PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846347

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846347

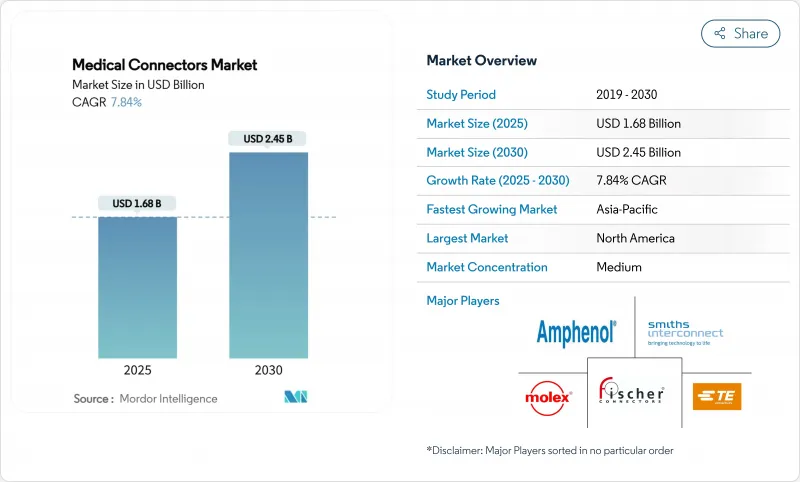

Medical Connectors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The medical connectors market size stands at USD 1.68 billion in 2025 and is forecast to reach USD 2.45 billion by 2030, reflecting a 7.84% CAGR through the period.

Demand expansion arises from the steady shift toward digitally networked care, the proliferation of wearable monitors, and the growing adoption of single-use device platforms that rely on compact, sterilizable interfaces. Manufacturers are investing in magnetic quick-connect designs that eliminate mechanical wear and accelerate device turnaround times in intensive care units. Interoperability initiatives within hospital information systems reinforce the need for standardized pin configurations, while home-care adoption places equal emphasis on intuitive, patient-safe connection methods. Regional opportunity dispersion is pronounced: North America remains technology-centric, whereas Asia-Pacific benefits from capacity build-out in public hospital networks that prefer modular, multi-purpose connector families. Material science breakthroughs, particularly in silicone shielding and copper-alloy anti-corrosion treatments, further enhance lifespan and performance.

Global Medical Connectors Market Trends and Insights

Rising Incidence of Chronic Diseases

Elevated cardiovascular and diabetes prevalence has intensified real-time monitoring requirements that depend on robust, low-profile electrical interfaces. Implantable loop recorders and insulin infusion pumps increasingly specify moisture-resistant contact plating that supports uninterrupted telemetry during extended wear periods. Health systems pursuing predictive analytics mandate connectors that sustain high sampling frequencies without electromagnetic interference. As hospital workloads migrate toward proactive disease management, magnetic quick-connect solutions gain traction because they avoid arcing and reduce connector fatigue. Continuous data capture also amplifies cybersecurity scrutiny, prompting OEMs to specify shielded connector housings that integrate physical keying with encryption-ready wiring architectures.

Expansion of the Medical Device Installed Base

Asia-Pacific hospital expansions and robotics investments enlarge the cumulative equipment fleet, driving preference for interoperable connector footprints that streamline spare-parts logistics. Device miniaturization, illustrated by capsule endoscopes and micro-pumps, compresses available board space, compelling manufacturers to develop sub-millimeter pitch headers with solder-reflowable silicone over-molds. Retrofit programs targeting legacy infusion pumps open retrofit revenue streams for vendors able to certify updated connector blocks under revised electrical and biocompatibility norms. Surgical robotics adopters request high-cycle connectors capable of surviving 3,000 autoclave passes without plating delamination. Suppliers that offer end-to-end qualification data shorten OEM design cycles and gain an edge in the medical connectors market.

Stringent Global and Regional Regulatory Compliance

The FDA's transition to the Quality Management System Regulation that aligns with ISO 13485:2016 compels manufacturers to overhaul documentation architectures and audit procedures. Europe's MDR regime imposes unique device identifier obligations, adding traceability costs to every connector batch. Markets in Latin America increasingly demand certified biocompatibility reports, elongating approval cycles for polymer revisions. Smaller suppliers struggle to finance concurrent submissions across multiple jurisdictions, accelerating consolidation within the medical connectors market. Cybersecurity clauses now extend to connectors that transmit patient identifiers, introducing encryption-testing steps that lengthen product validation timelines.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Home-Care and Remote Monitoring Solutions

- Miniaturization and High-Density Multi-Contact Designs

- Sterilization-Induced Material Degradation Risk

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Flat silicone surgical cables retained a 38.89% stake in the medical connectors market share during 2024, underlining their continued primacy in electrosurgical handpieces and laparoscopic energy platforms. The segment benefits from silicone's flexibility, dielectric stability, and compatibility with autoclave cycles, characteristics that shorten maintenance intervals and uphold electrical integrity. Advancements in layered extrusion now integrate two-tone insulation that provides instant visual damage detection, reinforcing hospital risk-management protocols. Magnetic medical connectors, though presently smaller in installed base, are forecast to log an 8.65% CAGR due to their contactless coupling that minimizes arc formation during high-current transfers. Disposable plastic connectors expand reception in single-use irrigation wands, where eliminating cleaning overhead aligns with infection-control mandates. Push-pull formats continue to address general ward monitoring, delivering a familiar tactile cue that nursing staff trust. Hybrid circular systems enable combined power, fiber, and pneumatic routing within robotic end-effectors, enhancing design freedom for surgical automation specialists. This plurality of formats ensures that the medical connectors market retains healthy product-mix dynamism.

Magnetic alternatives are reshaping purchasing criteria by prioritizing zero-wear longevity over upfront capital cost. Novel alloys such as gold-cobalt pellets enhance magnetic saturation limits, allowing downsizing without compromising retention force. Rapid detachment supports fall-prevention programs, as yanking leads from physiotherapy equipment no longer stresses device ports. Vendors integrating on-board EEPROM chips into connector shells create plug-and-play traceability, which helps technicians schedule predictive maintenance. Electrosurgical cable suppliers are exploring thermochromic jackets that visually indicate overheating, pre-empting insulation failure. The drive toward multi-contact density has spurred sub-assembly modularization, with OEMs outsourcing over-molding processes to connector specialists that hold ISO 14644-1 cleanroom certifications. These initiatives collectively sustain momentum for product innovation within the medical connectors market .

The Medical Connectors Market Report is Segmented by Product (Flat Silicone Surgical Cables, Embedded Electronics Connectors, and More), Application (Patient Monitoring Devices, Electrosurgical Devices, and More), End User (Hospitals, Ambulatory Surgical Centers, Other End Users), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 41.03% revenue leadership in 2024, reflecting mature capital equipment cycles and well-established compliance frameworks that reward early adoption of high-specification connectors. Value-based care metrics push hospitals to embed predictive maintenance sensors within connector housings, thereby reducing unplanned downtime. The region champions ISO 80369-7 implementation ahead of other geographies, accelerating replacement demand. Start-up ecosystems in Minneapolis and Boston foster next-generation neurostimulation devices, further lifting local connector design activity. Policy incentives for domestic semiconductor packaging benefit suppliers integrating miniaturized electrode arrays, maintaining technological headship for the medical connectors market.

Asia-Pacific will post the fastest regional trajectory at an 8.89% CAGR through 2030 as public health insurers in China and India commit to broadening access to chronic disease management technologies. Local OEMs are scaling infusion pump output, thereby enlarging baseline connector consumption. Regulatory agencies in Singapore and South Korea harmonize documentation with the US FDA, lowering duplication for global suppliers and hastening product launches. Government subsidies for indigenous medical electronics manufacturing reduce import dependency, prompting multinationals to establish connector assembly plants in Malaysia and Vietnam. Urbanization intensifies demand for patient monitoring systems in secondary cities, spreading volume beyond Tier 1 healthcare hubs and diversifying opportunity within the medical connectors market.

Europe maintains steady expansion driven by stringent environmental policies that prioritize recyclable connector materials. National health services renew aging device fleets, enforcing RoHS and REACH compliance that favors halogen-free insulation compounds. Collaborative purchasing platforms across the Nordics compress unit margins but guarantee multi-year volume commitments. Germany's precision-engineering base continues to pioneer hybrid circular connectors for surgical robotics, with EU-funded research propelling material science improvements. Eastern Europe emerges as a cost-competitive manufacturing locus, providing a near-shore alternative for Western suppliers concerned about Asia-Pacific freight volatility. Consequently, the region balances performance leadership with sustainability interventions, sustaining its strategic relevance in the medical connectors market.

- TE Connectivity

- Amphenol

- Smiths Group

- Fischer Connectors

- Molex

- ITT Interconnect Solutions

- Souriau (Souriau-Sunbank)

- Omnetics Connector

- KEL

- Qosina Corp

- Shenzhen Xime Connector Technology

- Salter Labs

- Lemo SA

- Samtec Inc.

- Aptiv PLC

- Rosenberger Hochfrequenztechnik

- ODU GmbH

- Neutrik AG

- Phoenix Contact

- Plastics One

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising incidence of chronic diseases

- 4.2.2 Expansion of the medical device installed-base

- 4.2.3 Shift toward home-care & remote monitoring solutions

- 4.2.4 Miniaturisation & high-density multi-contact designs

- 4.2.5 Hospital-grade magnetic quick-connect adoption

- 4.2.6 Integration of disposable fluid-path connectors in single-use OEM kits

- 4.3 Market Restraints

- 4.3.1 Stringent global & regional regulatory compliance

- 4.3.2 Sterilisation-induced material degradation risk

- 4.3.3 Connector mis-mating & cross-connection hazards

- 4.3.4 Supply-chain shortages of medical-grade resins & copper alloys

- 4.4 Regulatory Landscape

- 4.5 Porters Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Flat Silicone Surgical Cables

- 5.1.2 Embedded Electronics Connectors

- 5.1.3 Radio-Frequency Connectors

- 5.1.4 Disposable Plastic Connectors

- 5.1.5 Hybrid Circular Connector & Receptacle Systems

- 5.1.6 Power Cords with Retention Systems

- 5.1.7 Lighted Hospital-Grade Cords

- 5.1.8 Magnetic Medical Connectors

- 5.1.9 Push-Pull Connectors

- 5.2 By Application

- 5.2.1 Patient Monitoring Devices

- 5.2.2 Electrosurgical Devices

- 5.2.3 Diagnostic Imaging Devices

- 5.2.4 Cardiology Devices

- 5.2.5 Analysers & Processing Equipment

- 5.2.6 Respiratory Devices

- 5.2.7 Dental Instruments

- 5.2.8 Endoscopy Devices

- 5.2.9 Neurology Devices

- 5.2.10 Enteral Devices

- 5.2.11 Other Applications

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Other End Users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, Recent Developments)

- 6.3.1 TE Connectivity

- 6.3.2 Amphenol Corporation

- 6.3.3 Smiths Interconnect

- 6.3.4 Fischer Connectors SA

- 6.3.5 Molex LLC

- 6.3.6 ITT Interconnect Solutions

- 6.3.7 Souriau (Souriau-Sunbank)

- 6.3.8 Omnetics Connector Corp

- 6.3.9 KEL Corporation

- 6.3.10 Qosina Corp

- 6.3.11 Shenzhen Xime Connector Technology

- 6.3.12 Salter Labs

- 6.3.13 Lemo SA

- 6.3.14 Samtec Inc.

- 6.3.15 Aptiv PLC

- 6.3.16 Rosenberger Hochfrequenztechnik

- 6.3.17 ODU GmbH

- 6.3.18 Neutrik AG

- 6.3.19 Phoenix Contact

- 6.3.20 Plastics One

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment