PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848077

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848077

Japan Ophthalmic Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

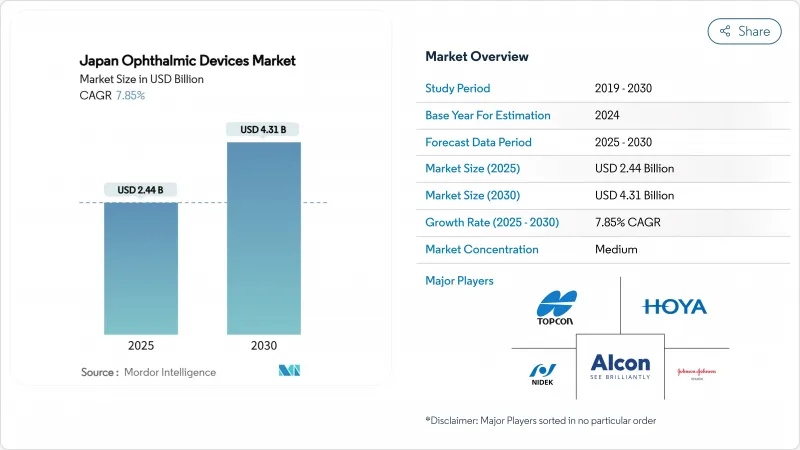

The Japan ophthalmic devices market size stands at USD 2.44 billion in 2025 and is forecast to reach USD 4.31 billion by 2030, advancing at a 7.85% CAGR during 2025-2030.

A super-aged population, fast-advancing imaging technologies, and reforms that reward outpatient care are reinforcing demand. Vision care products continue to dominate unit volumes, but diagnostic platforms anchored in optical coherence tomography (OCT) are expanding the addressable base of high-value capital equipment. Surgical volumes are migrating to ambulatory settings as fee parity closes the cost gap with hospitals, prompting rapid adoption of compact workstations and single-use disposables. At the same time, rigorous PMDA approval rules and new human-factors mandates are lengthening launch timelines, pushing firms to strengthen local clinical collaborations to maintain speed. The widening urban-rural ophthalmologist divide further amplifies interest in AI-assisted screening tools that can relieve physician workload and extend reach into underserved prefectures.

Japan Ophthalmic Devices Market Trends and Insights

Rapidly-Ageing Population Driving Cataract Surgery Volumes

An unprecedented demographic shift places nearly 30% of Japan's citizens above 65, triggering consistent cataract surgery demand that reached 1.6 million procedures in 2019 and continues to climb in 2025. Hospital audits show a growing share of patients over 90 benefiting from modern phacoemulsification combined with premium intraocular lenses, with documented cognitive score gains from 25.65 to 27.08 on the MMSE after surgery. This broader health impact positions cataract care as more than a vision solution and amplifies purchaser willingness to pay for femtosecond laser platforms, toric lens calculators, and digitally assisted microscopes. Manufacturers bundle ergonomic handpieces and workflow software to sustain throughput amid a tightening surgical workforce. Over the long run, this driver is expected to lift the Japan ophthalmic devices market by 2.0 percentage points of cumulative CAGR.

Rising Prevalence of Juvenile Myopia & Demand for Early Diagnosis

Japanese myopia rates among children aged 6-14 rose from 10% in the late 1970s to 53% by 2010 and remain above 36% in 2025, with COVID-19-related indoor lifestyles worsening the trend. The scale of the issue prompted Santen to launch RYJUSEA Mini (atropine 0.025%) in April 2025, the first locally approved therapy to slow myopia progression. Uptake of axial-length measurement devices, auto-refractors with cycloplegic modes, and school-based screening kiosks is accelerating. Vision-care market leaders promote spectacle lenses such as MiYOSMART and daily disposable contact lenses through omnichannel campaigns targeting concerned parents. These developments collectively could add 1.3 percentage points to the sector's growth trajectory through 2030.

High Capital Cost of Advanced Surgical Workstations

Femtosecond laser units, multimodal microscopes, and robotic cataract platforms require upfront payments topping USD 350,000, locking out clinics that handle fewer than 18 cases per week. While leading chains in Tokyo and Osaka easily secure financing, smaller providers face thin margins because reimbursement rates have not risen in line with device precision upgrades. Leasing and pay-per-procedure contracts now appear in tender documents, yet interest rates above 2% add further strain. As a result, the addressable pool of purchasers narrows, trimming 1.8 percentage points from the five-year growth outlook of the Japan ophthalmic devices market.

Other drivers and restraints analyzed in the detailed report include:

- Government Reimbursement Reforms Encouraging Out-of-Hospital Procedures

- Adoption of AI-Enabled Imaging & Screening Platforms

- Stringent PMDA Approval & Post-Market Surveillance Requirements

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Vision-care platforms accounted for 65.31% of 2024 revenue, reflecting the nation's long-standing reliance on corrective eyewear. HOYA's channel audits show contact-lens penetration expanding at 2% per year, with bifocal and myopia-control options fueling basket size gains. Diagnostic and monitoring equipment is the fastest riser, set to log a 9.99% CAGR through 2030 as self-imaging OCT, swept-source devices, and AI-ready fundus scanners move from tertiary centers into primary clinics. Adoption of Canon's OCT-R1, which earned a Red Dot award for its compact footprint, exemplifies this pivot toward earlier detection. Across both tiers, value-added software subscriptions help offset fee-schedule pressure by bundling analytics dashboards and remote consultation features into hardware sales. These multi-modal strategies underpin sustained leadership for platform vendors while widening access to proactive eye-health management.

Growth momentum in surgical devices remains steady, underpinned by minimally invasive glaucoma stents, single-use vitrectomy cutters, and compact phaco consoles designed for ASC workflows. Femtosecond laser cataract systems deliver added precision, yet their high capital requirement restricts uptake to high-volume metropolitan centers. To narrow this affordability gap, manufacturers trial pay-per-click models that align unit economics with procedure counts in tier-2 clinics. As a result, the Japan ophthalmic devices market size attributed to surgical technology is expected to expand but at a more measured pace than diagnostics.

The Japan Ophthalmic Devices Market Report is Segmented by Device Type (Diagnostic & Monitoring Devices, Surgical Devices, and Vision Care Devices), Disease Indication (Cataract, Glaucoma, Diabetic Retinopathy, Other Disease Indications), End-User (Hospitals, Specialty Ophthalmic Clinics, and More. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Alcon

- Johnson & Johnson Vision Care

- HOYA

- Nidek

- Topcon

- Takagi Seiko

- Canon

- Bausch + Lomb Corp.

- EssilorLuxottica

- Ziemer Group

- Optos

- Lumenis

- STAAR Surgical

- Ellex Medical Lasers Ltd

- Heidelberg Engineering

- Glaukos

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapidly-Ageing Population Driving Cataract Surgery Volumes

- 4.2.2 Rising Prevalence of Juvenile Myopia & Demand for Early Diagnosis

- 4.2.3 Government Reimbursement Reforms Encouraging Out-of-Hospital Procedures

- 4.2.4 Adoption of AI-enabled Imaging & Screening Platforms

- 4.2.5 Expansion of Ambulatory Surgery Centers in Tier-2 Cities

- 4.2.6 Penetration of Premium Toric & Multifocal IOLs

- 4.3 Market Restraints

- 4.3.1 High Capital Cost of Advanced Surgical Workstations

- 4.3.2 Stringent PMDA Approval & Post-Market Surveillance Requirements

- 4.3.3 Shrinking Ophthalmologist Workforce in Rural Prefectures

- 4.3.4 National Fee-Schedule Cuts Exerting Price Pressure

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Device Type

- 5.1.1 Diagnostic & Monitoring Devices

- 5.1.1.1 OCT Scanners

- 5.1.1.2 Fundus & Retinal Cameras

- 5.1.1.3 Autorefractors & Keratometers

- 5.1.1.4 Corneal Topography Systems

- 5.1.1.5 Ultrasound Imaging Systems

- 5.1.1.6 Perimeters & Tonometers

- 5.1.1.7 Other Diagnostic & Monitoring Devices

- 5.1.2 Surgical Devices

- 5.1.2.1 Cataract Surgical Devices

- 5.1.2.2 Vitreoretinal Surgical Devices

- 5.1.2.3 Refreactive Surgical Devices

- 5.1.2.4 Glaucoma Surgical Devices

- 5.1.2.5 Other Surgical Devices

- 5.1.3 Vision Care Devices

- 5.1.3.1 Spectacles Frames & Lenses

- 5.1.3.2 Contact Lenses

- 5.1.1 Diagnostic & Monitoring Devices

- 5.2 By Disease Indication

- 5.2.1 Cataract

- 5.2.2 Glaucoma

- 5.2.3 Diabetic Retinopathy

- 5.2.4 Other Disease Indications

- 5.3 By End-user

- 5.3.1 Hospitals

- 5.3.2 Specialty Ophthalmic Clinics

- 5.3.3 Ambulatory Surgery Centers (ASCs)

- 5.3.4 Other End-users

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Alcon Inc.

- 6.3.2 Johnson & Johnson Vision Care

- 6.3.3 HOYA Corporation

- 6.3.4 Nidek Co. Ltd

- 6.3.5 Topcon Corporation

- 6.3.6 Takagi Seiko Co. Ltd

- 6.3.7 Canon Medical Systems Corp.

- 6.3.8 Bausch + Lomb Corp.

- 6.3.9 EssilorLuxottica SA

- 6.3.10 Ziemer Group AG

- 6.3.11 Optos plc

- 6.3.12 Lumenis Ltd

- 6.3.13 STAAR Surgical Company

- 6.3.14 Ellex Medical Lasers Ltd

- 6.3.15 Heidelberg Engineering GmbH

- 6.3.16 Glaukos Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment