PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848286

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848286

South America Bottled Water - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

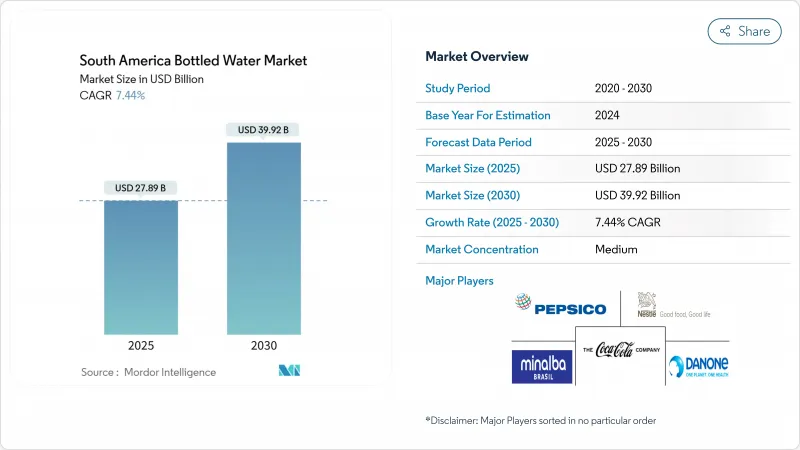

The South America bottled water market size reached USD 27.89 billion in 2025 and is projected to reach USD 39.92 billion by 2030, registering a compound annual growth rate of 7.44% CAGR during the forecast period.

This growth trajectory reflects the region's evolving consumer preferences toward premium hydration solutions and functional beverages, driven by rising health consciousness and expanding foodservice infrastructure. Moreover, bottled water demand in Brazil is showing significant growth, owing to that consumer inclination has shifted from soft drinks and alcoholic beverages to functional, flavored, and mineral water. Infrastructure investment in foodservice, tourism, and last-mile retail is widening cold-chain reach, while regulatory moves on recycled PET spur packaging upgrades that favor well-capitalized producers. Competitive intensity remains moderate as regional brands defend local loyalty even as multinationals push scale advantages. Sustainability credentials, direct-to-consumer models, and ingredient transparency are becoming decisive purchase criteria, especially in urban hubs where consumers scrutinize purity claims and carbon footprints.

South America Bottled Water Market Trends and Insights

Rising Demand for Functional Water from Fitness Enthusiasts

Fitness and sports culture expansion across South America's urban centers is creating unprecedented demand for electrolyte-enhanced and vitamin-fortified water products. According to the Ministry of Tourism and Sports data from 2023, 55% of the respondents in Argentina participated in sports . Brazilian consumers increasingly view hydration as performance optimization rather than a basic necessity, driving premiumization trends that extend beyond traditional sports drinks into everyday consumption patterns. The demographic shift toward younger, health-conscious consumers willing to pay premium prices for perceived wellness benefits creates sustainable competitive advantages for brands investing in functional innovation. This consumer behavior shift fundamentally alters competitive dynamics, as traditional volume-based competition gives way to value-creation strategies focused on ingredient transparency and health positioning. The trend's sustainability is reinforced by rising disposable incomes in key urban markets and expanding wellness consciousness across the region.

Consumer Perception Regarding Pure and Healthy Hydration Fueling Demand

Health consciousness evolution in South America reflects broader global wellness trends, yet manifests uniquely through regional concerns about municipal water quality and industrial contamination. Consumer willingness to pay premium prices for perceived purity creates margin expansion opportunities for brands emphasizing source protection and advanced filtration technologies. The trend gains momentum from social media influence and health professional recommendations, particularly among educated urban demographics who view bottled water as preventive healthcare investment. Brazil's flavored water market reveals high trial rates among consumers, with novelty and health positioning driving initial adoption, though sustained growth requires demonstrable functional benefits beyond marketing claims. This perception shift enables premium positioning strategies that differentiate products through mineral content, pH levels, and source story narratives. The sustainability of this driver depends on maintaining consumer trust through transparent quality assurance and avoiding quality scandals that could undermine category credibility.

Environmental Concerns and Plastic Waste

Regulatory pressure intensifies across South America as governments implement circular economy policies targeting single-use packaging, with Brazil's National Action Plan mandating 50% collection rates by 2040. Consumer environmental consciousness creates market headwinds for traditional packaging formats while accelerating innovation in sustainable alternatives, including refillable systems and aluminum packaging. The constraint forces industry transformation toward circular business models, with Coca-Cola Latin America targeting 40% refillable bottles by 2030 through innovative QR code tracking systems. BlueTriton's aluminum bottle launch for water brands demonstrates industry adaptation to sustainability demands, though implementation costs create competitive disadvantages for smaller players lacking scale economies. The restraint's impact varies by company sustainability capabilities, with well-capitalized multinationals potentially gaining market share as regulatory compliance costs eliminate marginal competitors. Long-term market evolution favors companies investing in packaging innovation and circular economy infrastructure.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Food Service Establishments

- Convenience and Portability Drives Demand

- Strong Competition From Water Purifier Appliances

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Still Bottled Water holds a 66.44% market share in 2024, supported by established consumer preferences and efficient distribution networks. The functional/flavored water segment is projected to grow at a 7.88% CAGR through 2030, demonstrating a market shift toward premium, value-added products. This growth reflects consumers' increasing willingness to pay more for products with health benefits, particularly those featuring electrolyte enhancement and vitamin fortification. Sparkling water continues to show consistent demand in urban markets, especially among younger consumers seeking alternatives to carbonated soft drinks.

The functional water segment continues to expand through product diversification and health-focused positioning. Manufacturers are developing specialized products targeting specific consumer needs, including post-workout recovery, immune support, and energy enhancement. The segment's continued growth relies on products with proven health benefits rather than marketing claims. While still water maintains its market leadership due to competitive pricing and established consumption habits, the market shows a gradual shift toward higher-value categories. Companies with strong product innovation capabilities and consumer insights are gaining competitive advantages over traditional volume-based business models.

Aluminum cans project an 8.24% CAGR through 2030, achieving the highest growth rate among packaging formats as consumers shift away from single-use plastic due to environmental concerns. PET bottles hold 81.46% market share in 2024, supported by cost advantages and established supply chains, but face growing regulatory constraints and resistance from environmentally conscious consumers. Glass bottles serve premium segments in foodservice and gift markets, though higher production costs restrict broader market adoption. These packaging trends align with the circular economy principles, transforming consumer goods industries across South America.

In April 2025, MERCOSUR's new recycled PET regulations increase operational costs, providing advantages to large manufacturers with established recycling capabilities while creating challenges for smaller regional producers . The aluminum can segment benefits from complete recyclability and premium market positioning, though higher material costs necessitate value-added product strategies to sustain profitability. PET bottles maintain market leadership through cost efficiency and widespread consumer acceptance, but require significant investment in recycling systems and recycled content integration for long-term viability. Companies that demonstrate packaging innovation and verifiable sustainability practices gain competitive advantages in serving environmentally aware consumers.

The South America Bottled Water Market is Segmented by Type (Still Water, Sparkling Water, and Functional/Flavored Bottled Water); Packaging Type (PET Bottles, Glass Bottles, and Cans), Category (Mass and Premium), Distribution Channel (On-Trade and Off-Trade); and Geography (Brazil, Argentina, Colombia, and Rest of South America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- The Coca-Cola Company

- Minalba Brasil

- PepsiCo Inc.

- Danone SA

- Nestle SA

- Grupo Edson Queiroz (Indaia)

- Ambev S.A. (AMA)

- AJE Group (Cielo)

- CCU S.A.

- Grupo Agua da Serra

- Socorro Bebidas

- Agua Mineral Ouro Fino

- Lindoya Verao

- Gota Water S.A.

- AJE Group

- Alpina Productos Alimenticios S.A

- Postobon S.A

- Socorro Bebidas

- Aguas Prata

- Togni SPA (Frasassi)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Functional Water From Fitness Enthusiasts

- 4.2.2 Consumer Perception Regarding Pure and Healthy Hydration Fueling Demand

- 4.2.3 Expansion of Food Service Establishments

- 4.2.4 Convenience and Portability Drives Demand

- 4.2.5 Increased Awareness of Waterborne Diseases

- 4.2.6 Advertisements and Promotional Campaigns

- 4.3 Market Restraints

- 4.3.1 Environmental Concerns and Plastic Waste

- 4.3.2 Strong Competition From Water Purifier Appliances

- 4.3.3 Misleading labels and concerns about nanoplastics restricts growth

- 4.3.4 High Cost Associated With Functional Water

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Still Bottled Water

- 5.1.2 Sparkling Bottled Water

- 5.1.3 Functional/Flavored Bottled Water

- 5.2 By Packaging Format

- 5.2.1 PET Bottles

- 5.2.2 Glass Bottles

- 5.2.3 Cans

- 5.3 By Category

- 5.3.1 Mass

- 5.3.2 Premium

- 5.4 By Distribution Channel

- 5.4.1 On-Trade

- 5.4.2 Off-Trade

- 5.4.2.1 Supermarket/Hypermarket

- 5.4.2.2 Convenience/Grocery Stores

- 5.4.2.3 Online Retail Stores

- 5.4.2.4 Others Distribution Channel

- 5.5 By Geography

- 5.5.1 Brazil

- 5.5.2 Argentina

- 5.5.3 Colombia

- 5.5.4 Rest of South America

6 Competitive Landscape

- 6.1 Rest of South America

- 6.2 Market Concentration

- 6.3 Strategic Moves

- 6.4 Market Share Analysis

- 6.5 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.5.1 The Coca-Cola Company

- 6.5.2 Minalba Brasil

- 6.5.3 PepsiCo Inc.

- 6.5.4 Danone SA

- 6.5.5 Nestle SA

- 6.5.6 Grupo Edson Queiroz (Indaia)

- 6.5.7 Ambev S.A. (AMA)

- 6.5.8 AJE Group (Cielo)

- 6.5.9 CCU S.A.

- 6.5.10 Grupo Agua da Serra

- 6.5.11 Socorro Bebidas

- 6.5.12 Agua Mineral Ouro Fino

- 6.5.13 Lindoya Verao

- 6.5.14 Gota Water S.A.

- 6.5.15 AJE Group

- 6.5.16 Alpina Productos Alimenticios S.A

- 6.5.17 Postobon S.A

- 6.5.18 Socorro Bebidas

- 6.5.19 Aguas Prata

- 6.5.20 Togni SPA (Frasassi)

7 Market Opportunities and Future Outlook