PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844489

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844489

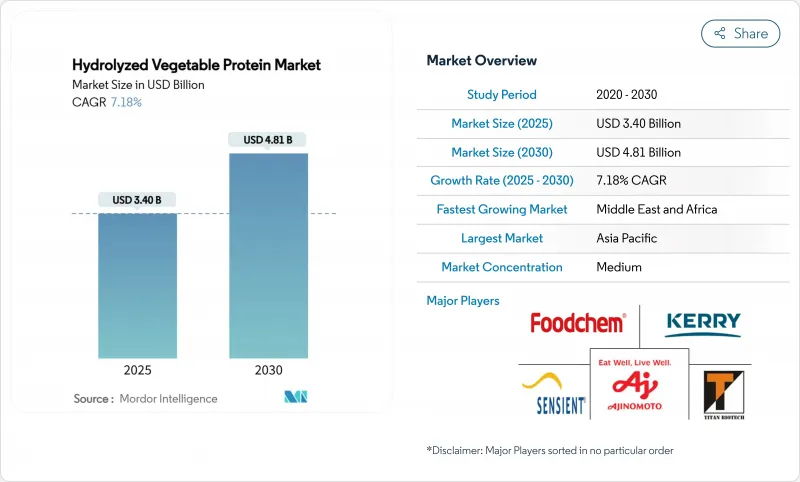

Hydrolyzed Vegetable Protein - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The hydrolyzed vegetable protein market size is estimated at USD 3.40 billion in 2025 and is projected to reach USD 4.81 billion by 2030, with a compound annual growth rate (CAGR) of 7.18%.

The market growth aligns with increasing demand for clean-label, plant-based, and allergen-free ingredients. Consumers prefer products with transparent ingredient sourcing that provide both functional and nutritional benefits, which drives hydrolyzed vegetable protein adoption across food and beverages, personal care, nutraceuticals, and pet nutrition sectors. Regulatory bodies in major regions support this trend by promoting natural protein sources and implementing restrictions on synthetic additives and allergens. The growing demand for plant-based meat alternatives, hypoallergenic pet foods, and fermentation-based bioprocessing expands hydrolyzed vegetable protein applications. As global focus on health, sustainability, and dietary personalization increases, hydrolyzed vegetable protein serves as an essential ingredient in modern product formulations, allowing manufacturers to meet consumer and regulatory requirements while improving flavor, nutrition, and functional performance.

Global Hydrolyzed Vegetable Protein Market Trends and Insights

Rising Popularity of Clean Label and Natural Ingredients

The demand for clean label and natural ingredients drives growth in the global hydrolyzed vegetable protein market. Consumers increasingly seek food products with transparent ingredient lists and minimal artificial additives, reflecting the clean label movement. This consumer behavior stems from concerns about synthetic chemicals and preservatives, along with preferences for sustainable and ethically sourced foods. The global hydrolyzed vegetable protein market benefits from plant sources such as soy, corn and peas, which meet these requirements by providing a natural protein alternative. Apart from food and beverages, there's a steady demand for vegetable protein in the persocal care products too. According to the National Sanitation Foundation (NSF), in 2024, 74% of Americans considered organic ingredients important in personal care products, while 65% emphasized the need for clear ingredient lists to identify potentially harmful substances . These statistics demonstrate the broader consumer preference for ingredient transparency across consumable goods. As a result, the increasing focus on clean label products and natural ingredients positions the global HVP market for sustained growth in the coming years.

Growing Demand for Hydrolyzed Vegetable Protein in Plant-based Meat Products

The increasing demand for hydrolyzed vegetable protein in plant-based meat products is driving the market. The rise in flexitarian, vegetarian, and vegan diets has increased the demand for plant-based meat alternatives. Hydrolyzed vegetable protein serves as both a flavor enhancer and protein source in these products, replicating the umami taste and mouthfeel of traditional meat. Its effectiveness in enhancing savory notes without animal-derived ingredients makes it essential in plant-based burgers, sausages, and deli slices. Hydrolyzed Vegetable Protein also improves texture and moisture retention, which are essential characteristics for meat alternatives. Health concerns, animal welfare considerations, and environmental sustainability drive consumer preferences toward meat alternatives. In Europe, meat consumption is declining, particularly in countries like Germany and Austria. The Federal Office for Agriculture and Food reported that German per capita meat consumption was approximately 430 grams in 2023, while Statistics Austria documented a decrease of 1.7 kilograms per person compared to the previous year . These global consumption patterns and the increasing incorporation of Hydrolyzed Vegetable Protein in plant-based alternatives indicate sustained market growth for hydrolyzed vegetable protein in the coming years.

Strict FDA and EU Regulations on Labeling and Safety Increases Costs

Strict labeling and safety regulations in the United States and the European Union push compliance costs higher for hydrolyzed vegetable protein suppliers. The FDA now expects detailed allergen statements, sodium declarations, and validated production controls under its updated plant-based labeling guidance issued in 2025. Manufacturers must also submit extensive toxicology data when filing GRAS notices, a process that can take more than a year and often requires third-party scientific studies. In Europe, the Novel Food Regulation mandates pre-market approval for new or significantly altered hydrolysates, adding application fees and rigorous safety assessments according to European Commission. The EU Food Information to Consumers Regulation further compels clear origin and nutritional information, forcing companies to redesign packaging and update digital traceability systems. Together, these rules lengthen product development timelines and raise the cost floor, which can squeeze smaller producers that lack dedicated regulatory teams. Larger players pass some of the overhead to customers, but price sensitivity in end-use markets limits how much cost recovery is possible.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand for Hypoallergenic Pet Food Increases Hydrolyzed Vegetable Protein Usage

- Growing Demand for Convenience Foods Drives Hydrolyzed Vegetable Protein Market

- Availability of Alternative Protein Ingredients

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The global hydrolyzed vegetable protein market demonstrates significant segmentation, with soy protein maintaining its dominant position at 48.23% market share in 2024. This predominance stems from well-established international supply chain networks, superior cost-effectiveness in commercial applications, and extensive functionality across industrial food processing operations. Food manufacturers worldwide consistently select soy-based proteins for large-scale production requirements, implementing it extensively in meat alternatives, bakery, and ready-to-eat meal solutions. The sophisticated global processing infrastructure, developed over decades of industrial application, ensures dependable production capabilities and maintains consistent quality standards across international markets, further solidifying soy protein's position as the primary choice for industrial food applications.

Pea protein is emerging as the fastest-growing segment, projected to expand at an 8.15% CAGR through 2030. This significant market expansion correlates directly with its allergen-free status and comprehensive amino acid profile, addressing the evolving requirements of health-conscious consumers across international markets. The regulatory validation through FDA's GRAS Notice 581 establishes concrete safety parameters for pea protein applications, considerably strengthening its position in the global marketplace. Corn protein benefits from non-GMO positioning and is finding opportunities in premium applications, while rice protein is carving out niche markets in hypoallergenic formulations especially in infant nutrition, where regulatory requirements favor easily digestible and allergen-safe proteins.

The Hydrolyzed Vegetable Protein Market is Segmented by Raw Material (Soy, Corn, Pea, and Others), Application (Food and Beverage, Nutraceuticals and Dietary Supplements, Personal Care and Cosmetics, and Animal Feed and Pet Food), Grade (Food Grade, and Non-Food Grade), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commands the largest regional market share at 35.29% in 2024 in the global hydrolyzed vegetable protein industry, attributed to China's strategic investments in fermentation-based protein production and comprehensive government policies supporting alternative protein development. The region's competitive advantage stems from its robust manufacturing infrastructure and efficient production capabilities for hydrolyzed protein manufacturing. Japan demonstrates significant market maturity through widespread consumer acceptance of plant-based foods, indicating market progression toward premium applications. South Korea's implementation of alternative protein standards through the Ministry of Food and Drug Safety establishes a structured regulatory environment for market advancement. The regional market expansion is further strengthened by accelerating urbanization and increasing disposable incomes in India, generating substantial demand for protein-fortified processed foods.

The Middle East and Africa (MEA) region demonstrates the highest growth potential in the global hydrolyzed vegetable protein market, projecting a CAGR of 7.49% through 2030. This substantial growth is attributed to the systematic development of domestic food processing industries, increasing urbanization rates, and evolving dietary preferences emphasizing convenience and affordability. The requirement for halal-certified ingredients remains a primary market driver across major markets including Saudi Arabia, the United Arab Emirates, Egypt, and South Africa. Hydrolyzed vegetable protein derived from plant sources with halal certification presents manufacturers with a regulatory-compliant flavor enhancement solution.

North America and Europe exhibit sustained growth in the global hydrolyzed vegetable protein market, characterized by comprehensive regulatory frameworks and evolving consumer preferences for product transparency, safety protocols, and sustainability measures. The Food and Drug Administration, European Food Safety Authority, and national regulatory organizations implement stringent food safety regulations, necessitating manufacturers to incorporate clean-label, non-GMO, and plant-based ingredients in their product formulations.

- Ajinomoto Co., Inc.

- Kerry Group plc

- Sensient Technologies Corporation

- Titan Biotech

- Foodchem International Corporation

- Innovative Health Care (India) Private Limited

- Roquette Freres

- Chemcopia Ingredients Pvt Ltd

- Chaitanya Group of Industries

- New Alliance Dye Chem Pvt. Ltd.

- Cargill, Incorporated

- Herbal Isolates Pvt Ltd

- Aipu Food Industry Co., Ltd.

- Nispoon

- Aarkay Food Products Ltd.

- Ataman Kimya A.S

- Fisino

- Arte Foods

- Akola Chemicals India Limited

- Tag Ingredients India Pvt Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Popularity of Clean Label and Natural Ingredients

- 4.2.2 Growing Demand for Hydrolyzed Vegetable Protein in Plant-based Meat Products

- 4.2.3 Demand for Hypoallergenic Pet Food Increases Hydrolyzed Vegetable Protein Usage

- 4.2.4 Growing Demand for Convenience Foods Drives Hydrolyzed Vegetable Protein Market

- 4.2.5 Inclination Towards Vegan Food Products Drives Demand for Hydrolyzed Vegetable Protein

- 4.2.6 Rising Demand for Umami-Rich Flavor Enhancers

- 4.3 Market Restraints

- 4.3.1 Volatility in Raw Material Prices

- 4.3.2 Availability of Alternative Protein Ingredients

- 4.3.3 Strict FDA and EU regulations on labeling and safety increases Costs

- 4.3.4 Concerns Regarding Potential Allergies

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Raw Material

- 5.1.1 Soy

- 5.1.2 Corn

- 5.1.3 Pea

- 5.1.4 Others

- 5.2 By Application

- 5.2.1 Food and Beverage

- 5.2.1.1 Bakery

- 5.2.1.2 Snack Foods

- 5.2.1.3 Soups, Sauces and Dressings

- 5.2.1.4 Meat Products and Analogues

- 5.2.1.5 Seasonings and Ready Meals

- 5.2.1.6 Others

- 5.2.2 Nutraceuticals and Dietary Supplements

- 5.2.3 Personal Care and Cosmetics

- 5.2.4 Animal Feed and Pet Food

- 5.2.1 Food and Beverage

- 5.3 By Grade

- 5.3.1 Food Grade

- 5.3.2 Non-Food Grade

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Ajinomoto Co., Inc.

- 6.4.2 Kerry Group plc

- 6.4.3 Sensient Technologies Corporation

- 6.4.4 Titan Biotech

- 6.4.5 Foodchem International Corporation

- 6.4.6 Innovative Health Care (India) Private Limited

- 6.4.7 Roquette Freres

- 6.4.8 Chemcopia Ingredients Pvt Ltd

- 6.4.9 Chaitanya Group of Industries

- 6.4.10 New Alliance Dye Chem Pvt. Ltd.

- 6.4.11 Cargill, Incorporated

- 6.4.12 Herbal Isolates Pvt Ltd

- 6.4.13 Aipu Food Industry Co., Ltd.

- 6.4.14 Nispoon

- 6.4.15 Aarkay Food Products Ltd.

- 6.4.16 Ataman Kimya A.S

- 6.4.17 Fisino

- 6.4.18 Arte Foods

- 6.4.19 Akola Chemicals India Limited

- 6.4.20 Tag Ingredients India Pvt Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK