PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849879

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849879

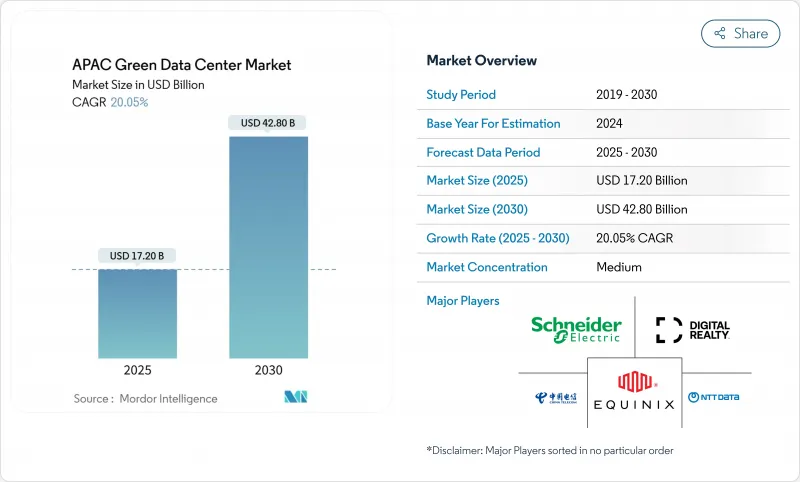

APAC Green Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Asia-Pacific green data center market is currently valued at USD 17.2 billion in 2025 and is forecast to reach USD 42.8 billion by 2030, advancing at a 20.05% CAGR.

Rising hyperscale deployments, strict net-zero policies, and rapid cloud adoption are steering capital toward energy-efficient facilities across China, India, Japan, and Southeast Asia. Liquid and hybrid cooling platforms, wider corporate power-purchase agreements, and lower weighted-average cost of capital from green financing are accelerating project pipelines. Companies are also re-engineering power architectures to support racks that now exceed 100 kW, while governments push location decisions toward secondary cities with abundant renewable energy. Competitive intensity is mounting as colocation specialists, cloud hyperscalers, and infrastructure real-estate investment trusts compete for scarce land, grid access, and skilled labor.

APAC Green Data Center Market Trends and Insights

AI-Driven High-Density Workloads Require Liquid and Hybrid Cooling

Rack densities have ballooned from 10 kW to beyond 100 kW for GPU-rich servers, prompting a shift toward direct, immersion, and precision liquid cooling systems. Operators such as SK Telecom are partnering with hardware manufacturers to commercialize next-generation thermal solutions that can trim energy use by up to 30% compared with air cooling. Equinix is rolling out liquid cooling in more than 100 facilities, including Singapore, to maintain performance for AI services while curbing water usage. Early adopters gain a cost advantage because higher rack density reduces floor space requirements and accelerates revenue per square foot.

Rapid Hyperscale and Colocation Build-Outs Across Emerging Southeast Asia Metros

Thailand has earmarked USD 2.7 billion for three hyperscale campuses, while Indonesia is receiving USD 100 million from Digital Realty for a Jakarta expansion. Malaysia has attracted a USD 2 billion pledge from Google that includes on-site water-treatment plants. New sites in these markets shorten deployment timelines for hyperscalers facing power and land caps in Singapore and Tokyo, though they strain regional supply chains for switchgear, transformers, and specialist contractors.

Land and Power Moratoriums in Mature Hubs

Singapore lifted its four-year moratorium in 2024 but released only 80 MW of new capacity, pushing developers to meet strict efficiency and AI-readiness rules. Tokyo faces similar challenges as grid upgrades lag demand, forcing projects to relocate to Chiba or Hokkaido. Limited permits inflate land prices and slow project starts, redirecting capital toward Kuala Lumpur, Jakarta, and Bangkok.

Other drivers and restraints analyzed in the detailed report include:

- Government Net-Zero Mandates and Green-Tax Incentives

- Grid Decarbonization and Corporate PPAs Accelerating Renewable Sourcing

- Skilled-Labour Shortage for Advanced Cooling and DCIM

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions captured 62.1% share of the Asia-Pacific green data center market in 2024 as enterprises favor integrated power, cooling, and automation stacks that can be deployed quickly for AI clusters. Power equipment remains the largest subsegment because facilities are re-wiring electrical backbones for higher density, while advanced cooling systems record double-digit growth as liquid technologies spread. Services are smaller today yet outpace all other categories with a 22.1% CAGR, fueled by demand for design-build engineering, renewable-energy integration, and certification consulting. The Asia-Pacific green data center market size for Services is projected to reach USD 15.4 billion by 2030, expanding alongside complex retrofits. Vendors able to bundle software-defined energy-management platforms with liquid cooling hardware position themselves as single-throat-to-choke partners for hyperscalers.

Enterprises also turn to professional services for carbon-accounting audits, green-bond structuring, and power-purchase agreement negotiations. Low-carbon materials, such as Amazon's cement replacements that cut embodied carbon by 64% in Tokyo builds, underscore how component innovation dovetails with service advisory. Integration specialists who can orchestrate electrical, mechanical, and IT systems reduce commissioning risk, shortening revenue realization cycles for investors.

Colocation operators held a 36.1% share in 2024 and remain vital for enterprises seeking scalable capacity without upfront capital. Yet hyperscalers, propelled by AI model training and sovereign-cloud contracts, are registering a 24.4% CAGR, making them the primary growth locomotive. The Asia-Pacific green data center market size tied to hyperscalers is projected to more than triple by 2030. Competition for land bank parcels in Jakarta, Johor, and Batam is intensifying as companies like TikTok pledge USD 8.8 billion over five years for Thailand hosting.

Colocation firms respond by offering liquid-ready white space, direct-to-chip cooling corridors, and high-density power feeds exceeding 40 kW per rack. Hyperscalers, in turn, expand colocation usage for on-ramp regions where self-build timelines exceed demand. Edge deployments by telecom operators add another layer, requiring micro-sites near 5G base stations to support real-time analytics.

Asia Pacific Green Data Center Market Report is Segmented by Services (System Integration, Monitoring Services, and More), Solutions (Power, Servers, Management Software, and More), Users (Colocation Providers, Cloud Service Providers, Enterprises), End-User Industries (Healthcare, Financial Services, and More), and by Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Fujitsu Limited

- Cisco Systems Inc.

- HP Inc.

- Dell Technologies Inc.

- Hitachi Ltd.

- Schneider Electric SE

- IBM Corporation

- Eaton Corporation plc

- Vertiv Holdings Co

- Equinix Inc.

- Digital Realty Trust Inc.

- NTT DATA Group Corp.

- China Telecom Corp. Ltd.

- ST Telemedia Global Data Centres

- Keppel DC REIT

- AirTrunk Operating Pty Ltd.

- Huawei Technologies Co. Ltd.

- Amazon Web Services Inc.

- Microsoft Corp.

- Alibaba Cloud Computing Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 AI-driven high-density workloads require liquid and hybrid cooling

- 4.2.2 Rapid hyperscale and colocation build-outs across emerging SE-Asia metros

- 4.2.3 Government net-zero mandates and green-tax incentives

- 4.2.4 Grid decarbonisation and corporate PPAs accelerating renewable sourcing

- 4.2.5 Under-reported: SMR (Small Modular Reactor) pilots for zero-carbon baseload

- 4.2.6 Under-reported: REIT-style green financing lowering WACC for DC developers

- 4.3 Market Restraints

- 4.3.1 Land and power moratoriums in mature hubs (e.g., Singapore, Tokyo)

- 4.3.2 High capex premium (15-20 %) for Tier III+ sustainable builds

- 4.3.3 Skilled-labour shortage for advanced cooling and DCIM

- 4.3.4 Under-reported: Water-stress regulations limiting evaporative cooling

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of the Impact of Macro Economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Service

- 5.1.1.1 System Integration

- 5.1.1.2 Monitoring Services

- 5.1.1.3 Professional Services

- 5.1.1.4 Other Services

- 5.1.2 Solution

- 5.1.2.1 Power

- 5.1.2.2 Cooling

- 5.1.2.3 Servers

- 5.1.2.4 Networking Equipment

- 5.1.2.5 Management Software

- 5.1.2.6 Other Solutions

- 5.1.1 Service

- 5.2 By Data Center Type

- 5.2.1 Colocation Providers

- 5.2.2 Hyperscalers/Cloud Service Providers

- 5.2.3 Enterprise and Edge

- 5.3 By Tier Type

- 5.3.1 Tier 1 and 2

- 5.3.2 Tier 3

- 5.3.3 Tier 4

- 5.4 By Industry Vertical

- 5.4.1 Healthcare

- 5.4.2 Financial Services

- 5.4.3 Government

- 5.4.4 Telecom and IT

- 5.4.5 Manufacturing

- 5.4.6 Media and Entertainment

- 5.4.7 Other Verticals

- 5.5 By Country

- 5.5.1 China

- 5.5.2 India

- 5.5.3 Japan

- 5.5.4 Malaysia

- 5.5.5 Australia

- 5.5.6 Indonesia

- 5.5.7 Thailand

- 5.5.8 Singapore

- 5.5.9 South Korea

- 5.5.10 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Fujitsu Limited

- 6.4.2 Cisco Systems Inc.

- 6.4.3 HP Inc.

- 6.4.4 Dell Technologies Inc.

- 6.4.5 Hitachi Ltd.

- 6.4.6 Schneider Electric SE

- 6.4.7 IBM Corporation

- 6.4.8 Eaton Corporation plc

- 6.4.9 Vertiv Holdings Co

- 6.4.10 Equinix Inc.

- 6.4.11 Digital Realty Trust Inc.

- 6.4.12 NTT DATA Group Corp.

- 6.4.13 China Telecom Corp. Ltd.

- 6.4.14 ST Telemedia Global Data Centres

- 6.4.15 Keppel DC REIT

- 6.4.16 AirTrunk Operating Pty Ltd.

- 6.4.17 Huawei Technologies Co. Ltd.

- 6.4.18 Amazon Web Services Inc.

- 6.4.19 Microsoft Corp.

- 6.4.20 Alibaba Cloud Computing Co. Ltd.

7 MARKET OPPORTUNITIES and FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment