PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844703

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844703

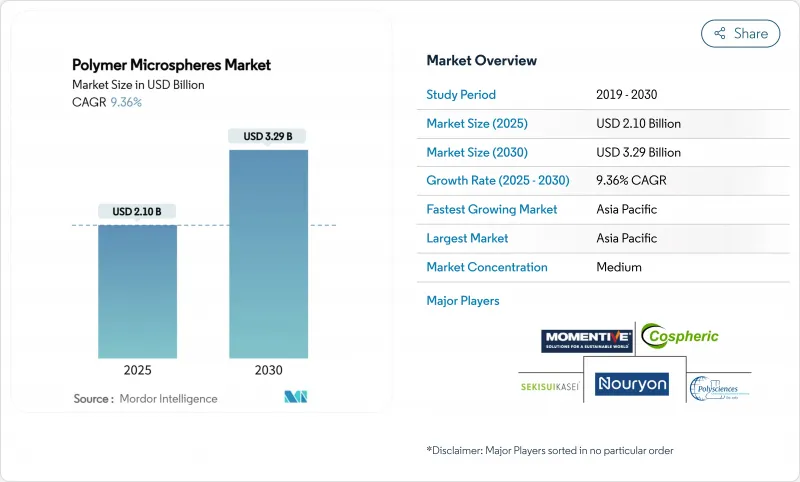

Polymer Microspheres - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Polymer Microspheres Market size is estimated at USD 2.10 billion in 2025, and is expected to reach USD 3.29 billion by 2030, at a CAGR of 9.36% during the forecast period (2025-2030).

Demand accelerates as drug developers seek precision delivery systems, automotive producers intensify lightweighting programs, and additive-manufacturing firms adopt spherical feedstocks for complex parts. Pharmaceutical formulations that exploit poly-lactic-co-glycolic acid (PLGA) and other biodegradable carriers bring price premiums that offset higher production costs. Automakers use hollow and expandable grades to cut part density, which supports emissions and electrification targets. Electronics assemblers specify thermally conductive variants for advanced packaging, while 3-D printing service bureaus purchase narrow-cut powders that ensure consistent layer deposition. On the supply side, bio-based innovations reposition incumbent producers, yet volatile styrene and propylene prices compress margins for firms without upstream integration.

Global Polymer Microspheres Market Trends and Insights

Rising Adoption in Targeted Drug Delivery and Controlled-Release Pharmaceuticals

Precise release profiles achievable with PLGA and other biodegradable carriers have shifted formulators away from traditional tablets toward injectable or implantable microsphere systems. The capability to encapsulate biologics improves stability, which reduces cold-chain losses and enhances therapeutic outcomes. Microfluidic manufacturing now delivers narrow particle-size distributions that overcome historic batch variability. The United States Food and Drug Administration has cleared more than 15 PLGA-based products, providing clear regulatory precedents. Personalized-medicine programs exploit tunable release kinetics, enabling dosing designed around individual pharmacokinetic profiles. Pharmaceutical companies that already own sterile microsphere capacity build high switching costs that reinforce competitive moats.

Demand for Lightweight Fillers in Automotive and Transportation Components

Regulators in Europe require fleetwide weight reductions that support CO2 intensity targets, encouraging polymers that integrate hollow spheres into interior trim, bumper beams, and under-hood parts. Density can fall by 25% with no loss in mechanical stiffness, a gain that extends electric vehicle driving range. Lower-pressure molding made possible by microspheres also trims cycle times, which improves plant productivity. Suppliers that co-develop grades with compounders lock in multiyear sourcing agreements. As battery-electric models account for a larger share of production, every kilogram removed from the body in white delivers tangible cost and range advantages for original equipment manufacturers.

Restrictions on Micro-Plastics in Cosmetics and Toiletries

European Union regulation limits microplastic content in rinse-off cosmetics to 0.01%, effectively banning conventional polystyrene spheres in facial scrubs and toothpastes. Global brands harmonize formulations to a single compliant standard, which removes a significant volume outlet for disposable grades. Suppliers that lack biodegradable alternatives see immediate revenue declines. New product development cycles also divert resources toward regulatory testing, slowing launches in adjacent categories. While bio-degradable replacements offer higher margins, the short-term shift challenges cash flows for firms heavily exposed to personal care.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Micro-Electronics Manufacturing

- Growth of 3-D Printing Feedstocks Using Polymer Microspheres

- Production-Scale Challenges in Ultra-Uniform Biodegradable Microspheres

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Expandable grades captured 52.76% of 2024 revenue, underpinned by steady use in automotive and construction composites, where controlled expansion lowers density without sacrificing strength. Biodegradable grades, while smaller, are forecast to grow fastest at 11.18% CAGR as regulators and drug developers favor PLGA and polycaprolactone matrices for controlled drug release. Asia-Pacific formulators historically focused on expandable spheres for lightweight fillers, now diversifying into bio-degradable capacity to hedge future demand.

Pharmaceutical contractors lock in long-term supply agreements that secure capacity for late-stage clinical programs, stabilizing order books. By contrast, generic expandable products face intensifying price competition, especially from domestic producers in China and India that leverage low-cost bases. As a result, revenue mix across the polymer microspheres market tilts toward higher-margin biodegradable segments through 2030.

The Polymer Microspheres Market Report is Segmented by Type (Expandable Microspheres, and Biodegradable Microspheres), Material Composition (Polystyrene (PS), Polymethyl-Methacrylate (PMMA), Polyethylene (PE), and More), End-User Industry (Life Sciences and Pharmaceuticals, Cosmetics and Personal Care, Paints and Coatings, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific holds a 37.20% share of the 2024 global value, reflecting its dominance in pharmaceutical manufacturing, semiconductor assembly, and automotive production. The region's 10.75% forecast CAGR stems from cost advantages in feedstocks and expanding electric-vehicle assembly lines that value lightweight fillers. India amplifies growth as domestic pharmaceutical output rises, and local cosmetics brands adopt compliant, degradable alternatives. Export-oriented suppliers leverage established logistics to ship to North America and Europe, reinforcing Asia-Pacific's role as the primary production hub for the polymer microspheres market.

The region's 10.75% forecast CAGR stems from cost advantages in feedstocks and expanding electric-vehicle assembly lines that value lightweight fillers. India amplifies growth as domestic pharmaceutical output rises, and local cosmetics brands adopt compliant, degradable alternatives. Export-oriented suppliers leverage established logistics to ship to North America and Europe, reinforcing Asia-Pacific's role as the primary production hub for the polymer microspheres market.

North America maintains strong consumption through innovation in drug delivery and stringent corporate average fuel economy regulations that embed lightweighting targets. Contract research organizations and original equipment manufacturers collaborate with microsphere suppliers on proprietary grades that meet unique performance criteria. Europe enforces micro-plastic restrictions under REACH, compelling formulators to adopt biodegradable spheres. This legislative push drives rapid product reformulation across personal care and paints. South America and the Middle-East, and Africa experience moderate uptake as industrial diversification advances, but supply relies on imports due to limited local production capacity.

- Bangs Laboratories Inc.

- CD Bioparticles

- Cospheric LLC

- DiaSorin S.p.A

- Evonik Industries AG

- Matsumoto Yushi Seiyaku Co., Ltd.

- Merck KGaA

- Momentive

- Nouryon

- Phosphorex Inc.

- PolyMicrospheres

- Polysciences Inc.

- Sekisui Kasei Co., Ltd.

- Sphere Fluidics Ltd.

- Sunjin Chemical Co., Ltd.

- Thermo Fisher Scientific Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Adoption in Targeted Drug Delivery and Controlled-Release Pharmaceuticals

- 4.2.2 Demand for Lightweight Fillers in Automotive and Transportation Components

- 4.2.3 Surge in Micro-Electronics Manufacturing

- 4.2.4 Growth of 3-D Printing Feedstocks Using Polymer Microspheres

- 4.2.5 Emergence of Bio-Based Expandable Microspheres for Low-Carbon Building Materials

- 4.3 Market Restraints

- 4.3.1 Restrictions on Micro-Plastics in Cosmetics and Toiletries

- 4.3.2 Volatile Petrochemical Feedstock Prices and Supply Disruption Risk

- 4.3.3 Production-Scale Challenges in Ultra-Uniform Biodegradable Microspheres

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Expandable Microspheres

- 5.1.2 Biodegradable Microspheres

- 5.2 By Material Composition

- 5.2.1 Polystyrene (PS)

- 5.2.2 Polymethyl-methacrylate (PMMA)

- 5.2.3 Polyethylene (PE)

- 5.2.4 Polyurethane (PU)

- 5.2.5 Biodegradable Polymers (PLGA, PCL, etc.)

- 5.2.6 Others (Nylon, PVDF, etc.)

- 5.3 By End-User Industry

- 5.3.1 Life Sciences and Pharmaceuticals

- 5.3.2 Cosmetics and Personal Care

- 5.3.3 Paints and Coatings

- 5.3.4 Electronics

- 5.3.5 Ceramics and Composites

- 5.3.6 Plastics

- 5.3.7 Other End-User Industries (3-D Printing, Agriculture, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration Analysis

- 6.2 Strategic Moves (Mergers and Acquisitions, JVs, Collaborations)

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Bangs Laboratories Inc.

- 6.4.2 CD Bioparticles

- 6.4.3 Cospheric LLC

- 6.4.4 DiaSorin S.p.A

- 6.4.5 Evonik Industries AG

- 6.4.6 Matsumoto Yushi Seiyaku Co., Ltd.

- 6.4.7 Merck KGaA

- 6.4.8 Momentive

- 6.4.9 Nouryon

- 6.4.10 Phosphorex Inc.

- 6.4.11 PolyMicrospheres

- 6.4.12 Polysciences Inc.

- 6.4.13 Sekisui Kasei Co., Ltd.

- 6.4.14 Sphere Fluidics Ltd.

- 6.4.15 Sunjin Chemical Co., Ltd.

- 6.4.16 Thermo Fisher Scientific Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment