PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848068

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848068

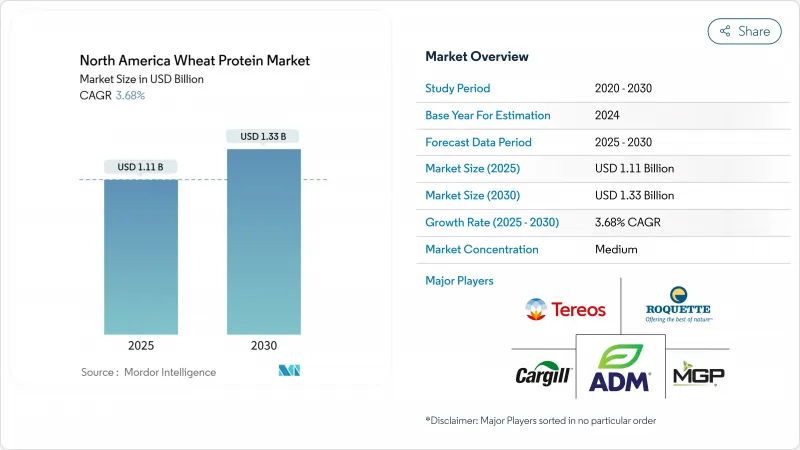

North America Wheat Protein - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North American wheat protein market size is valued at USD 1.11 billion in 2025 and is forecast to reach USD 1.33 billion by 2030, expanding at a 3.68% CAGR.

Steady growth reflects stable wheat production, rising demand for plant-based proteins, and clean label preferences. U.S. wheat output climbed to 1.97 billion bushels in 2024, the highest level in eight years, while Canadian production is projected at 35.6 million tonnes for 2025-26, creating an abundant raw-material supply, according to the United States Department of Agriculture. Technological differentiation in isolates and hydrolyzed variants is unlocking premium applications across food, feed, and cosmetics. Regenerative agriculture programs in Canada are scaling organic wheat protein, capturing sustainability premiums, and reinforcing the North American wheat protein market's resilience.

North America Wheat Protein Market Trends and Insights

Expanding Applications in Processed Foods

The processed food sector's protein fortification drive is reshaping wheat protein demand patterns beyond traditional bakery applications. MGP Ingredients' Arise wheat protein isolate has gained traction in keto-friendly snack formulations, where its viscoelastic properties enable high-protein content without compromising texture. This application expansion reflects a broader industry shift toward functional ingredients that address multiple nutritional objectives simultaneously. The trend is particularly pronounced in ready-to-eat and ready-to-cook food segments, where wheat protein serves as both a nutritional enhancer and a processing aid. Protein integration in baked goods has evolved beyond simple fortification to include fermented protein applications that create complete amino acid profiles. The processed food sector's embrace of wheat protein is accelerating as manufacturers seek declaration-friendly alternatives to synthetic additives, positioning wheat protein as a clean-label solution that meets consumer transparency demands.

Rising Demand for Clean Label and Non-GMO Product Categories

Clean label imperatives are driving wheat protein adoption as food manufacturers eliminate synthetic additives and embrace recognizable ingredients. U.S. Wheat Associates has identified clean label implications as a critical factor influencing wheat food production strategies, with manufacturers increasingly prioritizing ingredient transparency. The movement extends beyond simple ingredient substitution to encompass supply chain transparency, where wheat protein's agricultural traceability provides competitive advantages. BENEO's BeneoPro VWG wheat protein exemplifies this trend, offering clean label status alongside high solubility and excellent binding capacity for diverse food applications. The regulatory environment supports this trend, with FDA guidance emphasizing early safety evaluation of new proteins while maintaining established pathways for traditional wheat derivatives.

Rising Prevalence of Gluten Sensitivity and Celiac Disease

According to Celiac Australia data from 2024, 1 in 70 Australians has celiac disease. The condition affects patients beyond gastrointestinal symptoms, with manifestations that impact overall quality of life and require strict gluten-free diets. This dietary requirement influences market segmentation, as companies must balance developing wheat protein products for non-sensitive consumers while considering gluten-sensitive populations, which affects the addressable market size in certain demographics. The prevalence of celiac disease has prompted food manufacturers to invest in research and development of alternative protein sources and gluten-free formulations. Additionally, the growing awareness of celiac disease and gluten sensitivity has led to increased demand for clear product labeling and dedicated manufacturing facilities to prevent cross-contamination, further impacting production costs and market dynamics. The rise in diagnosis rates and improved testing methods have also contributed to market growth, with manufacturers expanding their product portfolios to include specialized gluten-free options. Furthermore, regulatory bodies have implemented stricter guidelines for gluten-free certification and labeling requirements, ensuring consumer safety while creating additional compliance considerations for industry participants.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand for Plant-Based Proteins in Plant-Based Meat Alternatives

- Canadian Regenerative Wheat Farming Unlocking Scalable Organic Protein Supply

- Growing Popularity of Gluten-Free Alternatives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wheat protein concentrates command 47.32% market share in 2024, reflecting their established role in traditional food applications where moderate protein content and cost-effectiveness drive adoption. The concentrates segment's dominance stems from its versatility across bakery, snack, and processed food categories, where protein levels provide sufficient functionality without premium pricing. Isolates represent a smaller but growing segment, targeting specialized applications requiring higher protein purity and specific functional characteristics.

Textured and hydrolyzed wheat proteins emerge as the fastest-growing segment at 5.21% CAGR through 2030, driven by innovation in plant-based meat alternatives and personal care applications where modified protein structures deliver enhanced functionality. The type segmentation's evolution reflects technological advancement in protein processing, with hydrolyzed variants gaining traction in cosmetic formulations and specialized food applications. The textured segment's growth trajectory aligns with plant-based meat market expansion, where wheat protein's unique viscoelastic properties provide texture advantages that complement other plant proteins in hybrid formulations.

The North American Wheat Protein Market Report is Segmented by Type (Concentrates, Isolates, Textured/Hydrolyzed), Nature (Conventional, Organic), Application (Food and Beverages, Animal Feed, Personal Care and Cosmetics), and Geography (United States, Canada, Mexico, Rest of North America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Archer-Daniels-Midland Company

- Cargill, Incorporated

- MGP Ingredients Inc.

- Roquette Freres SA

- Tereos S.A.

- Manildra Group

- Crespel & Deiters GmbH & Co. KG

- Kroner-Starke GmbH

- Glico Nutrition Co. Ltd.

- Kerry Group plc

- Tate & Lyle PLC

- CropEnergies AG

- Ardent Mills LLC

- Permolex International L.P.

- PureField Ingredients LLC

- Jackering Gruppe

- Amber Wave USA

- BENEO GmbH

- Planture (US broker)

- American Key Food Products

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanding Applications in Processed Foods

- 4.2.2 Rising Demand for Clean Label and Non-GMO Product Categories

- 4.2.3 Rising Demand for Plant-Based Proteins in Plant-Based Meat Alternatives

- 4.2.4 Canadian regenerative wheat farming unlocking scalable organic protein supply

- 4.2.5 Hydrolyzed Wheat Protein Uptake in Personal Care Products

- 4.2.6 Growing Adoption of Wheat Protein in Animal and Pet Food

- 4.3 Market Restraints

- 4.3.1 Rising Prevelance of Gluten Sensitivity and Celiac Disease

- 4.3.2 Growing Popularity of Gluten-Free Alternatives

- 4.3.3 Availability and Preference for Other Plant-Based Proteins

- 4.3.4 Fluctuating Raw Material Prices

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Patent Analysis

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Type

- 5.1.1 Concentrates

- 5.1.2 Isolates

- 5.1.3 Textured/Hydrolyzed

- 5.2 By Nature

- 5.2.1 Conventional

- 5.2.2 Organic

- 5.3 By Application

- 5.3.1 Food & Beverages

- 5.3.1.1 Bakery & Snacks

- 5.3.1.2 Breakfast Cereals

- 5.3.1.3 Meat/Poultry/Seafood and Meat Alternative Products

- 5.3.1.4 RTE/RTC Food Products

- 5.3.1.5 Condiments/Sauces

- 5.3.2 Animal Feed

- 5.3.3 Personal Care & Cosmetics

- 5.3.1 Food & Beverages

- 5.4 By Geography

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

- 5.4.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Archer-Daniels-Midland Company

- 6.4.2 Cargill, Incorporated

- 6.4.3 MGP Ingredients Inc.

- 6.4.4 Roquette Freres SA

- 6.4.5 Tereos S.A.

- 6.4.6 Manildra Group

- 6.4.7 Crespel & Deiters GmbH & Co. KG

- 6.4.8 Kroner-Starke GmbH

- 6.4.9 Glico Nutrition Co. Ltd.

- 6.4.10 Kerry Group plc

- 6.4.11 Tate & Lyle PLC

- 6.4.12 CropEnergies AG

- 6.4.13 Ardent Mills LLC

- 6.4.14 Permolex International L.P.

- 6.4.15 PureField Ingredients LLC

- 6.4.16 Jackering Gruppe

- 6.4.17 Amber Wave USA

- 6.4.18 BENEO GmbH

- 6.4.19 Planture (US broker)

- 6.4.20 American Key Food Products

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK