PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844571

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844571

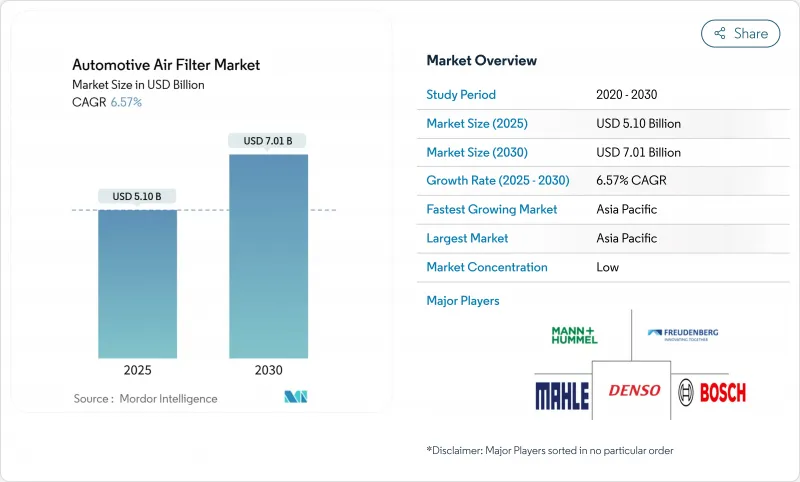

Automotive Air Filter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The automotive air filtration market size stands at USD 5.10 billion in 2025 and is forecast to reach USD 7.01 billion by 2030, advancing at a 6.57% CAGR.

Tightening emission norms in Europe, North America, and key Asian economies, together with consumer attention to in-cabin air quality, sustain a robust demand pipeline. Original equipment manufacturers (OEMs) increasingly specify high-efficiency particulate air (HEPA) systems and electrostatic nano-fiber media to comply with Euro 7, EPA 2027-2032 multi-pollutant standards, and Bharat Stage VI rules. Electric-vehicle (EV) platforms amplify the opportunity because battery thermal systems and silent cabins highlight filtration performance differences. At the same time, aftermarket distributors leverage predictive maintenance data to position premium replacement filters, countering the lengthening service intervals delivered by synthetic media.

Global Automotive Air Filter Market Trends and Insights

Strict Emission & In-Cabin Air-Quality Mandates

Regulatory convergence across major automotive markets creates unprecedented demand for advanced filtration technologies that address engine protection and cabin air quality. The EU's Euro 7 regulation introduces particulate emissions limits from tire and brake wear for the first time, requiring filtration systems to capture particles beyond traditional exhaust emissions. This regulatory expansion coincides with the EPA's Tier 4 standards mandating gasoline particulate filters for vehicles achieving 0.5 mg/mi PM emissions, fundamentally altering the filtration value proposition from an optional comfort feature to a regulatory compliance necessity. Cambodia's adoption of Euro 6/VI standards by 2030 demonstrates regulatory harmonization extending beyond developed markets, creating global scale opportunities for filtration suppliers. The regulatory timeline compression forces OEMs to accelerate filtration technology integration, with compliance deadlines creating artificial demand spikes that benefit suppliers with ready-to-deploy solutions. California's Advanced Clean Cars II program mandating 100% zero-emission vehicle sales by 2035 paradoxically increases filtration demand as EVs require sophisticated cabin air management systems to maintain battery thermal efficiency.

Growing Global Vehicle Parc & Service-Interval Mileage

The expanding global vehicle fleet, particularly in emerging markets, creates sustained aftermarket demand that outpaces new vehicle production growth rates. Extended service intervals, driven by synthetic lubricant adoption and improved engine durability, paradoxically increase filtration system stress as filters must perform longer between replacements while maintaining efficiency standards. This dynamic benefits premium filter manufacturers who can command higher margins for extended-life products that meet OEM specifications. Fleet operators increasingly recognize the benefits of premium filtration for total cost of ownership, with predictive maintenance algorithms enabling condition-based replacement schedules that optimize filter utilization while preventing premature engine wear. The shift toward mobility-as-a-service models intensifies filter replacement frequency as commercial vehicles accumulate higher annual mileage than private passenger cars, creating a more predictable and lucrative replacement cycle for aftermarket suppliers.

Long-Life Synthetic Media Extending Replacement Intervals

Advanced synthetic filter media technologies paradoxically constrain market growth by extending service intervals beyond traditional replacement cycles. Nano-fiber coating technologies, such as Hollingsworth & Vose's NANOWEB system, enhance depth filtration and pulse-cleaning capabilities, enabling filters to maintain efficiency longer while reducing replacement frequency. This technological advancement creates a classic innovator's dilemma where superior product performance reduces total addressable market size by decreasing replacement frequency. Premium vehicle manufacturers increasingly specify long-life filtration systems as standard equipment to reduce maintenance costs and improve customer satisfaction scores, inadvertently constraining aftermarket revenue potential. The trend toward "lifetime" sealed cabin filter modules in luxury EVs eliminates aftermarket replacement opportunities entirely, forcing suppliers to capture higher margins during OEM fitment rather than relying on recurring aftermarket sales. Iran's Behran Filter Company, receiving the first "Nano Namad" license for nanotechnology-based car air filters, demonstrates how emerging markets are leapfrogging to advanced filtration technologies that extend service intervals. Filter manufacturers must balance technological advancement with business model sustainability, potentially requiring shift toward subscription-based maintenance services or value-added monitoring systems that generate recurring revenue streams independent of physical filter replacement frequency.

Other drivers and restraints analyzed in the detailed report include:

- Consumer Health Awareness in High-Pollution Megacities

- HEPA-Grade Filters Adopted by EV & Premium OEM Platforms

- Volatile Non-Woven & Activated-Carbon Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Air-intake filters command 55.21% market share in 2024, reflecting their universal application across all vehicle types and mandatory replacement cycles driven by engine protection requirements. However, cabin air filters emerge as the growth catalyst with 9.21% CAGR through 2030, propelled by consumer health awareness and regulatory mandates for in-cabin air quality improvement.

Bosch's introduction of FILTER+pro cabin air filters with antimicrobial layers effective against viruses, bacteria, and allergens demonstrates how traditional suppliers innovate to capture premium pricing in the cabin filtration segment. The convergence of air quality regulations and consumer health consciousness creates sustained demand for cabin filtration upgrades, with OEMs increasingly specifying HEPA-grade systems as standard equipment in premium vehicle segments. Air-intake filters maintain steady demand driven by engine protection requirements, though growth rates lag cabin filters due to mature technology and established replacement cycles. The electrostatic and nano-fiber segments represent the industry's technological frontier, where suppliers command premium pricing for advanced particle capture capabilities that exceed traditional media performance.

Cellulose retained a 44.18% share in 2024 because it is inexpensive and well-understood by manufacturers. The automotive air filtration market size for nano-fiber and HEPA media is projected to expand at 11.48% CAGR, a clear indicator that premium, high-efficiency media sets the innovation pace.

Nanofiber layers add depth loading and high dust-holding capacity while maintaining low restriction, a critical benefit for engine performance and HVAC energy efficiency. Suppliers integrate proprietary nano-coatings into traditional substrates to create differentiated SKUs with significant price premiums. Activated-carbon producers invest in recycling technology to combat feedstock price swings, reinforcing the dual performance and sustainability value proposition demanded by automakers and regulators.

The Automotive Air Filter Market Report is Segmented by Product Type (Air-Intake Filters, Cabin Air Filters, Hybrid Filters, and More), Filter Media (Cellulose, Synthetic, Activated-Carbon Composite, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Sales Channel (OEM Fitment and Aftermarket) and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific's 38.75% share in 2024 is backed by China's EV surge and India's Bharat Stage VI norms. The region is anticipated to grow with a 6.41% CAGR during the forecast period. Local suppliers collaborate with global brands to secure advanced media licenses, while cost-efficient manufacturing plants in China, Thailand, and Vietnam feed worldwide demand. Australia's adoption of Euro 6d-equivalent tailpipe limits further widens the regulatory addressable market.

Euro 7's inclusion of non-exhaust particles in Europe opens niches for tire-wear capture devices and brake-dust filters. German OEMs spearhead HEPA and sensor integration, often co-engineering with suppliers such as MANN+HUMMEL. Hengst's Romanian plant shows that Eastern Europe's cost base attracts new capacity. Consumers associate advanced filtration with wellness and environmental responsibility, supporting premium pricing.

The EPA's 2027-2032 rules in North America guarantee sustained demand for high-efficiency engine-air and cabin systems. California's zero-emission vehicle mandate stimulates demand for EV-specific thermal-management filters. Hanon Systems' Ontario EV compressor plant signals supplier investment to serve growing regional EV output. Well-developed aftermarket logistics and strong do-it-yourself cultures ensure rapid uptake of performance upgrades.

- MANN+HUMMEL GmbH

- MAHLE GmbH

- Donaldson Company Inc.

- Robert Bosch GmbH

- Sogefi SpA

- Cummins Inc.

- DENSO Corporation

- Parker-Hannifin Corp.

- Ahlstrom-Munksjo

- Freudenberg & Co. KG

- Hengst SE

- K&N Engineering Inc.

- Champion Laboratories Inc.

- Fram Group LLC

- Hollingsworth & Vose Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Strict emission & in-cabin air-quality mandates

- 4.2.2 Growing global vehicle parc & service-interval mileage

- 4.2.3 Consumer health awareness in high-pollution megacities

- 4.2.4 HEPA-grade filters adopted by EV & premium OEM platforms

- 4.2.5 Sensor-activated smart HVAC filtration modules

- 4.2.6 Predictive fleet-maintenance algorithms driving filter turnover

- 4.3 Market Restraints

- 4.3.1 Long-life synthetic media extending replacement intervals

- 4.3.2 Volatile non-woven & activated-carbon prices

- 4.3.3 Sealed "lifetime" cabin-filter modules in luxury EVs reduce aftermarket

- 4.3.4 Energy/weight penalty of ultra-high-efficiency media in BEVs

- 4.4 Value/Supply-Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Rivalry

5 Market Size & Growth Forecasts (Value in USD and Volume in Units)

- 5.1 By Product Type

- 5.1.1 Air-Intake Filters

- 5.1.2 Cabin Air Filters

- 5.1.3 Hybrid / Electrostatic Nano-fiber Filters

- 5.1.4 Electrically-enhanced (ePM1) Filters

- 5.2 By Filter Media

- 5.2.1 Cellulose

- 5.2.2 Synthetic/Melt-blown

- 5.2.3 Activated-Carbon Composite

- 5.2.4 Nano-fiber/HEPA Grade

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Medium and Heavy Commercial Vehicles

- 5.4 By Sales Channel

- 5.4.1 OEM Fitment

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia & New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC Countries

- 5.5.5.2 Turkey

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JV, and Capacity)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 MANN+HUMMEL GmbH

- 6.4.2 MAHLE GmbH

- 6.4.3 Donaldson Company Inc.

- 6.4.4 Robert Bosch GmbH

- 6.4.5 Sogefi SpA

- 6.4.6 Cummins Inc.

- 6.4.7 DENSO Corporation

- 6.4.8 Parker-Hannifin Corp.

- 6.4.9 Ahlstrom-Munksjo

- 6.4.10 Freudenberg & Co. KG

- 6.4.11 Hengst SE

- 6.4.12 K&N Engineering Inc.

- 6.4.13 Champion Laboratories Inc.

- 6.4.14 Fram Group LLC

- 6.4.15 Hollingsworth & Vose Co.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment