PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848032

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848032

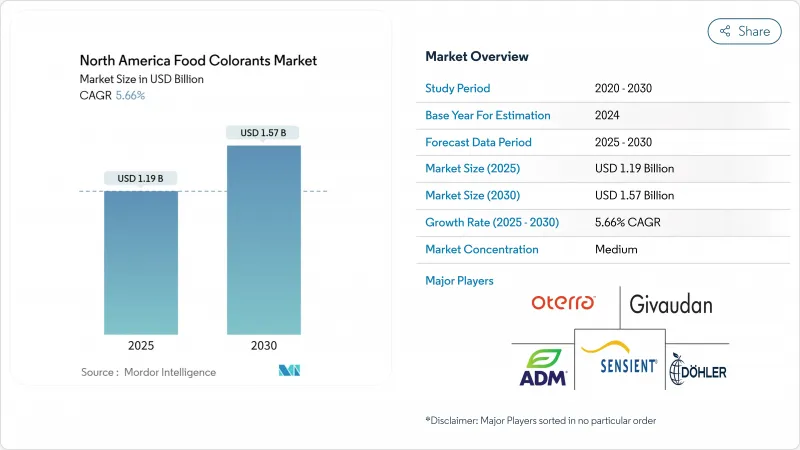

North America Food Colorants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North American food colorant market size is valued at USD 1.19 billion in 2025 and is forecast to reach USD 1.57 billion by 2030, advancing at a 5.66% CAGR throughout the period.

This growth is primarily attributed to the FDA's mandate to phase out petroleum-based synthetic dyes by December 2026, which has shifted natural colorants from a niche segment to mainstream adoption. Natural solutions market share is expected to increase as manufacturers secure long-term supply contracts to support reformulation efforts. Innovation in the sector is accelerating, with developments such as heat-stable spirulina blues, corn-derived anthocyanins, and fermentation-based pigments addressing historical performance limitations. These advancements are enabling broader applications across baked snacks, dairy products, and shelf-stable beverages. In this evolving competitive landscape, vertically integrated suppliers with control over crop inputs or proprietary microbial strains are well-positioned to benefit. Their strategic advantage allows them to capitalize on the expected price stabilization during the phase-out of synthetic dyes.

North America Food Colorants Market Trends and Insights

Processed Food Industry Driving Market Growth

The processed food sector in North America is experiencing significant growth, which serves as a major driver for the food colorant market. Manufacturers are increasingly recognizing the strategic importance of color in shaping consumer purchasing decisions. In 2024, ultra-processed foods accounted for a substantial share of the U.S. food supply. According to the International Food Information Council, nearly 79% of U.S. adults consider processed foods when making shopping decisions. This heightened focus on visual appeal is further amplified in the current social media-driven marketplace, where visually appealing food products gain a distinct competitive advantage in marketing. Leading companies, such as PepsiCo, are responding to this trend by reformulating their flagship products to incorporate natural colorants. For example, their Simply Ruffles Hot and Spicy chips now use tomato powder and red chile pepper as natural alternatives to synthetic red color, aligning with consumer preferences for cleaner and more natural ingredients.

Increasing Awareness of Food Aesthetics and Appeal to Boost the Market

Heightened consumer awareness of food aesthetics has elevated the role of color from a basic visual feature to a critical quality indicator, symbolizing freshness, flavor, and authenticity. In response to this evolving demand, manufacturers are increasingly prioritizing significant investments in premium-quality colorants to ensure their products exhibit consistent and visually appealing hues throughout their lifecycle. However, this trend is not limited to visual enhancement alone. Consumers are progressively favoring colorants derived from natural sources that also offer added nutritional benefits. For example, anthocyanins extracted from natural ingredients such as blueberries and purple carrots not only provide vibrant and attractive colors but also deliver antioxidant properties, aligning with the preferences of health-conscious consumers. This integration of aesthetic appeal and functional benefits is driving innovation in product development, with food manufacturers now adopting advanced colorant selection strategies that incorporate nutritional attributes alongside visual considerations.

Health Concerns Related to Food Color to Restrain the Market

Health concerns associated with synthetic food colorants pose significant challenges to the market, as growing scientific evidence links these additives to negative health outcomes, particularly in children. A comprehensive review by the Office of Environmental Health Hazard Assessment of seven FDA-certified synthetic dyes identified potential neurobehavioral effects, further eroding consumer trust in artificial colorants. Additionally, findings from the Environmental Working Group reveal that synthetic dyes are disproportionately used in products targeted at children, increasing scrutiny from parents and health-focused organizations. The market also faces obstacles due to the technical limitations of natural alternatives, which often require higher usage levels and specialized handling to deliver comparable visual performance. These limitations are especially evident in applications requiring heat stability or extended shelf life, restricting the adoption of natural ingredients despite growing consumer demand.

Other drivers and restraints analyzed in the detailed report include:

- Visual Appeal of Food Products Drives Market Growth

- Regulatory Shifts Accelerating Natural Colorant Adoption

- Strict FDA Regulations Impacting the Sales of Food Colorant Market

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Natural colors dominate the North American food colorant market with a 56.42% share in 2024 and are projected to grow at 6.89% CAGR from 2025-2030, substantially outpacing synthetic alternatives. This growth highlights a pivotal market shift driven by stricter regulatory frameworks and increasing consumer demand for clean-label ingredients. Technological advancements are rapidly overcoming historical performance challenges in the natural segment. For instance, in March 2024, Sensient Technologies introduced a heat-stable spirulina that retains vibrant blue hues even under processing conditions that previously degraded natural pigments.

Additionally, startups such as Phytolon and Michroma are leveraging fermentation technologies to develop fungal-derived pigments with superior stability and color intensity compared to traditional plant extracts. These innovations have the potential to close the performance gap with synthetic alternatives, transforming the economics of natural colorant production. Additionally, Consumers are increasingly opting for food products with natural coloring. The 2024 Food and Health Survey by the International Food Information Council revealed that 67% of consumers are willing to pay a premium for packaged products labeled as eco-friendly.

Red colorants maintain market leadership with 28.32% share in 2024, driven by widespread application across confectionery, beverages, and processed foods, while blue colorants are emerging as the fastest-growing segment at 8.64% CAGR (2025-2030). The FDA's ban on Red No. 3 and upcoming restrictions on Red No. 40 are driving significant changes in the red segment, creating notable reformulation challenges for manufacturers. This regulatory shift is fostering innovation in natural red alternatives. For instance, Givaudan Sense Colour is leveraging its Amaize line to develop corn-derived anthocyanins that match the performance of synthetic options.

Simultaneously, the blue segment is witnessing swift expansion, propelled by innovations in spirulina-derived colorants. Additionally, cutting-edge technologies harnessing butterfly pea flower extract granted FDA approval in 2025 are broadening the horizons of the natural blue color palette. Moreover, breakthroughs in extraction and processing techniques are bolstering this growth by enhancing the quality, stability, and cost-effectiveness of natural blue colorants.

The North America Food Colorants Market is Segmented by Product Type (Natural Color and Synthetic Color), Color (Blue, Red, Green, Yellow, and More), Application (Bakery and Confectionery, Dairy-Based Products, Beverages, and More), Form (Powder and Liquid), and Geography (United States, Canada, Mexico, and Rest of North America). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Tons).

List of Companies Covered in this Report:

- Sensient Technologies Corporation

- Oterra A/S

- Archer Daniels Midland Company

- Givaudan SA

- Dohler Group SE

- BASF SE

- GNT Group B.V.

- DSM-Firmenich

- Kalsec Inc.

- Kerry Group plc

- ADAMA Agricultural Solutions

- San-Ei Gen F.F.I., Inc.

- Kanegrade Ltd.

- Roha Dyechem Pvt. Ltd.

- Flavorchem Corporation

- Colormaker Inc

- Prime Ingredients, Inc

- ColorKitchen, LLC

- Roquette Freres

- IFC Solutions

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Processed food industry driving market growth

- 4.2.2 Increasing awareness of food aesthetics and appeal to boost the market

- 4.2.3 Visual appeal of food products drives market growth

- 4.2.4 Regulatory shifts accelerating natural colorant adoption

- 4.2.5 Rising demand for clean label products drives market growth

- 4.2.6 Technological advancements in food colorant production boost market expansion

- 4.3 Market Restraints

- 4.3.1 Health concerns related to food color to restrain the market

- 4.3.2 Strict FDA regulations impacting the sales of food colorant market

- 4.3.3 High production costs and limited availability of natural ingredients

- 4.3.4 Stringent labeling requirements hamper the market

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Natural Color

- 5.1.2 Synthetic Color

- 5.2 By Color

- 5.2.1 Blue

- 5.2.2 Red

- 5.2.3 Green

- 5.2.4 Yellow

- 5.2.5 Others

- 5.3 By Application

- 5.3.1 Bakery and Confectionery

- 5.3.2 Dairy-based Products

- 5.3.3 Beverages

- 5.3.3.1 Alcoholic Beverages

- 5.3.3.2 Non-alcoholic Beverages

- 5.3.4 Nutraceuticals

- 5.3.5 Snacks and Cereals

- 5.3.6 Other Applications

- 5.4 By Form

- 5.4.1 Powder

- 5.4.2 Liquid

- 5.5 By Country

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

- 5.5.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Sensient Technologies Corporation

- 6.4.2 Oterra A/S

- 6.4.3 Archer Daniels Midland Company

- 6.4.4 Givaudan SA

- 6.4.5 Dohler Group SE

- 6.4.6 BASF SE

- 6.4.7 GNT Group B.V.

- 6.4.8 DSM-Firmenich

- 6.4.9 Kalsec Inc.

- 6.4.10 Kerry Group plc

- 6.4.11 ADAMA Agricultural Solutions

- 6.4.12 San-Ei Gen F.F.I., Inc.

- 6.4.13 Kanegrade Ltd.

- 6.4.14 Roha Dyechem Pvt. Ltd.

- 6.4.15 Flavorchem Corporation

- 6.4.16 Colormaker Inc

- 6.4.17 Prime Ingredients, Inc

- 6.4.18 ColorKitchen, LLC

- 6.4.19 Roquette Freres

- 6.4.20 IFC Solutions

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK