PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846214

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846214

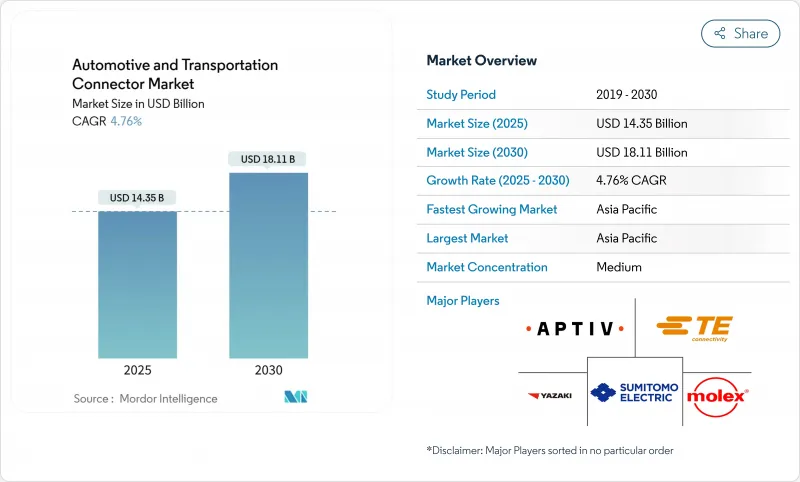

Automotive And Transportation Connector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The automotive and transportation connector market size stands at USD 14.35 billion in 2025 and is tracking a 4.76% CAGR that will lift revenue to USD 18.11 billion by 2030.

Growth now hinges less on sheer unit volume and more on the design complexity that supports high-voltage electrified powertrains, multi-gigabit data exchange for automated driving, and fast-evolving global compliance regimes. Demand bifurcates between legacy wire-to-board formats that anchor mature body-wiring looms and advanced high-density interfaces required for zonal vehicle architectures. Automakers' shift to software-defined platforms keeps data-rate performance in focus, while sourcing policies shaped by geopolitical concerns push design engineers to qualify multiple regional supply bases. These crosscurrents elevate development spending on high-reliability seals, electromagnetic shielding, and thermal management, allowing suppliers that master these disciplines to capture outsized value per vehicle.

Global Automotive And Transportation Connector Market Trends and Insights

Electrification Surge Spurring High-Voltage Connector Demand

Electric vehicles require nearly three times more copper than comparable combustion models, driving a parallel jump in connector amperage and creepage design discipline. TE Connectivity's AMP+ range already supports 800 V architectures, using touch-safe housings and optimized insulation paths that withstand charging currents above 350 A . Immersion-cooled connector assemblies are emerging as currents climb, ensuring thermal limits during ultra-fast charging sessions. Suppliers capable of balancing dielectric strength, vibration resistance, and automated manufacturability gain preferred-source status among global EV programs.

ADAS and Infotainment Integration Driving High-Speed Data Connectors

Autonomous prototypes generate over 4 TB of data per day, dictating connector systems that endure high vibration while transmitting 20 GHz signals at under-1 dB insertion loss. Aptiv's H-MTD miniature coax family meets 56 Gbps requirements within a sealed automotive housing, shrinking footprint versus legacy FAKRA designs. Ethernet shifts such as 1000BASE-T1 simplify wiring harnesses to a single twisted pair, supporting weight reduction targets on premium vehicles. Reliable connector EMI performance directly shapes camera-based sensor fusion accuracy that underpins level-3 autonomy.

Copper-Price Volatility Inflating BOM Costs

Global copper supply lags electrification demand, and the US Geological Survey notes declining ore grades lift extraction costs, contributing to price swings that averaged USD 8,490 per tonne in 2024. Connector bills of material are therefore indexed more frequently, and engineering teams test aluminum alloys for non-critical power pins even though conductivity remains lower. Recycling now covers 32% of worldwide copper consumption, but automotive-grade cleanliness limits still confine the practice .

Other drivers and restraints analyzed in the detailed report include:

- Shift to Zonal Architectures Boosting High-Density Board-Edge Connectors

- Safety-Critical Compliance Heightening Reliability Needs

- Local-Sourcing Mandates Limiting Procurement Flexibility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wire-to-board designs kept 39.66% of 2024 revenue, confirming their evergreen role in instrumentation panels, yet the automotive and transportation connector market now directs major R&D toward high-voltage assemblies that will grow 9.45% CAGR to 2030. The high-current category benefits from silicon-carbide inverters operating at 800 V, which demand reinforced creepage gaps and liquid-cooled pins. RF & coax connectors also gain renewed relevance as radar and camera counts increase. Suppliers such as JAE incorporate electromagnetic locks and emergency unmating in 200 A CHAdeMO plugs to satisfy global safety codes.

Standard ECU packaging still leans on board-to-board mezzanine decks, but zonal hardware elevates density beyond 120 pins per inch. Hybrid housings that mix signal and 50 A blades inside one header reduce SKU count and simplify automated pick-and-place. As a result, module integrators now treat the connector as a functional sub-system rather than a commodity fastening point, sustaining premium pricing inside the automotive and transportation connector market.

Body wiring and power distribution commanded 38.25% of 2024 spend, yet ADAS and autonomous electronics will log a 12.23% CAGR as camera, radar, and lidar sensor proliferation intensifies. That uptrend positions ADAS connectivity as the fastest pathway to margin expansion for specialized suppliers. Cockpit entertainment platforms follow closely because immersive displays and over-the-air upgrades need multi-gigabit backbones.

The automotive and transportation connector market size for powertrain and battery systems is projected to climb in tandem with EV unit growth, opening space for scale economies on shielded high-voltage interfaces. Meanwhile, safety-security modules integrate redundant power pins within a single housing, limiting space overhead while meeting ISO 26262 diagnostics requirements.

The Automotive and Transportation Connector Market Report is Segmented by Product Type (Wire-To-Board Connectors, Board-To-Board Connectors, and More), Application (Safety and Security, Body Wiring and Power Distribution, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Propulsion, Sales Channel, and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific contributed 45.31% of 2024 revenue, reflecting its position as both the world's largest vehicle assembly hub and the fastest-growing electric-mobility cluster. Chinese OEMs generate concentrated demand for high-voltage and battery-management connectors, while Japan and Korea supply precision board-to-board and coaxial formats for global premium nameplates. Indonesia's passenger-car output of 1.4 million units in 2024 underscored Southeast Asia's rise as a secondary production base that stimulates local connector tooling even as US sourcing rules tighten qualification paths for Chinese-made parts.

North America maintains premium-truck demand that favors sealed circular power connectors rated beyond IP68. The Inflation Reduction Act channels incentives into domestic battery plants, spurring localized high-voltage terminal supply. Canadian copper output of 508,250 tonnes in 2024 shores up raw-material availability for regional stamping operations that hedge price shocks. Connector makers also confront upcoming U.S. content rules slated for 2027 that bar Chinese telematics modules, accelerating dual-source qualifications.

Europe combines advanced EV production with cost pressure from surging imports. Germany built 1.35 million electric cars in 2024, yet EU manufacturers lost 53,669 jobs in the same year. The European Commission's Strategic Dialogue is funneling Horizon funds into interoperable 10BASE-T1S networking to cut harness weight, while Middle East and African projects tap Gulf smart-city investments and South-African export contracts. The UK's pledge to lower industrial power tariffs by 25% from 2027 aims to restore connector stamping competitiveness.

- TE Connectivity

- Yazaki Corporation

- Aptiv PLC

- Amphenol Corporation

- Molex (Koch Industries)

- Sumitomo Electric Industries

- Lear Corporation

- Leoni AG

- Korea Electric Terminal (KET)

- Rosenberger Hochfrequenztechnik

- Luxshare Precision Industry

- JST Mfg.

- HARTING Technology Group

- Furukawa Electric

- ITT Cannon

- Hirose Electric

- Japan Aviation Electronics (JAE)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Electrification Surge Spurring High-Voltage Connector Demand

- 4.2.2 ADAS and Infotainment Integration Driving High-Speed Data Connectors

- 4.2.3 Shift to Zonal E/E Architectures Boosting High-Density Board-Edge Connectors

- 4.2.4 Safety-Critical Compliance (ISO 26262, UN R155) Heightening Reliability Needs

- 4.2.5 Migration to Gigabit Ethernet and FAKRA-Mini Coax Interfaces

- 4.2.6 Emerging 48 V Sub-Systems in ICE Vehicles

- 4.3 Market Restraints

- 4.3.1 Copper-Price Volatility Inflating BOM Costs

- 4.3.2 Local-Sourcing Mandates Limiting Low-Cost Procurement

- 4.3.3 Recalls from Connector Seal or Crimp Failures

- 4.3.4 Rising In-Vehicle Wireless Sensor Nodes Reducing Hard-Wired Ports

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Wire-to-Board Connectors

- 5.1.2 Board-to-Board Connectors

- 5.1.3 Wire-to-Wire Connectors

- 5.1.4 High-Voltage/EV Connectors

- 5.1.5 RF & Coax Connectors

- 5.1.6 Modular/Hybrid Connectors

- 5.2 By Application

- 5.2.1 Safety and Security

- 5.2.2 Body Wiring and Power Distribution

- 5.2.3 Cockpit, Connectivity and Entertainment (CCE)

- 5.2.4 Powertrain and Battery Systems

- 5.2.5 Advanced Driver-Assistance/Autonomous

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Medium and Heavy Commercial Vehicles

- 5.3.4 Two-Wheelers

- 5.4 By Propulsion

- 5.4.1 Internal-Combustion Engine Vehicles

- 5.4.2 Hybrid Electric Vehicles

- 5.4.3 Plug-in Hybrid Electric Vehicles

- 5.4.4 Battery Electric Vehicles

- 5.5 By Sales Channel

- 5.5.1 OEM

- 5.5.2 Aftermarket

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Egypt

- 5.6.5.4 Turkey

- 5.6.5.5 South Africa

- 5.6.5.6 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 TE Connectivity

- 6.4.2 Yazaki Corporation

- 6.4.3 Aptiv PLC

- 6.4.4 Amphenol Corporation

- 6.4.5 Molex (Koch Industries)

- 6.4.6 Sumitomo Electric Industries

- 6.4.7 Lear Corporation

- 6.4.8 Leoni AG

- 6.4.9 Korea Electric Terminal (KET)

- 6.4.10 Rosenberger Hochfrequenztechnik

- 6.4.11 Luxshare Precision Industry

- 6.4.12 JST Mfg.

- 6.4.13 HARTING Technology Group

- 6.4.14 Furukawa Electric

- 6.4.15 ITT Cannon

- 6.4.16 Hirose Electric

- 6.4.17 Japan Aviation Electronics (JAE)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment