PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849844

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849844

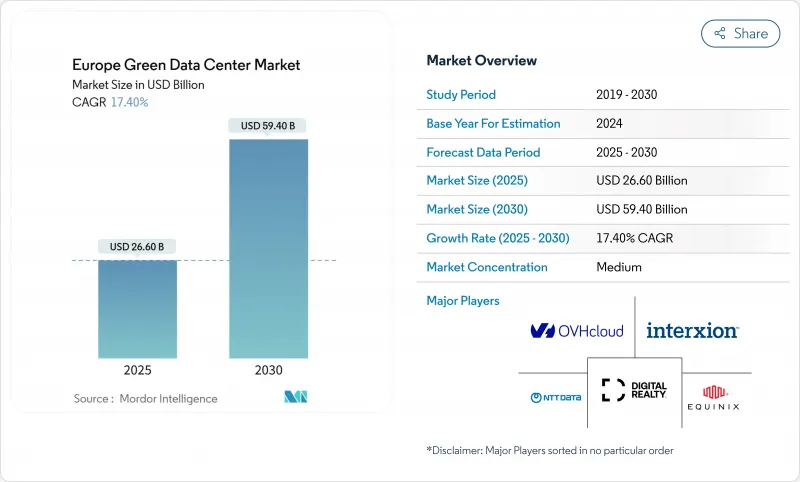

Europe Green Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe green data center market generated USD 26.6 billion in 2025 and is forecast to reach USD 59.4 billion by 2030, advancing at a 17.4% CAGR.

Heightened regulatory ambition under the EU Green Deal, hyperscale investments in next-generation AI infrastructure, and enterprise-wide digitization are reinforcing a sustained demand curve that supports both capacity growth and sustainability innovation. Operators are steering capital toward ultra-efficient power and cooling technologies as the Energy Efficiency Directive requires facilities above 500 kW to report energy metrics and meet renewable-energy thresholds. Nordic incentives for power-purchase agreements (PPAs) ensure low-carbon electricity and enable operators to post power-usage-effectiveness (PUE) ratios close to the physical minimum, while FLAP-D hubs remain attractive for interconnection density despite grid backlogs. Service providers that bundle monitoring, lifecycle management, and compliance reporting are expanding faster than hardware-centric peers, reflecting the shift from one-off builds to continuous optimization. Vendors able to align Scope 3 reporting support with high-density liquid cooling stand to capture the strongest upside.

Europe Green Data Center Market Trends and Insights

Cloud & Big-Data Workload Surge

AI and machine-learning tasks consumed 8% of data-center electricity in Europe during 2024 and may hit 20% by 2028, prompting rapid adoption of liquid cooling that removes heat 15-25 times faster than air. Microsoft earmarked USD 2.5 billion for an AI-focused campus in Leeds hosting more than 20,000 GPUs by 2026, signalling how hyperscalers reshape facility architecture around high-density racks. Smaller inference workloads at the edge are spawning distributed micro-sites tethered to central training clusters, reducing latency while sustaining renewable-energy targets. Enterprise cloud strategies now include quantitative sustainability metrics; 38% of European operators invested in greener facilities in 2024 to balance AI growth with carbon-reduction pledges. Liquid-ready designs and rack-level heat reuse deliver both performance and compliance benefits that reinforce the driver's position in near-term demand formation.

EU Green Deal & Fit-for-55 Mandates

The Energy Efficiency Directive obliges data centers above 500 kW to publish annual resource metrics and to cut energy consumption by 11.7% by 2030. Germany's Energy Efficiency Act sets a PUE ceiling of 1.2 for new builds from July 2026 and a 100% renewable-electricity mandate by 2027. A pan-EU sustainability-rating framework entering force in September 2024 enables operators to benchmark performance and secure procurement preference from corporates bound by the Corporate Sustainability Reporting Directive. Compliance spending is unlocking product innovation: Equinix is piloting waste-heat networks that warm neighboring homes while lowering facility PUE. Operators able to evidence transparent metrics gain a competitive edge in enterprise RFPs, intensifying adoption of automated monitoring and lifecycle-carbon accounting platforms.

High CAPEX for Liquid-Cooling & On-site RE

Direct-to-chip and immersion systems cost 20-40% more than air cooling despite life-cycle savings, stretching payback timelines for operators lacking low-cost capital. AI racks topping 20 kW magnify the need for these upgrades, yet retrofit works demand floorplate reconfiguration, electrical refits, and staff reskilling. On-site solar or battery installations face six-month permitting windows, complicating schedules and raising holding costs. Larger multinationals mitigate expense through sustainability-linked loans, but smaller colocation players risk margin compression until financing innovation or partnership models neutralize upfront burdens.

Other drivers and restraints analyzed in the detailed report include:

- Hyperscale & Edge Build-outs in FLAP-D Hubs

- Nordic PPAs Enabling Ultra-Low PUE

- Grid-Connection Delays in Power-Scarce Hubs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions revenue reached USD 16.1 billion in 2024, equal to 60.54% of overall expenditure, as operators procured efficient power trains, high-density servers, and advanced cooling to satisfy Directive-driven PUE benchmarks. Europe green data center market size for services registered USD 10.5 billion and is on track for a 22.1% CAGR to 2030, reflecting surging demand for carbon accounting, lifecycle monitoring, and regulatory advisory. Dedicated system-integration practices align liquid and air cooling within retrofit footprints, compressing migration time while raising resource efficiency. Continuous monitoring via data-center-infrastructure-management (DCIM) software automates energy reporting, a mandatory prerequisite for transparency audits under the EU Green Deal. As Scope 3 tracking obligations deepen, professional-services portfolios focused on supplier audits and embodied-carbon assessments capture an incremental share, reaffirming a services-led maturity phase that complements hardware refresh cycles.

Hyperscalers held 35.2% of 2024 revenue and expand at 24.4% CAGR, capitalizing on balance-sheet strength to lock renewable contracts and trial liquid-cooling at scale. The Europe green data center market size attributed to hyperscale campuses is projected to exceed USD 25 billion by 2030, with sustainability clauses embedded in power-purchase agreements anchoring long-term competitiveness. Colocation providers differentiate by bundling renewable credits and waste-heat-reuse schemes that appeal to mid-sized enterprises. Enterprise on-premises footprints continue to shrink, yet firms with latency-sensitive workloads maintain hybrid models that lean on edge nodes outfitted with efficient cooling. Edge providers deploy 250 kW-1 MW modules near population centers, ensuring regulatory compliance through recycled-air economizers and modular battery storage. Larger hyperscalers publicize construction-phase carbon cuts, such as AWS adopting low-carbon steel in Sweden to trim embodied emissions by up to 70%, setting a bar smaller competitors strive to match.

Europe Green Data Center Market Report Segments the Industry Into Service (System Integration, Monitoring Services, Professional Services, Other Services), Solution (Power, Servers, Management Software, and More), User (Colocation Providers, Cloud Service Providers, Enterprises), and End-User Industry (Healthcare, Financial Services, Government, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Equinix Inc.

- Digital Realty Trust Inc.

- NTT Global Data Centers EMEA GmbH

- Schneider Electric SE

- Fujitsu Ltd.

- Cisco Systems Inc.

- Dell Technologies Inc.

- Hewlett Packard Enterprise Co.

- IBM Corporation

- Eaton Corporation plc

- Vertiv Holdings Co.

- OVH Groupe SAS

- Interxion Holding N.V.

- Vantage Data Centers LLC

- Bulk Infrastructure AS

- Green Mountain AS

- EcoDataCenter AB

- Stack Infrastructure Inc.

- Iron Mountain Inc.

- Deep Green Data Centres Ltd.

- Verne Global Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mainstream Drivers

- 4.2.2 Cloud and Big-Data Workload Surge

- 4.2.3 EU Green Deal and Fit-for-55 Mandates

- 4.2.4 Hyperscale and Edge Build-outs in FLAP-D Hubs

- 4.2.5 Under-the-Radar Drivers

- 4.2.6 Nordic PPAs Enabling Ultra-Low PUE

- 4.2.7 District-Heating Waste-Heat Subsidies

- 4.2.8 Scope-3-Focused Green SLAs Demand

- 4.3 Market Restraints

- 4.3.1 Mainstream Restraints

- 4.3.2 High CAPEX for Liquid-Cooling and On-site RE

- 4.3.3 Grid-Connection Delays in Power-Scarce Hubs

- 4.3.4 Under-the-Radar Restraints

- 4.3.5 Embodied-Carbon Steel and Concrete Scrutiny

- 4.3.6 Sustainable-DC Engineering Talent Shortage

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Assessment of the impact of Macro Economic Trends on the Market

5 Market Size and Growth Forecasts (Value)

- 5.1 By Component

- 5.1.1 By Service

- 5.1.1.1 System Integration

- 5.1.1.2 Monitoring Services

- 5.1.1.3 Professional Services

- 5.1.1.4 Other Services

- 5.1.2 By Solution

- 5.1.2.1 Power

- 5.1.2.2 Cooling

- 5.1.2.3 Servers

- 5.1.2.4 Networking Equipment

- 5.1.2.5 Management Software

- 5.1.2.6 Other Solutions

- 5.1.1 By Service

- 5.2 By Data Center Type

- 5.2.1 Colocation Providers

- 5.2.2 Hyperscalers/Cloud Service Providers

- 5.2.3 Enterprise and Edge

- 5.3 By Tier Type

- 5.3.1 Tier 1 and 2

- 5.3.2 Tier 3

- 5.3.3 Tier 4

- 5.4 By Industry Vertical

- 5.4.1 Healthcare

- 5.4.2 Financial Services

- 5.4.3 Government

- 5.4.4 Telecom and IT

- 5.4.5 Manufacturing

- 5.4.6 Media and Entertainment

- 5.4.7 Other Verticals

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Netherlands

- 5.5.5 Ireland

- 5.5.6 Norway

- 5.5.7 Sweden

- 5.5.8 Denmark

- 5.5.9 Spain

- 5.5.10 Italy

- 5.5.11 Russia

- 5.5.12 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global?level Overview, Market?level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Equinix Inc.

- 6.4.2 Digital Realty Trust Inc.

- 6.4.3 NTT Global Data Centers EMEA GmbH

- 6.4.4 Schneider Electric SE

- 6.4.5 Fujitsu Ltd.

- 6.4.6 Cisco Systems Inc.

- 6.4.7 Dell Technologies Inc.

- 6.4.8 Hewlett Packard Enterprise Co.

- 6.4.9 IBM Corporation

- 6.4.10 Eaton Corporation plc

- 6.4.11 Vertiv Holdings Co.

- 6.4.12 OVH Groupe SAS

- 6.4.13 Interxion Holding N.V.

- 6.4.14 Vantage Data Centers LLC

- 6.4.15 Bulk Infrastructure AS

- 6.4.16 Green Mountain AS

- 6.4.17 EcoDataCenter AB

- 6.4.18 Stack Infrastructure Inc.

- 6.4.19 Iron Mountain Inc.

- 6.4.20 Deep Green Data Centres Ltd.

- 6.4.21 Verne Global Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment