PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910562

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910562

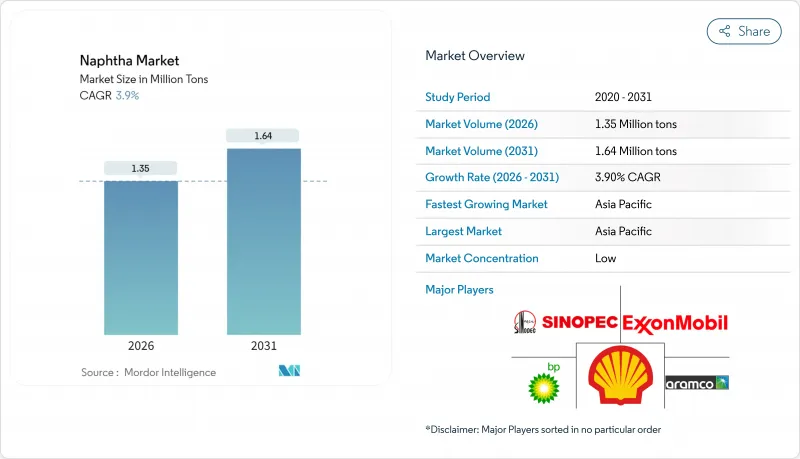

Naphtha - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Naphtha market is expected to grow from 1.30 million tons in 2025 to 1.35 million tons in 2026 and is forecast to reach 1.64 million tons by 2031 at 3.9% CAGR over 2026-2031.

Demand is anchored by naphtha's role as the dominant petrochemical feedstock for olefins and aromatics, a position reinforced by large-scale steam crackers that prefer light fractions for higher ethylene yields. Investments in condensate splitters along the U.S. Gulf Coast and new integrated refineries in Asia are reshaping global trade flows, while bio-naphtha capacity additions provide a complementary, low-carbon supply stream. Leading refiners integrate upstream crude supply with downstream petrochemical conversion to capture value across the chain. However, volatile crude-naphtha spreads, the growing appeal of natural gas liquids as alternative feedstocks, and increasingly stringent carbon regulations inject uncertainty into margin stability and capital-allocation decisions.

Global Naphtha Market Trends and Insights

Surging Demand for Olefins and Aromatics Feedstocks from Asian Steam Crackers

China is commissioning a wave of mega-crackers that elevate consumption of light naphtha because its paraffinic composition maximizes ethylene output. New capacity totaling 0.8-1.1 million b/d of refining throughput by 2028 is designed with integrated condensate splitters that raise naphtha yield ratios. Capacity additions at Hengli Petrochemical and Fujian Petrochemical will maintain upward demand momentum, translating into structurally higher imports of condensate-rich crudes and driving regional price alignment with the broader naphtha market. Supply security incentives are prompting long-term offtake agreements between Middle-East producers and Asian crackers, further knitting regional value chains. Net-back calculations suggest that each incremental steam cracker complex boosts regional light naphtha requirements by 1.5 million tons annually, underpinning the driver's substantial contribution to overall growth.

Integration of Naphtha Reformers with Refinery Upgrading Projects in the Middle East

Bahrain's Bapco Modernization Programme and Saudi Aramco's USD 11 billion AMIRAL complex illustrate the strategic shift toward co-locating catalytic reformers with mixed-feed crackers to enhance gasoline octane and aromatic output. The model diverts straight-run naphtha that previously entered the motor-fuel pool into higher-margin petrochemical streams, improving overall refinery gross margins. Integration delivers energy-efficiency gains through shared utilities and furnishes flexible feedstock menus that dampen margin volatility. With AMIRAL alone requiring about 5 million tons of naphtha annually, the region becomes a swing supplier to Asia, tightening inter-regional balances and supporting a more robust naphtha market.

Volatile Crude-Naphtha Spreads Undermining Crack Margins

Geopolitical incidents and refining capacity outages drive sharp swings in naphtha crack spreads, challenging refinery scheduling and prompting throughput cuts. An attack on a product tanker in the Gulf of Aden sent Asian naphtha cracks to a two-year high in early 2024, yet spreads retraced swiftly as arbitrage cargoes arrived. With post-2019 U.S. refinery capacity still 620,000 b/d below the peak, global supply buffers remain thin, magnifying volatility. This instability dampens refinery utilization rates by up to 8% in adverse periods and raises working-capital requirements for traders, tempering naphtha market expansion.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand for Fertilizers in India

- Bio-Naphtha Scale-up Backed by Renewable-Fuel Mandates

- Regulatory Push for Low-Carbon Alternatives and Recycled Feedstocks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Light naphtha generated 57.62% of the global naphtha market in 2025 as modern crackers favor its high paraffin content for superior ethylene yield. The segment is projected to grow at 4.55% CAGR to 2031, the briskest pace among cut types. Condensate splitter expansions in the United States and Asia are calibrated to produce paraffinic cuts that align with cracker slate requirements, reinforcing segment leadership in the naphtha market. Each 100,000 b/d splitter yields around 30,000 b/d of light naphtha, tightening balances and supporting premiums to gasoline-grade material. Integrated operators blend splitter streams with reformer output to hedge margin cycles and improve overall asset utilization.

Heavy naphtha lags with mid-single-digit growth owing to its higher aromatic content and lower ethylene productivity. Nonetheless, it remains an essential feedstock for catalytic reformers that upgrade octane and generate benzene, toluene, and xylenes. Investments in platinum-tin and platinum-rhenium bimetallic catalysts improve reformer severity tolerance, widening the processing window for heavier grades. Refiners leverage aromatics marketing agreements to monetize heavy cuts when gasoline spreads compress, preserving a supportive though less dynamic contribution to the naphtha market.

The Naphtha Market Report is Segmented by Type (Light Naphtha and Heavy Naphtha), Source (Refinery-Based, Bio-Naphtha, and Others), End-User Industry (Petrochemicals, Agriculture, Paints and Coatings, Aerospace, and Other Industries), and Geography (Asia Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (tons).

Geography Analysis

Asia-Pacific led the naphtha market with 43.65% share in 2025, and its 4.65% forecast CAGR to 2031 stems from synchronized growth in petrochemicals and fertilizers. China processed a record 14.8 million b/d of crude in 2023, underpinning self-sufficiency in feedstocks, while India's polymer demand is on track to hit 35 million tons by 2028. Aramco's 10% stake in Hengli Petrochemical and the Fujian project further expand regional integration, aligning Middle-East supply with East-Asian demand growth.

North America remains structurally long light naphtha due to condensate splitter investments and rising shale liquids output. U.S. refining capacity climbed 2% in 2023, taking operable nameplate to 18.4 million b/d at the start of 2024. Yet surging NGL availability diverts petrochemical demand, moderating the regional naphtha market expansion pace. Export growth into Latin America and occasional arbitrage to Europe balances seasonal surpluses.

Europe's naphtha demand contracts modestly as renewable fuel production displaces fossil feedstocks, but residual reformer capacity supplies aromatics chains and high-octane gasoline blendstocks. Refiners retrofit existing units for HVO and SAF rather than building greenfield assets, freeing investment for carbon-capture pilots that lower the embedded emissions of conventional naphtha. The Middle East capitalizes on integration projects that couple reformers and crackers, positioning itself as the marginal supplier into Asia and Europe when arbitrage windows open. South America and Africa gain influence through projects such as Nigeria's Dangote refinery, which will produce up to 80 kbd of gasoline and naphtha, gradually transforming regional trade balances.

- Alexandria Mineral Oils Company

- BP p.l.c.

- Chevron Phillips Chemical Company LLC

- China Petrochemical Corporation

- CNPC

- ENEOS Holdings Inc.

- Exxon Mobil Corporation

- Formosa Petrochemical Corporation

- Idemitsu Kosan Co.,Ltd.

- Indian Oil Corporation Ltd.

- Kuwait Petroleum Corporation

- LG Chem

- LyondellBasell Industries Holdings B.V.

- MGT Petroil

- PetroChina Company Limited

- Petroleos Mexicanos

- PTT Global Chemical Public Company Limited

- QatarEnergy

- Reliance Industries Limited

- SABIC

- Sasol Limited

- Saudi Arabian Oil Co.

- Shell plc

- SK Inc.

- TotalEnergies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Demand for Olefins and Aromatics Feedstocks from Asian Steam Crackers

- 4.2.2 Integration of Naphtha Reformers with Refinery Upgrading Projects in the Middle East

- 4.2.3 Rising Demand for Fertilizers in India

- 4.2.4 Rising Investments in USGC Condensate Splitters Targeting Light Naphtha Output

- 4.2.5 Bio-Naphtha Scale-up Backed by Renewable-Fuel Mandates

- 4.3 Market Restraints

- 4.3.1 Natural Gas Liquid Demand in the United States

- 4.3.2 Volatile Crude-Naphtha Spreads Undermining Crack Margins

- 4.3.3 Regulatory Push for Low-Carbon Alternatives and Recycled Feedstocks

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Feedstock Analysis

5 Market Size and Growth Forecasts (Volume and Value)

- 5.1 By Type

- 5.1.1 Light Naphtha

- 5.1.2 Heavy Naphtha

- 5.2 By Source

- 5.2.1 Refinery-Based

- 5.2.2 Bio-Naphtha

- 5.2.3 Others

- 5.3 By End-user Industry

- 5.3.1 Petrochemicals

- 5.3.2 Agriculture

- 5.3.3 Paints and Coatings

- 5.3.4 Aerospace

- 5.3.5 Other Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Alexandria Mineral Oils Company

- 6.4.2 BP p.l.c.

- 6.4.3 Chevron Phillips Chemical Company LLC

- 6.4.4 China Petrochemical Corporation

- 6.4.5 CNPC

- 6.4.6 ENEOS Holdings Inc.

- 6.4.7 Exxon Mobil Corporation

- 6.4.8 Formosa Petrochemical Corporation

- 6.4.9 Idemitsu Kosan Co.,Ltd.

- 6.4.10 Indian Oil Corporation Ltd.

- 6.4.11 Kuwait Petroleum Corporation

- 6.4.12 LG Chem

- 6.4.13 LyondellBasell Industries Holdings B.V.

- 6.4.14 MGT Petroil

- 6.4.15 PetroChina Company Limited

- 6.4.16 Petroleos Mexicanos

- 6.4.17 PTT Global Chemical Public Company Limited

- 6.4.18 QatarEnergy

- 6.4.19 Reliance Industries Limited

- 6.4.20 SABIC

- 6.4.21 Sasol Limited

- 6.4.22 Saudi Arabian Oil Co.

- 6.4.23 Shell plc

- 6.4.24 SK Inc.

- 6.4.25 TotalEnergies

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment