PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906901

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906901

Europe Tea - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

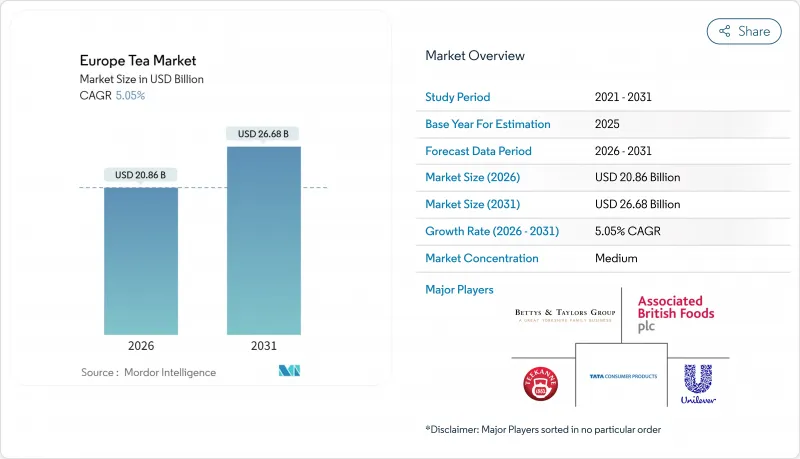

The Europe tea market is expected to grow from USD 19.86 billion in 2025 to USD 20.86 billion in 2026 and is forecast to reach USD 26.68 billion by 2031 at 5.05% CAGR over 2026-2031.

The market is increasingly prioritizing value over volume, driven by trends like premiumization, sustainability certifications, and a focus on wellness. Consumers are showing a growing preference for high-quality, ethically sourced, and health-oriented tea products, which is reshaping purchasing patterns. E-commerce platforms are playing a pivotal role in enhancing access to niche tea offerings, enabling smaller brands to reach a broader audience. While Germany's demand is rooted in its rich cultural traditions and long-standing tea consumption habits, the UK is witnessing the quickest growth, especially with the rising popularity of specialty blends that cater to evolving consumer tastes. Climate change-induced supply chain disruptions and tighter residue regulations are nudging firms towards direct-sourcing models, benefiting those with stronger capital and robust supply chain networks. The competitive landscape is moderately intense, allowing both established players and newcomers to explore diverse categories and innovate within the European tea market.

Europe Tea Market Trends and Insights

Premiumization and specialty tea demand surge

European consumers are increasingly willing to pay a premium for specialty tea experiences, shifting the market's value propositions away from traditional commodity views. This trend is particularly evident in Germany. In 2024, tea enthusiasts in Germany, as reported by the German Tea Association, consumed an average of 67.2 litres each. This total included 27.1 litres of traditional black and green teas, and a notable 40.1 litres of herbal and fruit infusions . Health-conscious consumers are now gravitating towards complex blends and high-quality teas. Brands that can authenticate their origin stories, processing methods, and sustainability credentials stand to benefit from this shift, creating opportunities for margin expansion. Single-estate European teas are emerging as specialty products. Comparative analyses highlight distinct flavor profiles between hot and cold brewing methods, catering to discerning consumer tastes. The premiumization trend isn't limited to product quality; it also spans packaging innovations, advanced brewing equipment, and experiential retail concepts. These developments position tea consumption as a lifestyle enhancement, rather than just a beverage choice.

Rising demand for herbal and green teas

In Europe, heightened health consciousness is fueling the demand for green and herbal teas. With non-communicable diseases, such as diabetes and heart ailments, on the rise, there's a pronounced shift towards healthier eating habits. In 2024, the International Diabetes Federation highlighted that around 66 million Europeans are contending with diabetes . Known for their antioxidants and health advantages, green and herbal teas have surged in popularity. These teas are known to aid in weight management, improve digestion, and reduce the risk of chronic illnesses, making them a preferred choice among health-conscious consumers. Globally, governments and health entities champion these teas in their health initiatives. A case in point: the European Food Safety Authority underscores the cardiovascular perks of green tea polyphenols, advocating for their wider acceptance. Additionally, the growing trend of natural and organic products further supports the adoption of green and herbal teas. Given these dynamics, the green and herbal tea market is poised for growth in the coming years.

Intensifying competition from coffee and RTD beverages

In Europe, coffee's stronghold poses challenges for tea's growth, especially among younger consumers. These younger demographics often link coffee with productivity, social status, and a sophisticated lifestyle-associations that tea brands find hard to consistently mirror. While coffee has historically dominated continental Europe and tea has held sway in Britain, this divide is being challenged. The rise of specialty coffee culture and the boom of third-wave coffee shops are reshaping these traditional patterns. Meanwhile, ready-to-drink (RTD) beverages are evolving. They're now infused with functional ingredients, packaged for convenience, and marketed aggressively, positioning coffee and energy drinks as enhancers of performance rather than mere refreshment. Furthermore, coffee's consumption is closely tied to income, paving the way for a premium market expansion. Tea companies, however, find it challenging to tap into this luxury market without shifting their image from everyday consumption to one of luxury and exclusivity. In a bid to counter coffee's edge in convenience, the European teaware market is pivoting towards 'on-the-go' formats. But this shift demands hefty investments in supply chain and packaging, a strain that smaller tea companies often struggle to bear.

Other drivers and restraints analyzed in the detailed report include:

- Cultural significance and tea consumption habits

- Sustainability and carbon-neutral certification targets

- Climate-change impact on tea yields

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The tea leaf segment generated 61.88% of the overall tea market size in 2025, highlighting a strong consumer preference for authenticity and the traditional brewing ritual. Leaf tea is valued for its superior quality, versatility, and the premium experience it offers, especially to consumers who appreciate artisanal, loose-leaf varieties. This segment appeals primarily to those seeking genuine flavor profiles and engaging brewing processes, contributing to its dominance in the market. Additionally, leaf tea has environmental advantages by reducing packaging waste compared to pre-packaged tea bags, aligning well with the rising consumer demand for sustainability. Advanced brewing tools and equipment have also made leaf tea more accessible and convenient, broadening its appeal.

Conversely, the CTC (Crush, Tear, Curl) tea segment, though smaller in market share, is growing rapidly at a CAGR of 7.18%. This growth is largely driven by foodservice operators and commercial buyers who favor CTC tea for its quick extraction and robust flavor, which suits high-turn environments like cafes, restaurants, and hotels. CTC tea's efficient brewing time allows foodservice establishments to serve customers faster without compromising on strength, making it a practical choice in busy settings. While it may not carry the same premium sentiment as leaf tea, CTC tea meets the demands of convenience and consistency, supporting steady expansion within a niche but important segment of the European tea market. Together, leaf tea and CTC tea serve distinct consumer and business needs, illustrating the diverse preferences that fuel Europe's evolving tea landscape.

Black tea remained the dominant segment in the European tea market in 2025, holding a substantial market share of 44.78%. This enduring preference highlights black tea's strong consumer loyalty, driven largely by its rich, robust flavor and classic appeal. It continues to be a staple in households and foodservice settings alike, often associated with traditional tea-drinking rituals and cultural heritage, particularly in countries like the UK and Germany. Black tea's versatility allows it to be consumed plain or with additions such as milk, sugar, or lemon, catering to a broad range of taste preferences. Although innovation in black tea varieties and blends has slowed compared to specialty teas, it remains a dependable revenue generator given its entrenched position. The segment's stability is also supported by well-established distribution channels and ongoing consumer demand for trusted, familiar products.

In contrast, the herbal tea segment, while smaller in market share, is the fastest-growing category in Europe, expanding at a remarkable CAGR of 8.56%. This rapid growth reflects a shifting consumer focus toward health and wellness, with buyers increasingly embracing herbal blends for their functional benefits such as relaxation, digestive health, and immunity support. Herbal teas often feature ingredients like chamomile, peppermint, ginger, and turmeric, which are celebrated for their natural therapeutic properties. The segment's appeal is further boosted by rising consumer interest in caffeine-free alternatives and clean-label products with transparent sourcing. Additionally, innovative flavor combinations and convenient formats like ready-to-drink herbal teas have broadened the market's reach. As a result, herbal tea is carving out a significant niche, attracting younger, health-conscious demographics and driving new opportunities for product development and market expansion within the European tea landscape.

The Europe Tea Market Report is Segmented by Form (Leaf Tea, CTC Tea), Product Type (Black Tea, Green Tea, Herbal Tea, Oolong Tea, Fruit-Infused and Flavored Tea, Other Product Types), Packaging Type (Box, Bag, Pouch, Sachets, Other Packaging Types), Category (Conventional, Organic), Distribution Channel (Off-Trade, On-Trade), and Geography (Germany, UK, France and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Unilever PLC

- Teekanne GmbH & Co. KG

- Associated British Foods PLC (Twinings)

- Dilmah Ceylon Tea Company PLC

- Bettys & Taylors of Harrogate Ltd

- Tata Consumer Products Limited

- Nestle S.A.

- Typhoo Tea Ltd

- Clipper Teas (Ecotone)

- Groupe Orientis (Kusmi Tea)

- Cafedirect PLC

- Groupe Orientis (Kusmi Tea)

- Ostfriesische Tee Gesellschaft (Messmer)

- Teapigs Ltd

- Yogi Tea GmbH

- Celestial Seasonings (Hain Celestial)

- Harney & Sons Fine Teas

- Mariage Freres SA

- Starbucks Corp. (Teavana)

- Lu Lin Teas

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Premiumization and specialty-tea demand surge

- 4.2.2 Rising demand for herbal and green teas

- 4.2.3 Cultural significance and tea consumption habits

- 4.2.4 Cold-brew and RTD tea uptake

- 4.2.5 Sustainability and carbon-neutral certification targets

- 4.2.6 E-commerce direct-to-consumereExpansion

- 4.3 Market Restraints

- 4.3.1 Intensifying competition from coffee and RTD beverages

- 4.3.2 Climate-change impact on tea yields

- 4.3.3 Regulatory scrutiny on pesticide residues

- 4.3.4 Labor shortage and ethical-sourcing compliance costs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers/Consumers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Form

- 5.1.1 Leaf Tea

- 5.1.2 CTC Tea

- 5.2 By Product Type

- 5.2.1 Black Tea

- 5.2.2 Green Tea

- 5.2.3 Herbal Tea

- 5.2.4 Oolong Tea

- 5.2.5 Fruit-Infused and Flavoured Tea

- 5.2.6 Other Product Types

- 5.3 By Packaging Type

- 5.3.1 Box

- 5.3.2 Bag

- 5.3.3 Pouch

- 5.3.4 Sachets

- 5.3.5 Other Packaging Types

- 5.4 By Category

- 5.4.1 Conventional

- 5.4.2 Organic

- 5.5 By Distribution Channel

- 5.5.1 Off-Trade

- 5.5.1.1 Supermarkets/Hypermarkets

- 5.5.1.2 Convenience Stores

- 5.5.1.3 Online Retail Stores

- 5.5.1.4 Online Retail Stores

- 5.5.1.5 Other Distribution Channels

- 5.5.2 On-Trade

- 5.5.1 Off-Trade

- 5.6 By Geography

- 5.6.1 Germany

- 5.6.2 United Kingdom

- 5.6.3 France

- 5.6.4 Russia

- 5.6.5 Italy

- 5.6.6 Spain

- 5.6.7 Netherlands

- 5.6.8 Poland

- 5.6.9 Sweden

- 5.6.10 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Unilever PLC

- 6.4.2 Teekanne GmbH & Co. KG

- 6.4.3 Associated British Foods PLC (Twinings)

- 6.4.4 Dilmah Ceylon Tea Company PLC

- 6.4.5 Bettys & Taylors of Harrogate Ltd

- 6.4.6 Tata Consumer Products Limited

- 6.4.7 Nestle S.A.

- 6.4.8 Typhoo Tea Ltd

- 6.4.9 Clipper Teas (Ecotone)

- 6.4.10 Groupe Orientis (Kusmi Tea)

- 6.4.11 Cafedirect PLC

- 6.4.12 Groupe Orientis (Kusmi Tea)

- 6.4.13 Ostfriesische Tee Gesellschaft (Messmer)

- 6.4.14 Teapigs Ltd

- 6.4.15 Yogi Tea GmbH

- 6.4.16 Celestial Seasonings (Hain Celestial)

- 6.4.17 Harney & Sons Fine Teas

- 6.4.18 Mariage Freres SA

- 6.4.19 Starbucks Corp. (Teavana)

- 6.4.20 Lu Lin Teas

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK