PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844298

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844298

U.S. Veterinary Assistive Reproduction Technology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

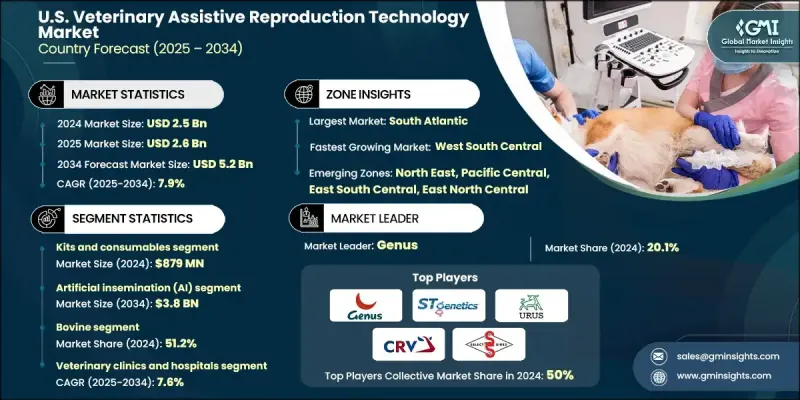

U.S. Veterinary Assistive Reproduction Technology Market was valued at USD 2.5 billion in 2024 and is estimated to grow at a CAGR of 7.9% to reach USD 5.2 billion by 2034.

Veterinary ART includes advanced techniques such as artificial insemination (AI), in vitro fertilization (IVF), embryo transfer (ET), and other reproductive technologies that support efficient animal breeding. These technologies are becoming increasingly vital in improving genetic quality, conserving rare species, and boosting the overall productivity of livestock. A growing focus on livestock genetic enhancement, herd management, and the use of sexed semen is accelerating the adoption of ART across the U.S. market. This surge is supported by rising demand for sustainable animal production systems and efficient breeding strategies. Leading companies like Select Sires, Genus, CRV Holdings, STgenetics, and URUS Group are driving market momentum through continuous innovation, professional training programs, improved access to specialized tools, and expanded R&D initiatives to improve ART success rates. The market's upward trajectory is heavily influenced by these developments, especially in key livestock-producing regions where ART adoption is becoming a standard practice to ensure animal health, productivity, and genetic advancement.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Billion |

| Forecast Value | $5.2 Billion |

| CAGR | 7.9% |

Among the product segments, the kits and consumables segment generated USD 879 million in 2024. Their importance lies in their indispensable use across various ART procedures, including ovum pick-up, cryopreservation, AI, and MOET. Unlike instruments, which are generally one-time capital purchases, consumables are required for every individual procedure, thereby generating steady, high-volume demand. This recurring need for supplies makes them a consistent revenue source and a key driver of growth in the market. Their critical function across multiple stages of reproduction processes ensures their continued relevance and contribution to overall market expansion.

The artificial insemination (AI) segment is expected to reach USD 3.8 billion by 2034. The technology's ease of use, cost-effectiveness, and minimal infrastructure requirements make it suitable for both small-scale clinics and large commercial operations. AI's adaptability across various environments and economic conditions contributes to its widespread appeal. Additionally, its proven track record in improving breeding outcomes has solidified its role as the go-to method for reproductive support in animals. The popularity of AI has been further supported by initiatives that aim to streamline breeding efficiency nationwide.

Florida Veterinary Assistive Reproduction Technology Market generated USD 110.7 million in 2024. The state's thriving livestock sector significantly contributes to this growth trajectory. The continued emphasis on improving animal genetics and herd productivity is fueling the demand for ART services in the region. Florida's strong agricultural landscape is playing a central role in pushing ART adoption, with producers actively incorporating these technologies into their operations to optimize reproductive performance and genetic gains.

Some of the prominent companies operating in the U.S. Veterinary Assistive Reproduction Technology Market include VikingGenetics, STgenetics, Hamilton Thorne, SEMEX, Minitube Group, Genus, URUS Group, Select Sires, IMV Technologies, CRV Holdings, Geno, Bovine Elite, and Swine Genetics International. To reinforce their standing, major players in the U.S. veterinary assistive reproduction technology market are prioritizing innovation through targeted R&D to boost ART success rates and procedural efficiency. Companies like URUS Group, STgenetics, and Hamilton Thorne are actively expanding their service networks and upgrading ART tools to enhance practitioner accessibility. Strategic collaborations with veterinary clinics and academic institutions are also helping these firms widen their customer base. Additionally, training initiatives for veterinarians and livestock producers are being rolled out to encourage the practical adoption of ART. Firms are also investing in digital reproductive tracking systems and genome editing technologies to stay ahead. These strategies, combined with continuous product development, are instrumental in securing a competitive edge in the rapidly growing market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Business trends

- 2.2.2 Zone trends

- 2.2.3 Type trends

- 2.2.4 Technology trends

- 2.2.5 Animal type trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising protein consumption in the region

- 3.2.1.2 Advancements in veterinary reproductive medicine

- 3.2.1.3 Increased focus on genetic preservation and quality

- 3.2.1.4 Rising veterinary healthcare expenditure

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High costs of ART procedures

- 3.2.2.2 Inconsistent outcomes and risk of procedure failure

- 3.2.3 Market opportunities

- 3.2.3.1 Expanding companion animal ART services

- 3.2.3.2 Development of cryobanks and genetic trade

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological platforms

- 3.5.2 Emerging technologies

- 3.6 U.S. dairy statistics, by state, 2024

- 3.6.1 Total milk production

- 3.6.2 Number of cows

- 3.6.3 Milk per cow

- 3.6.4 Licensed dairy herds

- 3.6.5 Average herd size

- 3.7 U.S. livestock population statistics

- 3.7.1 Cattle

- 3.7.2 Swine

- 3.8 Future market trends

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Services

- 5.3 Semen

- 5.3.1 Normal semen

- 5.3.2 Sexed semen

- 5.4 Instruments

- 5.5 Kits and consumables

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Artificial insemination (AI)

- 6.3 In vitro fertilization (IVF)

- 6.4 Embryo transfer (MOET)

- 6.5 Other technologies

Chapter 7 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Bovine

- 7.3 Swine

- 7.4 Ovine

- 7.5 Caprine

- 7.6 Equine

- 7.7 Other animal types

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary clinics and hospitals

- 8.3 Animal breeding centers

- 8.4 Research institutes and universities

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Zone, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North East

- 9.2.1 Connecticut

- 9.2.2 Maine

- 9.2.3 Massachusetts

- 9.2.4 New Hampshire

- 9.2.5 Rhode Island

- 9.2.6 Vermont

- 9.2.7 New Jersey

- 9.2.8 New York

- 9.2.9 Pennsylvania

- 9.3 East North Central

- 9.3.1 Wisconsin

- 9.3.2 Michigan

- 9.3.3 Illinois

- 9.3.4 Indiana

- 9.3.5 Ohio

- 9.4 West North Central

- 9.4.1 North Dakota

- 9.4.2 South Dakota

- 9.4.3 Nebraska

- 9.4.4 Kansas

- 9.4.5 Minnesota

- 9.4.6 Iowa

- 9.4.7 Missouri

- 9.5 South Atlantic

- 9.5.1 Delaware

- 9.5.2 Maryland

- 9.5.3 District of Columbia

- 9.5.4 Virginia

- 9.5.5 West Virginia

- 9.5.6 North Carolina

- 9.5.7 South Carolina

- 9.5.8 Georgia

- 9.5.9 Florida

- 9.6 East South Central

- 9.6.1 Kentucky

- 9.6.2 Tennessee

- 9.6.3 Mississippi

- 9.6.4 Alabama

- 9.7 West South Central

- 9.7.1 Oklahoma

- 9.7.2 Texas

- 9.7.3 Arkansas

- 9.7.4 Louisiana

- 9.8 Mountain States

- 9.8.1 Idaho

- 9.8.2 Montana

- 9.8.3 Wyoming

- 9.8.4 Nevada

- 9.8.5 Utah

- 9.8.6 Colorado

- 9.8.7 Arizona

- 9.8.8 New Mexico

- 9.9 Pacific Central

- 9.9.1 California

- 9.9.2 Alaska

- 9.9.3 Hawaii

- 9.9.4 Oregon

- 9.9.5 Washington

Chapter 10 Company Profiles

- 10.1 Bovine Elite

- 10.2 CRV Holdings

- 10.3 Geno

- 10.4 Genus

- 10.5 Hamilton Thorne

- 10.6 IMV Technologies

- 10.7 Minitube Group

- 10.8 SEMEX

- 10.9 Select Sires

- 10.10 Swine Genetics International

- 10.11 STgenetics

- 10.12 URUS Group

- 10.13 VikingGenetics