PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846188

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846188

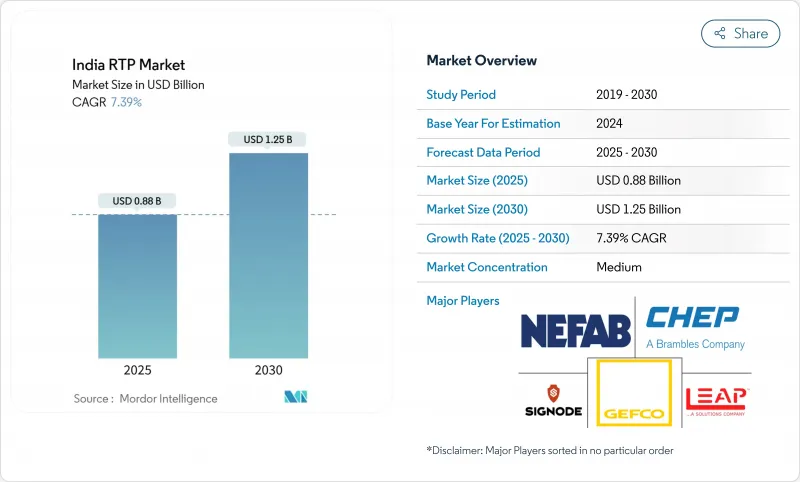

India RTP - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The India returnable transport packaging market is valued at USD 0.875 billion in 2025 and is forecast to reach USD 1.25 billion by 2030, advancing at a 7.39% CAGR.

Rising regulatory pressure, especially the Extended Producer Responsibility (EPR) mandate that stipulates 30% recycled content in rigid plastics by April 2025, is accelerating the transition from single-use to multi-cycle assets. The rapid surge of e-commerce toward a USD 300 billion opportunity by 2030 is magnifying demand for pooled pallets, crates, and Intermediate Bulk Containers that can circulate across fragmented last-mile networks. Consolidation of asset pools, such as LEAP India's acquisition of CHEP India, is adding scale efficiencies while embedding digital track-and-trace systems that curb an estimated 10% annual pallet loss rate. Meanwhile, the National Logistics Policy's vision to trim logistics costs to global benchmarks by 2030 underpins infrastructure investments that facilitate faster asset turns and improved utilization across the India returnable transport packaging market.

India RTP Market Trends and Insights

Government EPR and Recycled-Content Mandates

Mandatory 30% recycled content for rigid plastics effective April 2025 is prompting beverage, FMCG, and electronics players to redesign supply chains around reusable assets. Resistance from bottlers has exposed recycling-capacity gaps, but EPR is simultaneously rewarding early movers such as Ganesha Ecopet, which tripled PET recycling output to 42,000 tpa in 2024. Anticipated expansion of EPR to all substrates by 2026 will widen compliance terrain, placing the India returnable transport packaging market at the center of corporate circularity strategies. Companies with established reverse-logistics loops now enjoy a regulatory moat that raises switching costs for laggards. Investments in deposit-return schemes and reverse-vending networks across Maharashtra and Gujarat illustrate how regional policy leadership can accelerate asset circulation.

Explosive Growth of E-commerce 3PL Pooling

Tier II and III cities contributed 41.5% of online retail volumes in 2022, compelling 3PLs to adopt standardized totes and foldable crates that survive multiple touchpoints without repacking costs. Warehousing stock exceeded 300 million ft2 by 2025, and operators such as NIDO Group are automating sortation with scanners that read RFID tags embedded in shared crates. The collective scale is shrinking unit logistics spend by up to 15%, a saving that directly feeds e-commerce's competitive pricing model. Government e-Marketplace orders topping USD 24 billion in FY 2023 further validate pooled-asset economics for institutional procurement channels. These dynamics widen the India returnable transport packaging market's customer base beyond traditional manufacturing, anchoring growth in digital trade corridors.

High Upfront Capex and ROI Uncertainty

A comprehensive RTP program can demand millions of USD in tooling, moulds, and fleet build-out, which challenges the cash flow of small enterprises. Time Technoplast's Rs 1,500 crore (USD 180 million) outlay illustrates the scale required for nationwide presence. With payback periods spanning 18-36 months, CFOs hesitate amid volatile resin prices and demand swings. Supreme Industries' revenue dip during Q2 FY 2025, aggravated by PVC price fluctuations, highlights how material cycles can stretch ROI horizons. Limited access to asset-financing instruments keeps many SMEs on the fence, muting potential penetration in the India returnable transport packaging market.

Other drivers and restraints analyzed in the detailed report include:

- Cost-Saving Push by Food and beverage and Electronics OEMs

- OEM Demand for RFID-Enabled Zero-Defect Logistics

- Fragmented Reverse-Logistics Infrastructure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic retained 58.42% of the India returnable transport packaging market in 2024, reflecting its lightweight strength and affordable tooling costs. The segment's leadership is entrenched in beverage, FMCG, and electronics supply chains that prioritize speed over heavy-duty performance. Yet escalating sustainability mandates and the need for higher heat resistance are steering pharmaceutical and chemical exporters toward metal containers, propelling the segment at a 9.32% CAGR to 2030. Polypropylene's price creep is pushing buyers to scrutinize total life-cycle economics rather than upfront unit costs, a calculus that often favors stainless-steel or aluminum IBCs for high-margin payloads. Nilkamal's investment in food-grade HDPE crates underlines niche specialization as a defense against metal incursion. Bio-based PLA initiatives backed by Rs 2,000 crore (USD 240 million) in new capacity could reorder material preference by late decade, adding a green premium layer to the India returnable transport packaging market.

Material supply stability now influences sourcing contracts as much as price. Resin buyers monitor refinery shutdowns and freight disruptions with new urgency, adopting dual-spec packaging qualified across plastic and metal to hedge risk. Meanwhile, metal pool operators highlight 8-10-year service lives and secondary scrap value that offsets higher capex. As circular-economy scorecards become part of tender evaluations, brand owners increasingly refresh bills of material to reflect quantified CO2 reductions linked to closed-loop polymers and infinitely recyclable alloys. The competitive interplay is likely to sustain plastic's headline dominance yet chip away incremental share in regulated end-markets, keeping material choice fluid across the India returnable transport packaging market.

Pallets represented 35.42% of the India returnable transport packaging market size in 2024, cementing their status as the universal workhorse of domestic logistics. Standardized footprints, especially the 1200 X 1000 mm base, mesh well with automated storage and retrieval systems now proliferating in Grade A warehouses. Collaborative robots at snack-food plants stack pallet loads 12% faster, cutting labor cost per ton and reinforcing the pallet's centrality to factory automation strategies. Intermediate Bulk Containers are the fastest riser with an 8.92% CAGR, drawing demand from chemical, agrochemical, and pharmaceutical exporters that value their high payload density and compatibility with ISO tank freight lanes. Fold-flat models pare backhaul volume by up to 65%, a compelling benefit as diesel remains above INR 90 per liter in key corridors.

Product development is tilting toward smart variants: RFID-enabled pallets capable of plug-and-play sensor integration, insulated IBCs with phase-change materials for 120-hour cold hold, and collapsible crates that self-lock to cut manual clip usage. Time Technoplast's 60% share in large plastic drums shows how dominance in a niche can shield margins even when broader product lines face commoditization pressures. Over the forecast period, demand convergence around omnichannel fulfillment will blur product boundaries, birthing hybrid solutions such as pallet-sized foldable boxes fitted with dunnage inserts. These innovations will elevate product mix complexity across the India returnable transport packaging market.

India Returnable Transport Packaging Market is Segmented by Material (Plastic, Metal, Wood), Product Type (Pallets, Crates and Trays, Intermediate Bulk Containers, and More), End-User Industry (Automotive, Food and Beverage, Consumer Goods and Retail, and More), Circulation Mode (Closed-Loop, Open/Pooling), and Ownership Model (Rental/Leasing, In-House Ownership). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Nefab AB

- Signode India Ltd

- Holisol Logistics

- CHEP India (Brambles)

- Montara Logistics

- Leap India

- Leadec Group

- Flexol Packaging (India) Ltd

- GEFCO India Pvt Ltd

- ORBIS Corporation

- Nilkamal Ltd

- Schoeller Allibert India

- Supreme Industries

- Tosca Services LLC

- Time Technoplast Ltd

- IFCO Systems India

- Loscam (India)

- IPL Macro Plastics

- Mahindra Logistics - BoxNow

- Reusable Transport Packaging India LLP

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government EPR and recycled-content mandates

- 4.2.2 Explosive growth of e-commerce 3PL pooling

- 4.2.3 Cost-saving push by FandB and electronics OEMs

- 4.2.4 OEM demand for RFID-enabled zero-defect logistics

- 4.2.5 Cold-chain pharma export boom needing insulated RTP

- 4.3 Market Restraints

- 4.3.1 High upfront capex and ROI uncertainty

- 4.3.2 Fragmented reverse-logistics infrastructure

- 4.3.3 GST compliance hurdles for pooled assets

- 4.3.4 Asset loss from lack of pallet-tracking standards

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Industry Value-Chain Analysis

- 4.9 PESTEL Analysis - India RTP Industry

- 4.10 Coverage of Circulation Models

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Material

- 5.1.1 Plastic

- 5.1.2 Metal

- 5.1.3 Wood

- 5.2 By Product Type

- 5.2.1 Pallets

- 5.2.2 Crates and Trays

- 5.2.3 Intermediate Bulk Containers (IBCs)

- 5.2.4 Drums and Barrels

- 5.2.5 Dunnage and Racks

- 5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Food and Beverage

- 5.3.3 Consumer Goods and Retail

- 5.3.4 Electronics and Appliances

- 5.3.5 Pharmaceuticals and Healthcare

- 5.3.6 Other End-User Industry

- 5.4 By Circulation Mode

- 5.4.1 Closed-Loop

- 5.4.2 Open/Pooling

- 5.5 By Ownership Model

- 5.5.1 Rental/Leasing

- 5.5.2 In-house Ownership

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Nefab AB

- 6.4.2 Signode India Ltd

- 6.4.3 Holisol Logistics

- 6.4.4 CHEP India (Brambles)

- 6.4.5 Montara Logistics

- 6.4.6 Leap India

- 6.4.7 Leadec Group

- 6.4.8 Flexol Packaging (India) Ltd

- 6.4.9 GEFCO India Pvt Ltd

- 6.4.10 ORBIS Corporation

- 6.4.11 Nilkamal Ltd

- 6.4.12 Schoeller Allibert India

- 6.4.13 Supreme Industries

- 6.4.14 Tosca Services LLC

- 6.4.15 Time Technoplast Ltd

- 6.4.16 IFCO Systems India

- 6.4.17 Loscam (India)

- 6.4.18 IPL Macro Plastics

- 6.4.19 Mahindra Logistics - BoxNow

- 6.4.20 Reusable Transport Packaging India LLP

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment