PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844665

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844665

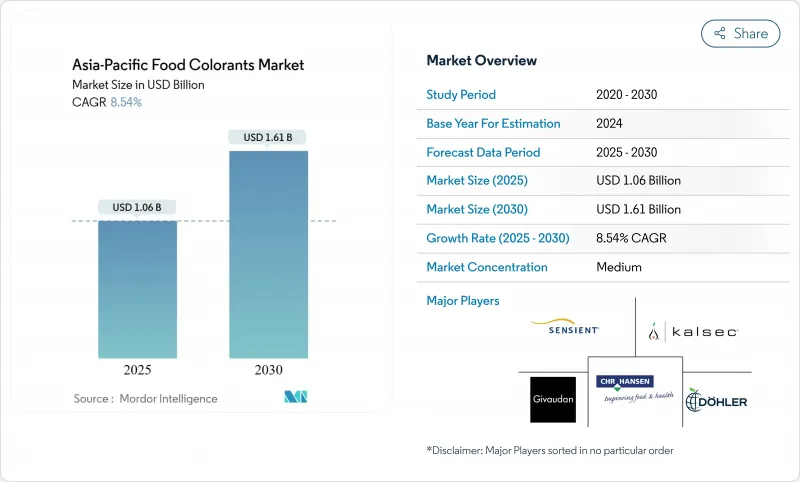

Asia-Pacific Food Colorants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Asia-Pacific food colorants market, valued at USD 1.06 billion in 2025, is expected to reach USD 1.61 billion by 2030, growing at a CAGR of 8.54%.

The market is experiencing significant growth due to increasing consumer demand for natural and organic food products, particularly in China and India's expanding food processing industries. While the beverage and confectionery sectors drive demand for colorants, the regulatory landscape across Asia-Pacific influences market dynamics through varying standards and maximum permissible limits for synthetic colors. Health concerns, including studies linking synthetic colorants to hyperactivity in children, have prompted manufacturers to shift toward natural alternatives, despite challenges related to higher costs and stability. This transition aligns with growing consumer preference for clean-label products, although manufacturers must navigate different regulatory requirements across regional markets. As the industry continues to evolve, the successful adaptation to natural alternatives and compliance with regional regulations will be crucial for manufacturers to maintain their market position and meet consumer expectations.

Asia-Pacific Food Colorants Market Trends and Insights

Rapid Expansion of Processed Food Industry Leading Regional Manufacturing Boom

The expansion of the processed food industry across Asia-Pacific is driving significant growth in the food colorant market, fueled by increasing urbanization, rising disposable incomes, and changing consumer preferences toward convenience foods. Manufacturers require stable and vibrant colorants capable of withstanding various processing conditions, particularly in countries like China, India, and Indonesia, where significant investments in food processing facilities and technological advancements are occurring. China exemplifies this trend, with its food processing industry experiencing substantial growth, supported by government initiatives focused on modernizing the agricultural sector and food supply chain. However, according to UNCTAD-WHO analysis published in March 2024, developed economies in Asia, including the Republic of Korea and Singapore, maintain processed foods at 40% or less of their total food imports. This diverse landscape of processed food consumption and regulatory frameworks across Asia-Pacific continues to shape the trajectory of the food colorant market, creating opportunities for innovation and market expansion.

Growing Influence of Western Dietary Pattern

The increasing adoption of Western dietary patterns across the Asia-Pacific region has transformed the food colorants market, driven by the growing middle-class population and their changing food preferences. This shift is particularly evident in the rising consumption of packaged foods, beverages, confectionery, and bakery products. Consumers, especially in urban areas with higher disposable incomes, expect food products to match the visual characteristics of Western counterparts. The expansion of international fast-food chains, cafes, and modern retail formats has improved access to Western-style food products, while social media and international travel have increased consumer awareness of global food trends. Local and international food manufacturers are expanding their production capacities to meet this growing demand, particularly in emerging economies. According to the World Migration Report, Europeans comprise the largest group of migrants from outside Asia in the region, including migrants from the European part of the former Soviet Union now living in Central Asia, further influencing these dietary preferences. This trend is expected to continue as urbanization increases and Western food products become more integrated into local food cultures.

Health Concerns Limiting Market Growth of Food Colorant

The increasing awareness of health issues associated with synthetic food colorants in the Asia-Pacific region poses significant challenges to market growth. Several studies have linked artificial food colors to behavioral problems in children, allergic reactions, and potential carcinogenic effects. Countries like Japan and South Korea have implemented strict regulations on synthetic food colors, particularly those derived from petroleum-based sources. Consumer advocacy groups in major markets, including China and India, are pushing for clearer labeling requirements and restrictions on artificial colorants in food products. The growing preference for clean-label products and natural ingredients has led many food manufacturers to reformulate their products, moving away from synthetic colorants. Additionally, media coverage highlighting the potential risks of artificial food colors has influenced consumer purchasing decisions, particularly among urban populations and parents of young children. These factors collectively create barriers for synthetic food colorant manufacturers and impact overall market expansion in the region.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Demand of Colorant in Bakery and Confectionery Industries

- Investments in Research and Development to Create Innovative and Stable Food Coloring Solutions

- Industry Compliance Impacts Market Development

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Red dominates the color segment with a 29.32% market share in 2024, establishing its position as the primary choice in the market. This dominance reflects the color's widespread acceptance across various food and beverage applications, particularly in products requiring warm, appetizing hues. However, blue is emerging as the fastest-growing color segment, projected to grow at a CAGR of 9.86% during 2025-2030. This growth pattern highlights a significant shift in market dynamics, where traditional preferences meet evolving consumer demands. The shift is particularly evident in regions with high social media penetration and younger consumer demographics.

The expansion of the blue segment is particularly significant given the historical challenges in sourcing natural blue colorants. This scarcity has historically limited product development options for manufacturers seeking natural alternatives. Manufacturers are addressing this through innovations in extracting and stabilizing blue pigments from natural sources such as butterfly pea flower (Clitoria ternatea) and spirulina. The trend is further supported by increasing consumer preference for clean-label products and natural ingredients, pushing manufacturers to invest more in natural blue colorant research and development.

Natural colors command a dominant 52.87% share of the Asia-Pacific food colorant market in 2024, with projections indicating a robust CAGR of 9.33% from 2025-2030. This market leadership stems from increasing health consciousness and stricter regulations against synthetic alternatives, particularly evident in markets like Japan and Australia, where consumer awareness and regulatory frameworks favor natural options. While synthetic colors continue to maintain their presence due to their cost-effectiveness and stability, the trend is further supported by technological advancements in extraction and stabilization techniques, with microencapsulation technology improving the performance of natural colorants in complex food applications.

The transition toward natural colorants has created significant agricultural opportunities across the Asia-Pacific region. India, in particular, has expanded its cultivation of color-rich crops such as turmeric and beetroot to meet the growing market demand. According to the Ministry of Agriculture and Farmers Welfare, during fiscal year 2023, the volume of turmeric production in India accounted for 1.23 million metric tons, which was 0.86 million metric tons in 2018 . This agricultural expansion, coupled with improved processing capabilities, is strengthening the natural colorant supply chain and supporting the market's continued growth trajectory.

The Asia-Pacific Food Colorants Market is Segmented by Product Type (Natural Color and Synthetic Color), Color (Blue, Red, Green, Yellow, and Others), Application (Bakery and Confectionery, Dairy-Based Products, Beverages, Nutraceuticals, Snacks and Cereals, and Others), Form (Powder and Liquid) and Geography (China, Japan, India, Australia and Rest of Asia-Pacific). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Chr. Hansen Holding A/S

- Sensient Technologies Corporation

- Dohler Group SE

- Kalsec Inc.

- Givaudan SA

- Koninklijke DSM-Firmenich AG

- Archer Daniels Midland Co.

- Roha Dyechem Sez Private Limited

- Lycored Ltd.

- Akay Natural Ingredients Private Limited

- Synthite Industries Private Limited

- San-Ei Gen F.F.I., Inc.

- Denim Colourchem (P) Limited

- Yiming Biological Tech. Co., Ltd.

- Fine Japan Co., Ltd.

- Guangzhou Leader Bio-Tech Co., Ltd.

- Shanghai Rainbow Biological Tech. Co., Ltd.

- BASF SE

- Riken Vatamin Co. Ltd

- D.D. Willaimson

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid expansion of processed food industry

- 4.2.2 Growing influence of western dietary pattern

- 4.2.3 Increase demand of colorant in bakery and confectionery industries

- 4.2.4 Investments in research and development to create innovative and stable food coloring solutions

- 4.2.5 Rising consumer demand for visually appealing food products

- 4.2.6 Changing consumer preferences toward convenience foods boost the market growth

- 4.3 Market Restraints

- 4.3.1 Health concerns limiting market growth of food colorant

- 4.3.2 Industry compliance impacts market development

- 4.3.3 Strict regulations regarding the use of synthetic food colors

- 4.3.4 Price volatility of raw materials used in natural food colorants

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Natural Color

- 5.1.2 Synthetic Color

- 5.2 By Color

- 5.2.1 Blue

- 5.2.2 Red

- 5.2.3 Green

- 5.2.4 Yellow

- 5.2.5 Others

- 5.3 By Application

- 5.3.1 Bakery and Confectionery

- 5.3.2 Dairy-based Products

- 5.3.3 Beverages

- 5.3.3.1 Alcoholic Beverages

- 5.3.3.2 Non-alcoholic Beverages

- 5.3.4 Nutraceuticals

- 5.3.5 Snacks and Cereals

- 5.3.6 Other Applications

- 5.4 By Form

- 5.4.1 Powder

- 5.4.2 Liquid

- 5.5 By Country

- 5.5.1 China

- 5.5.2 Japan

- 5.5.3 India

- 5.5.4 Australia

- 5.5.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Chr. Hansen Holding A/S

- 6.4.2 Sensient Technologies Corporation

- 6.4.3 Dohler Group SE

- 6.4.4 Kalsec Inc.

- 6.4.5 Givaudan SA

- 6.4.6 Koninklijke DSM-Firmenich AG

- 6.4.7 Archer Daniels Midland Co.

- 6.4.8 Roha Dyechem Sez Private Limited

- 6.4.9 Lycored Ltd.

- 6.4.10 Akay Natural Ingredients Private Limited

- 6.4.11 Synthite Industries Private Limited

- 6.4.12 San-Ei Gen F.F.I., Inc.

- 6.4.13 Denim Colourchem (P) Limited

- 6.4.14 Yiming Biological Tech. Co., Ltd.

- 6.4.15 Fine Japan Co., Ltd.

- 6.4.16 Guangzhou Leader Bio-Tech Co., Ltd.

- 6.4.17 Shanghai Rainbow Biological Tech. Co., Ltd.

- 6.4.18 BASF SE

- 6.4.19 Riken Vatamin Co. Ltd

- 6.4.20 D.D. Willaimson

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK