PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849840

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849840

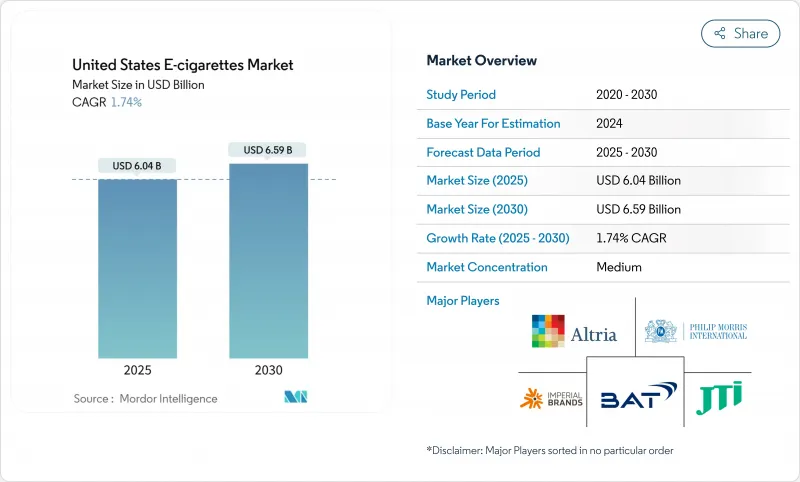

United States E-cigarettes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United States e-cigarette market is valued at USD 6.04 billion in 2025 and is projected to grow to USD 6.59 billion by 2030. This reflects a modest CAGR of 1.74%, indicating a transition from the sector's earlier rapid growth phase to a period of regulatory-driven consolidation.

Regulatory measures, including the FDA's stringent pre-market reviews, increased product seizures, and heightened public health scrutiny, have reshaped the competitive landscape. Compliance costs now play a critical role in market success, creating a divide between authorized products and a shadow market evading oversight. While consumer demand for e-cigarettes remains strong, a shift toward imports bypassing federal reviews reduces revenue for compliant firms and increases enforcement challenges for retailers. Technological advancements, changing gender preferences, and online retail growth offer opportunities, but stricter policies limit their overall impact on market expansion.

United States E-cigarettes Market Trends and Insights

Growing Health Consciousness and Smoking Cessation

The growing health consciousness among individuals in the United States is significantly driving the e-cigarette market. According to the Centers for Disease Control and Prevention (CDC), smoking-related illnesses account for over 480,000 deaths annually in the United States, prompting increased efforts toward smoking cessation . Additionally, initiatives like the U.S. Food and Drug Administration's (FDA) "The Real Cost" campaign aim to educate youth about the dangers of smoking, further encouraging the adoption of alternatives such as e-cigarettes. The American Lung Association also highlights that nearly 70% of smokers express a desire to quit, creating a substantial market opportunity for e-cigarette manufacturers. These factors collectively underscore the role of rising health awareness in shaping the growth of the e-cigarette market in the country.

Technological Advancements in Devices

The market is driven by significant technological advancements in devices. The adoption of e-cigarettes has been influenced by innovations such as temperature control, longer battery life, and customizable options. Additionally, data from the American Vaping Association highlights the increasing preference for devices with enhanced safety features and user-friendly designs. These advancements cater to consumer demand for convenience and efficiency, further propelling market growth. For instance, the Food and Drug Administration (FDA) has noted a rise in the development of closed-system devices that reduce the risk of tampering and ensure consistent nicotine delivery. Furthermore, the introduction of Bluetooth-enabled e-cigarettes, which allow users to monitor their usage patterns via mobile applications, has gained traction. Such technological progress not only enhances user experience but also aligns with regulatory requirements, thereby supporting the sustained growth of the market.

Stringent FDA Regulatory Framework and PMTA Requirements

The U.S. e-cigarette market faces strict regulations from the Food and Drug Administration (FDA). The FDA's Premarket Tobacco Product Application (PMTA) process requires manufacturers to submit scientific data proving products protect public health. As of March 2023, over 99% of PMTA applications for flavored e-cigarettes were denied . The Family Smoking Prevention and Tobacco Control Act further empowers the FDA to regulate tobacco products, including e-cigarettes. In 2023, the Centers for Disease Control and Prevention (CDC) reported 2.5 million middle and high school students as active e-cigarette users, prompting stricter enforcement. The American Lung Association continues to advocate for tighter regulations, citing health risks. These regulatory pressures hinder innovation and market entry.

Other drivers and restraints analyzed in the detailed report include:

- Availability of Diverse Flavor Options

- Social Acceptance and Cultural Shifts

- Supply Chain Vulnerabilities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, device sales accounted for a dominant 87.13% of the U.S. e-cigarette market, underscoring the pivotal role of hardware in driving revenue. Devices, such as rechargeable vape pens and pod systems, remain the primary choice for consumers due to their durability and compatibility with various e-liquid options. For instance, pod systems like JUUL and Vuse have gained significant traction, offering convenience and ease of use, which appeals to a broad consumer base. This strong preference for hardware highlights its position as the revenue anchor in the market.

In 2024, e-liquids accounted for a modest share of earnings, yet they're set to expand at a 1.95% CAGR. This uptick underscores a growing consumer inclination towards customized nicotine levels and unique flavor blends. For instance, many consumers now favor bottled refills, enabling them to craft their own flavor mixes, like blending fruit with menthol. Moreover, the ascent of e-liquids is bolstered by import restrictions on favored disposable models, steering users towards refillable alternatives. Brands like Naked 100 and Vapetasia, with their bottled refills, are adept at navigating regulatory challenges, positioning them as prime choices for consumers prioritizing both flexibility and compliance.

In 2024, closed pods captured 82.83% of the U.S. e-cigarette market revenue due to their plug-and-play convenience and manufacturers' control over refill contents. This ensures consistent nicotine delivery and simplifies inventory management, benefiting retailers under strict regulations. Brands like JUUL and Vuse have leveraged this trend with pre-filled pods, appealing to beginners for their ease of use and low maintenance. Additionally, compliance with regulatory requirements, such as nicotine limits and product safety, strengthens their market position.

Open systems, while holding a smaller market share, are projected to grow at a CAGR of 1.86% by 2030, driven by experienced users seeking cost efficiency and customization. Devices like SMOK and Vaporesso allow adjustments to wattage and coil resistance, catering to enthusiasts who value flexibility in e-liquid flavors and nicotine strengths. The market reflects a maturing user base, with novices favoring closed pods for simplicity and veterans opting for open systems for greater control and personalization.

The United States E-Cigarettes Market Report is Segmented by Product Type (E-Cigarette Device, E-Liquid), Category (Open Vaping System, Closed Vaping System), End User (Men, Women), and Distribution Channel (Offline Retail, Online Retail). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Altria Group Inc.

- British American Tobacco plc

- Juul Labs Inc.

- Imperial Brands plc

- Philip Morris International

- Japan Tobacco Inc.

- RELX Technology

- Geek Bar (Shenzhen Geekvape)

- Puff Bar (Cool Clouds)

- Flumgio Technology Inc

- Breeze Smoke LLC

- Vector Group Ltd.

- Kaival Brands (BIDI Stick)

- SMOORE (Vaporesso)

- Aspire (Global CigTech)

- Innokin Technology

- Suorin (Shenzhen Bluemark)

- Smok Tech Co.

- Intelligent Cigarettes LLC

- BOTS Inc.

- Turning Point Brands, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Health Consciousness and Smoking Cessation

- 4.2.2 Technological Advancements in Devices

- 4.2.3 Availability of Diverse Flavor Options

- 4.2.4 Social Acceptance and Cultural Shifts

- 4.2.5 Social Media and Influencer Marketing

- 4.2.6 Customization and Variety in Nicotine Levels and Flavors

- 4.3 Market Restraints

- 4.3.1 Stringent FDA Regulatory Framework and PMTA Requirements

- 4.3.2 Supply Chain Vulnerabilities

- 4.3.3 Availibility of Illegal and Unauthorized Product

- 4.3.4 Youth Vaping Concerns and Related Restrictions

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 E-Cigarette Device

- 5.1.1.1 Disposable E-Cigarette

- 5.1.1.2 Non-Disposable E-Cigarette

- 5.1.2 E-Liquid

- 5.1.1 E-Cigarette Device

- 5.2 By Category

- 5.2.1 Open Vaping Systems

- 5.2.2 Closed Vaping Systems

- 5.3 By End User

- 5.3.1 Men

- 5.3.2 Women

- 5.4 By Distribution Channel

- 5.4.1 Offline Stores

- 5.4.2 Online Stores

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Altria Group Inc.

- 6.4.2 British American Tobacco plc

- 6.4.3 Juul Labs Inc.

- 6.4.4 Imperial Brands plc

- 6.4.5 Philip Morris International

- 6.4.6 Japan Tobacco Inc.

- 6.4.7 RELX Technology

- 6.4.8 Geek Bar (Shenzhen Geekvape)

- 6.4.9 Puff Bar (Cool Clouds)

- 6.4.10 Flumgio Technology Inc

- 6.4.11 Breeze Smoke LLC

- 6.4.12 Vector Group Ltd.

- 6.4.13 Kaival Brands (BIDI Stick)

- 6.4.14 SMOORE (Vaporesso)

- 6.4.15 Aspire (Global CigTech)

- 6.4.16 Innokin Technology

- 6.4.17 Suorin (Shenzhen Bluemark)

- 6.4.18 Smok Tech Co.

- 6.4.19 Intelligent Cigarettes LLC

- 6.4.20 BOTS Inc.

- 6.4.21 Turning Point Brands, Inc.

7 MARKET OPPORTUNITIESAND FUTURE OUTLOOK