PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848047

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848047

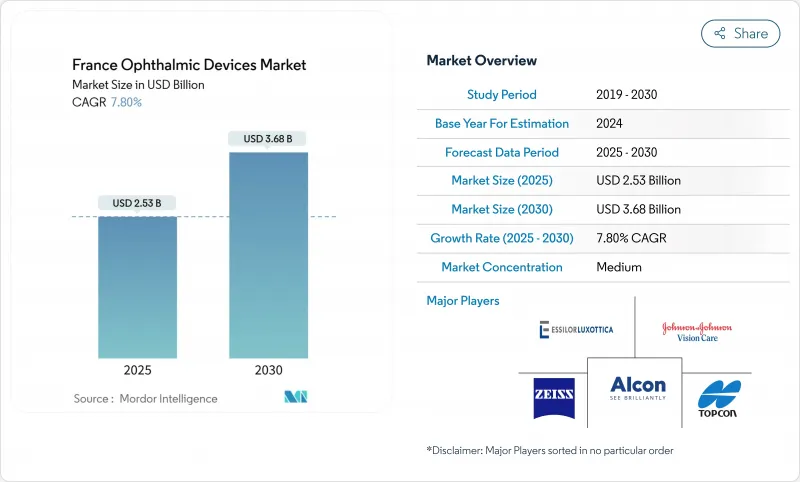

France Ophthalmic Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The France ophthalmic devices market size stands at a current value of USD 2.35 billion, and analysts project it will reach USD 3.68 billion by 2030, reflecting a compound annual growth rate (CAGR) of 7.80% from 2025 to 2030.

The steady expansion of the France ophthalmic devices market is underpinned by a surge in premium intraocular lens (IOL) use across public hospitals, wider deployment of optical coherence tomography (OCT) in community practices, and government incentives that reward locally manufactured medical technology. Global brands and French innovators have accelerated product introductions, while artificial-intelligence (AI) software that supports diagnostic imaging is rapidly moving from pilot programs into routine diabetic-retinopathy screening workflows. Technology-driven cost efficiencies are enabling ambulatory surgery centers (ASCs) to capture a higher share of cataract and refractive procedures, adding further momentum to the France ophthalmic devices market. At the same time, reimbursement hurdles for novel hardware and an uneven distribution of ophthalmologists outside large cities temper growth by delaying device adoption in under-served regions, yet the long-term demographic tailwind tied to population ageing keeps the outlook positive.

France Ophthalmic Devices Market Trends and Insights

Increasing Adoption of Premium Intraocular Lenses in Post-Cataract Procedures

Surgeons in public hospitals are moving decisively toward presbyopia-correcting and toric IOLs, encouraged by patients who now actively request spectacle independence and by recent Haute Autorite de Sante (HAS) decisions that opened partial reimbursement pathways for select premium implants. Alcon's VIVITY and PANOPTIX families continue to set the uptake pace, benefiting from the firm's global supply reach and targeted surgeon-training programs. A 27.0% rise in cataract surgeries since 2020, coupled with 64% of procedures now performed on an ambulatory basis, positions the France ophthalmic devices market for sustained premium-lens growth as the population over 65 swells. Enthusiastic consumer acceptance is evident in surveys that show 38% of cataract patients explicitly asking for high-end IOL models at pre-operative visits, a figure that was barely 10% five years ago. Ongoing innovation in lens-design optics and materials is expected to widen indications, further lifting revenue potential over the forecast horizon.

Rising Penetration of Optical Coherence Tomography in Community Ophthalmology Networks

Compact spectral-domain and swept-source OCT units, bundled with secure cloud image-sharing software, have reached community clinics and optometrist co-management sites, reducing the diagnostic gap between tertiary centers and primary care. Reimbursement for tele-ophthalmology consultations introduced in 2018 eliminates the need for a prior face-to-face visit, allowing earlier macular-pathology detection and streamlining referrals. Evidence from Paris shows that regions deploying OCT at general-practice level reduced vision-loss incidence compared with areas that relied solely on hospital-based services. Suppliers are racing to embed AI-enabled layer-segmentation and automated progression-analysis tools directly onto the OCT console, lowering reading times for busy clinicians and accelerating diagnostic throughput.

Stringent HAS Reimbursement Barriers Limiting Novel Device Adoption

The Service Medical Rendu and Amelioration du Service Medical Rendu assessment metrics demand unequivocal clinical-benefit proof before a new product can claim reimbursement, elongating time-to-market and squeezing smaller manufacturers that lack phase-4-level data packages. Even devices that clear the clinical bar face protracted Economic Committee for Health-Care Products price talks, which peg tariffs to cost-effectiveness benchmarks, sometimes below production cost for low-volume specialties. As a result, several innovators sidestep France and pilot in neighboring markets first, delaying domestic access to cutting-edge solutions.

Other drivers and restraints analyzed in the detailed report include:

- National Screening Programs for Diabetic Retinopathy Driving Diagnostic Device Uptake

- Surge in Refractive Surgery Volumes Fueling Demand for Excimer and Femtosecond Lasers

- Ophthalmologist Shortage Creating Geographic Disparities in Device Utilization

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Vision Care products led the France ophthalmic devices market in 2024, with EssilorLuxottica and other suppliers capturing 63.0% of value through a mix of prescription eyewear, contact lenses and myopia-management interventions. The France ophthalmic devices market size for Vision Care reached USD 1.48 billion in 2024 and will expand steadily on the back of Stellest myopia-control lenses, whose real-world data show an average 67.0% slowdown in axial elongation among school-aged users. Innovations in silicone-hydrogel and water-gradient materials are raising wearing comfort, cementing daily-disposable formats as the fastest-rising subcategory. The corporate push into smart spectacles that integrate heads-up displays and biosensors further differentiates product offerings and deepens barriers to entry.

Diagnostic & Monitoring devices represent the most dynamic slice of the France ophthalmic devices market, exhibiting a 9.95% CAGR through 2030 as OCT units, fundus cameras and perimeters embed AI screening modules. Suppliers are pivoting from hardware margins toward subscription models that bundle cloud analytics and upgrade pathways, smoothing revenue visibility. Miniaturization unlocks sales to community optometrists and pharmacies, significantly raising installed bases in areas formerly underserved by hospital imaging. Collaborative purchasing schemes among regional health agencies are also encouraging bulk orders, reducing unit costs and accelerating refresh cycles.

The France Ophthalmic Devices Market Report is Segmented by Device Type (Diagnostic & Monitoring Devices, Surgical Devices, and Vision Care Devices), Disease Indication (Cataract, Glaucoma, Diabetic Retinopathy, Other Disease Indications), End-User (Hospitals, Specialty Ophthalmic Clinics, and More. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Alcon

- Bausch Health

- Carl Zeiss

- EssilorLuxottica

- HOYA

- Johnson & Johnson Vision Care

- Nidek

- Topcon

- Ziemer Group

- Precilens

- Lumibird Medical

- Luneau Technology (Visionix)

- Heidelberg Engineering

- Optotek Medical

- Schwind eye-tech-solutions

- Oculus Optikgerte GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Adoption of Premium Intraocular Lenses in Post-Cataract Procedures Across Public Hospitals

- 4.2.2 Rising Penetration of Optical Coherence Tomography in Community Ophthalmology Networks

- 4.2.3 National Screening Programs for Diabetic Retinopathy Driving Diagnostic Device Uptake

- 4.2.4 Surge in Refractive Surgery Volumes Fueling Demand for Excimer and Femtosecond Lasers

- 4.2.5 Government Incentives for Domestic Manufacturing under France 2030 Medical Devices Plan

- 4.2.6 Integration of AI-based Decision-Support Algorithms into Ophthalmic Imaging Modalities

- 4.3 Market Restraints

- 4.3.1 Stringent Haute Autorit de Sant (HAS) Reimbursement Barriers for Novel Devices

- 4.3.2 Shortage of Trained Ophthalmologists Limiting Device Utilization Outside Major Cities

- 4.3.3 High Capital Cost of Advanced Surgical Platforms for Small Private Clinics

- 4.3.4 Post-Covid Supply-Chain Disruptions Impacting Availability of Semiconductor Components

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Device Type

- 5.1.1 Diagnostic & Monitoring Devices

- 5.1.1.1 OCT Scanners

- 5.1.1.2 Fundus & Retinal Cameras

- 5.1.1.3 Autorefractors & Keratometers

- 5.1.1.4 Corneal Topography Systems

- 5.1.1.5 Ultrasound Imaging Systems

- 5.1.1.5.1 Excimer Lasers

- 5.1.1.6 Perimeters & Tonometers

- 5.1.1.6.1 Femtosecond Lasers

- 5.1.1.7 Other Diagnostic & Monitoring Devices

- 5.1.1.7.1 YAG Lasers

- 5.1.2 Surgical Devices

- 5.1.2.1 Cataract Surgical Devices

- 5.1.2.2 Vitreoretinal Surgical Devices

- 5.1.2.3 Refreactive Surgical Devices

- 5.1.2.4 Glaucoma Surgical Devices

- 5.1.2.5 Other Surgical Devices

- 5.1.3 Vision Care Devices

- 5.1.3.1 Spectacles Frames & Lenses

- 5.1.3.2 Contact Lenses

- 5.1.1 Diagnostic & Monitoring Devices

- 5.2 By Disease Indication

- 5.2.1 Cataract

- 5.2.2 Glaucoma

- 5.2.3 Diabetic Retinopathy

- 5.2.3.1 Soft Contact Lenses

- 5.2.4 Other Disease Indications

- 5.2.4.1 Rigid Gas-Permeable Lenses

- 5.3 By End-user

- 5.3.1 Hospitals

- 5.3.2 Specialty Ophthalmic Clinics

- 5.3.3 Ambulatory Surgery Centers (ASCs)

- 5.3.4 Other End-users

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Alcon Inc.

- 6.3.2 Bausch Health Companies Inc.

- 6.3.3 Carl Zeiss Meditec AG

- 6.3.4 EssilorLuxottica SA

- 6.3.5 HOYA

- 6.3.6 Johnson & Johnson Vision Care

- 6.3.7 Nidek Co., Ltd.

- 6.3.8 Topcon Corporation

- 6.3.9 Ziemer Ophthalmic Systems AG

- 6.3.10 Precilens

- 6.3.11 Lumibird Medical

- 6.3.12 Luneau Technology (Visionix)

- 6.3.13 Heidelberg Engineering GmbH

- 6.3.14 Optotek Medical

- 6.3.15 Schwind eye-tech-solutions

- 6.3.16 Oculus Optikgerte GmbH

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment