PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851432

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851432

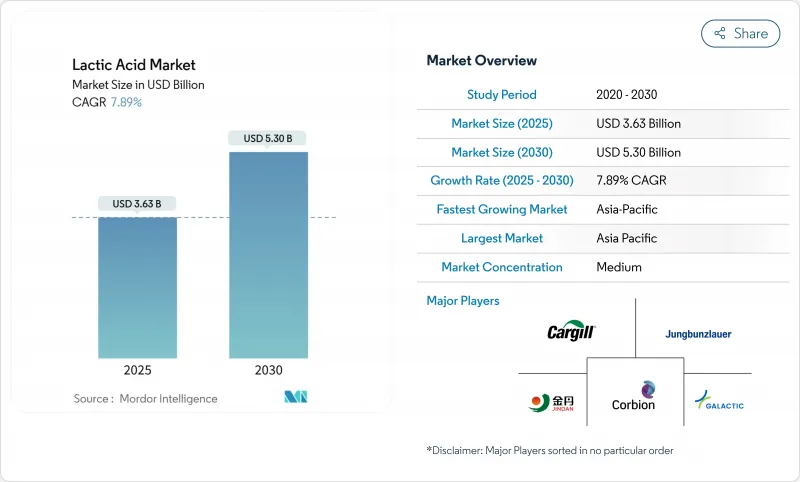

Lactic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The lactic acid market size is projected to increase from USD 3.63 billion in 2025 to USD 5.30 billion by 2030, at a CAGR of 7.89%.

The market expansion is primarily driven by increasing applications in biodegradable plastics, pharmaceutical excipients, and industrial cleaning products. The biodegradable plastics segment is growing due to environmental concerns and strict regulations on conventional plastics. In pharmaceuticals, lactic acid is essential for drug formulations and controlled-release systems. The industrial cleaning sector uses lactic acid for its antimicrobial properties and environmental compatibility. Growth enablers include integrated manufacturing facilities in Asia-Pacific, European regulations limiting single-use plastics, and the US FDA's GRAS (Generally Recognized as Safe) status.The 3D printing segment benefits from lactic acid-based materials that provide enhanced mechanical properties and biocompatibility. The industry maintains competitiveness through vertical integration, diverse feedstock sources, and process optimization, enabling manufacturers to manage raw material price fluctuations effectively. This includes implementing advanced fermentation technologies, efficient purification processes, and developing strategic partnerships throughout the value chain.

Global Lactic Acid Market Trends and Insights

PLA-driven Demand for Biodegradable Plastics

The evolution of lactic acid from a food additive to a polymer precursor is driving significant market growth, with Polylactic Acid (PLA) applications contributing to the overall market CAGR. NatureWorks' USD 600 million facility in Thailand, scheduled for commercial operation by 2025, demonstrates this transition by combining lactic acid production, lactide synthesis, and PLA polymerization in a single facility. The facility's integrated approach aims to optimize production efficiency and reduce operational costs. The European Union's Single-Use Plastics Directive supports market growth by requiring biodegradable alternatives for specific packaging applications, creating a regulatory framework that favors PLA adoption. The planned Emirates Biotech facility in the UAE, set to become the world's largest PLA plant, indicates increasing Middle Eastern investment in this market and highlights the region's commitment to sustainable materials production. The expansion of PLA technology into 3D printing filaments and medical devices has broadened its market potential, offering innovative solutions for manufacturing and healthcare applications. FDA approval of poly-L-lactic acid for facial fat loss treatment demonstrates its versatility and safety profile in high-value medical segments. The combination of supportive regulatory frameworks, continuous technological progress, and increased manufacturing capacity establishes PLA as the main driver of lactic acid market growth through 2030, reshaping the industry landscape and creating new opportunities for sustainable material solutions.

Food and Beverage Preservative and Flavor Uses

The food and beverage sector remains the largest end-market for lactic acid, with growth supported by increasing demand for clean-label products and natural preservation methods. The FDA's designation of lactic acid as Generally Recognized as Safe (GRAS), with restrictions limited to good manufacturing practices, provides food manufacturers with comprehensive regulatory guidance for product formulation, safety compliance, and quality control measures. USDA research confirms lactic acid's effectiveness in reducing Salmonella in poultry applications, demonstrating pathogen reduction rates in controlled studies and expanding its use beyond traditional dairy fermentation processes.The antimicrobial properties of lactic acid have been extensively documented across various food matrices, showing particular efficacy in meat and poultry processing environments. The European Food Safety Authority encourages lactic acid concentrations of 2-5% for beef carcass decontamination, strengthening its role in food safety protocols, microbial control strategies, and overall meat processing hygiene standards. In the plant-based dairy segment, manufacturers utilize specific lactic acid bacteria strains to reduce off-flavors, enhance nutrient absorption, and improve texture profiles, creating product differentiation opportunities through improved organoleptic properties, functional benefits, and extended shelf life. The application of lactic acid in plant-based dairy alternatives has also shown promising results in protein stabilization and flavor development, particularly in fermented products like yogurt alternatives and cheese substitutes.

Industrial Cleaning Formulations

Production costs significantly constrain market growth, particularly affecting lactic acid's competitiveness in price-sensitive industrial applications. The fermentation-based production process requires substantial capital investment in specialized bioreactors, advanced separation equipment, and complex purification systems compared to synthetic chemical routes, despite its environmental advantages. Corbion's 2024 capital market presentation emphasizes comprehensive operational efficiency improvements and strategic restructuring initiatives to address persistent cost competitiveness challenges. The current cost structure substantially impacts commodity applications where lactic acid directly competes with synthetic preservatives and acidulants, limiting market penetration in price-sensitive segments despite its superior environmental benefits and sustainable characteristics. The high production costs affect the entire value chain, from raw material procurement to final product distribution, creating additional challenges for manufacturers seeking to maintain competitive pricing while ensuring product quality and sustainability standards.

Other drivers and restraints analyzed in the detailed report include:

- Pharmaceutical Formulations and Excipients

- Personal Care and Cosmetics Expansion

- Raw-material Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Natural fermentation accounts for 88.14% of the lactic acid market share in 2024 and is expected to grow at an 8.34% CAGR through 2030. Consumer preference for bio-based products stems from increasing awareness of sustainable production methods and environmental concerns. Food safety regulations supporting naturally derived acids, particularly in food and beverage applications, further reinforce the dominance of this production method. Synthetic production, primarily from petroleum intermediates, serves specific industrial segments where cost is the primary consideration, such as in chemical manufacturing and industrial applications.

Technological advancements in natural fermentation include multi-substrate processing, which allows for simultaneous fermentation of different raw materials, gene-edited Lactobacillus strains that improve conversion efficiency, and in situ product removal techniques that increase production yields. The successful implementation of demonstration projects using fruit waste and lignocellulosic residues indicates the potential for scaled production without competing with food crops. These alternative feedstock sources include agricultural residues, food processing waste, and forestry byproducts. This feedstock diversification helps protect the lactic acid market against fluctuations in grain prices while promoting circular economy principles.

Liquid lactic acid held a 64.82% revenue share in 2024, due to its compatibility with direct pumping systems in food, pharmaceutical, and clean-in-place (CIP) applications. This form maintains its market dominance because most industrial bioreactors and downstream filling equipment are specifically designed and optimized for liquid handling operations. The extensive infrastructure investment in liquid handling systems across industries further reinforces this dominance. The solid form segment is growing at an 8.66% CAGR, driven by increased adoption in animal feed premixes and dry-blend personal care products, particularly in regions with challenging storage and transportation conditions. The growth is also supported by the rising demand for extended shelf-life products and easier handling in bulk manufacturing processes.

Recent technological advancements in spray drying and crystallization processes enable manufacturers to maintain high product purity levels while significantly reducing shipping weights. These improvements include optimized particle size distribution and enhanced moisture control systems. New hybrid systems combining membrane technology and evaporation processes reduce energy consumption by more than 10%, according to pilot studies conducted across multiple production facilities. These efficiency improvements are gradually reducing the historical price difference between liquid and solid forms, making solid lactic acid increasingly competitive in various applications. The development of specialized packaging solutions and improved storage stability has further enhanced the appeal of solid lactic acid in emerging markets.

The Global Lactic Acid Market is Segmented by Source (Natural and Synthetic), Form (Liquid and Solid), Grade (Food Grade, Industrial Grade, and More), Application (Food and Beverages, Personal Care and Cosmetics, and More), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Size and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held a 31.08% market share in 2024 and is expected to grow at a 9.08% CAGR through 2030. The region maintains a competitive advantage through integrated manufacturing facilities in Thailand, China, and India, which benefit from readily available sugarcane and corn feedstock, along with lower capital expenditure requirements per installed ton. NatureWorks' Thailand facility exemplifies this regional strategy by combining local feedstock availability, economies of scale, and strategic proximity to export ports. The market growth is further supported by increasing domestic demand for disposable food service items and regulatory requirements for compostable shopping bags.

North America maintains its market position through established corn-wet-milling infrastructure, sophisticated bioprocessing capabilities, and well-defined regulatory frameworks. The region focuses on high-value applications in medical, personal care, and food safety sectors. Despite increased PLA packaging imports from Asia, the North American market remains stable due to corporate preferences for local sourcing to reduce scope 3 emissions.

Europe's market growth is primarily driven by the Single-Use Plastics Directive, which encourages manufacturers to adopt compostable alternatives. Companies like Galactic and Jungbunzlauer have adapted to regulatory requirements, establishing strong positions in pharmaceutical and cosmetic applications. While agricultural price fluctuations affect adoption rates, Green Deal initiatives continue to support investments in regional fermentation facilities.

- Corbion N.V.

- Cargill Incorporated

- Galactic S.A.

- Henan Jindan Lactic Acid Technology Co. Ltd.

- Jungbunzlauer Suisse AG

- Musashino Chemical Laboratory, Ltd.

- Futerro S.A.

- BBCA Biochemical

- Shandong Baisheng Biotech

- Cellulac Ltd.

- NatureWorks LLC

- Zhengzhou Tianrun

- Anhui COFCO Biochemical

- Qingdao Abel Technology

- TotalEnergies Corbion

- Zhejiang Huakang Pharmaceutical Co.

- Synbra Technology

- Henan Shenzhou Biochem

- Sulzer Chemtech

- Wei Mon Industry Co. (Unitika PLA JV)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanding applications in biodegradable plastics production, particularly PLA (Polylactic Acid)

- 4.2.2 Surging Demand from the Food and Beverage Industry for Lactic Acid as a Preservative and Flavor Enhancer

- 4.2.3 Expanding use in pharmaceutical applications for drug formulation and as an excipient

- 4.2.4 Growing adoption in personal care products and cosmetics manufacturing

- 4.2.5 Escalating demand in industrial cleaning applications

- 4.2.6 Rising usage in animal feed production

- 4.3 Market Restraints

- 4.3.1 High production costs of lactic acid compared to conventional alternatives

- 4.3.2 Fluctuating raw material prices, particularly for corn and sugarcane

- 4.3.3 Competition from synthetic alternatives

- 4.3.4 Storage and transportation challenges due to the product's chemical properties

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Source

- 5.1.1 Natural

- 5.1.2 Synthetic

- 5.2 By Form

- 5.2.1 Liquid

- 5.2.2 Solid

- 5.3 By Grade

- 5.3.1 Food Grade

- 5.3.2 Industrial Grade

- 5.3.3 Pharmaceutical Grade

- 5.3.4 Cosmetic Grade

- 5.4 By Application

- 5.4.1 Food and Beverages

- 5.4.1.1 Meat, Poultry and Seafood

- 5.4.1.2 Dairy Products

- 5.4.1.3 Bakery

- 5.4.1.4 Confectionery

- 5.4.1.5 Beverages

- 5.4.1.6 Others Food and Beverage Applications

- 5.4.2 Polylactic Acid (PLA) and Bioplastics

- 5.4.3 Personal Care and Cosmetics

- 5.4.4 Pharmaceutical and Healthcare

- 5.4.5 Industrial and Chemical Processing

- 5.4.1 Food and Beverages

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Corbion N.V.

- 6.4.2 Cargill Incorporated

- 6.4.3 Galactic S.A.

- 6.4.4 Henan Jindan Lactic Acid Technology Co. Ltd.

- 6.4.5 Jungbunzlauer Suisse AG

- 6.4.6 Musashino Chemical Laboratory, Ltd.

- 6.4.7 Futerro S.A.

- 6.4.8 BBCA Biochemical

- 6.4.9 Shandong Baisheng Biotech

- 6.4.10 Cellulac Ltd.

- 6.4.11 NatureWorks LLC

- 6.4.12 Zhengzhou Tianrun

- 6.4.13 Anhui COFCO Biochemical

- 6.4.14 Qingdao Abel Technology

- 6.4.15 TotalEnergies Corbion

- 6.4.16 Zhejiang Huakang Pharmaceutical Co.

- 6.4.17 Synbra Technology

- 6.4.18 Henan Shenzhou Biochem

- 6.4.19 Sulzer Chemtech

- 6.4.20 Wei Mon Industry Co. (Unitika PLA JV)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK