PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844646

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844646

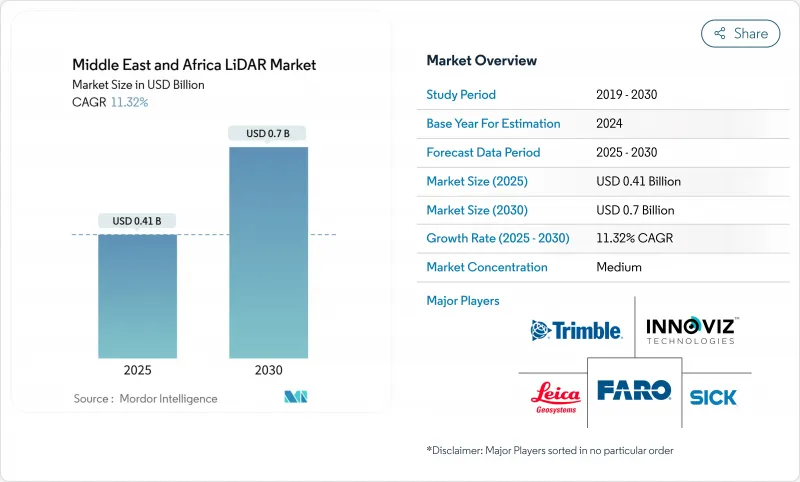

Middle East And Africa LiDAR - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Middle East and Africa LiDAR market stands at USD 0.41 billion in 2025 and is projected to reach USD 0.7 billion by 2030, reflecting an 11.32% CAGR.

Rapid rollout of giga-projects under Saudi Vision 2030, expanding smart-city programs across the Gulf, and sustained infrastructure spending in Southern Africa are intensifying demand for high-precision, three-dimensional spatial data. Increased pairing of LiDAR with artificial intelligence for automated feature extraction is shortening project cycles in construction monitoring and asset inspection. Solid-state advances such as Geiger-mode sensors are reducing size, weight, power, and cost, enabling deployment on drones that can tolerate harsh desert heat and dust. Automotive original-equipment manufacturers are incorporating LiDAR into advanced driver assistance systems, supported by the UAE plan that requires 25% of city journeys to shift to autonomous vehicles by 2030.

Middle East And Africa LiDAR Market Trends and Insights

LiDAR Mandate for Smart-City Digital Twins in GCC

Gulf governments now require sub-centimeter digital replicas of city assets, making LiDAR indispensable for underground-utility mapping, traffic-flow optimisation, and carbon-footprint analysis. Dubai Municipality is applying mobile scanners to model buried pipes and cables, cutting unplanned outages and excavation re-works. In Qatar, a USD 60 million smart-city platform for Lusail City processes continuous LiDAR feeds to manage 450,000 residents' services. Mandatory BIM adoption in public projects ensures that LiDAR point clouds flow directly into standardised construction models, removing data-format bottlenecks. The result is a unified planning approach that speeds permit approvals and reduces lifecycle cost overruns. GCC authorities also bundle LiDAR procurement with cloud analytics, encouraging local data-centres that comply with sovereignty rules.

Surge in UAV-Borne Corridor Mapping for Saudi Giga-Projects

High-profile programmes such as NEOM's 170 km linear city require weekly topographic updates over vast tracts that conventional surveys cannot cover in time. Rotary-wing drones equipped with medium-range LiDAR now map up to 100 acres per day at 1-3 cm accuracy, slashing progress-tracking cycles by 70%. Specialist operators like Aeromotus supply turnkey drone-as-a-service packages that combine flight planning, scanning, and cloud processing. Resulting digital twins allow contractors to compare design intent with as-built conditions, catching earthwork deviations early. For linear infrastructure such as high-speed rail spines and desalination pipelines, rapid corridor updates reduce change-order frequency and safeguard delivery milestones.

Scarcity of Regional Calibration Labs Inflating Lead-Times

Only a handful of accredited laboratories exist between Riyadh and Johannesburg, forcing most operators to ship sensors to Europe for annual recalibration. Logistics lags can stretch to 12 weeks, freezing fleet availability during peak construction phases. Larger contractors respond by leasing pre-calibrated units from providers such as ClearSkies Geomatics, while smaller firms idle crews and absorb liquidated damages. The bottleneck also hampers adoption of advanced solid-state LiDAR, which often requires shorter service cycles to uphold warranty specifications. Several Gulf free-zones have announced incentives for foreign metrology houses to open branches, yet timelines suggest meaningful capacity will not arrive before 2027.

Other drivers and restraints analyzed in the detailed report include:

- Offshore Wind-Farm Bathymetry Needs Off Namibia and South Africa

- Security-Driven Perimeter Surveillance at UAE Critical Sites

- Limited GNSS Reference-Station Density Outside Gulf States

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Aerial platforms generated 55% of the Middle East and Africa LiDAR market size in 2024, a position rooted in their ability to survey giga-project footprints that sprawl across arid terrains. Saudi engineering firms rely on helicopter and fixed-wing campaigns to update cut-and-fill quantities weekly, feeding dashboards that flag schedule slippage. The combination of oblique photogrammetry with high-density point clouds helps planners visualise rock-cut faces and desert wadis that influence road alignments. Aerial scanning also underpins coastal-erosion monitoring in Namibia, where green-wavelength laser pulses measure dune migration along tourist beaches.

Ground-based scanners, though holding a smaller share, are slated for 14.11% CAGR as municipalities digitise sewers, bridges, and heritage facades. Wearable systems map multistorey tunnels without GPS, letting inspectors detect spalling concrete behind tiles. The Middle East and Africa LiDAR market benefits from SLAM algorithms that register scans in real time, permitting overnight issuance of clash-detection reports that would once take a week. Hardware miniaturisation means a two-person crew can now capture an entire metro station in an evening, democratising high-precision documentation beyond tier-one contractors.

Time-of-Flight remained the workhorse with 63% revenue in 2024, prized for robust performance under dust-laden winds and intense solar glare typical of the Arabian Peninsula. Power utilities employ ToF units for corridor clearance checks on transmission lines, avoiding vegetation-related outages that could stall refinery production. Vendor roadmaps introduce eye-safe 1,550 nm lasers that extend range past 3 km, widening use in open-pit mine slope analysis.

Geiger-mode sensors post a 13.11% CAGR forecast because ultra-high-point densities accelerate environmental modelling. Forestry-carbon projects in Gabon use the technology to refine biomass estimates, an attractive quality as voluntary carbon markets tighten verification standards. Elevated altitude operation supports 366 km2/h coverage, enabling national-scale DEM refreshes on single aircraft sorties. Continued research into compressive sensing promises 64-fold resolution gains without heavier data volumes, enhancing suitability for real-time flood simulations.

Middle East and Africa LiDAR Market Share Report is Segmented by Product (Aerial LiDAR, Ground-Based and More), Technology (Time-Of-Flight, Geiger-Mode and More), Component (Laser Scanners, GPS and More), Deployment Platform (UAV-Based, and More), Range (Short-Range, and More), End-Use Industry (Engineering, and More), and Country (Saudi Arabia, and More). The Market Size and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Leica Geosystems AG

- Sick AG

- Ouster Inc.

- Cepton Technologies Inc.

- Hexagon AB

- MENA 3D

- Sandvik Mining and Rock Solutions

- Trimble Inc.

- FARO Technologies Inc.

- RIEGL Laser Measurement Systems

- Quanergy Systems Inc.

- LightWare LiDAR LLC

- GlobalScan Technologies LLC

- Microdrones GmbH

- Innoviz Technologies Ltd

- Velodyne Lidar Inc.

- Teledyne Optech

- Topcon Positioning Group

- Falcon-3D

- Sitech Gulf

- DJI Enterprise

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 LiDAR mandate for smart-city digital twins in GCC

- 4.2.2 Surge in UAV-borne corridor mapping for Saudi giga-projects

- 4.2.3 Offshore wind-farm bathymetry needs off Namibia and South Africa

- 4.2.4 Security-driven perimeter surveillance at UAE critical sites

- 4.2.5 High-resolution topography for copper and gold open-pit mines

- 4.2.6 Climate-resilience flood-plain modelling across Nile basin

- 4.3 Market Restraints

- 4.3.1 Scarcity of regional calibration labs inflating lead-times

- 4.3.2 Customs duties on Class-3B laser imports in non-GCC Africa

- 4.3.3 Limited GNSS reference-station density outside Gulf states

- 4.3.4 Low public-sector CAPEX in post-conflict North Africa

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product

- 5.1.1 Aerial LiDAR

- 5.1.2 Mechanical Scanning

- 5.1.3 Solid-state Scanning

- 5.2 By Technology

- 5.2.1 Ground-based LiDAR

- 5.2.2 Time-of-Flight

- 5.2.3 Geiger-Mode

- 5.2.4 Phase-Shift

- 5.2.5 Flash LiDAR

- 5.3 By Component

- 5.3.1 Laser Scanners

- 5.3.2 GPS/GNSS Receiver

- 5.3.3 Inertial Measurement Unit

- 5.3.4 Cameras and MEMS Mirrors

- 5.3.5 Other Components

- 5.4 By Deployment Platform

- 5.4.1 Terrestrial Static Tripod

- 5.4.2 UAV-/Drone-based

- 5.4.3 Mobile Mapping (Vehicle-mounted)

- 5.4.4 Bathymetric/Airborne Hydrographic

- 5.5 By Range

- 5.5.1 Short-Range

- 5.5.2 Medium-Range

- 5.5.3 Long-Range

- 5.6 By End-Use Industry

- 5.6.1 Engineering and Construction

- 5.6.2 Oil and Gas

- 5.6.3 Aerospace and Defense

- 5.6.4 Automotive and ADAS

- 5.6.5 Mining and Quarrying

- 5.6.6 Agriculture and Forestry

- 5.7 By Country

- 5.7.1 Saudi Arabia

- 5.7.2 Qatar

- 5.7.3 Kuwait

- 5.7.4 United Arab Emirates

- 5.7.5 South Africa

- 5.7.6 Kenya

- 5.7.7 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Leica Geosystems AG

- 6.4.2 Sick AG

- 6.4.3 Ouster Inc.

- 6.4.4 Cepton Technologies Inc.

- 6.4.5 Hexagon AB

- 6.4.6 MENA 3D

- 6.4.7 Sandvik Mining and Rock Solutions

- 6.4.8 Trimble Inc.

- 6.4.9 FARO Technologies Inc.

- 6.4.10 RIEGL Laser Measurement Systems

- 6.4.11 Quanergy Systems Inc.

- 6.4.12 LightWare LiDAR LLC

- 6.4.13 GlobalScan Technologies LLC

- 6.4.14 Microdrones GmbH

- 6.4.15 Innoviz Technologies Ltd

- 6.4.16 Velodyne Lidar Inc.

- 6.4.17 Teledyne Optech

- 6.4.18 Topcon Positioning Group

- 6.4.19 Falcon-3D

- 6.4.20 Sitech Gulf

- 6.4.21 DJI Enterprise

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment