PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848087

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848087

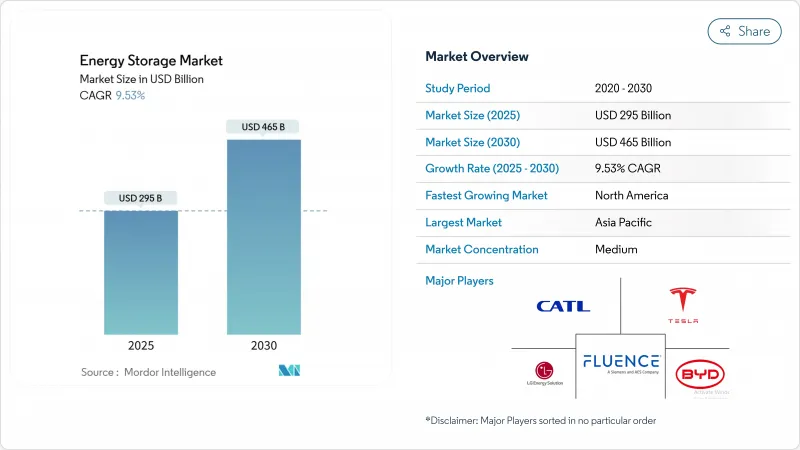

Energy Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Energy Storage Market size is estimated at USD 295 billion in 2025, and is expected to reach USD 465 billion by 2030, at a CAGR of 9.53% during the forecast period (2025-2030).

This scale-up rests on falling battery pack prices, policy incentives that reward standalone storage, and a rising need for flexible capacity as solar and wind portfolios expand. Rapid cost declines in lithium-iron-phosphate (LFP) technology, the pivot to >6-hour battery energy storage systems (BESS), and the accelerating electrification of transport all reinforce the current growth trajectory. Competitive dynamics are equally fluid: Chinese suppliers are pursuing cost leadership and global contracts, while North American and European integrators emphasize software, grid-forming controls, and safety compliance. Longer-duration technologies-thermal, gravity, and flow batteries-are beginning to complement lithium-ion in markets that prize multi-hour dispatchability and low lifetime cost.

Global Energy Storage Market Trends and Insights

Rapid LFP Battery Cost Declines Driving >6-Hour BESS Adoption

Record lows of USD 115/kWh in 2024 firmly repositioned LFP as the anchor chemistry for long-duration BESS. With 88% share of 2024 installations, the chemistry's safety profile is easing permitting and insurance barriers while enabling utilities to displace gas peakers for up to 10 hours of discharge. Chinese oversupply is reinforcing buyer leverage, accelerating multigigawatt procurement rounds in the United States and Europe.

Grid-Scale Incentive Schemes Accelerating Market Transformation

Investment tax credits under the U.S. Inflation Reduction Act (IRA) unlocked 11.9 GW of storage additions in 2024 and a pipeline of 18.2 GW for 2025. Similar momentum stems from the EU Renewable Energy Directive III, which mandates higher renewables penetration, and China's long-duration storage targets that foster flow-battery innovation. Public grants, such as the California Energy Commission's USD 270 million program for long-duration pilots, are bridging the gap between lab and commercial scale.

Scarcity of Suitable Reservoir Sites Limiting New Pumped Hydro

Although pumped hydro still stores about 9,000 GWh worldwide, greenfield prospects are scarce in Europe, Japan, and parts of North America. Permitting can exceed 8 years, eroding the technology's cost advantage. Closed-loop concepts and gravity systems repurposing disused mine shafts, such as Energy Vault's Sardinia project, aim to keep long-duration options alive but remain unproven at comparable scale.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory GCC Renewable-Integration Targets Boosting Thermal & CAES

- Data-Center Power-Quality Demands Spurring Flywheel & BESS

- Fire Safety Regulations Increasing Urban Storage Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Battery systems delivered USD 49 billion of the energy storage market size in 2024 and are forecast to expand at a 16.5% CAGR through 2030. LFP packs under USD 115/kWh are allowing 8-hour dispatch to compete with conventional pumped hydro for daily arbitrage cycles. Meanwhile, the energy storage market share of pumped-storage hydroelectricity slipped to 84% in 2024 as reservoir-site scarcity, long permitting cycles, and environmental constraints stalled new projects in Europe and Japan.

Thermal, gravity, and flow batteries are gaining traction where multi-day or week-long storage is desired. Iron-air technology, backed by USD 405 million of recent funding, promises 100-hour discharge windows, while zinc-bromine and vanadium flow stacks avoid lithium supply risks. Hybrid topologies are proliferating: gravity or CAES modules supply baseload discharge while batteries handle ancillary services in the first minutes after a grid event.

The Energy Storage Market Report is Segmented by Technology (Batteries, Pumped-Storage Hydroelectricity, Thermal Energy Storage, Compressed Air Energy Storage, Liquid Air/Cryogenic Storage, Flywheel Energy Storage, and Others), Connectivity (On-Grid and Off-Grid), Application (Grid-Scale Utility, Residential Behind-The-Meter, and Others), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa)

Geography Analysis

Asia-Pacific retained 43% of 2024 revenue and is central to supply-chain scale-up. China alone installed 81 GWh in 2024-more than the rest of the world combined-bolstered by its 33% renewable-energy share target for 2025. Australia leads residential adoption as high rooftop-solar penetration and volatile tariffs accelerate payback for paired batteries. India's first stand-alone utility BESS in 2025 signals an emerging procurement cycle aimed at hybrid renewable parks.

North America is the fastest-growing region at a projected 14.5% CAGR through 2030. The IRA's direct incentive for stand-alone storage flattened the previous solar-coupling requirement, unleashing gigawatt-scale pipelines centered in California and Texas. The U.S. Energy Information Administration expects batteries to supply 18.2 GW of new utility-scale capacity in 2025, second only to solar additions. Regional focus on resilience after extreme-weather outages further reinforces demand for microgrids and community-storage schemes.

Europe recorded a 94% y-o-y capacity jump in 2023, reaching 17.2 GWh. Germany dominates with 1.9 GWh of large-scale systems in operation by late-2024, aided by high retail prices and streamlined permitting. The United Kingdom and France trail but have multigigawatt pipelines backed by capacity-market revenue and grid-balancing services. The continent's shift from residential to utility-scale projects is evident in TotalEnergies' new 100 MW/200 MWh German site that pairs solar with two-hour storage for intraday smoothing.

- Contemporary Amperex Technology Co. Ltd. (CATL)

- LG Energy Solution Ltd.

- Tesla Inc.

- BYD Co. Ltd.

- Fluence Energy Inc.

- Wartsila Energy

- Siemens Gamesa Renewable Energy

- GS Yuasa Corporation

- NGK Insulators Ltd.

- Samsung SDI Co. Ltd.

- General Electric (Vernova)

- ABB Ltd.

- Hitachi Energy Ltd.

- Eaton Corporation

- Mitsubishi Power Americas |

- AES Corporation

- Voith Hydro GmbH

- ANDRITZ AG

- Hydrostor Inc.

- Highview Powe

- Amber Kinetics Inc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Report

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid LFP Battery Cost Declines Driving >6-Hour BESS Adoption (Asia-Pacific

- 4.2.2 Grid-Scale Incentive Schemes (IRA-US, EU RED III, China Long-Duration Mandate

- 4.2.3 Mandatory GCC Renewable-Integration Targets Boosting Thermal & CAES

- 4.2.4 Data-Center Power-Quality Demands Spurring Flywheel & BESS (NA, Nordics)

- 4.2.5 EV-Charging Corridor Build-outs Requiring Stationary Storage

- 4.2.6 Corporate PPA Surge Triggering Behind-the-Meter Storage (EU, AUS)

- 4.3 Market Restraints

- 4.3.1 Scarcity of Suitable Reservoir Sites Limiting New Pumped Hydro (EU, JP)

- 4.3.2 Vanadium/Zinc Electrolyte Supply Volatility Hindering Flow-Battery Scale-up

- 4.3.3 Stringent Fire Codes (NFPA 855, IEC 62933) Raising Urban BESS CAPEX

- 4.3.4 Revenue-Stacking Uncertainty in Emerging Markets

- 4.4 Supply-Chain Analysis

- 4.5 Government Policies & Regulations

- 4.6 Technological Outlook

- 4.7 Energy Storage Price Trends & Forecast

- 4.8 Installed Capacity & Deployment Analysis

- 4.9 Porter's Five Forces

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Buyers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes

- 4.9.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Technology

- 5.1.1 Batteries (Lithium-ion, Solid-State Li, Sodium-ion, Lead-acid, Sodium-Sulfur, and Flow Batteries (Vanadium, Zinc-Bromine))

- 5.1.2 Pumped-Storage Hydroelectricity

- 5.1.3 Thermal Energy Storage (Sensible Heat (Molten Salt, Water), Latent Heat (Phase-Change Materials), Thermochemical)

- 5.1.4 Compressed Air Energy Storage

- 5.1.5 Liquid Air/Cryogenic Storage

- 5.1.6 Flywheel Energy Storage

- 5.1.7 Gravity-Based Storage

- 5.1.8 Hydrogen-Based Storage (Power-to-H2-to-Power)

- 5.1.9 Other Emerging Technologies (Iron-Air, Zinc-Air)

- 5.2 By Connectivity

- 5.2.1 On-Grid

- 5.2.2 Off-Grid

- 5.3 By Application

- 5.3.1 Grid-Scale Utility (Front-of-Meter)

- 5.3.2 Residential Behind-the-Meter

- 5.3.3 Commercial and Industrial Behind-the-Meter

- 5.3.4 Data Centers and Critical Facilities

- 5.3.5 Remote and Off-Grid/Microgrids

- 5.3.6 Others (Transportation and Rail Electrification, EV-Charging Infrastructure, Transmission and Distribution Deferral)

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Nordic Countries

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 ASEAN Countries

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Egypt

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Contemporary Amperex Technology Co. Ltd. (CATL)

- 6.4.2 LG Energy Solution Ltd.

- 6.4.3 Tesla Inc.

- 6.4.4 BYD Co. Ltd.

- 6.4.5 Fluence Energy Inc.

- 6.4.6 Wartsila Energy

- 6.4.7 Siemens Gamesa Renewable Energy

- 6.4.8 GS Yuasa Corporation

- 6.4.9 NGK Insulators Ltd.

- 6.4.10 Samsung SDI Co. Ltd.

- 6.4.11 General Electric (Vernova)

- 6.4.12 ABB Ltd.

- 6.4.13 Hitachi Energy Ltd.

- 6.4.14 Eaton Corporation

- 6.4.15 Mitsubishi Power Americas |

- 6.4.16 AES Corporation

- 6.4.17 Voith Hydro GmbH

- 6.4.18 ANDRITZ AG

- 6.4.19 Hydrostor Inc.

- 6.4.20 Highview Powe

- 6.4.21 Amber Kinetics Inc

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment