PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848285

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848285

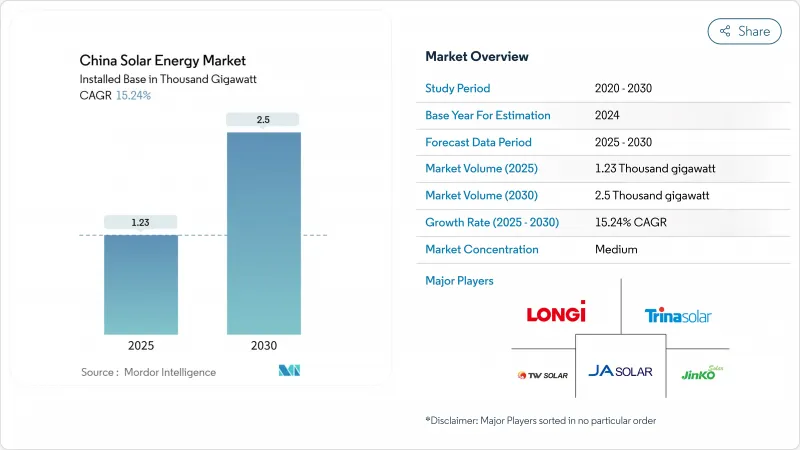

China Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The China Solar Energy Market size in terms of installed base is expected to grow from 1.23 Thousand gigawatt in 2025 to 2.5 Thousand gigawatt by 2030, at a CAGR of 15.24% during the forecast period (2025-2030).

Accelerated deployment under the 14th Five-Year Plan, record-low module prices, and an expanding corporate PPA ecosystem keep growth momentum high. Rapid improvement in N-type cell efficiency, ultra-high voltage transmission build-out, and policies mandating rooftop systems on public buildings create new project pipelines. At the same time, grid congestion in northwestern provinces, the incoming market-based tariff regime, and intensifying global trade barriers pose structural headwinds. Nonetheless, continued innovation and policy coordination position the Chinese solar energy market to remain the world's largest renewable-power arena through 2030.

China Solar Energy Market Trends and Insights

Record-Low Module Prices Drive LCOE Competitiveness

Module prices fell to RMB 0.75/W in early 2024 after China's manufacturing capacity ballooned to 861 GW against global demand of 600 GW . Cost leadership pushed solar LCOE below coal in more than 25 provinces, prompting developers to accelerate gigawatt-scale projects without subsidies. Industry consolidation is inevitable, yet leading firms such as LONGi and JinkoSolar benefit from N-type TOPCon lines that preserve margins.

14th Five-Year Plan Targets Accelerate Capacity Expansion

The plan prioritizes gigantic desert bases such as Kubuqi and "Great Solar Wall" clusters, ensuring land, grid, and financing coordination. Local governments link rooftop, agro-PV, and storage pilots to national quotas, bringing rural households into the energy transition.

Grid Congestion Constrains Northwestern Capacity Utilization

Curtailment has subsided nationally but remains above 5% in parts of Xinjiang and Gansu . +-800 kV UHVDC lines now under construction will raise renewable transfer by 36 TWh a year, yet full relief comes only after 2027.

Other drivers and restraints analyzed in the detailed report include:

- Corporate PPA Market Transforms Energy Procurement

- Mandatory Rooftop PV Policies Drive Distributed Growth

- Feed-in-Tariff Phase-out Intensifies Market Competition

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solar photovoltaic retained 99.5% of the Chinese solar energy market in 2024. Within PV, N-type TOPCon, HJT, and back-contact cells reached 70% shipment share by the end of 2024 as conversion efficiency climbed to 25.4% record. Higher power density lowers balance-of-system costs, sustaining price premiums. Concentrated solar power capacity topped 1 GW after Xinjiang's demonstration plant joined the grid in December 2024, pairing 8-hour storage with Linear Fresnel heliostats to enhance peak-shaving capability. CSP's dedicated subsidy of 0.55 yuan/kWh in Qinghai secures returns and diversifies generation sources that balance high-penetration PV provinces.

The PV segment's economies of scale, localized supply chain, and policy certainty make it the Chinese solar energy market anchor. CSP remains niche but gains policy tailwinds as a stabilizing resource amid rising inverter-related grid regulations. Advancements in perovskite-silicon tandem research could arrive after 2027, potentially redefining efficiency thresholds across both technologies.

The China Solar Energy Market Report is Segmented by Technology (Solar Photovoltaic and Concentrated Solar Power), Connection Type (On-Grid and Off-Grid), and End-User (Residential, Commercial and Industrial, and Utilities). The Market Size and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- LONGi Green Energy Technology Co Ltd

- Trina Solar Co Ltd

- JA Solar Technology Co Ltd

- JinkoSolar Holding Co Ltd

- Tongwei Solar Co Ltd

- Zhejiang Chint Electrics Co Ltd

- Hanwha Q CELLS Co Ltd

- Yingli Green Energy Holding Co Ltd

- Huasun Energy Co Ltd

- Drinda New Energy Technology Co Ltd

- GCL-Poly Energy Holdings Ltd

- Risen Energy Co Ltd

- Suntech Power Co Ltd

- Seraphim Solar System Co Ltd

- GoodWe Technologies Co Ltd

- Sungrow Power Supply Co Ltd

- Huawei Digital Power Technologies Co Ltd

- Tianjin Zhonghuan Semiconductor Co Ltd

- Aiko Solar Energy Co Ltd

- Shunfeng International Clean Energy Ltd

- Envision Energy Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Record-low module prices cut LCOE

- 4.2.2 14th Five-Year Plan capacity targets

- 4.2.3 Corporate PPAs/green-power trading boom

- 4.2.4 Mandatory rooftop PV on new public buildings

- 4.2.5 Grid-friendly inverter retrofits policy

- 4.2.6 CSP-plus-storage subsidy scheme

- 4.3 Market Restraints

- 4.3.1 Grid congestion & curtailment in NW China

- 4.3.2 Feed-in-tariff phase-out & low auction prices

- 4.3.3 Overseas trade barriers to Chinese modules

- 4.3.4 ESG scrutiny of Xinjiang polysilicon supply

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Competitive Rivalry

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Threat of New Entrants

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Technology

- 5.1.1 Solar Photovoltaic (PV)

- 5.1.2 Concentrated Solar Power (CSP)

- 5.2 By Connection Type

- 5.2.1 On-Grid

- 5.2.2 Off-Grid

- 5.3 By End-User

- 5.3.1 Residential

- 5.3.2 Commercial and Industrial

- 5.3.3 Utilities

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 LONGi Green Energy Technology Co Ltd

- 6.4.2 Trina Solar Co Ltd

- 6.4.3 JA Solar Technology Co Ltd

- 6.4.4 JinkoSolar Holding Co Ltd

- 6.4.5 Tongwei Solar Co Ltd

- 6.4.6 Zhejiang Chint Electrics Co Ltd

- 6.4.7 Hanwha Q CELLS Co Ltd

- 6.4.8 Yingli Green Energy Holding Co Ltd

- 6.4.9 Huasun Energy Co Ltd

- 6.4.10 Drinda New Energy Technology Co Ltd

- 6.4.11 GCL-Poly Energy Holdings Ltd

- 6.4.12 Risen Energy Co Ltd

- 6.4.13 Suntech Power Co Ltd

- 6.4.14 Seraphim Solar System Co Ltd

- 6.4.15 GoodWe Technologies Co Ltd

- 6.4.16 Sungrow Power Supply Co Ltd

- 6.4.17 Huawei Digital Power Technologies Co Ltd

- 6.4.18 Tianjin Zhonghuan Semiconductor Co Ltd

- 6.4.19 Aiko Solar Energy Co Ltd

- 6.4.20 Shunfeng International Clean Energy Ltd

- 6.4.21 Envision Energy Ltd

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment