PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844295

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844295

Latin America Veterinary Assistive Reproduction Technology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

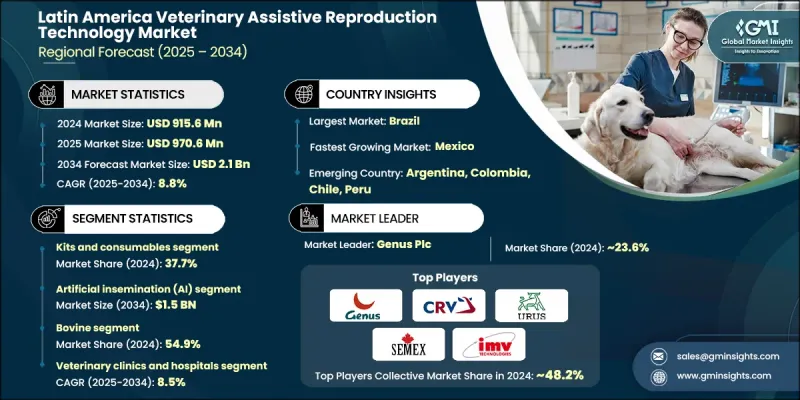

Latin America Veterinary Assistive Reproduction Technology Market was valued at USD 915.6 million in 2024 and is estimated to grow at a CAGR of 8.8% to reach USD 2.1 billion by 2034.

This growth is fueled by the rising need to enhance livestock productivity across the region. Countries like Mexico, Argentina, and Brazil rank among the world's leading producers and exporters of beef, dairy, and swine products. Veterinary assistive reproductive technologies (ART) are gaining widespread traction because of their ability to boost genetic performance and improve herd fertility. These technologies, including artificial insemination, embryo transfer, and vitro fertilization, play a critical role in breeding efficiency, animal health, and genetic advancement. Farmers and breeders across Latin America are increasingly relying on ART to improve the quality and performance of their livestock. In response to growing global demand for protein-rich food, there's a shift towards selecting genetically superior, disease-resistant animals. Additionally, various government initiatives, research-backed programs, and veterinary infrastructure improvements are pushing adoption forward. Public and private investments in livestock development and reproductive research are making ART more accessible across commercial and independent farming operations, solidifying its role as a vital component in the region's agricultural strategy.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $915.6 Million |

| Forecast Value | $2.1 Billion |

| CAGR | 8.8% |

In 2024, the kits and consumables segment held a 37.7% share and is projected to grow at a CAGR of 9% through 2034. This strong growth is being driven by rising demand for single-use items like catheters, insemination kits, and culture media. As these products are required for each procedure and cannot be reused, they generate consistent demand in veterinary ART practices. The increasing application of these consumables in both large-scale livestock farms and specialized breeding centers is contributing to the segment's momentum. Unlike capital equipment, these materials ensure recurring purchases, which makes this category the most dynamic part of the supply chain.

The artificial insemination segment is projected to generate USD 1.5 billion by 2034. Its dominance can be attributed to its cost-efficiency and ease of implementation compared to other advanced breeding techniques. The prevalence of artificial insemination is further enhanced by the well-established semen logistics and distribution infrastructure across Latin American countries. Scalable, standardized, and relatively affordable, AI remains the method of choice for livestock breeders seeking reliable reproductive outcomes without incurring the higher costs of alternatives like IVF or embryo transfer.

Brazil Veterinary Assistive Reproduction Technology Market was valued at USD 497.1 million in 2024. The country's leadership in the market stems from its expansive livestock population and strong demand for both dairy and meat. Significant investments in reproductive technologies have helped Brazil increase breeding efficiency, improve livestock genetics, and remain globally competitive in exports. A robust system of semen banks, research institutes, and breeding programs continues to support national growth. Government-backed initiatives aimed at advancing animal genetics and improving reproductive outcomes are further solidifying Brazil's top market position in the region.

Key players active in the Latin America Veterinary Assistive Reproduction Technology Market include Select Sires, SEMEX, STgenetics, Bovine Elite, VikingGenetics, URUS Group LP, Geno SA, Tropigs Norsvin, CRV Holdings B.V., IMV Technologies, Swine Genetics International, Genus Plc, and Minitube Group. To build stronger market positions in Latin America's veterinary ART space, leading companies are executing multiple strategic initiatives. Many are expanding regional production and distribution capabilities to meet growing local demand. Others are investing heavily in R&D to create more efficient and user-friendly reproductive technologies tailored to the livestock industry's evolving needs. Collaborations with agricultural cooperatives and local veterinary networks are helping these firms enhance product penetration in rural and commercial settings. Additionally, training programs for farmers and technicians are being implemented to promote the effective use of ART solutions, while some companies are entering public-private partnerships to benefit from government-backed livestock development projects.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional

- 1.3.2 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Country

- 2.2.2 Type

- 2.2.3 Technology

- 2.2.4 Animal type

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising protein consumption in the region

- 3.2.1.2 Advancements in reproductive technology

- 3.2.1.3 Expansion of veterinary service networks

- 3.2.1.4 Government-supported breeding initiatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High costs of ART procedures

- 3.2.2.2 Shortage of trained professionals

- 3.2.3 Market opportunities

- 3.2.3.1 Development of cryobanks and genetic trade

- 3.2.3.2 Expanding reach to small and mid-scale farms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Livestock population, by country

- 3.7 Meat production volume, by species

- 3.8 Milk production volume, by country

- 3.9 Future market trends

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Services

- 5.3 Semen

- 5.3.1 Normal semen

- 5.3.2 Sexed semen

- 5.4 Instruments

- 5.5 Kits and consumables

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Artificial insemination (AI)

- 6.3 In vitro fertilization (IVF)

- 6.4 Embryo transfer (MOET)

- 6.5 Other technologies

Chapter 7 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Bovine

- 7.3 Swine

- 7.4 Ovine

- 7.5 Caprine

- 7.6 Equine

- 7.7 Other animal types

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary clinics and hospitals

- 8.3 Animal breeding centers

- 8.4 Research institutes and universities

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Brazil

- 9.3 Mexico

- 9.4 Argentina

- 9.5 Colombia

- 9.6 Chile

- 9.7 Peru

Chapter 10 Company Profiles

- 10.1 Bovine Elite

- 10.2 CRV Holdings B.V.

- 10.3 Geno SA

- 10.4 Genus Plc

- 10.5 IMV Technologies

- 10.6 Minitube Group

- 10.7 SEMEX

- 10.8 Select Sires

- 10.9 Swine Genetics International

- 10.10 STgenetics

- 10.11 Tropigs Norsvin

- 10.12 URUS Group LP

- 10.13 VikingGenetics