PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848046

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848046

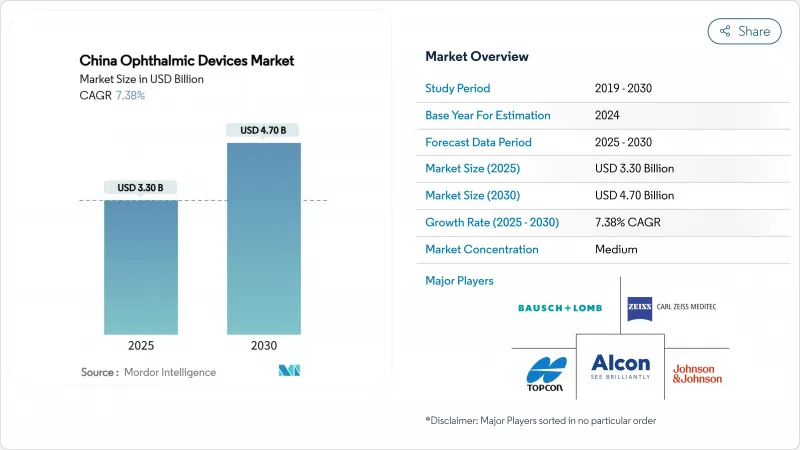

China Ophthalmic Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The China ophthalmic devices market size is USD 3.30 billion in 2025 and is on track to reach USD 4.70 billion by 2030, translating into a 7.38%CAGR over 2025-2030 for the China ophthalmic devices market.

Demographic ageing, a steep rise in juvenile myopia and a national cataract-reimbursement program are enlarging procedure volumes, while government-run bulk-buy auctions propel domestically engineered imaging, surgical and vision-care products into mainstream procurement. Hospitals facing tariff-inflated import prices now trial Chinese premium lasers that meet global accuracy thresholds, accelerating import substitution and diversifying supply. In parallel, private eye-care chains are equipping Tier-II and Tier-III cities with turnkey diagnostic suites, widening geographic coverage and reinforcing the China ophthalmic devices market's momentum through the decade.

China Ophthalmic Devices Market Trends and Insights

Rapid Urban Myopia Surge Transforms Device Demand

Escalating juvenile myopia has reoriented family spending from basic spectacles toward premium screening and treatment, lifting high-margin segments inside the China Ophthalmic Devices market. National-Medical-Products-Administration-cleared phakic intraocular lenses now extend surgical correction to teenagers, evidencing a leap from adult-only procedures. Community clinics deploy AI fundus cameras with >95% diagnostic accuracy, accelerating early detection and feeding referrals into surgical hubs. Parents increasingly choose daily disposable lenses promising axial-elongation control, boosting retailer revenue and sustaining demand for axial-length biometers that track therapy outcomes. Shorter innovation cycles in diagnostic software drive system upgrades ahead of hardware depreciation, reinforcing repeat-purchase behaviour.

Government-Led Cataract Surgery Reimbursement Expansion

National reimbursement doubled cataract surgeries in five years, elevating use of viscoelastics, phaco handpieces and intraocular lenses. Budget certainty prompts hospitals to replace aging consoles with femtosecond platforms that lower complication rates, confident that higher capital outlays are offset by guaranteed case volumes. Bulk-buy tenders favour domestic consumables meeting price ceilings, anchoring a long-run revenue engine for the China Ophthalmic Devices market. Suppliers bundling capsulotomy add-ons and single-use packs gain advantage by compressing turnover times and operating-room staffing.

Shortage of Fellowship-Trained Ophthalmic Surgeons

Surgeon-to-population ratios lag national targets in inland counties, capping surgical throughput despite equipment availability. Provincial grants subsidise AI-triage kiosks that refer only confirmed cases to city hospitals, easing workload but constraining adoption of complex vitreoretinal platforms. Training partnerships mandate donation of simulation systems, boosting capital equipment sales in teaching centres yet not fully eliminating the manpower bottleneck that tempers China Ophthalmic Devices market growth.

Other drivers and restraints analyzed in the detailed report include:

- Private Eye-Care Chain Investments in Tier-II & III Cities

- Ageing-Related Cataract & Glaucoma Incidence Spike

- High Import Tariffs on Premium Surgical Lasers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Diagnostic & Monitoring devices represented 23.11% of the 2024 China Ophthalmic Devices market size and are expected to compound at 10.11%CAGR to 2030. Local suppliers now install more than half of OCT workstations in county hospitals, buoyed by AI modules that allow technicians to deliver referral-ready reports without specialist oversight. Faster software release cycles persuade facilities to refresh equipment ahead of depreciation schedules, lifting replacement revenue. Vision Care remains the largest slice at 60.41%, driven by daily disposable silicone-hydrogel lenses that benefit from e-commerce penetration. Surgical devices contribute 16.6% and gain from bulk tender guarantees that underpin cataract lens offtake, while ambulatory centres purchase phaco consoles with integrated capsulotomy to minimize theatre time.

The China Ophthalmic Devices Market Report is Segmented by Device Type (Diagnostic & Monitoring Devices, Surgical Devices, and Vision Care Devices), Disease Indication (Cataract, Glaucoma, Diabetic Retinopathy, Other Disease Indications), End-User (Hospitals, Specialty Ophthalmic Clinics, and More. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Alcon

- Johnson & Johnson

- Carl Zeiss

- Bausch + Lomb Corp.

- HOYO Corporation

- Nidek

- Topcon Corp.

- Lumenis

- Mindray Bio-Medical Electronics Co., Ltd.

- Shenzhen Certainn Technology Co., Ltd.

- Brighten Optix Corp.

- Shanghai Haohai Biological Technology Co., Ltd.

- Kanghua Ruiming Medical (VisionStar)

- Oculus

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Urban Myopia Surge among Chinese Youth

- 4.2.2 Government-led Cataract Surgery Reimbursement Expansion

- 4.2.3 Growing Private Eye-Care Chain Investments in Tier-II & III Cities

- 4.2.4 Aging-related Cataract & Glaucoma Incidence Spike in Coastal Provinces

- 4.2.5 AI-enabled Screening Kiosks Adoption by Community Hospitals

- 4.2.6 NMPA Fast-track Approvals for Innovative Ophthalmic Implants

- 4.3 Market Restraints

- 4.3.1 Shortage of Fellowship-trained Ophthalmic Surgeons in Inland China

- 4.3.2 High Import Tariffs on Premium Surgical Lasers

- 4.3.3 Price-sensitive Public Hospital Procurement Auctions

- 4.3.4 Counterfeit Diagnostic Hand-helds in Informal Distribution Channels

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Device Type

- 5.1.1 Diagnostic & Monitoring Devices

- 5.1.1.1 OCT Scanners

- 5.1.1.2 Fundus & Retinal Cameras

- 5.1.1.3 Autorefractors & Keratometers

- 5.1.1.4 Corneal Topography Systems

- 5.1.1.5 Ultrasound Imaging Systems

- 5.1.1.6 Perimeters & Tonometers

- 5.1.1.7 Other Diagnostic & Monitoring Devices

- 5.1.2 Surgical Devices

- 5.1.2.1 Cataract Surgical Devices

- 5.1.2.2 Vitreoretinal Surgical Devices

- 5.1.2.3 Refreactive Surgical Devices

- 5.1.2.4 Glaucoma Surgical Devices

- 5.1.2.5 Other Surgical Devices

- 5.1.3 Vision Care Devices

- 5.1.3.1 Spectacles Frames & Lenses

- 5.1.3.2 Contact Lenses

- 5.1.1 Diagnostic & Monitoring Devices

- 5.2 By Disease Indication

- 5.2.1 Cataract

- 5.2.2 Glaucoma

- 5.2.3 Diabetic Retinopathy

- 5.2.4 Other Disease Indications

- 5.3 By End-user

- 5.3.1 Hospitals

- 5.3.2 Specialty Ophthalmic Clinics

- 5.3.3 Ambulatory Surgery Centers (ASCs)

- 5.3.4 Other End-users

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Alcon Inc.

- 6.3.2 Johnson & Johnson Vision Care Inc.

- 6.3.3 Carl Zeiss Meditec AG

- 6.3.4 Bausch + Lomb Corp.

- 6.3.5 HOYO Corporation

- 6.3.6 Nidek Co., Ltd.

- 6.3.7 Topcon Corp.

- 6.3.8 Lumenis Be Ltd.

- 6.3.9 Mindray Bio-Medical Electronics Co., Ltd.

- 6.3.10 Shenzhen Certainn Technology Co., Ltd.

- 6.3.11 Brighten Optix Corp.

- 6.3.12 Shanghai Haohai Biological Technology Co., Ltd.

- 6.3.13 Kanghua Ruiming Medical (VisionStar)

- 6.3.14 OCULUS

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment