PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844485

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844485

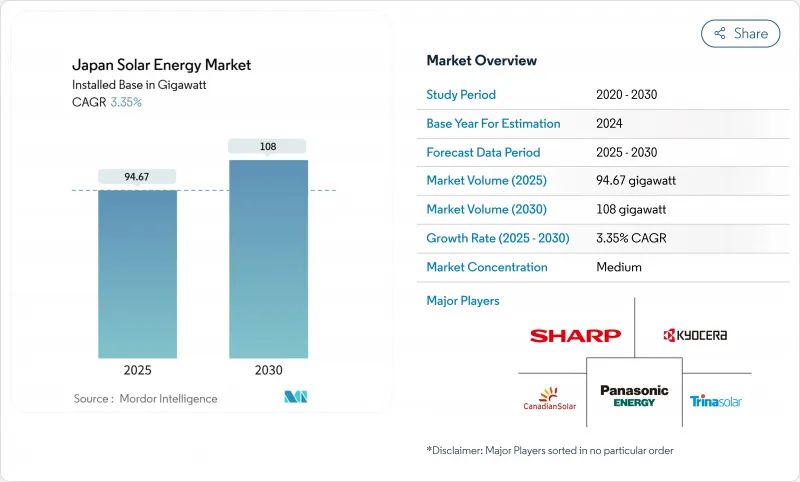

Japan Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Japan Solar Energy Market size in terms of installed base is expected to grow from 94.67 gigawatt in 2025 to 108 gigawatt by 2030, at a CAGR of 3.35% during the forecast period (2025-2030).

Growth continues even after the shift from the Feed-in Tariff to the Feed-in Premium scheme, which encourages developers to follow wholesale price signals, integrated battery storage, and lower consumer levies . Faster permitting for rooftop arrays, mandatory on-site generation rules in Tokyo, and falling module plus battery prices have enlarged the addressable base for distributed systems. Competitive pressure from overseas manufacturers decreases hardware costs, while domestic firms accelerate perovskite research, co-located storage, and energy-management software to retain value. Rising power demand from data centers and corporate decarbonization targets deepens the project finance pool through long-term power-purchase agreements.

Japan Solar Energy Market Trends and Insights

Net-zero 2050 roadmap & FIT -> FIP incentives

The move from a guaranteed tariff to a premium above the wholesale price has realigned the Japanese solar energy market with standard power-market economics. By February 2024, the FIP program had accredited 1,036 projects, including 518 MW of solar, driving developers to pair modules with batteries to capture peak-price spreads . Government notices released for fiscal 2025 confirm fresh budget lines for early-stage solar investments, signaling ongoing policy commitment. As developers invest in dispatchable capacity to hedge price risk, project structures now integrate forecasting software, virtual power-plant functions, and ancillary service revenues. These adaptations anchor the long-term competitiveness of the Japanese solar energy market while easing public-subsidy exposure.

Mandatory rooftop-PV building codes (Tokyo, Kanagawa)

Tokyo's regulation that all new buildings above 2,000 m2 must include solar panels from April 2025 has changed the baseline for urban construction. Compliance obligations rest with the builder, not the end-owner, simplifying logistics and placing a floor under annual installation volumes. The city's parallel subsidy of up to JPY 80,000 per kW supports high-efficiency systems, further lifting return profiles. Early site inspection data indicates that builders now embed solar procurement into design workflows, normalizing on-site generation in the capital. Several prefectures are drafting similar ordinances, pointing toward a potential nationwide regulatory cascade that would underpin sustained demand in the Japanese solar energy market.

Grid congestion & curtailment in Kyushu/Hokkaido

Curtailment jumped to 1.76 TWh in fiscal 2023, with Kyushu hitting a 6.7% rate because limited inter-regional links and inflexible baseload reactors leave little room for midday solar peaks. Utilities are piloting AI-based voltage control that has cut stabilizer activations by up to 70%, showing a technical path forward. Policymakers also draft negative-pricing rules and economic dispatch, but timelines remain unsettled. Until infrastructure aligns, Japanese solar energy market developers must add batteries, reposition plants, or accept revenue cannibalization during oversupply events.

Other drivers and restraints analyzed in the detailed report include:

- Falling module and battery prices improve project IRRs

- Data-center electricity surge spurring corporate PPAs

- Skilled-labour gap for HV solar-plus-storage installs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Rooftop arrays accounted for 49.4% of the Japanese solar energy market in 2024, reflecting scarce land and maturing zero-cost installation schemes that resonate with city dwellers. The segment benefits from proximity to demand, avoiding grid-upgrade fees, and straightforward permitting, reinforcing its primacy in the Japanese solar energy market. Tokyo's compulsory rooftop rules and the nationwide "zero-yen" subscription trend remove upfront costs and establish predictable savings for households and commercial tenants. These structural incentives tie distributed generation closely to the broader net-zero roadmap.

Floating solar is the fastest-growing deployment class, expanding at 4.1% CAGR through 2030. Pilot plants in irrigation reservoirs and Tokyo Bay demonstrate technical viability under typhoon conditions and show ancillary benefits such as reduced water evaporation. After past slope-failure incidents, ground-mount sites face stricter zoning, steering developers toward rooftops, carports, and water surfaces. Building-integrated photovoltaics are emerging, aided by lighter perovskite laminates that can attach to facades and acoustic barriers, offering another outlet for growth in the Japanese solar energy market.

The Japan Solar Energy Market Report is Segmented by Deployment (Rooftop, Ground-Mounted, Floating Solar, and Building-Integrated PV), Application (Residential, Commercial and Industrial, Utility-Scale, and Agrivoltaics), and Component (PV Modules Inverters, Mounting and Tracking Systems, Balance-Of-System, and Co-Located Battery Storage). The Market Size and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- Sharp Corporation

- Kyocera Corporation

- Panasonic Energy Co.

- Canadian Solar Inc.

- Trina Solar Co. Ltd.

- JinkoSolar Holding Co. Ltd.

- JA Solar Technology Co. Ltd.

- LONGi Green Energy Technology Co. Ltd.

- Hanwha Q CELLS

- First Solar Inc.

- Mitsubishi Electric Corporation

- Toshiba Energy Systems & Solutions

- Omron Corporation

- Nihon Techno Co. Ltd.

- SoftBank Energy (SB Power)

- Eurus Energy Holdings

- RENOVA Inc.

- Shizen Energy Inc.

- West Holdings Corporation

- Sekisui Chemical (Perovskite R&D)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Net-zero 2050 roadmap and FIT and FIP incentives

- 4.2.2 Mandatory rooftop-PV building codes (Tokyo, Kanagawa)

- 4.2.3 Falling module + battery prices improve project IRRs

- 4.2.4 Data-center electricity surge spurring corporate PPAs

- 4.2.5 Lightweight perovskite PV opens facade &and vehicle skins

- 4.2.6 "Zero-Yen Solar" subscription model unlocks households

- 4.3 Market Restraints

- 4.3.1 Grid congestion and curtailment in Kyushu/Hokkaido

- 4.3.2 Scarce land/strict zoning for ground-mount projects

- 4.3.3 PV waste-management liability and recycling cost spike

- 4.3.4 Skilled-labour gap for HV solar-plus-storage installs

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Deployment

- 5.1.1 Rooftop

- 5.1.2 Ground-mounted

- 5.1.3 Floating Solar

- 5.1.4 Building-Integrated PV (BIPV)

- 5.2 By Application

- 5.2.1 Residential

- 5.2.2 Commercial and Industrial

- 5.2.3 Utility-scale

- 5.2.4 Agrivoltaics

- 5.3 By Component

- 5.3.1 PV Modules

- 5.3.2 Inverters (String, Central and Micro-inverter)

- 5.3.3 Mounting and Tracking Systems

- 5.3.4 Balance-of-System (Cables, Combiner, etc.)

- 5.3.5 Co-located Battery Storage

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Sharp Corporation

- 6.4.2 Kyocera Corporation

- 6.4.3 Panasonic Energy Co.

- 6.4.4 Canadian Solar Inc.

- 6.4.5 Trina Solar Co. Ltd.

- 6.4.6 JinkoSolar Holding Co. Ltd.

- 6.4.7 JA Solar Technology Co. Ltd.

- 6.4.8 LONGi Green Energy Technology Co. Ltd.

- 6.4.9 Hanwha Q CELLS

- 6.4.10 First Solar Inc.

- 6.4.11 Mitsubishi Electric Corporation

- 6.4.12 Toshiba Energy Systems & Solutions

- 6.4.13 Omron Corporation

- 6.4.14 Nihon Techno Co. Ltd.

- 6.4.15 SoftBank Energy (SB Power)

- 6.4.16 Eurus Energy Holdings

- 6.4.17 RENOVA Inc.

- 6.4.18 Shizen Energy Inc.

- 6.4.19 West Holdings Corporation

- 6.4.20 Sekisui Chemical (Perovskite R&D)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment