PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850002

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850002

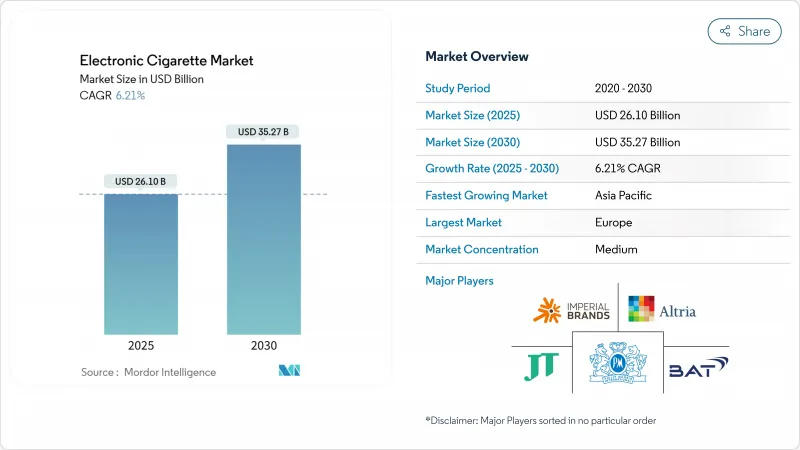

Electronic Cigarette - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global electronic cigarette market reached USD 26.10 billion in 2025 and is expected to grow to USD 35.27 billion by 2030, with a CAGR of 6.21%.

The market expansion stems from consumers transitioning from traditional cigarettes to e-cigarettes, influenced by increased health consciousness and technological advancements in vaping devices. Consumer preferences are evolving, with increased demand for varied flavors and improved product formulations, while demographic patterns shift across regions. Open vaping systems have gained traction as users seek more flexibility in e-liquid selection. Manufacturers are investing in research and development to improve device performance, battery life, and safety features. Regulatory frameworks differ across countries, with varying policies governing e-cigarette sales, marketing, and usage. Market competition has intensified between established firms and new entrants, driving continuous innovation and competitive pricing. The growth of e-commerce and direct-to-consumer channels has increased product availability worldwide. These market dynamics, combined with ongoing technological innovations and evolving consumer preferences, indicate sustained growth potential in the electronic cigarette industry.

Global Electronic Cigarette Market Trends and Insights

Growing health consciousness and smoking cessation

The increasing focus on health-conscious consumer behavior is reshaping tobacco consumption patterns, with e-cigarettes emerging as harm reduction alternatives. The integration of health monitoring features in next-generation devices, including usage tracking and nicotine delivery optimization, has transformed e-cigarettes from simple alternatives into health management tools. For instance, the Vuse PRO Smart vape and its MYVUSE app provide health tracking and usage monitoring capabilities. This medical validation has accelerated adoption among older demographics who prioritize health outcomes. Additionally, the integration of health monitoring features in next-generation devices, including usage tracking and nicotine delivery optimization, has transformed e-cigarettes from simple alternatives into health management tools. The growing emphasis on preventive healthcare and wellness has further positioned e-cigarettes as a transitional tool for smokers seeking to reduce their health risks. Moreover, healthcare providers and smoking cessation programs increasingly recommend e-cigarettes as part of structured quit-smoking strategies, contributing to their mainstream acceptance. According to Public Health England, e-cigarettes are 95% less harmful than traditional cigarettes, along the incorporation of medical-grade materials and quality control standards in e-cigarette manufacturing has enhanced their perception as legitimate harm reduction devices in the healthcare community.

Technological advancements in production

Manufacturing innovation in the e-cigarette industry drives market growth through continuous technological advancements that enhance product performance and user experience. The integration of advanced battery technology, particularly improvements in lithium-ion energy density, enables longer device lifespans and consistent nicotine delivery. Production automation and enhanced quality control systems reduce manufacturing defects while allowing customization of nicotine levels and flavor profiles. The industry is also adopting sustainable practices, as demonstrated by Vaporesso's Eco Nano Solar launch in April 2025, which incorporates solar power technology. The implementation of smart features, such as Bluetooth connectivity and mobile app integration, provides manufacturers with usage data for product optimization while improving the overall user experience. These manufacturing advancements have significantly reduced production costs, enabling manufacturers to offer competitive pricing while maintaining product quality. Furthermore, the development of modular designs and standardized components has streamlined the manufacturing process, allowing for rapid product iterations and faster market response to changing consumer preferences.

High production and operational costs

Manufacturing complexity in the e-cigarette industry poses significant challenges, as regulatory compliance requirements create substantial cost pressures in the market, particularly impacting smaller manufacturers and emerging market entrants. The need for sophisticated quality control systems, specialized testing equipment, and skilled personnel establishes fixed cost structures that favor large-scale operations. Additionally, supply chain complexity for specialized components drives supplier consolidation and increases procurement costs. These factors, combined with requirements for comprehensive product liability insurance and legal compliance support, create substantial operational overhead that smaller companies struggle to absorb while maintaining competitive pricing. The intricate nature of e-cigarette production, including precision engineering of atomizers, temperature control mechanisms, and battery safety systems, further amplifies manufacturing challenges. Moreover, the constant evolution of safety standards and regulatory frameworks across different regions requires manufacturers to frequently update their production processes and quality assurance protocols, adding another layer of operational complexity and cost burden to the industry.

Other drivers and restraints analyzed in the detailed report include:

- Availability of diverse flavor options

- Social media and influencer marketing

- Stringent regulatory framework

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

E-cigarette devices currently hold an 83.28% market share in 2024, primarily due to the widespread adoption of disposable products that offer integrated solutions and eliminate the need for separate component purchases. While disposable e-cigarettes have gained significant traction due to their convenience and consistent performance, non-disposable devices offered by companies like Aspire, Lost Mary maintain their appeal among experienced users who prioritize control over nicotine delivery and flavor selection, along with long-term cost benefits. The market dominance of devices reflects the industry's successful transition from traditional tobacco products to electronic alternatives.

The e-liquid segment is experiencing the fastest growth rate with a 6.95% CAGR through 2030, indicating a market shift toward customizable vaping experiences. This growth is driven by increasing consumer awareness of cost-effectiveness and environmental benefits of refillable systems, coupled with advancements in e-liquid formulations, including synthetic nicotine and sophisticated flavor profiles. The trend suggests a maturing market where initial device adoption naturally progresses to sustained consumable purchases and personalization options. The e-liquid market expansion is further supported by improvements in manufacturing processes that ensure product consistency and safety. Moreover, the growing variety of nicotine strengths and flavor combinations continues to attract consumers seeking personalized vaping experiences.

Closed vaping systems command a dominant 74.83% market share in 2024, driven by their simplicity, consistency, and reduced risk of user error or product tampering. These systems particularly appeal to new users and those transitioning from traditional cigarettes who prioritize ease of use over customization. The closed system advantage extends beyond user experience to regulatory compliance, as manufacturers maintain greater control over product specifications and quality assurance. Additionally, closed systems benefit from streamlined supply chains and standardized manufacturing processes that enable competitive pricing and consistent availability.

While open vaping systems hold a smaller market share, they demonstrate stronger growth momentum at 6.86% CAGR, attracting experienced users seeking greater flexibility in nicotine levels, flavor combinations, and device modifications. Open systems command higher margins but require more sophisticated distribution networks and customer education programs. Manufacturers such as RELX PLC are developing hybrid solutions that offer adjustable vapor production and flavor intensity settings. This evolution reflects the broader market segmentation between convenience-focused and customization-oriented consumers.

The Global Electronic Cigarette Market is Segmented by Product Type (E-Cigarette Device and E-Liquid), Category (Open Vaping Systems and Closed Vaping Systems), End User (Men and Women), Distribution Channel (Offline Stores and Online Stores), and Geography (North America, Europe, Asia-Pacific, South America and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe holds the largest regional market share at 32.24% in 2024, attributed to its balanced regulatory framework for e-cigarettes. The European Union's Tobacco Products Directive implements harmonized standards for product safety, marketing, and nicotine content limits, creating a stable operating environment for manufacturers. Countries like Germany, the United Kingdom, Italy, and France have developed comprehensive regulatory frameworks that differentiate between product categories and risk profiles, with the United Kingdom's progressive stance on e-cigarettes as harm reduction tools influencing broader European policy and consumer acceptance. The region's established distribution networks and retail infrastructure further support market growth, enabling efficient product delivery to consumers.

Asia-Pacific region demonstrates the highest growth potential with a projected CAGR of 7.12% through 2030. This growth is supported by expanding middle-class populations, increasing health awareness, and evolving tobacco control policies. Japan stands out with significant heated tobacco product adoption, while Southeast Asian markets offer substantial growth opportunities. Australia's market structure is distinct, characterized by three dominant tobacco companies and imported products, which influences distribution and pricing dynamics. The region's large youth population and increasing disposable income levels create favorable conditions for market expansion.

North America maintains a substantial market presence despite stringent regulations, particularly the FDA's premarket tobacco product application requirements in the United States . The United States market features competition between authorized products and unauthorized alternatives, while Canada operates under the more flexible Tobacco and Vaping Products Act. Mexico's market integration through the USMCA trade agreement facilitates regional trade while preserving regulatory independence. State-level regulations significantly impact product availability and marketing strategies throughout the region. The well-established retail infrastructure and strong consumer purchasing power continue to drive market stability in North America.

- Imperial Brands plc

- Altria Group Inc.

- British American Tobacco PLC

- Philip Morris International Inc.

- Japan Tobacco Group

- RELX PLC

- Smoore International

- Hangsen International Group Ltd.

- Innokin Technology

- FEELM

- MOTI Planet

- Shenzhen Uwell Technology Co., Ltd

- JWEI Group

- Ispire Technology

- Shenzhen Innokin Technology Co., Ltd.

- Geekvape

- ICCPP (VOOPOO)

- Flavourart srl.

- Hong Kong IVPS International Limited

- Kanger Tech

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing health consciousness and smoking cessation

- 4.2.2 Technological advancements in production

- 4.2.3 Availability of diverse flavor options

- 4.2.4 Convenience and user-friendly design

- 4.2.5 Social media and influencer marketing

- 4.2.6 Customizable nicotine levels

- 4.3 Market Restraints

- 4.3.1 High production and operational costs

- 4.3.2 Health campaign opposition

- 4.3.3 Age and access restrictions

- 4.3.4 Stringent regulatory framework

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 E-Cigarette Device

- 5.1.1.1 Disposable E-Cigarette

- 5.1.1.2 Non-Disposable E-Cigarette

- 5.1.2 E-Liquid

- 5.1.1 E-Cigarette Device

- 5.2 By Category

- 5.2.1 Open Vaping Systems

- 5.2.2 Closed Vaping Systems

- 5.3 By End User

- 5.3.1 Men

- 5.3.2 Women

- 5.4 By Distribution Channel

- 5.4.1 Offline Stores

- 5.4.2 Online Stores

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 United Kingdom

- 5.5.2.4 Spain

- 5.5.2.5 Netherlands

- 5.5.2.6 Italy

- 5.5.2.7 Sweden

- 5.5.2.8 Poland

- 5.5.2.9 Belgium

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Indonesia

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Chile

- 5.5.4.4 Colombia

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 South Africa

- 5.5.5.3 Nigeria

- 5.5.5.4 Saudi Arabia

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Imperial Brands plc

- 6.4.2 Altria Group Inc.

- 6.4.3 British American Tobacco PLC

- 6.4.4 Philip Morris International Inc.

- 6.4.5 Japan Tobacco Group

- 6.4.6 RELX PLC

- 6.4.7 Smoore International

- 6.4.8 Hangsen International Group Ltd.

- 6.4.9 Innokin Technology

- 6.4.10 FEELM

- 6.4.11 MOTI Planet

- 6.4.12 Shenzhen Uwell Technology Co., Ltd

- 6.4.13 JWEI Group

- 6.4.14 Ispire Technology

- 6.4.15 Shenzhen Innokin Technology Co., Ltd.

- 6.4.16 Geekvape

- 6.4.17 ICCPP (VOOPOO)

- 6.4.18 Flavourart srl.

- 6.4.19 Hong Kong IVPS International Limited

- 6.4.20 Kanger Tech

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK