PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848073

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848073

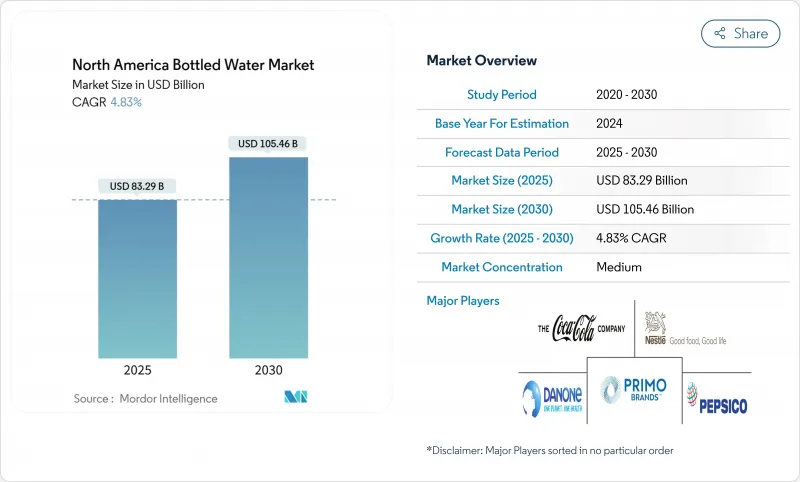

North America Bottled Water - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North American bottled water market size is expected to reach USD 83.29 billion in 2025 and is projected to grow to USD 105.46 billion by 2030, with a CAGR of 4.83% during the forecast period.

Market growth is driven by increased health consciousness, persistent water quality issues, and a recovery in the tourism and hospitality sectors. While still water remains the primary sales segment, functional and flavored water variants are experiencing increased demand as consumers prioritize health and performance benefits. Manufacturers are implementing packaging innovations, including recycled PET materials and lightweight cans, to meet sustainability requirements while maintaining profitability. The market expansion is further supported by population growth and the convenience of portable bottled water. Functional water, enhanced with vitamins, has gained consumer acceptance due to its convenience, health benefits, and improved taste compared to tap water.

North America Bottled Water Market Trends and Insights

Rising Demand for Functional Water From Fitness Enthusiasts

The growing emphasis on health and wellness has transformed consumer perception of hydration from a basic need to a performance enhancement tool. This shift has increased demand for water products enhanced with electrolytes and vitamins. Consumers now associate functional beverages with healthy lifestyles and proactive health management. The fitness community particularly seeks products with natural electrolytes, adaptogens, and minerals for recovery and performance benefits, as these components directly support their athletic pursuits and training goals. According to the U.S. Census Bureau data from 2023, 21.1% of Americans participated in daily sports, exercise, and recreational activities, indicating a substantial market for functional hydration products. This increased fitness participation has created a robust consumer base seeking specialized hydration solutions. The younger demographic's preference for functional benefits over traditional beverages has reshaped market dynamics significantly. This shift in consumer behavior, combined with growing health awareness, has driven demand for premium functional water products.

Advertisements and Promotional Campaigns

Digital marketing strategies target health-conscious consumers through social media platforms and influencer collaborations to increase brand visibility and educate consumers about hydration benefits. Companies use data analytics to create personalized messages that position bottled water as essential for health-focused consumers. Marketing campaigns focus on brand differentiation through source purity, mineral content, and sustainability credentials to support premium pricing. The emphasis on digital channels allows companies to reach specific consumer segments with tailored messaging about product benefits and environmental commitments. In the premium segment, brand reputation and quality perception significantly influence consumer purchase decisions. The growth of direct-to-consumer channels enables targeted marketing campaigns that reduce retail markups, allowing companies to allocate more resources to consumer education and loyalty programs. These direct channels provide companies with valuable consumer data and feedback, enhancing their ability to refine marketing strategies. Companies leverage this information to develop more effective promotional campaigns and strengthen customer relationships across digital platforms.

Environmental Concerns and Plastic Waste

Environmental awareness has increased consumer resistance to single-use plastic bottles, leading to regulatory measures and corporate sustainability commitments that raise operational costs. Companies are investing in recycling infrastructure and alternative packaging materials, which increases production costs and supply chain complexity. Plastic bottle bans in airports and public venues require companies to use aluminum and glass alternatives. These alternatives have resulted in higher transportation costs across the supply chain. The shift in consumer preferences has also led to increased scrutiny of packaging materials and their environmental impact. The environmental factors continue to drive innovation in packaging design and biodegradable materials development. Companies are implementing comprehensive recycling systems to address sustainability concerns. These initiatives require significant capital investments that affect industry profit margins. The industry is also experiencing pressure to develop more sustainable solutions while maintaining product quality. The balance between environmental responsibility and operational efficiency remains a key challenge for companies in the sector.

Other drivers and restraints analyzed in the detailed report include:

- Growing Tourism and Hospitality Sector

- Expansion of Food Service Establishments

- Strong Competition From Water Purifier Appliances

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Still bottled water maintains commanding market leadership with 74.65% share in 2024, reflecting consumer preference for pure, unflavored hydration solutions across diverse consumption occasions. However, functional and flavored bottled water segments demonstrate superior growth momentum at 5.48% CAGR through 2030, driven by health-conscious consumers seeking enhanced benefits beyond basic hydration. This growth differential suggests a gradual market evolution where traditional still water consumption stabilizes while innovation concentrates in value-added segments. Sparkling bottled water occupies a smaller but stable niche, appealing to consumers seeking carbonation without artificial additives or sweeteners.

The functional water segment benefits from technological advances in mineral infusion, electrolyte balancing, and vitamin fortification that maintain product stability and taste profiles. Companies increasingly position functional variants as lifestyle products rather than mere beverages, targeting fitness enthusiasts, health-conscious professionals, and wellness-focused demographics willing to pay premium prices. In March 2024, Essentia Water launched its first-ever range of flavored and functional water products. The products are available in lemon lime, peach-mango, and raspberry pomegranate flavors. The segment's growth trajectory aligns with broader consumer trends toward preventive health measures and performance optimization, creating sustained demand that justifies higher production costs and marketing investments

PET bottles command 78.46% market share in 2024, benefiting from lightweight properties, cost efficiency, and an established supply chain infrastructure that supports mass market distribution. The format's dominance reflects practical considerations, including transportation costs, breakage resistance, and consumer convenience preferences across diverse retail channels. However, cans experience accelerated growth at 5.85% CAGR through 2030, driven by premium positioning, sustainability perceptions, and enhanced product differentiation capabilities.

Sustainability initiatives increasingly influence packaging decisions, with companies investing in recycled content, lightweighting technologies, and alternative materials to address environmental concerns while maintaining cost competitiveness. The National Association for Packaging Innovation focuses on recyclability improvements, barrier properties for extended shelf life, and design elements that enhance brand differentiation in competitive retail environments. In October 2023, A US-based mountain spring mineral water introduced 100% recycled polyethylene terephthalate (rPET) for its water bottles. The bottles feature CleanFlake label technology, which enhances the recovery of high-quality PET during recycling.

The North America Bottled Water Market Report is Segmented by Type (Still Water, Sparkling Water, and Functional/Flavored Water), Packaging Format (PET Bottles, Glass Bottles, and Cans), Category (Mass and Premium), Distribution Channel (On-Trade and Off-Trade), and Geography (United States, Canada, Mexico, and Rest of North America). The Market Forecast are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Primo Brands Corporation

- The Coca-Cola Company

- PepsiCo, Inc.

- Danone S.A.

- Nestle S.A.

- Niagara Bottling LLC

- Otsuka Holdings Co. Ltd.

- The Wonderful Company LLC

- Voss of Norway AS

- National Beverage Corp.

- Highland Spring Ltd.

- Flow Hydration Inc.

- Talking Rain Beverage Co. (Sparkling Ice)

- Hint Water Inc.

- Keurig Dr Pepper Inc. (CORE Hydration)

- Absopure Water Company

- Penta Water

- Eternal Water

- Propel Fitness Water

- Deer Park Spring Water

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Functional Water From Fitness Enthusiasts

- 4.2.2 Advertisements and Promotional Campaigns

- 4.2.3 Growing Tourism and Hospitality Sector

- 4.2.4 Expansion of Food Service Establishments

- 4.2.5 Water Quality and Safety Concerns

- 4.2.6 Increased Awareness of Waterborne Diseases

- 4.3 Market Restraints

- 4.3.1 Environmental Concerns and Plastic Waste

- 4.3.2 Strong Competition From Water Purifier Appliances

- 4.3.3 Consumer Shift Towards Sustainability

- 4.3.4 High Cost Associated With Functional Water

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Still Bottled Water

- 5.1.2 Sparkling Bottled Water

- 5.1.3 Functional/Flavored Bottled Water

- 5.2 By Packaging Format

- 5.2.1 PET Bottles

- 5.2.2 Glass Bottles

- 5.2.3 Cans

- 5.3 By Category

- 5.3.1 Mass

- 5.3.2 Premium

- 5.4 By Distribution Channel

- 5.4.1 On-Trade

- 5.4.2 Off-Trade

- 5.4.2.1 Supermarkets/Hypermarkets

- 5.4.2.2 Convenience/Grocery Stores

- 5.4.2.3 Online Retail Stores

- 5.4.2.4 Others Distribution Channel

- 5.5 By Geography

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

- 5.5.4 Rest of North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Primo Brands Corporation

- 6.4.2 The Coca-Cola Company

- 6.4.3 PepsiCo, Inc.

- 6.4.4 Danone S.A.

- 6.4.5 Nestle S.A.

- 6.4.6 Niagara Bottling LLC

- 6.4.7 Otsuka Holdings Co. Ltd.

- 6.4.8 The Wonderful Company LLC

- 6.4.9 Voss of Norway AS

- 6.4.10 National Beverage Corp.

- 6.4.11 Highland Spring Ltd.

- 6.4.12 Flow Hydration Inc.

- 6.4.13 Talking Rain Beverage Co. (Sparkling Ice)

- 6.4.14 Hint Water Inc.

- 6.4.15 Keurig Dr Pepper Inc. (CORE Hydration)

- 6.4.16 Absopure Water Company

- 6.4.17 Penta Water

- 6.4.18 Eternal Water

- 6.4.19 Propel Fitness Water

- 6.4.20 Deer Park Spring Water

7 Market Opportunities and Future Outlook