PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846177

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846177

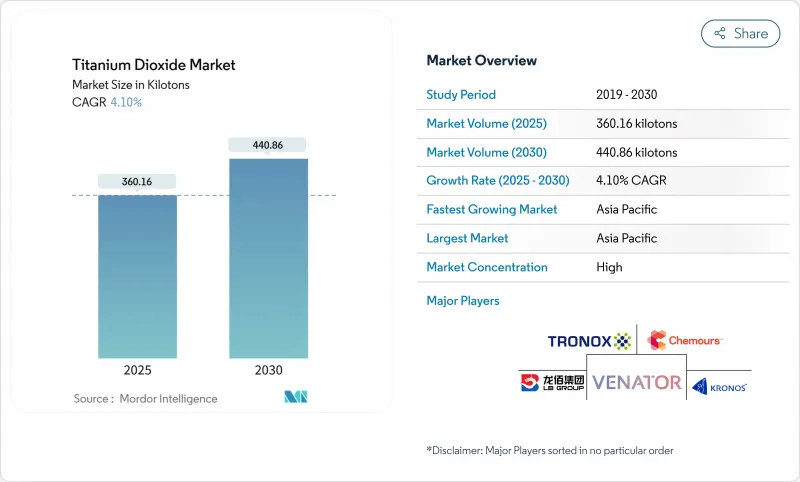

Titanium Dioxide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Titanium Dioxide Market size is estimated at 360.16 kilotons in 2025, and is expected to reach 440.86 kilotons by 2030, at a CAGR of 4.10% during the forecast period (2025-2030).

Rising demand from construction, packaging, automotive plastics, and cool-roof coatings offsets regulatory headwinds, especially Europe's Category 2 carcinogen labeling and anti-dumping duties on Chinese material. Asia-Pacific, anchored by China's supply base and India's localization push, is advancing at a 4.92% CAGR. Manufacturers are balancing cost pressures from volatile ilmenite and rutile feedstock with technology upgrades in the chloride route. Process optimization by players such as Chemours is boosting capacity by 15% without major capital outlays, while vertical integration by Tronox and others mitigates raw-material volatility. Regulatory divergence between the EU and other regions is spurring differentiated product portfolios and creating scope for regional arbitrage.

Global Titanium Dioxide Market Trends and Insights

Surge in Demand for Waterborne Architectural Coatings in Asia-Pacific

Escalating volatile-organic-compound regulations across China, India and Indonesia are accelerating substitution of solvent systems by waterborne paints, driving incremental rutile pigment offtake in the region. Regional coating lines are upgrading dispersion technology to achieve hiding power parity, underpinning continuous volume growth for the titanium dioxide market. Infrastructure stimulus programs in India and Indonesia compound demand, while localized chloride-route capacity secures supply resilience. Formulators emphasize lower odor and safer worksite conditions, bolstering acceptance among contractors. The shift is adding a structural tailwind despite feedstock price swings.

Shift Toward Lightweight, High-Gloss Automotive Plastics in Europe

Stringent EU fleet-average carbon-dioxide limits have placed lightweighting at the center of design strategies. Incorporating titanium dioxide into polypropylene and polycarbonate trim delivers high-gloss surfaces that rival coated metal panels yet weigh markedly less, achieving a 5-7% fuel-efficiency gain per 10% vehicle weight reduction. Premium OEMs adopt hydrophobic grades such as TIOXIDE TR48, which disperse at high processing temperatures without loss of brightness. The titanium dioxide market gains not only in volume but in value because these specialty grades command premium pricing and carry minimal regulatory substitution risk.

EU Classification of TiO2 as Suspected Carcinogen Raising Labeling Costs

European Regulation 2025/4 mandates cancer warnings on powder formulations containing more than or equal to 1% titanium dioxide. Coating, plastisol, and printing-ink suppliers face reformulation, new packaging artwork, and legal reviews, inflating compliance costs. Divergent rules in the United Kingdom and North America complicate global portfolio management, requiring dual labeling strategies. Short-run manufacturing batches raise unit costs, dampening discretionary demand in DIY channels. Although the European Court annulled the hazard label in 2022, the ruling was reversed in 2025 after scientific reassessment, reinforcing uncertainty for the titanium dioxide market.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Laminated Paperboard Packaging for E-Commerce Logistics

- Uptake of UV-Resistant Cool-Roof Coatings in Middle-East Construction

- Volatility in Ilmenite/Rutile Feedstock Prices Impacting Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Rutile commanded 78% of the titanium dioxide market in 2024, reflecting its higher refractive index (2.7) and superior weatherability. This supremacy is entrenched in outdoor architectural coatings, automotive topcoats, and polymer masterbatches where long-term gloss retention is critical. Dual-function grades integrating photocatalytic traits are unlocking new self-cleaning surface opportunities, further entrenching the rutile's lead.

Anatase, accounting for the demand balance, is advancing at a faster 4.5% CAGR thanks to niche growth in pharmaceutical excipients and photocatalytic building materials. Surface-modified anatase grades extend shelf life in food-contact papers and offer distinct bluish undertones valued in premium office papers.

The sulfate route delivered 65% of the titanium dioxide market size in 2024 by leveraging lower-grade ilmenite and smaller capital footprints. Nevertheless, chloride-based capacity is expanding at 4.7% CAGR as regulators intensify scrutiny of acidic sulfate waste streams. Chloride plants use high-TiO2 slag or natural rutile and generate primarily rutile pigment with lower trace impurities, enabling higher pricing in premium coatings and masterbatch segments. Chemours reports that proprietary low-temperature chlorination at 350-450 °C can reduce energy use by 30% and improve yield.

Emerging producers in India are adopting chloride technology to achieve quality parity with Western suppliers and to hedge against evolving effluent norms. Incremental debottlenecking projects across North America and Europe aim to squeeze 5-15% extra output from existing chloride assets without greenfield spending, keeping supply balanced despite regional capacity closures such as Tronox's Botlek facility. Process-driven cost differentials, therefore, remain central to titanium dioxide market competitiveness.

The Titanium Dioxide Market Report Segments the Industry by Grade (Rutile and Anatase), Process (Chloride and Sulfate) Application (Paints and Coatings, Plastics, Paper and Pulp, Cosmetics and Other Applications), End-User Industry (Construction, Automotive and Transportation, Packaging, and More) and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Volume (Tons)

Geography Analysis

Asia-Pacific controls 35% of the titanium dioxide market and delivers the fastest 4.92% CAGR through 2030. China alone houses a major portion of global TiO2 capacity, balancing exports with rising domestic architectural and infrastructure demand. Government directives to upgrade pigment quality and curb sulfate-process effluent are pushing producers toward chloride technology, replicating Western standards.

North America's titanium dioxide market remains driven by durable goods, aerospace coatings, and packaging films. Mature environmental regulations favor chloride output, and corporate ESG commitments spur research and development into lower-carbon pigment pathways. Europe's market is shaped by dual constraints: Category 2 carcinogen labeling and definitive anti-dumping duties on Chinese imports. These measures elevate local production costs but also encourage premium-grade innovation to justify higher price points.

The Middle-East and Africa present emergent potential propelled by construction megaprojects. Cool-roof mandates in the Gulf Cooperation Council and rising tourism facilities spur high-albedo coating uptake. Domestic TiO2 production remains negligible, driving import dependency and exposure to freight fluctuations.

- Cinkarna Celje

- Evonik Industries AG

- Grupa Azoty S.A.

- Hangzhou Harmony Chemical Co.,Ltd

- INEOS

- ISHIHARA SANGYO KAISHA, LTD.

- Kemipex

- Kronos Worldwide, Inc.

- LB Group

- Precheza

- Shandong Jinhai Titanium Resources Technology Co., Ltd.

- TAYCA Co., Ltd.

- The Chemours Company

- Titanos

- Tronox Holdings Plc

- Venator Materials PLC

- Zhejiang TITAN Design& Engineering CO., Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Demand for Waterborne Architectural Coatings in Asia-Pacific Boosting Rutile TiO2 Pigment Consumption

- 4.2.2 Shift Toward Lightweight, High-Gloss Automotive Plastics in Europe

- 4.2.3 Growth of Laminated Paperboard Packaging for E-Commerce Logistics

- 4.2.4 Uptake of UV-Resistant Cool-Roof Coatings in Middle-East Construction

- 4.2.5 Localization of Chloride-Route TiO2 Capacity in India

- 4.3 Market Restraints

- 4.3.1 EU Classification of TiO2 as Suspected Carcinogen Raising Labeling Costs

- 4.3.2 Volatility in Ilmenite/Rutile Feedstock Prices Impacting Margins

- 4.3.3 Competitive Pressure from Alternative White Pigments

- 4.4 Value Chain Analysis

- 4.5 Trade Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products and Services

- 4.6.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Grade

- 5.1.1 Rutile

- 5.1.2 Anatase

- 5.2 By Process

- 5.2.1 Chloride

- 5.2.2 Sulfate

- 5.3 By Application

- 5.3.1 Paints and Coatings

- 5.3.2 Plastics

- 5.3.3 Paper and Pulp

- 5.3.4 Cosmetics

- 5.3.5 Other Applications (Leather, Textiles, Rubber)

- 5.4 By End-user Industry

- 5.4.1 Construction

- 5.4.2 Automotive and Transportation

- 5.4.3 Packaging

- 5.4.4 Consumer Goods

- 5.4.5 Other End-user Industries

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Nordics

- 5.5.3.6 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Egypt

- 5.5.5.5 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Cinkarna Celje

- 6.4.2 Evonik Industries AG

- 6.4.3 Grupa Azoty S.A.

- 6.4.4 Hangzhou Harmony Chemical Co.,Ltd

- 6.4.5 INEOS

- 6.4.6 ISHIHARA SANGYO KAISHA, LTD.

- 6.4.7 Kemipex

- 6.4.8 Kronos Worldwide, Inc.

- 6.4.9 LB Group

- 6.4.10 Precheza

- 6.4.11 Shandong Jinhai Titanium Resources Technology Co., Ltd.

- 6.4.12 TAYCA Co., Ltd.

- 6.4.13 The Chemours Company

- 6.4.14 Titanos

- 6.4.15 Tronox Holdings Plc

- 6.4.16 Venator Materials PLC

- 6.4.17 Zhejiang TITAN Design& Engineering CO., Ltd

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Increased Use of Ultrafine Titanium Dioxide in Cosmetics and Cool-Roofing