PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851237

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851237

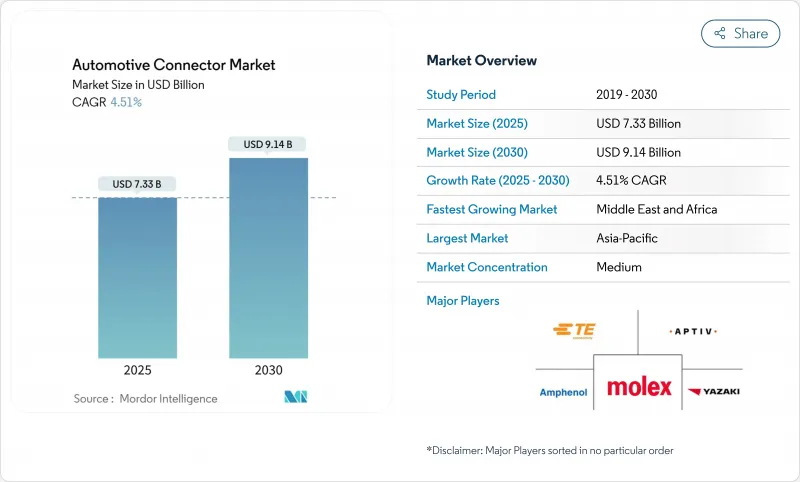

Automotive Connector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The automotive connector market size stands at USD 7.33 billion in 2025. It is forecast to reach USD 9.14 billion by 2030, advancing at a 4.51% CAGR as vehicle platforms move toward electrified and software-defined architectures.

Growth remains moderate on the surface, yet the mix changes quickly: demand linked to internal-combustion powertrains plateaus while high-voltage and high-speed data interconnects scale up. The shift from distributed ECUs to zonal electronic structures compresses harness length, trimming vehicle weight. It raises connector complexity, creating displacement risk for legacy suppliers that lack high-density, mixed-signal capabilities. Rigorous safety regulations, data-rich ADAS features, and 800 V battery systems propel orders for sealed, high-performance interfaces that carry power and multi-gigabit signals while meeting IP67/IP6K9K ratings. Suppliers that combine semiconductor-grade manufacturing precision with software integration support are positioned to win as OEMs demand fault-tolerant links, over-the-air updatability, and cyber-secure data paths.

Global Automotive Connector Market Trends and Insights

Accelerating Electrification and Higher-Voltage E-Powertrains

The transition to 48V and 800V electrical architectures fundamentally reshapes connector requirements, moving beyond traditional 12V systems to support electric turbocharging, regenerative braking, and high-power charging capabilities. Aptiv's high-voltage interconnects now support voltage ranges from 400V to 1000V with current capacities up to 250A, addressing the industry's shift toward faster charging and improved efficiency.

The emergence of 48V mild hybrid systems creates a dual-voltage architecture challenge, requiring connectors to safely isolate and manage 12V legacy systems and 48V power delivery networks. TE Connectivity's AMP+ HVA 280 system exemplifies this evolution, featuring integrated high-voltage interlocks and two-stage floating latches for enhanced safety in applications up to 850V. This electrification wave extends beyond passenger vehicles to commercial fleets, where Eaton's power connection solutions enable efficient energy transfer in heavy-duty applications, supporting the broader transportation electrification mandate. The complexity of managing multiple voltage domains within a single vehicle drives demand for sophisticated connector systems that can maintain isolation, provide diagnostic capabilities, and ensure fail-safe operation across diverse operating conditions.

Stricter Global Safety and Emission Mandates

Regulatory frameworks increasingly mandate advanced safety systems, with the EU requiring autonomous emergency braking and forward collision warning in new vehicles, directly driving connector demand for sensor integration and real-time data processing. The NHTSA's push for vehicle-to-vehicle communication standards creates new requirements for high-frequency, low-latency connectors capable of supporting 5.9 GHz DSRC and cellular V2X protocols. CISPR 25 electromagnetic compatibility standards have become increasingly stringent, particularly for conducted emissions above 10 GHz, forcing connector manufacturers to integrate advanced shielding and filtering capabilities.

The shift toward software-defined vehicles amplifies these requirements, as over-the-air updates and continuous monitoring systems demand connectors with enhanced signal integrity and cybersecurity features. China's New Energy Vehicle mandate and California's Advanced Clean Cars II regulation create regional variations in connector specifications, particularly for battery management systems and charging infrastructure, requiring global suppliers to develop platform-flexible solutions that can adapt to diverse regulatory environments while maintaining cost efficiency.

Volatile Copper and Metal Commodity Prices

Copper prices are rising, driven by supply constraints and surging demand from renewable energy and electric vehicle sectors, creating significant cost pressures across the automotive connector supply chain. Electric vehicles require significantly more copper than traditional ICE vehicles, with each EV containing approximately 83 kilograms of copper compared to 23 kilograms in conventional vehicles, amplifying the impact of price volatility on automotive connector costs. Copperweld's bimetallic solutions, including Copper-Clad Aluminum and Copper-Clad Steel conductors, offer potential alternatives that can reduce copper usage by up to 83% while maintaining electrical performance characteristics. The concentration of copper mining in politically unstable regions creates additional supply chain risks. At the same time, trade tensions and export restrictions further exacerbate price volatility, forcing automotive OEMs to implement hedging strategies and long-term supply contracts that may limit flexibility in connector sourcing and design optimization.

Other drivers and restraints analyzed in the detailed report include:

- Surge in In-Vehicle Infotainment and Connectivity Units

- Rapid ADAS and Autonomous Functionality Penetration

- Shortage of High-Performance Resins (PPS, LCP)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Powertrain applications maintain the largest market share at 33.60% of the automotive connector market size in 2024, reflecting the continued importance of engine management, transmission control, and fuel injection systems across both ICE and hybrid powertrains. However, ADAS and autonomous systems emerge as the fastest-growing segment at 17.8% CAGR from 2025-2030, driven by regulatory mandates for advanced safety features and the industry's progression toward higher levels of vehicle automation.

Safety and security applications benefit from the increasing integration of airbag systems, electronic stability control, and collision avoidance technologies. At the same time, body wiring and power distribution segments adapt to zonal architecture implementations that consolidate multiple functions into fewer, more sophisticated control units. Comfort, convenience, and entertainment systems experience steady growth as consumer expectations for premium features expand across all vehicle segments. At the same time, navigation and instrumentation applications evolve to support high-resolution displays and augmented reality interfaces.

The emergence of charging and energy management applications specifically for electric vehicles represents a new category that didn't exist in traditional automotive connector markets, highlighting the industry's fundamental transformation toward electrified powertrains. This segmentation shift reflects the broader transition from mechanical to electronic vehicle systems, where traditional powertrain connectors face displacement by high-voltage, high-current solutions capable of managing battery systems, DC-DC converters, and regenerative braking networks. The rapid growth in ADAS applications creates opportunities for connector suppliers with expertise in high-frequency, low-latency transmission, as these systems require real-time processing of sensor data from multiple sources simultaneously.

Passenger cars command 54.20% of the automotive connector market share in 2024, benefiting from high production volumes and increasing electronic content per vehicle. Yet, two-wheelers represent the fastest-growing segment at 11.5% CAGR through 2030. Light commercial vehicles maintain steady demand driven by e-commerce growth and last-mile delivery optimization. Meanwhile, medium and heavy commercial vehicles increasingly adopt advanced telematics and fleet management systems that require ruggedized, high-performance connector solutions. The commercial vehicle segments drive innovation in connector durability and environmental resistance, as these applications demand IP67/IP6K9K ratings and operation across extreme temperature ranges that exceed passenger car requirements.

The growth in two-wheelers reflects urbanization trends and regulatory support for electric transportation in congested city centers, creating demand for compact, lightweight connectors optimized for space-constrained applications. Commercial vehicle electrification accelerates as fleet operators seek to reduce operating costs and meet emission regulations. This drives demand for high-voltage connectors supporting rapid charging and energy-dense battery systems. The segmentation between passenger and commercial vehicles becomes increasingly relevant as autonomous driving technologies develop along different trajectories, with commercial applications potentially achieving higher automation levels sooner due to controlled operating environments and dedicated infrastructure investments.

The Automotive Connector Market Report is Segmented by Application (Powertrain, Safety and Security, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Propulsion Type (ICE Vehicles, Hybrid Electric Vehicles, and More), Connector Type (Wire-To-Wire, Wire-To-Board, and More), Connection Sealing (Sealed and Unsealed), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained leadership with 38.60% of the automotive connector market revenue in 2024, thanks to dense electronics supply chains, the world's highest vehicle output, and state policies favoring electric cars and buses. Chinese OEMs build zonal harnesses in-house, pulling tier-two connector makers into local joint ventures under technology-transfer clauses. Japanese incumbents pursue CASE programs such as Sumitomo's "30VISION," launching compact, low-insertion-force models optimized for 800 V platforms. Korean suppliers channel battery know-how into high-current board terminals that support cell-to-pack architectures. Southeast Asian nations offer lower labor costs for commodity crimping yet increasingly demand IP67 ratings for tropical downpours, widening the automotive connector market across price tiers.

The Middle East and Africa, while small today, are poised for a 15.20% CAGR through 2030 as sovereign wealth funds seed electric-vehicle plants and charging corridors. Saudi Arabia bankrolls EV clusters and sources high-voltage cabling locally; Leoni's new Agadir plant exemplifies North-African wire harness momentum. Harsh heat and dust provoke demand for high-temperature LCP housings and reinforced gasket flanges. Regional content rules push multinationals to qualify domestic polymer compounds, adding resilience yet demanding duplicate validation runs.

North America and Europe represent mature but innovation-rich arenas. United States OEMs integrate hands-free Level 3 stacks on premium trims, spurring the supply of 20 Gbps board connectors and silicon-grade cleanroom processes. Europe's climate targets accelerate 400 kW fast-charge hubs, obliging 1,000 V contactors with embedded temperature sensors. Both regions chase circular-economy mandates; TE Connectivity's Green Stock program repurposes excess inventory, cutting landfill waste and carbon footprints. Supply chain shocks during 2024 catalyzed the on-shoring of tin plating and plastic molding to secure strategic autonomy within the automotive connector market.

- TE Connectivity Ltd

- Yazaki Corporation

- Aptiv PLC

- Molex Inc. (Koch Industries)

- Sumitomo Wiring Systems Ltd

- Luxshare Precision Industry Co., Ltd

- Hirose Electric Co., Ltd

- J.S.T. Mfg Co., Ltd

- Amphenol Corporation

- Furukawa Electric Co., Ltd

- Rosenberger Hochfrequenztechnik GmbH

- Leoni AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating electrification and higher-voltage e-powertrains

- 4.2.2 Rapid ADAS and autonomous functionality penetration

- 4.2.3 Software-defined vehicles requiring high-speed data links

- 4.2.4 Stricter global safety and emission mandates

- 4.2.5 Shift to zonal e/e architectures driving high-density connectors

- 4.2.6 Surge in in-vehicle infotainment and connectivity units

- 4.3 Market Restraints

- 4.3.1 Volatile copper and metal commodity prices

- 4.3.2 Shortage of high-performance resins (PPS, LCP)

- 4.3.3 Reliability challenges in harsh automotive environments

- 4.3.4 EMI compliance hurdles at more than 10 Gbps signal speeds

- 4.4 Value / Supply-Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value in USD)

- 5.1 By Application

- 5.1.1 Powertrain

- 5.1.2 Safety and Security

- 5.1.3 Body Wiring and Power Distribution

- 5.1.4 Comfort, Convenience and Entertainment

- 5.1.5 Navigation and Instrumentation

- 5.1.6 ADAS and Autonomous Systems

- 5.1.7 Charging and Energy Management (EV)

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Medium and Heavy Commercial Vehicles

- 5.2.4 Two-Wheelers

- 5.2.5 Bus and Coach

- 5.3 By Propulsion Type

- 5.3.1 Internal Combustion Engine (ICE) Vehicles

- 5.3.2 Hybrid Electric Vehicles (HEV)

- 5.3.3 Plug-in Hybrid Electric Vehicles (PHEV)

- 5.3.4 Battery Electric Vehicles (BEV)

- 5.3.5 Fuel-Cell Electric Vehicles (FCEV)

- 5.4 By Connector Type

- 5.4.1 Wire-to-Wire

- 5.4.2 Wire-to-Board

- 5.4.3 Board-to-Board

- 5.4.4 I/O and Circular

- 5.4.5 FFC/FPC and Micro

- 5.4.6 High-Speed / High-Voltage

- 5.5 By Connection Sealing

- 5.5.1 Sealed

- 5.5.2 Unsealed

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Indonesia

- 5.6.4.6 Vietnam

- 5.6.4.7 Philippines

- 5.6.4.8 Australia

- 5.6.4.9 New Zealand

- 5.6.4.10 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Turkey

- 5.6.5.4 South Africa

- 5.6.5.5 Egypt

- 5.6.5.6 Nigeria

- 5.6.5.7 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 TE Connectivity Ltd

- 6.4.2 Yazaki Corporation

- 6.4.3 Aptiv PLC

- 6.4.4 Molex Inc. (Koch Industries)

- 6.4.5 Sumitomo Wiring Systems Ltd

- 6.4.6 Luxshare Precision Industry Co., Ltd

- 6.4.7 Hirose Electric Co., Ltd

- 6.4.8 J.S.T. Mfg Co., Ltd

- 6.4.9 Amphenol Corporation

- 6.4.10 Furukawa Electric Co., Ltd

- 6.4.11 Rosenberger Hochfrequenztechnik GmbH

- 6.4.12 Leoni AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment