PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844667

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844667

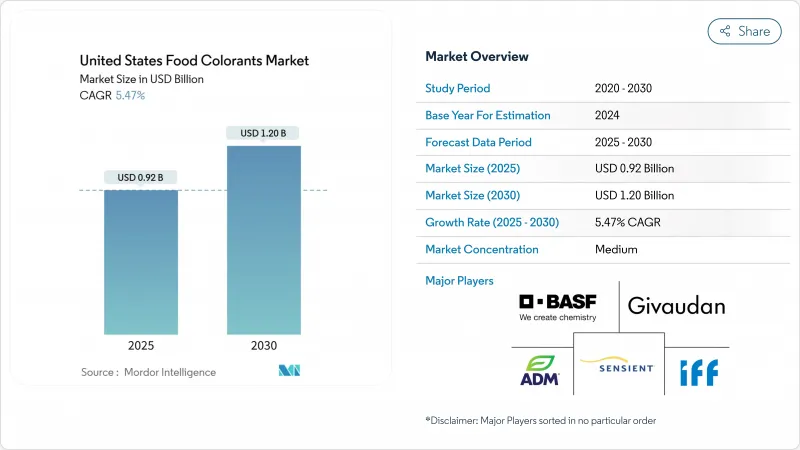

United States Food Colorants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United States food colorants market size, valued at USD 0.92 billion in 2025, is projected to reach USD 1.20 billion by 2030, reflecting a compound annual growth rate (CAGR) of 5.47% over the forecast period.

The market's growth is primarily driven by the increasing demand for processed and packaged foods, which require consistent and appealing aesthetics to attract consumers. Furthermore, the rising consumer awareness regarding natural and clean-label products has led to a shift in preference toward natural food colorants derived from plant-based sources, such as fruits, vegetables, and spices. This trend is further supported by the growing popularity of organic and plant-based food products, which align with the health-conscious and environmentally aware lifestyles of modern consumers. Advancements in food processing technologies have also contributed to the market's expansion, enabling manufacturers to develop innovative and stable colorant solutions that meet the diverse needs of the food and beverage sector. Regulatory frameworks and guidelines in the United States, such as those established by the Food and Drug Administration (FDA), ensure the safety, quality, and compliance of food colorants, thereby fostering consumer trust and market growth.

United States Food Colorants Market Trends and Insights

Demand from Processed Food Sector Boosts Market Growth

The processed food sector's expansion creates sustained demand for food colorants as manufacturers seek to maintain product consistency and visual appeal across extended shelf lives. The FDA's approval of three new natural color additives in September 2025, Galdieria extract blue, butterfly pea flower extract, and calcium phosphate, directly addresses processed food requirements by offering enhanced stability in various pH environments. This regulatory support enables processed food manufacturers to transition from synthetic alternatives without compromising product quality or consumer acceptance. The sector's growth particularly benefits liquid colorant formulations, which integrate more effectively into large-scale manufacturing processes and offer superior batch-to-batch consistency. Technological innovations in microencapsulation allow natural colorants to withstand the thermal processing and extended storage conditions typical of processed foods, eliminating a historical barrier to adoption.

Technological Advancements in Color Extraction Methods

Technological advancements in color extraction methods are significantly driving the United States Food Colorants Market. These innovations have enabled the development of more efficient, sustainable, and cost-effective processes for extracting natural colors from various sources, such as fruits, vegetables, and other plant-based materials. Enhanced extraction technologies, including enzymatic extraction, supercritical fluid extraction, and ultrasound-assisted extraction, are improving yield and quality while reducing environmental impact. Additionally, these advancements are addressing the growing consumer demand for clean-label and natural food products, further propelling the adoption of advanced color extraction methods in the food industry. The integration of these technologies is expected to play a pivotal role in shaping the market's growth trajectory during the forecast period. Furthermore, the increasing focus on research and development activities by key players in the market is leading to the introduction of innovative solutions that cater to the specific needs of food manufacturers. For instance, advancements in microencapsulation techniques are enhancing the stability and shelf life of natural food colorants, making them more viable for a wide range of applications.

Growing Health Consciousness Affects Synthetic Food Color Market Growth

The growing health consciousness among consumers is acting as a significant restraint in the market. Increasing awareness about the potential health risks associated with synthetic food colors has led to a shift in consumer preferences toward natural alternatives. This trend is further fueled by the rising demand for clean-label products, as consumers increasingly scrutinize ingredient lists and opt for food products perceived as healthier and safer. Regulatory bodies, such as the FDA, have also implemented stringent guidelines on the use of synthetic food colors, which has added to the challenges faced by manufacturers in this market. Consequently, companies are being compelled to invest in research and development to create innovative, natural color solutions that meet consumer expectations while adhering to regulatory standards. This shift in consumer behavior and regulatory pressure is expected to continue influencing the dynamics of the synthetic food color market in the United States during the forecast period.

Other drivers and restraints analyzed in the detailed report include:

- Food Product Visual Aesthetics Boosts Market Growth

- Increasing Demand for Natural and Clean-Label Products

- Stringent Government Regulations on Food Colorants

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, natural pigments dominated the United States food colorants market with a 54.92% share. This segment is projected to grow at a 6.78% CAGR through 2030, primarily fueled by the mandated phase-out of petroleum-based dyes. The increasing consumer preference for clean-label products and the rising awareness of health risks associated with synthetic dyes are further driving the demand for natural pigments. Additionally, regulatory bodies in the United States are enforcing stricter guidelines on the use of artificial colorants, which is accelerating the shift toward natural alternatives. Key industries, such as beverages, bakery, and confectionery, are increasingly incorporating natural pigments to meet consumer expectations and comply with evolving regulations.

The growing trend of plant-based and organic food products is also contributing to the adoption of natural pigments, as manufacturers aim to align with consumer demand for sustainable and environmentally friendly ingredients. Furthermore, advancements in extraction technologies and the development of innovative natural pigment formulations are enabling manufacturers to achieve vibrant and stable colors, enhancing the appeal of food and beverage products. The rising popularity of functional foods and beverages, which often utilize natural pigments for their perceived health benefits, is another factor bolstering market growth. As the United States food colorants market continues to evolve, natural pigments are expected to remain a critical component, driven by both regulatory pressures and shifting consumer preferences.

Red colors accounted for 28.32% of the 2024 revenues. Its enduring ubiquity across various applications, including beverages, gummies, and meat analogues, has solidified its position as a key player in the market. The versatility of red colorants, coupled with their widespread consumer acceptance, ensures their sustained demand across multiple product categories. Manufacturers are leveraging red's popularity to innovate and expand their product portfolios, further driving its market share. Additionally, the growing trend of plant-based and natural food products has led to increased demand for natural red colorants derived from sources such as beetroot and paprika. These natural alternatives are gaining traction as consumers prioritize clean-label products, further boosting the red segment's growth in the market.

On the other hand, blue is emerging as the fastest-growing segment in the market, with a remarkable CAGR of 8.94% during the forecast period. This growth is primarily attributed to the increasing adoption of FDA-approved Galdieria and butterfly pea extracts, which are enabling a mainstream transition from synthetic Brilliant Blue FCF to natural alternatives. These natural blue colorants are gaining traction due to rising consumer preference for clean-label products and regulatory support for safer, plant-based ingredients. Furthermore, the expanding use of blue colorants in innovative food and beverage products, such as functional drinks, confectionery, and bakery items, is driving their demand. The vibrant and appealing hues provided by natural blue colorants are also helping manufacturers differentiate their products in a competitive market.

The United States Food Colorants Market Report is Segmented by Product Type (Natural Color, and Synthetic Color), Color (Blue, Red, Green, Yellow, and Others), Application (Bakery and Confectionery, Dairy-Based Products, Beverages, Nutraceuticals, Snacks and Cereals, and Others), and Form (Powder and Liquid). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Sensient Technologies Corporation

- BASF SE

- Imternational Flavors & Fragrances Inc.

- Archer Daniels Midland Company

- Givaudan S.A.

- Dohler Group SE

- Oterra A/S

- DSM-Firmenich AG

- Kalsec Inc.

- GNT Group B.V.

- San-Ei Gen F.F.I., Inc.

- IFC Solutions Inc.

- Flavorchem Corporation

- Proquimac Color, S.L.

- Syngenta Group Co., Ltd. (Lycored Corp.)

- Biocon Colors

- Nactarome S.P.A.

- ROHA Dyechem Pvt. Ltd.

- Mane Kancor Ingredients Private Limited

- ColorKitchen, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand from Processed Food Sector Boosts Market Growth

- 4.2.2 Technological Advancements in Color Extraction Methods

- 4.2.3 Wide Availability of Food Colorant Products Driving the Market

- 4.2.4 Increasing Demand for Natural and Clean-Label Products

- 4.2.5 Food Product Visual Aesthetics Boosts Market Growth

- 4.2.6 Expansion of the Beverage and Bakery Industries

- 4.3 Market Restraints

- 4.3.1 Growing Health Consciousness Affects Synthetic Food Color Market Growth

- 4.3.2 Stringent Government Regulations on Food Colorants

- 4.3.3 Limited Stability of Natural Colorants

- 4.3.4 Fluctuating Raw Material Prices for Natural Colors

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Natural Color

- 5.1.2 Synthetic Color

- 5.2 By Color

- 5.2.1 Blue

- 5.2.2 Red

- 5.2.3 Green

- 5.2.4 Yellow

- 5.2.5 Others

- 5.3 By Application

- 5.3.1 Bakery and Confectionery

- 5.3.2 Dairy-based Products

- 5.3.3 Beverages

- 5.3.3.1 Alcoholic Beverages

- 5.3.3.2 Non-alcoholic Beverages

- 5.3.4 Nutraceuticals

- 5.3.5 Snacks and Cereals

- 5.3.6 Other Applications

- 5.4 By Form

- 5.4.1 Powder

- 5.4.2 Liquid

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Sensient Technologies Corporation

- 6.4.2 BASF SE

- 6.4.3 Imternational Flavors & Fragrances Inc.

- 6.4.4 Archer Daniels Midland Company

- 6.4.5 Givaudan S.A.

- 6.4.6 Dohler Group SE

- 6.4.7 Oterra A/S

- 6.4.8 DSM-Firmenich AG

- 6.4.9 Kalsec Inc.

- 6.4.10 GNT Group B.V.

- 6.4.11 San-Ei Gen F.F.I., Inc.

- 6.4.12 IFC Solutions Inc.

- 6.4.13 Flavorchem Corporation

- 6.4.14 Proquimac Color, S.L.

- 6.4.15 Syngenta Group Co., Ltd. (Lycored Corp.)

- 6.4.16 Biocon Colors

- 6.4.17 Nactarome S.P.A.

- 6.4.18 ROHA Dyechem Pvt. Ltd.

- 6.4.19 Mane Kancor Ingredients Private Limited

- 6.4.20 ColorKitchen, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK