PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907267

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907267

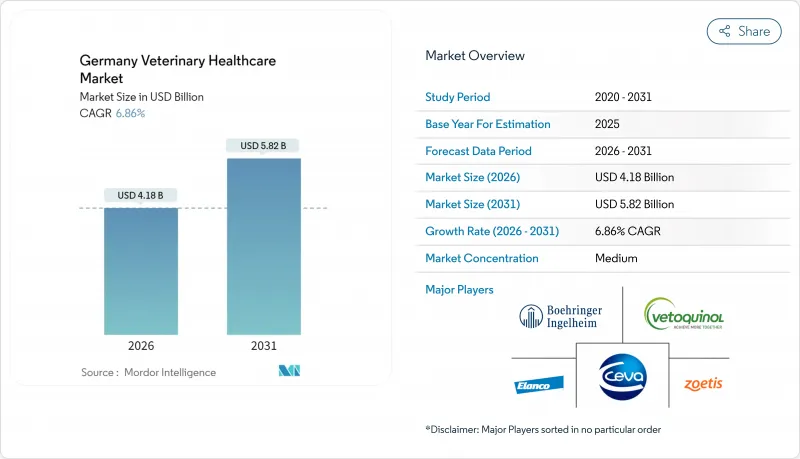

Germany Veterinary Healthcare - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Germany veterinary healthcare market size in 2026 is estimated at USD 4.18 billion, growing from 2025 value of USD 3.91 billion with 2031 projections showing USD 5.82 billion, growing at 6.86% CAGR over 2026-2031.

Steady companion-animal ownership, stricter livestock health mandates and rapid diagnostic innovation sustain this expansion. A pet population of 33.9 million animals underpins recurrent demand, while increasing zoonotic threats and the first domestic foot-and-mouth disease case since 1988 reinforce the need for robust preventive programs. Digital tools such as AI-powered hematology analyzers and teleconsultation platforms improve practice efficiency and support rural coverage gaps. Corporate consolidation among manufacturers accelerates product rollouts, and rising pet insurance uptake broadens affordability for higher-value care. However, workforce shortages and mandatory fee schedules temper near-term growth momentum.

Germany Veterinary Healthcare Market Trends and Insights

Growth in Companion Animal Population

Rising pet ownership supports continuous service demand as 44% of German households kept at least one animal in 2024. Generational shifts position pets as family members, prompting willingness to pay for advanced treatments. Singles and couples in urban apartments boost per-capita spending, and post-pandemic adoption rates among families with children anchor long-term growth. This environment sustains specialty clinics, oncology services and nutrition counseling.

Rise in Zoonotic Disease Incidence

Climate change and cross-border trade intensify pathogen spread. Vector-borne threats such as Lyme borreliosis, affecting up to 200,000 people yearly, push owners toward tick preventives. Schmallenberg seroprevalence jumped to 40.15% in 2023, underscoring viral unpredictability. The January 2025 foot-and-mouth outbreak triggered rapid containment, illustrating how one event reverberates across supply chains. Robust surveillance and vaccination programs therefore gain priority.

High Cost of Advanced Veterinary Care

Mandatory fee revisions raised procedure prices by roughly 50% in 2022, straining budgets despite quality benefits. Limited insurance penetration means owners self-finance surgeries and MRI scans, sometimes deferring care. Livestock producers weigh premium vaccines against thin margins, and escalating student debt discourages clinic startups in low-income districts, sustaining access disparities.

Other drivers and restraints analyzed in the detailed report include:

- Government Animal Health Initiatives

- Advancements in Veterinary Diagnostics and Telehealth

- Stringent Regulatory Approval Process

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Therapeutics contributed 61.78% of Germany veterinary healthcare market size in 2025, anchored by vaccines and parasiticides. Poultry immunizations against Marek's disease and avian influenza remain critical, and targeted antiparasitics protect companion animals from vector-borne diseases. Anti-infectives face volume curbs but benefit from premium pricing for last-resort molecules. Medical feed additives provide non-antibiotic growth support across swine and broilers.

Diagnostics, expanding at 7.42% CAGR, capture value from molecular panels that match therapies to BRAF or KIT mutations in canine cancers. AI-assisted imaging increases radiograph throughput, while on-farm PCR kits satisfy rapid outbreak containment rules. This convergence of regulatory demand and technology fuels segment acceleration.

Dogs and cats maintained 46.02% Germany veterinary healthcare market share in 2025, reflecting high household penetration and willingness to fund specialty oncology or orthopedic interventions. Feline-specific anxiety therapies such as pregabalin oral solutions intend to close the care gap where only 40% of cats visit clinics annually.

Poultry, forecast to grow at 6.88% CAGR, responds to dense production environments needing comprehensive vaccination and water-quality oversight. H5N1 events have validated investment in multivalent vaccines, and PFAS-free feed additives gain traction to meet export standards.

The Germany Veterinary Healthcare Market Report is Segmented by Product (Therapeutics, Diagnostics), Animal Type (Dogs & Cats, Horses, and More), Route of Administration (Oral, Parenteral, and More), End User (Veterinary Hospitals & Clinics, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Boehringer Ingelheim

- Ceva

- Elanco

- IDEXX

- Merck

- Phibro Animal Health

- Vetoquinol

- Virbac

- Zoetis

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Advanced Technology Leading to Innovations in Animal Healthcare

- 4.2.2 Rising Awareness and Initiatives by the Government

- 4.2.3 Increasing Prevalence of Zoonotic Diseases

- 4.3 Market Restraints

- 4.3.1 Increasing Cost of Animal Testing and Veterinary Services

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value in USD million)

- 5.1 By Product

- 5.1.1 By Therapeutics

- 5.1.1.1 Vaccines

- 5.1.1.2 Parasiticides

- 5.1.1.3 Anti-infectives

- 5.1.1.4 Medical Feed Additives

- 5.1.1.5 Other Therapeutics

- 5.1.2 By Diagnostics

- 5.1.2.1 Immunodiagnostic Tests

- 5.1.2.2 Molecular Diagnostics

- 5.1.2.3 Diagnostic Imaging

- 5.1.2.4 Clinical Chemistry

- 5.1.2.5 Other Diagnostics

- 5.1.1 By Therapeutics

- 5.2 By Animal Type

- 5.2.1 Dogs and Cats

- 5.2.2 Horses

- 5.2.3 Ruminants

- 5.2.4 Swine

- 5.2.5 Poultry

- 5.2.6 Other Animals

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Boehringer Ingelheim International GmbH

- 6.1.2 Ceva Animal Health

- 6.1.3 Elanco Animal Health

- 6.1.4 Idexx Laboratories

- 6.1.5 Merck & Co. Inc.

- 6.1.6 Phibro Animal Health

- 6.1.7 Vetoquinol

- 6.1.8 Virbac SA

- 6.1.9 Zoetis, Inc

7 MARKET OPPORTUNITIES AND FUTURE TRENDS