. Organic acids, particularly lactic acid, are emerging as key components due to their dual functionality. Lactic acid effectively combats foodborne pathogens such as E. coli and Salmonella through its dual mechanism of pH reduction and direct antimicrobial action, all while maintaining the sensory quality of baked goods. This capability enables formulators to replace synthetic preservatives without compromising food safety standards. In response to this growing demand, Brazilian bakery manufacturers are adopting lactic acid-based solutions that not only extend shelf life but also align with clean-label claims. Beyond preservation, lactic acid derivatives, such as PURACAL(R) PP, are being utilized to reduce acrylamide formation-a harmful compound generated during baking processes. This additional functionality highlights the versatility of lactic acid, making it a strategic ingredient for bakery manufacturers. By addressing consumer preferences for natural ingredients and adhering to stringent food safety regulations, lactic acid is playing a pivotal role in reshaping the bakery market in South America.

Volatility in feedstock (corn, sugarcane) prices impacting production margins

South American lactic acid producers are facing significant margin pressures due to feedstock price instability, driven by heightened volatility in agricultural commodity markets influenced by climate and policy factors. In Brazil, sugarcane production remains under strain from adverse weather conditions. The 2025/26 harvest is projected to decline by 2% compared to the previous season, despite a stable cultivation area. This decline is attributed to a 2.3% drop in productivity caused by drought conditions in key producing regions, which is driving up feedstock costs for manufacturers reliant on sugarcane-derived substrates. Simultaneously, the rapid expansion of corn ethanol production is intensifying competition for corn feedstocks. Brazil's corn consumption is expected to reach 3,464 million bushels in 2024/25, as 25 operational ethanol plants compete with traditional feed and food applications. This dual challenge of reduced sugarcane availability and heightened corn demand has pushed domestic feedstock prices to their highest levels since 2022. To navigate these pressures, lactic acid producers are optimizing their feedstock sourcing strategies and actively exploring alternative substrate options. These measures are critical for maintaining competitive positioning in a market increasingly shaped by supply chain disruptions and rising input costs.

Other drivers and restraints analyzed in the detailed report include:

- Government incentives for sugarcane bio-based chemicals production in brazil

- Increasing utilization of lactic acid in livestock feed acidifiers to combat antibiotic ban

- Limited availability of food-grade fermentation infrastructure outside brazil

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, natural lactic acid commands a dominant 92.04% market share and is set to expand at a robust CAGR of 8.52% through 2030. This growth is largely driven by Brazil's rich agricultural feedstock and a rising consumer appetite for bio-based ingredients. Brazil's sophisticated sugarcane processing infrastructure, easily adaptable for biochemical production, provides a notable cost edge over synthetic counterparts. Furthermore, the Brazilian Ministry of Agriculture's stringent safety and efficacy standards for natural feed ingredients bolster the adoption of naturally derived lactic acid in animal nutrition. The recent enactment of Law #15,070/2024 further fortifies the natural segment, instituting rigorous quality benchmarks for microbial and biotechnological products in agriculture and livestock, thereby ensuring product consistency and market expansion.

Moreover, bolstered by government initiatives championing bio-based chemical production and the surging use of natural lactic acid in clean-label food products, the market is witnessing significant growth. In 2023, Brazil's Energy Research Office highlighted a record sugarcane processing volume of 713 million tons, buoyed by both sugarcane and corn-based ethanol production. This achievement guarantees a reliable feedstock supply for natural lactic acid producers. Additionally, the Development Bank of Latin America's commitment to sustainable development and enhancing environmental quality further propels the preference for natural chemicals over synthetic ones across diverse industrial applications.

In 2024, liquid lactic acid secures a significant 60.11% share of the market, driven by its operational efficiency in large-scale food processing and its seamless incorporation into beverage formulations. The liquid form offers ease of handling and precise dosing, which are critical for applications such as dairy acidification, meat preservation, and beverage pH control. These attributes make it indispensable in South America's expansive food processing industry. Additionally, Argentina's stringent food code, which outlines specific standards for dairy products and food additives, has fostered a standardized demand for liquid acidulants. These acidulants integrate effortlessly into existing processing systems, further solidifying their market dominance.

The powder and granules segment is poised for rapid growth, with a projected CAGR of 9.34% through 2030. This growth is fueled by the increasing preference for shelf-stable formulations in dry mix applications and export markets, where concentrated forms reduce transportation costs. The segment also benefits from industrial applications, particularly in water treatment. The World Bank has highlighted the need for significant investments in Latin America's wastewater infrastructure, estimating USD 80 billion for sewerage and USD 33 billion for wastewater treatment between 2010 and 2030. These investments create opportunities for powder forms in industrial water treatment processes. Moreover, the powder segment is gaining traction in the animal feed industry, where its dry mixing capabilities and extended shelf life provide operational advantages. These features are particularly valuable for feed manufacturers catering to the region's growing livestock sector, further driving the segment's expansion.

The South America Lactic Acid Market Report Segments the Industry by Source (Natural and Synthetic); Form (Liquid and Solid); Grade (Food Grade, Industrial Grade, Pharmaceutical Grade, and Cosmetic Grade); and Application (Food and Beverages, Personal Care and Cosmetics, Pharmaceutical, Animal Feed, and Industrial and Chemical Processing), and Geography (Brazil and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Corbion NV

- Cargill, Incorporated

- BASF SE

- Archer-Daniels-Midland Company

- Galactic Holdings, Inc

- Henan Jindan Lactic Acid Co., Ltd.

- Jungbunzlauer Suisse AG, Basel

- Arshine Food Additives Co., Ltd.

- Cellulac plc,

- Brenntag AG

- Dsm-Firmenich AG

- Futerro SA

- Univar Solutions LLC.

- Shenzhen Esun Industrial Co., Ltd.

- BBCA Group Corporation

- International Flavors & Fragrances (Danisco)

- Natureworks LLC

- Musashino Chemical Laboratory, Ltd.

- DuPont de Nemours, Inc.

- Tokyo Chemical Industry Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth of plant-based food processing in brazil boosting demand for natural acidulants

- 4.2.2 Rising consumer preference for clean-label preservatives in bakery segment

- 4.2.3 Government incentives for sugarcane bio-based chemicals production in brazil

- 4.2.4 Increasing utilization of lactic acid in livestock feed acidifiers to combat antibiotic ban

- 4.2.5 Pharmaceutical companies adopting lactic acid for topical drug formulations in dermatology

- 4.2.6 Rising demand for fermented dairy alternatives in urban south american markets

- 4.3 Market Restraints

- 4.3.1 Volatility in feedstock (corn, sugarcane) prices impacting production margins

- 4.3.2 Limited availability of food-grade fermentation infrastructure outside brazil

- 4.3.3 Stringent effluent disposal norms increasing operating costs in andean countries

- 4.3.4 Competition from cheaper imported acidulants such as citric acid from asia

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Source

- 5.1.1 Natural

- 5.1.2 Synthetic

- 5.2 By Form

- 5.2.1 Liquid

- 5.2.2 Solid (Powder/Granules)

- 5.3 By Grade

- 5.3.1 Food Grade

- 5.3.2 Industrial Grade

- 5.3.3 Pharmaceutical Grade

- 5.3.4 Cosmetic Grade

- 5.4 By Application

- 5.4.1 Food and Beverages

- 5.4.1.1 Bakery

- 5.4.1.2 Confectionery

- 5.4.1.3 Dairy Products

- 5.4.1.4 Meat, Poultry and, Seafood

- 5.4.1.5 Beverages

- 5.4.1.6 Other Food and Beverage Applications

- 5.4.2 Personal Care and Cosmetics

- 5.4.3 Pharmaceutical

- 5.4.4 Animal Feed

- 5.4.5 Industrial and Chemical Processing

- 5.4.1 Food and Beverages

- 5.5 By Geography

- 5.5.1 Brazil

- 5.5.2 Argentina

- 5.5.3 Colombia

- 5.5.4 Chile

- 5.5.5 Peru

- 5.5.6 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Corbion NV

- 6.4.2 Cargill, Incorporated

- 6.4.3 BASF SE

- 6.4.4 Archer-Daniels-Midland Company

- 6.4.5 Galactic Holdings, Inc

- 6.4.6 Henan Jindan Lactic Acid Co., Ltd.

- 6.4.7 Jungbunzlauer Suisse AG, Basel

- 6.4.8 Arshine Food Additives Co., Ltd.

- 6.4.9 Cellulac plc,

- 6.4.10 Brenntag AG

- 6.4.11 Dsm-Firmenich AG

- 6.4.12 Futerro SA

- 6.4.13 Univar Solutions LLC.

- 6.4.14 Shenzhen Esun Industrial Co., Ltd.

- 6.4.15 BBCA Group Corporation

- 6.4.16 International Flavors & Fragrances (Danisco)

- 6.4.17 Natureworks LLC

- 6.4.18 Musashino Chemical Laboratory, Ltd.

- 6.4.19 DuPont de Nemours, Inc.

- 6.4.20 Tokyo Chemical Industry Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK