PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844474

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844474

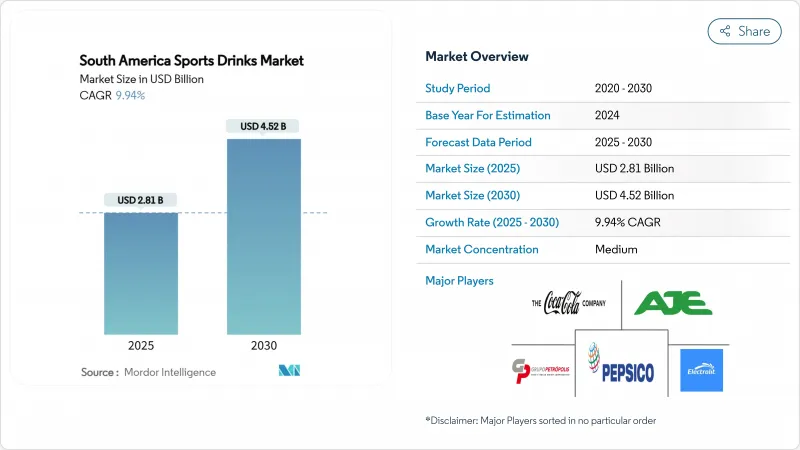

South America Sports Drinks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The South America sports drink market size is projected to be valued at USD 2.81 billion in 2025 and is expected to grow to USD 4.52 billion by 2030, registering a CAGR of 9.94%.

This growth is driven by increasing awareness about fitness, evolving food regulations, and consistent sponsorship of regional sports events, which together create a favorable environment for revenue expansion. Leading global beverage companies are focusing on introducing localized flavors, reformulating products with clearer labeling, and leveraging digital marketing strategies to build brand loyalty, particularly among younger, tech-savvy consumers in South America. The market is also benefiting from the rising popularity of e-sports, greater participation in endurance races, and experimentation with premium ingredients, which are helping to diversify product offerings. However, stricter policies aimed at reducing sugar consumption are slowing down volume growth. At the same time, these policies are pushing brands to develop zero-sugar product variants, which typically have higher profit margins and are contributing to an increase in average selling prices.

South America Sports Drinks Market Trends and Insights

Adoption of sports drinks among gym-goers and fitness enthusiasts

The sports drinks market in South America is expanding due to the growing popularity of gym memberships and a stronger focus on fitness and health. For instance, in Brazil, over 54% of consumers are open to consuming more beverages if they are healthier and made with natural ingredients, as per the Kerry Group's Survey performed in 2024 . This trend is driving the demand for sports drinks, especially those rich in electrolytes, like isotonic drinks. Additionally, fitness chains are expanding into smaller cities in countries such as Brazil and Argentina, introducing these products to new groups of consumers. Similar patterns are emerging in Chile and Colombia, where gym memberships are also on the rise. According to Health Club Management, in 2025, 78% of people living in major cities across Latin America are expected to exercise several times a month. To take advantage of this growing trend, sports drink brands are collaborating with gym operators to secure exclusive product placements inside gyms, ensuring their drinks are easily accessible and visible to consumers during workouts.

Rise in endurance event across the country

The rising popularity of endurance events such as marathons, triathlons, and cycling festivals across South America is significantly contributing to the growth of the sports drinks market. According to Ahotu, as of 2025 to 2026, 16 cycling events are programmed in South America. These events, now staples on capital-city calendars, generate predictable surges in demand for carbohydrate- and electrolyte-rich hydration solutions. In Chile, government-led initiatives like "Crecer en Movimiento" aim to increase physical activity nationwide, indirectly fueling sports drink consumption. As athletes engage in months-long training regimens, they tend to purchase multi-pack formats, fostering consistent, repeat purchases rather than occasional trials. Brands capitalize on this by sponsoring race expos and bib collection events, where they distribute samples in performance-driven settings to enhance credibility. The seasonal concentration of events allows companies to streamline inventory and launch targeted advertising around high-visibility race routes, effectively creating a recurring marketing cycle that refreshes consumer interest every quarter.

Rising concerns over adulteration and mislabeling in the market

Concerns about product adulteration and mislabeling are becoming major challenges for the sports drinks market in South America. Regulatory authorities, such as INAL (Instituto Nacional de Alimentos) in Argentina, have increased their monitoring efforts after cases of incorrect nutrient labeling and undisclosed additives came to light. For instance, Argentina's Law 27.642, which came into effect in 2023, mandates that products exceeding specific limits of sugar, sodium, or saturated fats must display clear black octagonal warning labels on the front of their packaging. This law aims to make nutritional information more transparent to consumers. As a result, manufacturers now face higher costs due to stricter requirements for laboratory testing, ingredient tracking, and digital transparency measures. These added expenses are particularly challenging for smaller or local producers. On the other hand, larger multinational companies benefit from their established quality control systems and certifications, which help them comply more easily.

Other drivers and restraints analyzed in the detailed report include:

- Brand endorsements by sports celebrities fuel demand

- Demand for functional beverages

- Health concerns over sugar and artificial ingredients

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, isotonic drinks claimed an 84.29% share of the South American sports drink market, reinforcing their status as the leading and most trusted choice for hydration. Their efficacy in replacing electrolytes appeals to a diverse audience, spanning from casual fitness buffs to elite athletes. The established benefits of isotonic formulations foster robust brand loyalty and a prominent retail presence, positioning them as the primary choice for many consumers in the category.

Yet, the segment witnessing the swiftest growth is the hypertonic and hypotonic drinks, anticipated to surge at a 5.72% CAGR by 2030. Athletes are gravitating towards these specialized options, seeking more customized hydration solutions. Seizing this momentum, premium brands are rolling out high-value products enriched with functional benefits like botanical extracts and amino acids. This strategy not only caters to specific performance demands but also bolsters revenue through smaller, high-margin offerings. With a rising emphasis on clean and effective sports nutrition, brands are broadening their horizons, moving beyond traditional isotonic offerings to diversify and elevate their product portfolios.

The South America Sports Drinks Market Report is Segmented by Product Type (Isotonic and Hypertonic/Hypotonic), Packaging Type (PET Bottles, Cans, and Others), Distribution Channel (On-Trade and Off-Trade), and Geography (Brazil, Argentina, Chile, Colombia, Peru, and Rest of South America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- PepsiCo Inc.

- The Coca-Cola Company

- AJE Group

- Grupo Petropolis

- Electrolit USA

- Genomma Lab Internacional

- Nitrix Brasil Ltda

- Positive Company Group

- A-Game Hydration Beverage, Inc.

- Prime Hydration LLC

- Mas+ Next Generation Beverage Co.

- The Kraft Heinz Company

- Agua Nuestra

- Four Sport

- Refrescos del Centro SA

- Fabrica de Licores y Alcoholes de Antioquia

- D1 S.A.S

- ProScience (Sports & Science Lab SAS)

- Kent Precision Foods Group, Inc.

- Global Quality Foods (GuaraMEGA)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Adoption of sports drinks among gym-goers and fitness enthusiasts

- 4.2.2 Rise in endurance event across the country

- 4.2.3 Product innovation with functional additives

- 4.2.4 Brand endorsements by sports celebrities fuel demand

- 4.2.5 Demand for functional beverages

- 4.2.6 Convenience and on-the-go consumption

- 4.3 Market Restraints

- 4.3.1 Rising concerns over adulteration and mislabeling in the market

- 4.3.2 Stringent regulations shape industry standards

- 4.3.3 Health concerns over sugar and artificial ingredients

- 4.3.4 Rising competition from alternatives

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Isotonic

- 5.1.2 Hypertonic/Hypotonic

- 5.2 By Packaging Type

- 5.2.1 PET Bottles

- 5.2.2 Cans

- 5.2.3 Others

- 5.3 By Distribution Channel

- 5.3.1 On-trade

- 5.3.2 Off-Trade

- 5.3.2.1 Supermarkets/Hypermarkets

- 5.3.2.2 Pharmacy/Health Stores

- 5.3.2.3 Online Retail Stores

- 5.3.2.4 Other Distribution Channels

- 5.4 By Geography

- 5.4.1 Brazil

- 5.4.2 Argentina

- 5.4.3 Chile

- 5.4.4 Colombia

- 5.4.5 Peru

- 5.4.6 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 PepsiCo Inc.

- 6.4.2 The Coca-Cola Company

- 6.4.3 AJE Group

- 6.4.4 Grupo Petropolis

- 6.4.5 Electrolit USA

- 6.4.6 Genomma Lab Internacional

- 6.4.7 Nitrix Brasil Ltda

- 6.4.8 Positive Company Group

- 6.4.9 A-Game Hydration Beverage, Inc.

- 6.4.10 Prime Hydration LLC

- 6.4.11 Mas+ Next Generation Beverage Co.

- 6.4.12 The Kraft Heinz Company

- 6.4.13 Agua Nuestra

- 6.4.14 Four Sport

- 6.4.15 Refrescos del Centro SA

- 6.4.16 Fabrica de Licores y Alcoholes de Antioquia

- 6.4.17 D1 S.A.S

- 6.4.18 ProScience (Sports & Science Lab SAS)

- 6.4.19 Kent Precision Foods Group, Inc.

- 6.4.20 Global Quality Foods (GuaraMEGA)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK