PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848292

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848292

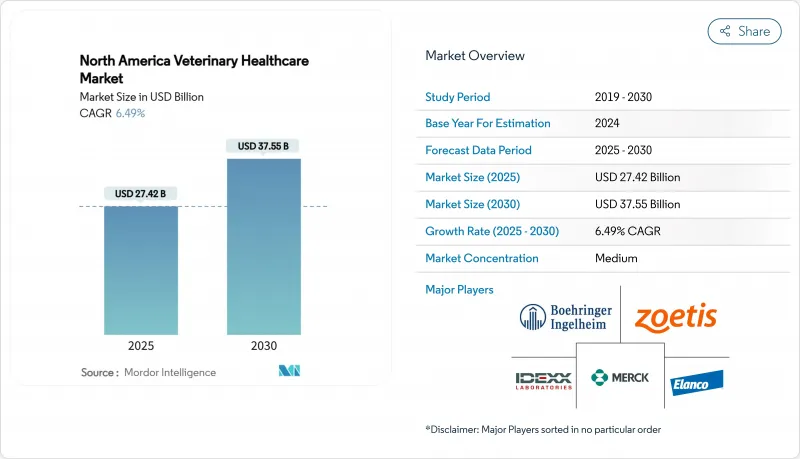

North America Veterinary Healthcare - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North America veterinary healthcare market recorded a market size of USD 27.42 billion in 2025 and is forecast to expand to USD 37.55 billion by 2030, advancing at a 6.49% CAGR during the period.

This resilient trajectory reflects sustained pet humanization, rapid diagnostic innovation, and corporate consolidation that collectively re-shape service delivery across the region. Consolidators harness scale to standardize protocols and extract purchasing efficiencies, while venture-backed upstarts introduce specialty services that further diversify revenue streams. Intensifying regulatory scrutiny on mega-mergers opens acquisition windows for mid-tier platforms, prompting a more competitive landscape that favors operational agility. Demand for sophisticated biologics, point-of-care testing, and telehealth integration continues to climb as pet owners accept veterinary care as a non-discretionary household expense. At the same time, widening workforce shortages and escalating treatment costs impose structural constraints that stakeholders must address to unlock the market's full potential.

North America Veterinary Healthcare Market Trends and Insights

Growing Pet Insurance Adoption and Reimbursement

Regional pet insurance penetration remained just 3% in 2024 despite USD 3.5 billion in written premiums, revealing substantial headroom for policy expansion. Policy counts rose 23.5% year-over-year, reflecting heightened consumer anxiety over rising medical bills that climbed 8.24% from August 2023 to August 2024. Private-equity activity, highlighted by JAB Holding Company's acquisition of Pumpkin Insurance Services, signals confidence in a future USD 2 billion premium pool. Yet premium inflation prompted Nationwide to exit 100,000 policies, underscoring the need for insurers to balance coverage breadth with affordability. Seamless reimbursement platforms and direct-billing integrations will determine providers' ability to convert uninsured households.

Increasing Prevalence of Zoonotic and Chronic Animal Diseases

The CDC's 2025-2029 One Health Framework targets eight priority zoonoses, including avian influenza strains that migrated into dairy cattle and caused 38 human cases in California during late 2024. Regulatory mandates now require pet-food manufacturers to address H5N1 in hazard plans, fueling demand for diagnostic reagents. Chronic disease prevalence is likewise up as longer pet lifespans call for oncology, cardiology, and endocrine specialties. USDA bulk-milk surveillance and interstate movement testing create recurring revenue for laboratories, while public funding accelerates product approvals under the One Health umbrella. Practices that invest in rapid detection technologies capture emerging testing volumes tied to biosecurity compliance.

Shortage of Licensed Veterinarians and Support Staff

An additional 132,885 veterinary technicians are needed by 2030, yet only 7,500 candidates pass credentialing each year. Program enrollment fell 43% between 2018 and 2022, reflecting limited wage incentives as median pay stands at USD 53,759. Compassion fatigue affects 88% of technicians, contributing to attrition and productivity losses. Although the AVMA projects future graduate supply may balance demand if several new schools gain accreditation, near-term staffing gaps inflate labor costs and cap patient volumes. Competitive bidding for talent pushes associate veterinarian compensation to USD 110,000-150,000, with sign-on bonuses approaching USD 250,000.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Corporate Veterinary Chains and Consolidation

- Digitalization of Veterinary Practices and Telehealth Integration

- Escalating Costs of Advanced Veterinary Treatments

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The therapeutics category accounted for 62.43% of North America Veterinary Healthcare market revenue in 2024, buoyed by steady vaccine demand and blockbuster monoclonal antibodies. Yet diagnostics is set to post the highest 6.43% CAGR through 2030, reflecting a pivot toward precision medicine and preventive screening. IDEXX logged 7% organic growth in recurring diagnostic revenue despite a 2% dip in clinical visit volume. The North America Veterinary Healthcare market size for diagnostics is projected to climb alongside AI-powered image analysis tools that reduce interpretation time and elevate case accuracy. Meanwhile, therapeutics innovation stays vibrant; Zoetis' pipeline features long-acting pain management injectables that extend dosing intervals to quarterly administration. Segment players who bundle diagnostic tests with targeted therapies capture cross-sell synergies and lock in client loyalty.

Smaller categories such as nutraceuticals and medical devices also benefit from lifestyle-driven purchases and chronic disease management. Novel biologics targeting dermatologic and oncologic indications enter clinical use, while compounded formulations lose share amid tighter FDA oversight. Collectively, product diversification cushions revenue against cyclical swings in any single treatment area, supporting long-term stability in the North America Veterinary Healthcare market.

Companion animals represented 45.78% of North America Veterinary Healthcare market share in 2024 and continue to generate the bulk of clinic revenue as premium care norms solidify among urban owners. The North America Veterinary Healthcare market size attributable to dogs and cats is forecast to expand at mid-single-digit rates, driven by chronic disease therapies and wellness plans. In contrast, poultry healthcare exhibits a faster 6.66% CAGR because of heightened H5N1 monitoring mandates that require routine flock testing and vaccination protocols. Livestock operators allocate greater budgets to diagnostics to preserve export eligibility, creating a secondary growth pillar for service providers. Equine and exotic species carve premium niches where specialized practitioners command elevated fees for advanced sports medicine and minimally invasive procedures. Swine and ruminant segments embrace precision livestock farming tools that integrate sensor data with veterinary oversight to optimize herd health and feed efficiency.

The North America Veterinary Healthcare Market Report is Segmented by Product (Therapeutics and Diagnostics), Animal Type (Dogs & Cats, Horses, and More), Route of Administration (Oral, Parenteral, and More), End User (Veterinary Hospitals & Clinics, Reference Laboratories, and More), and Geography (United States, Canada, Mexico). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Zoetis

- Merck Animal Health (Merck & Co.)

- Elanco Animal Health Inc.

- Boehringer Ingelheim

- Ceva Sant- Animale

- IDEXX

- Dechra Pharmaceuticals

- Neogen

- Vetoquinol

- Bimeda

- Covetrus

- Patterson Companies (Animal Health)

- Mars Veterinary Health / VCA

- Heska

- Phibro Animal Health

- Henry Schein Animal Health

- ImmuCell Corp.

- Medtronic Veterinary Portfolio

- Abaxis (Zoetis Subsidiary)

- Royal Canin Veterinary (Mars)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Pet Ownership and Humanization

- 4.2.2 Growing Pet Insurance Adoption and Reimbursement

- 4.2.3 Increasing Prevalence of Zoonotic and Chronic Animal Diseases

- 4.2.4 Expansion of Corporate Veterinary Chains And Consolidation

- 4.2.5 Digitalization of Veterinary Practices and Telehealth Integration

- 4.2.6 One-Health Policy Alignment and Government Funding Boost

- 4.3 Market Restraints

- 4.3.1 Shortage of Licensed Veterinarians and Support Staff

- 4.3.2 Escalating Costs of Advanced Veterinary Treatments

- 4.3.3 Regulatory Uncertainty Around Antimicrobial Usage

- 4.3.4 Data Interoperability Gaps Across Veterinary Health IT Systems

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power Of Buyers

- 4.5.2 Bargaining Power Of Suppliers

- 4.5.3 Threat Of New Entrants

- 4.5.4 Threat Of Substitutes

- 4.5.5 Industry Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Therapeutics

- 5.1.1.1 Vaccines

- 5.1.1.2 Parasiticides

- 5.1.1.3 Anti-Infectives

- 5.1.1.4 Medical Feed Additives

- 5.1.1.5 Other Therapeutics

- 5.1.2 Diagnostics

- 5.1.2.1 Immunodiagnostic Tests

- 5.1.2.2 Molecular Diagnostics

- 5.1.2.3 Diagnostic Imaging

- 5.1.2.4 Clinical Chemistry

- 5.1.2.5 Other Diagnostics

- 5.1.1 Therapeutics

- 5.2 By Animal Type

- 5.2.1 Dogs & Cats

- 5.2.2 Horses

- 5.2.3 Ruminants

- 5.2.4 Swine

- 5.2.5 Poultry

- 5.2.6 Other Animal Types

- 5.3 By Route Of Administration

- 5.3.1 Oral

- 5.3.2 Parenteral

- 5.3.3 Topical

- 5.3.4 Other Route of Administrations

- 5.4 By End User

- 5.4.1 Veterinary Hospitals & Clinics

- 5.4.2 Reference Laboratories

- 5.4.3 Point-Of-Care / In-House Testing Settings

- 5.4.4 Academic & Research Institutes

- 5.5 By Country

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Zoetis Inc.

- 6.3.2 Merck Animal Health (Merck & Co.)

- 6.3.3 Elanco Animal Health Inc.

- 6.3.4 Boehringer Ingelheim Animal Health

- 6.3.5 Ceva Sant- Animale

- 6.3.6 IDEXX Laboratories Inc.

- 6.3.7 Dechra Pharmaceuticals PLC

- 6.3.8 Neogen Corporation

- 6.3.9 Vetoquinol SA

- 6.3.10 Bimeda Inc.

- 6.3.11 Covetrus Inc.

- 6.3.12 Patterson Companies (Animal Health)

- 6.3.13 Mars Veterinary Health / VCA

- 6.3.14 Heska Corp.

- 6.3.15 Phibro Animal Health Corp.

- 6.3.16 Henry Schein Animal Health

- 6.3.17 ImmuCell Corp.

- 6.3.18 Medtronic Veterinary Portfolio

- 6.3.19 Abaxis (Zoetis Subsidiary)

- 6.3.20 Royal Canin Veterinary (Mars)

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment