PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1823729

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1823729

Green Data Center Market by Infrastructure, Software - Global Forecast to 2030

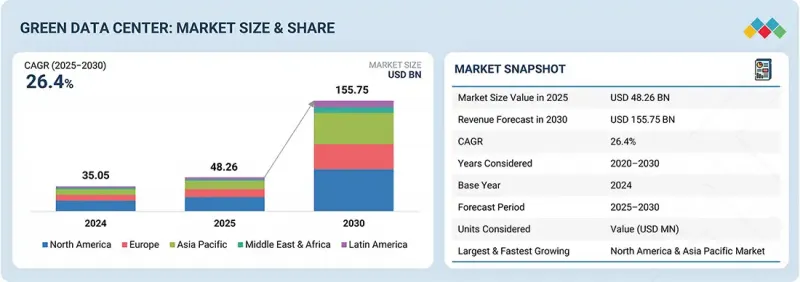

The global green data center market is expanding rapidly, with a projected market size anticipated to rise from about USD 48.26 billion in 2025 to USD 155.75 billion by 2030, featuring a CAGR of 26.4%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD Million |

| Segments | Component, Data Center Size & Capacity, Data Center Type, and Enterprise Data Center |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

The market is driven by the increasing demand for energy-efficient infrastructure to support high-density workloads, where minimizing power consumption and emissions is critical for sustainability. Enterprises are also seeking advanced cooling solutions and intelligent energy management systems to optimize operational efficiency and align with corporate net-zero goals, along with the growing adoption of renewable energy sources to power resource-intensive applications such as AI, cloud computing, and data analytics.

Furthermore, the need for reliable, low-carbon power and scalable modular designs is becoming essential to meet expanding digital workloads, while automated monitoring and carbon reporting capabilities enable compliance with tightening global regulations. In contrast, the market faces restraints, including significant upfront capital expenditure for renewable integration and advanced cooling technologies, and operational complexity in retrofitting existing facilities, which can slow adoption among budget-conscious or legacy-focused organizations.

"Cloud & Hyperscale data centers to account for the fastest growth rate during the forecast period"

Cloud & hyperscale data centers are at the forefront of the green data center market, driving the adoption of renewable energy, advanced cooling technologies, and energy-efficient infrastructure to support large-scale cloud platforms, AI workloads, and global applications. These facilities are designed to deliver high-performance computing at scale while minimizing environmental impact, making sustainability a central component of operational strategy. Strategic partnerships are playing a key role in accelerating this transformation and creating opportunities for emerging vendors and solution providers to contribute innovative, energy-efficient solutions. In November 2024, Schneider Electric and Vertiv, in collaboration with major tech companies such as Google and Microsoft, launched a Request for Information in Europe to replace diesel backup generators with cleaner alternatives, demonstrating the industry's commitment to reducing carbon emissions and embracing low-carbon operations.

Similarly, in 2023, Huawei partnered with Qinghai Yungu Big Data Industry Development Co., Ltd. to develop a 100% clean energy data center in Hainan Prefecture, Qinghai, revealing the potential of modular designs to deliver reliability, flexibility, and high energy efficiency. These collaborations highlight how integrated, scalable, and sustainable infrastructure can meet performance demands while reducing environmental impact. For emerging vendors and solution providers, engaging in such initiatives allows them to offer innovative technologies, enhance their market presence, and contribute significantly to the green transformation of cloud and hyperscale data centers.

"Data center infrastructure management software to hold the largest market share during the forecast period"

Data center infrastructure management (DCIM) is the most critical software segment in green data centers, expected to hold the largest market share during the forecast period, as it enables comprehensive monitoring, control, and optimization of IT and facility resources to maximize sustainability and reduce energy consumption. DCIM provides continuous power and environment monitoring, tracking metrics such as power usage, voltage, temperature, humidity, and airflow across the facility, allowing operators to identify hotspots, detect anomalies, and prevent energy waste while ensuring reliable operations. The software's energy optimization tools analyze consumption patterns to suggest or automate adjustments in cooling, lighting, and IT workloads, reducing carbon footprint without compromising performance. Capacity planning within DCIM enables precise forecasting of power, cooling, and space requirements, ensuring efficient resource allocation and minimizing over-provisioning.

Asset lifecycle management tracks IT and infrastructure components from procurement to retirement, supporting optimal utilization, redundancy reduction, and sustainable procurement practices. Alerting and incident management features provide real-time notifications for potential failures, threshold breaches, or inefficiencies, allowing rapid corrective action to minimize downtime and energy loss. Emerging vendors can capitalize on this growth. For instance, in June 2025, Schneider Electric partnered with NTT Data to deploy its EcoStruxure IT DCIM platform across multiple European data centers, enhancing operational efficiency and energy savings. By integrating analytics, automation, and monitoring, vendors can deliver energy-efficient, sustainable, and regulatory-compliant data center operations.

"North America leads the green data center market with advanced energy-efficient facilities, while Asia Pacific is the fastest-growing region driven by rapid digitalization and high-density computing deployments"

North America is expected to dominate the green data center market, driven by rising enterprise demand for energy-efficient infrastructure, renewable-powered facilities, and compliance with stringent sustainability regulations. This presents significant opportunities to deliver scalable platforms that support industries such as hyperscale cloud, financial services, AI-driven analytics, and healthcare for solution providers and vendors. The region's mature data center ecosystem and rapid adoption of net-zero initiatives accelerate the transition from traditional power-intensive facilities to low-emission, modular, and high-density designs, creating strong demand for sustainable, regulation-compliant infrastructure.

Strategic collaborations, including partnerships with renewable energy suppliers and technology vendors, demonstrate how green data centers enhance operational efficiency and reduce carbon footprints. Capitalizing on these developments enables providers to meet evolving enterprise sustainability goals, address energy and regulatory challenges, and establish resilient market positions in an industry increasingly defined by environmental responsibility and technological innovation.

Breakdown of Primaries

In-depth interviews were conducted with chief executive officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the green data center market.

- By Company: Tier I - 30%, Tier II - 45%, and Tier III - 25%

- By Designation: C-Level Executives - 50%, D-Level Executives -35%, and Others - 15%

- By Region: North America - 50%, Europe - 30%, Asia Pacific - 15%, and Rest of the world - 5%

The report includes a study of key players offering green data center products. It profiles major vendors in the green data center market. The major market players include Schneider Electric (France), Vertiv (US), Eaton (US), Daikin (Japan), ABB (Switzerland), Delta Electronics (Taiwan), Carrier (US), Siemens (Germany), GE Vernova (US), Stulz GmbH (Germany), Green Revolution Cooling (US), Johnson Controls (US), Honeywell International Inc. (US), Trane (Ireland), Cyber Power Systems, Inc. (Taiwan), Rittal Pvt. Ltd. (India), Asetek Inc. (Denmark), Sunbird Software, Inc. (US), Packet Power (US), Danfoss (Denmark), Zutacore, Inc. (US), Submer (Spain), Nortek Data Center Cooling (US), Toshiba (Japan), Midas Immersion Cooling (US), Coolit Systems (Canada), and Riello UPS (Italy).

Research Coverage

This research report categorizes the green data center market based on component (infrastructure (energy infrastructure (renewable power generators, power backup & energy storage, energy effective power distribution), cooling infrastructure (green air cooling, green liquid cooling)), software (data center infrastructure management (DCIM), building management, compliance, others), services (strategy consulting & energy audits, eco-friendly integration & deployment, sustainable operation & maintenance services, others)), data center size & capacity (edge & micro centers, medium data centers, large & hyperscale data centers), data center type (cloud & hyperscale data centers, colocation data centers, enterprise data centers), enterprise data center (BFSI, healthcare & life sciences, energy & utilities, manufacturing, technology & software, media & entertainment, government & defense, telecommunications, retail & e-commerce, and other verticals (education, transportation & logistics, and travel & hospitality)) and region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America).

The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the green data center market. A detailed analysis of the key industry players was done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, new product & service launches, and mergers and acquisitions; and recent developments associated with the green data center market. This report also covers the competitive analysis of upcoming startups in the green data center market ecosystem.

Reason to Buy this Report

The report would provide market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall green data center market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. It also helps stakeholders understand the market's pulse and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the pointers listed below.

- Analysis of key drivers (AI workloads drive the adoption of green data center solutions, Net-zero mandates accelerate renewable-powered facilities, Rising energy tariffs increase demand for efficiency solutions, Carbon pricing drives investment in low-emission operations), restraints (Limited renewable availability restricts large-scale deployments, High upfront CAPEX slows green data center adoption), opportunities (Prefabricated green modules accelerate facility deployment, Circular IT asset management expands service scope, Sustainability certifications improve enterprise client wins, Waste heat recovery creates monetization avenues), and challenges (Regional policy fragmentation complicates vendor compliance, Supply chain gaps limit access to eco-friendly components)

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and new product & service launches in the green data center market

- Market Development: Comprehensive information about lucrative markets - analysis of the green data center market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the green data center market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such as Schneider Electric (France), Vertiv (US), Eaton (US), Daikin (Japan), ABB (Switzerland), Delta Electronics (Taiwan), Carrier (US), Siemens (Germany), GE Vernova (US), Stulz GmbH (Germany), Green Revolution Cooling (US), Johnson Controls (US), Honeywell International Inc. (US), Trane (Ireland), Cyber Power Systems, Inc. (Taiwan), Rittal Pvt. Ltd. (India), Asetek Inc. (Denmark), Sunbird Software, Inc. (US), Packet Power (US), Danfoss (Denmark), Zutacore, Inc. (US), Submer (Spain), Nortek Data Center Cooling (US), Toshiba (Japan), Midas Immersion Cooling (US), Coolit Systems (Canada), and Riello UPS (Italy). The report also helps stakeholders understand the green data center market's pulse and provides information on key market drivers, restraints, challenges, and opportunities

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakup of primary profiles

- 2.1.2.3 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN GREEN DATA CENTER MARKET

- 4.2 GREEN DATA CENTER MARKET, BY COMPONENT

- 4.3 GREEN DATA CENTER MARKET, BY DATA CENTER SIZE & CAPACITY

- 4.4 GREEN DATA CENTER MARKET, BY DATA CENTER TYPE

- 4.5 GREEN DATA CENTER MARKET, BY ENTERPRISE DATA CENTER

- 4.6 GREEN DATA CENTER MARKET, BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 AI workloads to drive adoption of green data center solutions

- 5.2.1.2 Net-zero mandates to accelerate renewable-powered facilities

- 5.2.1.3 Rising energy tariffs to increase demand for efficiency solutions

- 5.2.1.4 Carbon pricing to drive investment in low-emission operations

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited renewable availability to restrict large-scale deployments

- 5.2.2.2 High upfront CAPEX to slow green data center adoption

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Prefabricated green modules to accelerate facility deployment

- 5.2.3.2 Circular IT asset management to expand service scope

- 5.2.3.3 Sustainability certifications to improve enterprise client wins

- 5.2.3.4 Waste heat recovery to create monetization avenues

- 5.2.4 CHALLENGES

- 5.2.4.1 Regional policy fragmentation to complicate vendor compliance

- 5.2.4.2 Supply chain gaps to limit access to eco-friendly components

- 5.2.1 DRIVERS

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 GREENERGY AND A-KAABEL DRIVE GREEN DATA CENTER GROWTH WITH VERTIV RACK PDUS'

- 5.3.2 SIEMENS SUPPORTS BMO FINANCIAL GROUP WITH WHITE SPACE COOLING OPTIMIZATION (WSCO)

- 5.3.3 HITACHI ENERGY POWERS GREEN DATA CENTER ADVANCEMENT AT TURKIYE'S STAR OF BOSPHORUS FACILITY

- 5.3.4 GRC ENABLES GREEN SUPERCOMPUTING AT TACC WITH IMMERSION COOLING

- 5.3.5 RITTAL LOWERS CARBON FOOTPRINT AT SCOTTISH QUALIFICATIONS AUTHORITY (SQA) DATA CENTERS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.5.1 TECHNOLOGY PROVIDERS

- 5.5.2 POWER & COOLING SOLUTION VENDORS

- 5.5.3 INFRASTRUCTURE SPECIALISTS

- 5.5.4 DATA CENTER SERVICE PROVIDERS

- 5.5.5 ENTERPRISE VERTICALS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Renewable/Clean power integration

- 5.6.1.2 Adiabatic cooling

- 5.6.1.3 Free cooling

- 5.6.1.4 Heat reuse/recovery systems

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Immersion cooling

- 5.6.2.2 AI/ML-driven energy optimization

- 5.6.2.3 Grid-interactive demand response systems

- 5.6.2.4 Hydrogen backup systems

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Smart grid systems

- 5.6.3.2 Carbon capture & storage

- 5.6.3.3 Renewable energy trading platforms

- 5.6.3.4 Smart buildings & energy management systems

- 5.6.1 KEY TECHNOLOGIES

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.3 BARGAINING POWER OF SUPPLIERS

- 5.7.4 BARGAINING POWER OF BUYERS

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.8.2 BUYING CRITERIA

- 5.9 PRICING ANALYSIS

- 5.9.1 PRICING RANGE OF DATA CENTER UPS, BY REGION, 2024

- 5.9.2 PRICING RANGE OF DATA-CENTER UPS FOR HYPERSCALE DEPLOYMENTS, BY KEY PLAYER, 2024

- 5.10 PATENT ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.11.1 EXPORT SCENARIO

- 5.11.2 IMPORT SCENARIO

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 KEY REGULATIONS, BY REGION

- 5.12.2.1 North America

- 5.12.2.2 Europe

- 5.12.2.3 Asia Pacific

- 5.12.2.4 Middle East & South Africa

- 5.12.2.5 Latin America

- 5.13 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 IMPACT OF GENERATIVE AI

- 5.15.1 TOP USE CASES & MARKET POTENTIAL

- 5.15.2 KEY USE CASES

- 5.15.3 CASE STUDY

- 5.15.3.1 Siemens AI-powered Optimization at Greenergy Data Centers, Estonia

- 5.15.4 VENDOR INITIATIVE

- 5.16 BUSINESS MODELS

- 5.17 INVESTMENT AND FUNDING SCENARIO

- 5.18 IMPACT OF 2025 US TARIFF

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRY/REGION

- 5.18.4.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON ENTERPRISE DATA CENTERS

- 5.18.5.1 Manufacturing

- 5.18.5.2 Retail & Ecommerce

- 5.18.5.3 Energy & Utilities

- 5.18.5.4 Technology & Software

- 5.18.5.5 Telecommunications

- 5.18.5.6 Media & Entertainment

- 5.18.5.7 BFSI

- 5.18.5.8 Healthcare & Life Sciences

- 5.18.5.9 Government & Defense

6 GREEN DATA CENTER MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.1.1 COMPONENT: GREEN DATA CENTER MARKET DRIVERS

- 6.2 INFRASTRUCTURE

- 6.2.1 ENERGY INFRASTRUCTURE

- 6.2.1.1 Reducing carbon footprint through clean energy to provide sustainable power

- 6.2.1.2 Renewable power generators

- 6.2.1.2.1 Solar power generators

- 6.2.1.2.2 Wind power generators

- 6.2.1.2.3 Hydrogen-ready turbines/HVO/Biofuel-ready gensets

- 6.2.1.3 Power backup & energy storage

- 6.2.1.3.1 High-efficiency UPS (Modular, Lithium-ion, Eco-mode)

- 6.2.1.3.2 Battery energy storage systems (Li-ion/LFP, Flow)

- 6.2.1.4 Energy-effective power distribution

- 6.2.1.4.1 Intelligent PDUs (Switched/Metered)

- 6.2.1.4.2 Efficient busway systems

- 6.2.1.4.3 Others

- 6.2.2 COOLING INFRASTRUCTURE

- 6.2.2.1 Combining air and liquid cooling to provide optimal efficiency

- 6.2.2.2 Green air cooling

- 6.2.2.2.1 Energy-efficient air handlers (CRAH & CRAC)

- 6.2.2.2.2 Eco-friendly air-cooled chillers

- 6.2.2.2.3 Others

- 6.2.2.3 Green liquid cooling

- 6.2.2.3.1 Optimized thermal transfer coolant distribution units (CDUs)

- 6.2.2.3.2 High-efficiency water-cooled chillers

- 6.2.2.3.3 Energy efficient heat exchangers

- 6.2.2.3.4 Others

- 6.2.1 ENERGY INFRASTRUCTURE

- 6.3 SOFTWARE

- 6.3.1 DATA CENTER INFRASTRUCTURE MANAGEMENT

- 6.3.1.1 Integrating data center infrastructure to maximize sustainability and reduce energy consumption

- 6.3.1.1.1 Power & Environment monitoring

- 6.3.1.1.2 Energy optimization

- 6.3.1.1.3 Capacity planning

- 6.3.1.1.4 Asset lifecycle management

- 6.3.1.1.5 Altering & incident management

- 6.3.1.1 Integrating data center infrastructure to maximize sustainability and reduce energy consumption

- 6.3.2 BUILDING MANAGEMENT

- 6.3.2.1 Monitoring and control of electrical and mechanical systems to minimize energy consumption

- 6.3.2.1.1 Building automation system

- 6.3.2.1.2 Smart lighting systems

- 6.3.2.1.3 HVAC control & optimization platforms

- 6.3.2.1 Monitoring and control of electrical and mechanical systems to minimize energy consumption

- 6.3.3 COMPLIANCE

- 6.3.3.1 Maintaining regulatory and industry standards to track carbon emissions and other sustainability metrics

- 6.3.3.1.1 Sustainability compliance reporting

- 6.3.3.1.2 ESG reporting tools

- 6.3.3.1.3 Green certification management

- 6.3.3.1 Maintaining regulatory and industry standards to track carbon emissions and other sustainability metrics

- 6.3.4 OTHER SOFTWARE

- 6.3.1 DATA CENTER INFRASTRUCTURE MANAGEMENT

- 6.4 SERVICES

- 6.4.1 STRATEGY CONSULTING & ENERGY AUDITS

- 6.4.1.1 Operational risk assessment to ensure sustainability and long-term performance

- 6.4.2 ECO-FRIENDLY INTEGRATION & DEPLOYMENT

- 6.4.2.1 Eco-friendly technology commissioning to reduce energy consumption and environmental impact

- 6.4.3 SUSTAINABLE OPERATION AND MAINTENANCE SERVICES

- 6.4.3.1 Routine inspection and system tuning to ensure optimal efficiency

- 6.4.4 OTHER SERVICES

- 6.4.1 STRATEGY CONSULTING & ENERGY AUDITS

7 GREEN DATA CENTER MARKET, BY DATA CENTER SIZE & CAPACITY

- 7.1 INTRODUCTION

- 7.1.1 DATA CENTER SIZE & CAPACITY: GREEN DATA CENTER MARKET DRIVERS

- 7.2 EDGE & MICRO DATA CENTERS (1-5 MW)

- 7.2.1 POWERING NEXT WAVE OF LOW-CARBON COMPUTING TO SUPPORT 5G, IOT, AND AI APPLICATIONS

- 7.3 MEDIUM DATA CENTERS (5-50 MW)

- 7.3.1 ACCELERATING SUSTAINABLE DIGITAL TRANSFORMATION TO ENHANCE SCALABLE CAPACITY

- 7.4 LARGE & HYPERSCALE DATA CENTERS (50 MW & ABOVE)

- 7.4.1 REDEFINING GLOBAL CONNECTIVITY THROUGH GREEN INNOVATION TO SUPPORT HYPERSCALE CLOUD PLATFORMS

8 GREEN DATA CENTER MARKET, BY DATA CENTER TYPE

- 8.1 INTRODUCTION

- 8.1.1 DATA CENTER TYPE: GREEN DATA CENTER MARKET DRIVERS

- 8.2 CLOUD & HYPERSCALE DATA CENTERS

- 8.2.1 CLOUD AND HYPERSCALE DATA CENTERS TO DRIVE GLOBAL SUSTAINABILITY WITH SCALABLE ENERGY-EFFICIENT INFRASTRUCTURE

- 8.3 COLOCATION DATA CENTERS

- 8.3.1 COLOCATION DATA CENTERS TO TRANSFORM MULTI-TENANT OPERATIONS THROUGH INNOVATIVE GREEN TECHNOLOGIES

- 8.4 ENTERPRISE DATA CENTERS

- 8.4.1 ENTERPRISE DATA CENTERS TO ACCELERATE LOW-CARBON DIGITAL INFRASTRUCTURE VIA STRATEGIC SUSTAINABLE COLLABORATIONS

9 GREEN DATA CENTER MARKET, BY ENTERPRISE DATA CENTER

- 9.1 INTRODUCTION

- 9.1.1 VERTICALS: GREEN DATA CENTER MARKET DRIVERS

- 9.2 MANUFACTURING

- 9.2.1 ENHANCE SUSTAINABLE MANUFACTURING WITH LOW-CARBON, MODULAR, AND ENERGY-EFFICIENT SOLUTIONS

- 9.3 ENERGY & UTILITIES

- 9.3.1 ENABLE SUSTAINABLE GRID INTEGRATION WITH EFFICIENT, RENEWABLE-READY DATA CENTERS

- 9.4 RETAIL & E-COMMERCE

- 9.4.1 POWER SEAMLESS OMNICHANNEL GROWTH THROUGH ENERGY-EFFICIENT, SCALABLE FACILITIES

- 9.5 TECHNOLOGY & SOFTWARE

- 9.5.1 SUPPORT AI AND ANALYTICS WITH LOW-CARBON, HIGH-DENSITY INFRASTRUCTURE

- 9.6 TELECOMMUNICATIONS

- 9.6.1 DRIVE 5G AND EDGE EXPANSION USING RESILIENT GREEN DATA CENTERS

- 9.7 MEDIA & ENTERTAINMENT

- 9.7.1 DELIVER HIGH-PERFORMANCE STREAMING WITH OPTIMIZED COOLING AND POWER SYSTEMS

- 9.8 BANKING, FINANCIAL SERVICES & INSURANCE

- 9.8.1 ENSURE SECURE, COMPLIANT OPERATIONS WITH ENERGY-EFFICIENT, LOW-EMISSION INFRASTRUCTURE

- 9.9 HEALTHCARE & LIFE SCIENCES

- 9.9.1 ENABLE DATA-INTENSIVE RESEARCH WITH SUSTAINABLE, HIGH-AVAILABILITY DATA CENTERS

- 9.10 GOVERNMENT & DEFENSE

- 9.10.1 ACHIEVE RESILIENT DIGITAL INFRASTRUCTURE THROUGH EFFICIENT, POLICY-ALIGNED GREEN FACILITIES

- 9.11 OTHER ENTERPRISE DATA CENTERS

10 GREEN DATA CENTER MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: GREEN DATA CENTER MARKET DRIVERS

- 10.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 10.2.3 US

- 10.2.3.1 Replacing fossil-based systems with renewable-ready power and efficiency-driven technologies to drive market

- 10.2.4 CANADA

- 10.2.4.1 Innovative cooling initiatives to create favorable conditions for building and scaling sustainable data center infrastructure

- 10.3 EUROPE

- 10.3.1 EUROPE: GREEN DATA CENTER MARKET DRIVERS

- 10.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 10.3.3 UK

- 10.3.3.1 Need for sustainable data center infrastructure to support grid stability and community energy goals

- 10.3.4 GERMANY

- 10.3.4.1 Stringent efficiency laws and emphasis on waste heat reuse to increase demand for utility-integrated solutions

- 10.3.5 FRANCE

- 10.3.5.1 Strong low-carbon grid and stringent energy regulations to drive demand for advanced power and cooling technologies

- 10.3.6 ITALY

- 10.3.6.1 Rising need for AI workloads and growing grid complexity to drive demand for sustainable data center solutions

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: GREEN DATA CENTER MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 10.4.3 CHINA

- 10.4.3.1 Increasing demand for sustainable data centers to support rising AI and high-performance workloads

- 10.4.4 JAPAN

- 10.4.4.1 Robust policies and strategic industrial partnerships to drive demand for low-carbon and net-zero infrastructure

- 10.4.5 INDIA

- 10.4.5.1 Increasing adoption of green data centers to drive sustainable, low-carbon digital infrastructure

- 10.4.6 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: GREEN DATA CENTER MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 10.5.3 GULF COOPERATION COUNCIL

- 10.5.3.1 Saudi Arabia

- 10.5.3.1.1 Green data center initiatives to offer opportunities for sustainable and energy-efficient solutions

- 10.5.3.2 UAE

- 10.5.3.2.1 Integration of renewable energy and innovative cooling technologies to drive market

- 10.5.3.3 Rest of GCC

- 10.5.3.1 Saudi Arabia

- 10.5.4 SOUTH AFRICA

- 10.5.4.1 Renewable energy integration and energy-efficient operations to boost adoption of sustainable digital infrastructure

- 10.5.5 REST OF MIDDLE EAST & AFRICA

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: GREEN DATA CENTER MARKET DRIVERS

- 10.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 10.6.3 BRAZIL

- 10.6.3.1 Aligning renewable energy strength with advanced infrastructure development to drive market

- 10.6.4 MEXICO

- 10.6.4.1 Integration of solar energy and efficient Tier III expansions to boost demand for sustainable digital infrastructure

- 10.6.5 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 PRODUCT/BRAND COMPARISON ANALYSIS

- 11.5.1 SCHNEIDER ELECTRIC

- 11.5.2 EATON

- 11.5.3 VERTIV

- 11.5.4 DAIKIN

- 11.5.5 ABB

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- 11.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.6.5.1 Company footprint

- 11.6.5.2 Region footprint

- 11.6.5.3 Component footprint

- 11.6.5.4 Data center type footprint

- 11.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.7.5.1 Detailed list of key startups/SMEs

- 11.7.5.2 Competitive benchmarking of startups/SMEs

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 MAJOR PLAYERS

- 12.1.1 SCHNEIDER ELECTRIC

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 VERTIV

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 EATON

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 DAIKIN

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.3.2 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 ABB

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 DELTA ELECTRONICS

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.6.3.2 Deals

- 12.1.6.4 Expansions

- 12.1.7 CARRIER

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.3.2 Deals

- 12.1.8 SIEMENS

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches

- 12.1.8.3.2 Deals

- 12.1.9 GE VERNOVA

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches

- 12.1.9.3.2 Deals

- 12.1.10 STULZ GMBH

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches

- 12.1.10.3.2 Deals

- 12.1.10.3.3 Expansions

- 12.1.1 SCHNEIDER ELECTRIC

- 12.2 OTHER PLAYERS

- 12.2.1 GREEN REVOLUTION COOLING

- 12.2.2 MODINE (AIREDALE)

- 12.2.3 JOHNSON CONTROLS

- 12.2.4 HUAWEI DIGITAL POWER TECHNOLOGIES CO., LTD.

- 12.2.5 HONEYWELL INTERNATIONAL INC.

- 12.2.6 HITACHI ENERGY LTD.

- 12.2.7 TRANE

- 12.2.8 CYBER POWER SYSTEMS, INC.

- 12.2.9 LITE-ON TECHNOLOGY CORPORATION.

- 12.2.10 RITTAL PVT. LTD.

- 12.2.11 ASETEK INC.

- 12.2.12 SUNBIRD SOFTWARE, INC.

- 12.2.13 PACKET POWER

- 12.2.14 DANFOSS

- 12.2.15 ZUTACORE, INC.

- 12.2.16 SUBMER

- 12.2.17 NORTEK DATA CENTER COOLING

- 12.2.18 ALFA LAVAL

- 12.2.19 TOSHIBA

- 12.2.20 MIDAS IMMERSION COOLING

- 12.2.21 COOLIT SYSTEMS

- 12.2.22 RIELLO UPS

- 12.2.23 MITSUBISHI HEAVY INDUSTRIES, LTD.

- 12.2.24 LANGLEY HOLDINGS PLC

- 12.2.25 FUJI ELECTRIC CO., LTD.

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.1.1 RELATED MARKETS

- 13.1.2 LIMITATIONS

- 13.2 DATA CENTER COOLING MARKET

- 13.3 DATA CENTER SOLUTIONS MARKET

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 GREEN DATA CENTER MARKET SIZE AND GROWTH, 2020-2024 (USD MILLION, YOY GROWTH% %)

- TABLE 4 GREEN DATA CENTER MARKET SIZE AND GROWTH, 2025-2030 (USD MILLION, YOY GROWTH% %)

- TABLE 5 GREEN DATA CENTER MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 6 IMPACT OF PORTER'S FIVE FORCES

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS (%)

- TABLE 8 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 9 PRICING RANGE OF DATA CENTER UPS, BY REGION, 2024 (USD/KVA)

- TABLE 10 PRICING RANGE OF DATA-CENTER UPS FOR HYPERSCALE DEPLOYMENTS, BY KEY PLAYER, 2024 (USD/KVA)

- TABLE 11 PATENTS GRANTED TO VENDORS IN GREEN DATA CENTER MARKET

- TABLE 12 EXPORT SCENARIO FOR HS CODE 8419, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 13 IMPORT SCENARIO FOR HS CODE 8419, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 GREEN DATA CENTER MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 19 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 20 GREEN DATA CENTER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 21 GREEN DATA CENTER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 22 GREEN DATA CENTER MARKET, BY INFRASTRUCTURE, 2020-2024 (USD MILLION)

- TABLE 23 GREEN DATA CENTER MARKET, BY INFRASTRUCTURE, 2025-2030 (USD MILLION)

- TABLE 24 INFRASTRUCTURE: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 25 INFRASTRUCTURE: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 26 GREEN DATA CENTER MARKET, BY ENERGY INFRASTRUCTURE, 2020-2024 (USD MILLION)

- TABLE 27 GREEN DATA CENTER MARKET, BY ENERGY INFRASTRUCTURE, 2025-2030 (USD MILLION)

- TABLE 28 ENERGY INFRASTRUCTURE: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 29 ENERGY INFRASTRUCTURE: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 RENEWABLE POWER GENERATORS: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 31 RENEWABLE POWER GENERATORS: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 POWER BACKUP & ENERGY STORAGE: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 33 POWER BACKUP & ENERGY STORAGE: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 ENERGY-EFFECTIVE POWER DISTRIBUTION: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 35 ENERGY-EFFECTIVE POWER DISTRIBUTION: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 GREEN DATA CENTER MARKET, BY COOLING INFRASTRUCTURE, 2020-2024 (USD MILLION)

- TABLE 37 GREEN DATA CENTER MARKET, BY COOLING INFRASTRUCTURE, 2025-2030 (USD MILLION)

- TABLE 38 COOLING INFRASTRUCTURE: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 39 COOLING INFRASTRUCTURE: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 GREEN AIR COOLING: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 41 GREEN AIR COOLING: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 GREEN LIQUID COOLING: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 43 GREEN LIQUID COOLING: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 GREEN DATA CENTER MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 45 GREEN DATA CENTER MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 46 SOFTWARE: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 47 SOFTWARE: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 DATA CENTER INFRASTRUCTURE MANAGEMENT: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 49 DATA CENTER INFRASTRUCTURE MANAGEMENT: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 BUILDING MANAGEMENT: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 51 BUILDING MANAGEMENT: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 COMPLIANCE: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 53 COMPLIANCE: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 OTHER SOFTWARE: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 55 OTHER SOFTWARE: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 GREEN DATA CENTER MARKET, BY SERVICES, 2020-2024 (USD MILLION)

- TABLE 57 GREEN DATA CENTER MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 58 STRATEGY CONSULTING & AUDIT: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 59 STRATEGY CONSULTING & AUDIT: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 ECO-FRIENDLY INTEGRATION & DEPLOYMENT: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 61 ECO-FRIENDLY INTEGRATION & DEPLOYMENT: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 SUSTAINABLE OPERATION & MAINTENANCE SERVICES: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 63 SUSTAINABLE OPERATION & MAINTENANCE SERVICES: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 OTHER SERVICES: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 65 OTHER SERVICES: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 GREEN DATA CENTER MARKET, BY DATA CENTER SIZE & CAPACITY, 2020-2024 (USD MILLION)

- TABLE 67 GREEN DATA CENTER MARKET, BY DATA CENTER SIZE & CAPACITY, 2025-2030 (USD MILLION)

- TABLE 68 EDGE & MICRO DATA CENTERS: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 69 EDGE & MICRO DATA CENTERS: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 MEDIUM DATA CENTERS: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 71 MEDIUM DATA CENTERS: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 LARGE & HYPERSCALE DATA CENTERS: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 73 LARGE & HYPERSCALE DATA CENTERS: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 GREEN DATA CENTER MARKET, BY DATA CENTER TYPE, 2020-2024 (USD MILLION)

- TABLE 75 GREEN DATA CENTER MARKET, BY DATA CENTER TYPE, 2025-2030 (USD MILLION)

- TABLE 76 CLOUD & HYPERSCALE DATA CENTERS: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 77 CLOUD & HYPERSCALE DATA CENTERS: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 COLOCATION DATA CENTER: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 79 COLOCATION DATA CENTER: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 ENTERPRISE DATA CENTER: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 81 ENTERPRISE DATA CENTER: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 82 GREEN DATA CENTER MARKET, BY ENTERPRISE DATA CENTER, 2020-2024 (USD MILLION)

- TABLE 83 GREEN DATA CENTER MARKET, BY ENTERPRISE DATA CENTER, 2025-2030 (USD MILLION)

- TABLE 84 MANUFACTURING: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 85 MANUFACTURING: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 ENERGY & UTILITIES: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 87 ENERGY & UTILITIES: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 RETAIL & E-COMMERCE: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 89 RETAIL & E-COMMERCE: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 90 TECHNOLOGY & SOFTWARE: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 91 TECHNOLOGY & SOFTWARE: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 92 TELECOMMUNICATIONS: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 93 TELECOMMUNICATIONS: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 94 MEDIA & ENTERTAINMENT: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 95 MEDIA & ENTERTAINMENT: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 96 BFSI: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 97 BFSI: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 98 HEALTHCARE & LIFE SCIENCES: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 99 HEALTHCARE & LIFE SCIENCES: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 100 GOVERNMENT & DEFENSE: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 101 GOVERNMENT & DEFENSE: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 102 OTHER ENTERPRISE DATA CENTERS: GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 103 OTHER ENTERPRISE DATA CENTERS: GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 104 GREEN DATA CENTER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 105 GREEN DATA CENTER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 106 NORTH AMERICA: GREEN DATA CENTER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 107 NORTH AMERICA: GREEN DATA CENTER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 108 NORTH AMERICA: GREEN DATA CENTER MARKET, BY INFRASTRUCTURE, 2020-2024 (USD MILLION)

- TABLE 109 NORTH AMERICA: GREEN DATA CENTER MARKET, BY INFRASTRUCTURE, 2025-2030 (USD MILLION)

- TABLE 110 NORTH AMERICA: GREEN DATA CENTER MARKET, BY ENERGY INFRASTRUCTURE, 2020-2024 (USD MILLION)

- TABLE 111 NORTH AMERICA: GREEN DATA CENTER MARKET, BY ENERGY INFRASTRUCTURE, 2025-2030 (USD MILLION)

- TABLE 112 NORTH AMERICA: GREEN DATA CENTER MARKET, BY COOLING INFRASTRUCTURE, 2020-2024 (USD MILLION)

- TABLE 113 NORTH AMERICA: GREEN DATA CENTER MARKET, BY COOLING INFRASTRUCTURE, 2025-2030 (USD MILLION)

- TABLE 114 NORTH AMERICA: GREEN DATA CENTER MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 115 NORTH AMERICA: GREEN DATA CENTER MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 116 NORTH AMERICA: GREEN DATA CENTER MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 117 NORTH AMERICA: GREEN DATA CENTER MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 118 NORTH AMERICA: GREEN DATA CENTER MARKET, BY DATA CENTER SIZE & CAPACITY, 2020-2024 (USD MILLION)

- TABLE 119 NORTH AMERICA: GREEN DATA CENTER MARKET, BY DATA CENTER SIZE & CAPACITY, 2025-2030 (USD MILLION)

- TABLE 120 NORTH AMERICA: GREEN DATA CENTER MARKET, BY DATA CENTER TYPE, 2020-2024 (USD MILLION)

- TABLE 121 NORTH AMERICA: GREEN DATA CENTER MARKET, BY DATA CENTER TYPE, 2025-2030 (USD MILLION)

- TABLE 122 NORTH AMERICA: GREEN DATA CENTER MARKET, BY ENTERPRISE DATA CENTER, 2020-2024 (USD MILLION)

- TABLE 123 NORTH AMERICA: GREEN DATA CENTER MARKET, BY ENTERPRISE DATA CENTER, 2025-2030 (USD MILLION)

- TABLE 124 NORTH AMERICA: GREEN DATA CENTER MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 125 NORTH AMERICA: GREEN DATA CENTER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 126 US: GREEN DATA CENTER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 127 US: GREEN DATA CENTER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 128 CANADA: GREEN DATA CENTER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 129 CANADA: GREEN DATA CENTER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 130 EUROPE: GREEN DATA CENTER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 131 EUROPE: GREEN DATA CENTER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 132 EUROPE: GREEN DATA CENTER MARKET, BY INFRASTRUCTURE, 2020-2024 (USD MILLION)

- TABLE 133 EUROPE: GREEN DATA CENTER MARKET, BY INFRASTRUCTURE, 2025-2030 (USD MILLION)

- TABLE 134 EUROPE: GREEN DATA CENTER MARKET, BY ENERGY INFRASTRUCTURE, 2020-2024 (USD MILLION)

- TABLE 135 EUROPE: GREEN DATA CENTER MARKET, BY ENERGY INFRASTRUCTURE, 2025-2030 (USD MILLION)

- TABLE 136 EUROPE: GREEN DATA CENTER MARKET, BY COOLING INFRASTRUCTURE, 2020-2024 (USD MILLION)

- TABLE 137 EUROPE: GREEN DATA CENTER MARKET, BY COOLING INFRASTRUCTURE, 2025-2030 (USD MILLION)

- TABLE 138 EUROPE: GREEN DATA CENTER MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 139 EUROPE: GREEN DATA CENTER MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 140 EUROPE: GREEN DATA CENTER MARKET, BY SERVICES, 2020-2024 (USD MILLION)

- TABLE 141 EUROPE: GREEN DATA CENTER MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 142 EUROPE: GREEN DATA CENTER MARKET, BY DATA CENTER SIZE & CAPACITY, 2020-2024 (USD MILLION)

- TABLE 143 EUROPE: GREEN DATA CENTER MARKET, BY DATA CENTER SIZE & CAPACITY, 2025-2030 (USD MILLION)

- TABLE 144 EUROPE: GREEN DATA CENTER MARKET, BY DATA CENTER TYPE, 2020-2024 (USD MILLION)

- TABLE 145 EUROPE: GREEN DATA CENTER MARKET, BY DATA CENTER TYPE, 2025-2030 (USD MILLION)

- TABLE 146 EUROPE: GREEN DATA CENTER MARKET, BY ENTERPRISE DATA CENTER, 2020-2024 (USD MILLION)

- TABLE 147 EUROPE: GREEN DATA CENTER MARKET, BY ENTERPRISE DATA CENTER, 2025-2030 (USD MILLION)

- TABLE 148 EUROPE: GREEN DATA CENTER MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 149 EUROPE: GREEN DATA CENTER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 150 UK: GREEN DATA CENTER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 151 UK: GREEN DATA CENTER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 152 GERMANY: GREEN DATA CENTER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 153 GERMANY: GREEN DATA CENTER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 154 FRANCE: GREEN DATA CENTER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 155 FRANCE: GREEN DATA CENTER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 156 ITALY: GREEN DATA CENTER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 157 ITALY: GREEN DATA CENTER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 158 REST OF EUROPE: GREEN DATA CENTER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 159 REST OF EUROPE: GREEN DATA CENTER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 160 ASIA PACIFIC: GREEN DATA CENTER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 161 ASIA PACIFIC: GREEN DATA CENTER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 162 ASIA PACIFIC: GREEN DATA CENTER MARKET, BY INFRASTRUCTURE, 2020-2024 (USD MILLION)

- TABLE 163 ASIA PACIFIC: GREEN DATA CENTER MARKET, BY INFRASTRUCTURE, 2025-2030 (USD MILLION)

- TABLE 164 ASIA PACIFIC: GREEN DATA CENTER MARKET, BY ENERGY INFRASTRUCTURE, 2020-2024 (USD MILLION)

- TABLE 165 ASIA PACIFIC: GREEN DATA CENTER MARKET, BY ENERGY INFRASTRUCTURE, 2025-2030 (USD MILLION)

- TABLE 166 ASIA PACIFIC: GREEN DATA CENTER MARKET, BY COOLING INFRASTRUCTURE, 2020-2024 (USD MILLION)

- TABLE 167 ASIA PACIFIC: GREEN DATA CENTER MARKET, BY COOLING INFRASTRUCTURE, 2025-2030 (USD MILLION)

- TABLE 168 ASIA PACIFIC: GREEN DATA CENTER MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 169 ASIA PACIFIC: GREEN DATA CENTER MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 170 ASIA PACIFIC: GREEN DATA CENTER MARKET, BY SERVICES, 2020-2024 (USD MILLION)

- TABLE 171 ASIA PACIFIC: GREEN DATA CENTER MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 172 ASIA PACIFIC: GREEN DATA CENTER MARKET, BY DATA CENTER SIZE & CAPACITY, 2020-2024 (USD MILLION)

- TABLE 173 ASIA PACIFIC: GREEN DATA CENTER MARKET, BY DATA CENTER SIZE & CAPACITY, 2025-2030 (USD MILLION)

- TABLE 174 ASIA PACIFIC: GREEN DATA CENTER MARKET, BY DATA CENTER TYPE, 2020-2024 (USD MILLION)

- TABLE 175 ASIA PACIFIC: GREEN DATA CENTER MARKET, BY DATA CENTER TYPE, 2025-2030 (USD MILLION)

- TABLE 176 ASIA PACIFIC: GREEN DATA CENTER MARKET, BY ENTERPRISE DATA CENTER, 2020-2024 (USD MILLION)

- TABLE 177 ASIA PACIFIC: GREEN DATA CENTER MARKET, BY ENTERPRISE DATA CENTER, 2025-2030 (USD MILLION)

- TABLE 178 ASIA PACIFIC: GREEN DATA CENTER MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 179 ASIA PACIFIC: GREEN DATA CENTER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 180 CHINA: GREEN DATA CENTER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 181 CHINA: GREEN DATA CENTER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 182 JAPAN: GREEN DATA CENTER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 183 JAPAN: GREEN DATA CENTER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 184 INDIA: GREEN DATA CENTER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 185 INDIA: GREEN DATA CENTER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 186 REST OF ASIA PACIFIC: GREEN DATA CENTER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 187 REST OF ASIA PACIFIC: GREEN DATA CENTER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: GREEN DATA CENTER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: GREEN DATA CENTER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: GREEN DATA CENTER MARKET, BY INFRASTRUCTURE, 2020-2024 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: GREEN DATA CENTER MARKET, BY INFRASTRUCTURE, 2025-2030 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: GREEN DATA CENTER MARKET, BY ENERGY INFRASTRUCTURE, 2020-2024 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: GREEN DATA CENTER MARKET, BY ENERGY INFRASTRUCTURE, 2025-2030 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: GREEN DATA CENTER MARKET, BY COOLING INFRASTRUCTURE, 2020-2024 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: GREEN DATA CENTER MARKET, BY COOLING INFRASTRUCTURE, 2025-2030 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: GREEN DATA CENTER MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: GREEN DATA CENTER MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: GREEN DATA CENTER MARKET, BY SERVICES, 2020-2024 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: GREEN DATA CENTER MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: GREEN DATA CENTER MARKET, BY DATA CENTER SIZE & CAPACITY, 2020-2024 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: GREEN DATA CENTER MARKET, BY DATA CENTER SIZE & CAPACITY, 2025-2030 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: GREEN DATA CENTER MARKET, BY DATA CENTER TYPE, 2020-2024 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: GREEN DATA CENTER MARKET, BY DATA CENTER TYPE, 2025-2030 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: GREEN DATA CENTER MARKET, BY ENTERPRISE DATA CENTER, 2020-2024 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: GREEN DATA CENTER MARKET, BY ENTERPRISE DATA CENTER, 2025-2030 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: GREEN DATA CENTER MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: GREEN DATA CENTER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 208 GULF COOPERATION COUNCIL: GREEN DATA CENTER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 209 GULF COOPERATION COUNCIL: GREEN DATA CENTER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 210 GULF COOPERATION COUNCIL: GREEN DATA CENTER MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 211 GULF COOPERATION COUNCIL: GREEN DATA CENTER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 212 SAUDI ARABIA: GREEN DATA CENTER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 213 SAUDI ARABIA: GREEN DATA CENTER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 214 UAE: GREEN DATA CENTER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 215 UAE: GREEN DATA CENTER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 216 REST OF GCC: GREEN DATA CENTER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 217 REST OF GCC: GREEN DATA CENTER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 218 SOUTH AFRICA: GREEN DATA CENTER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 219 SOUTH AFRICA: GREEN DATA CENTER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 220 REST OF MIDDLE EAST & AFRICA: GREEN DATA CENTER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 221 REST OF MIDDLE EAST & AFRICA: GREEN DATA CENTER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 222 LATIN AMERICA: GREEN DATA CENTER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 223 LATIN AMERICA: GREEN DATA CENTER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 224 LATIN AMERICA: GREEN DATA CENTER MARKET, BY INFRASTRUCTURE, 2020-2024 (USD MILLION)

- TABLE 225 LATIN AMERICA: GREEN DATA CENTER MARKET, BY INFRASTRUCTURE, 2025-2030 (USD MILLION)

- TABLE 226 LATIN AMERICA: GREEN DATA CENTER MARKET, BY ENERGY INFRASTRUCTURE, 2020-2024 (USD MILLION)

- TABLE 227 LATIN AMERICA: GREEN DATA CENTER MARKET, BY ENERGY INFRASTRUCTURE, 2025-2030 (USD MILLION)

- TABLE 228 LATIN AMERICA: GREEN DATA CENTER MARKET, BY COOLING INFRASTRUCTURE, 2020-2024 (USD MILLION)

- TABLE 229 LATIN AMERICA: GREEN DATA CENTER MARKET, BY COOLING INFRASTRUCTURE, 2025-2030 (USD MILLION)

- TABLE 230 LATIN AMERICA: GREEN DATA CENTER MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 231 LATIN AMERICA: GREEN DATA CENTER MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 232 LATIN AMERICA: GREEN DATA CENTER MARKET, BY SERVICES, 2020-2024 (USD MILLION)

- TABLE 233 LATIN AMERICA: GREEN DATA CENTER MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 234 LATIN AMERICA: GREEN DATA CENTER MARKET, BY DATA CENTER SIZE & CAPACITY, 2020-2024 (USD MILLION)

- TABLE 235 LATIN AMERICA: GREEN DATA CENTER MARKET, BY DATA CENTER SIZE & CAPACITY, 2025-2030 (USD MILLION)

- TABLE 236 LATIN AMERICA: GREEN DATA CENTER MARKET, BY DATA CENTER TYPE, 2020-2024 (USD MILLION)

- TABLE 237 LATIN AMERICA: GREEN DATA CENTER MARKET, BY DATA CENTER TYPE, 2025-2030 (USD MILLION)

- TABLE 238 LATIN AMERICA: GREEN DATA CENTER MARKET, BY ENTERPRISE DATA CENTER, 2020-2024 (USD MILLION)

- TABLE 239 LATIN AMERICA: GREEN DATA CENTER MARKET, BY ENTERPRISE DATA CENTER, 2025-2030 (USD MILLION)

- TABLE 240 LATIN AMERICA: GREEN DATA CENTER MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 241 LATIN AMERICA: GREEN DATA CENTER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 242 BRAZIL: GREEN DATA CENTER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 243 BRAZIL: GREEN DATA CENTER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 244 MEXICO: GREEN DATA CENTER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 245 MEXICO: GREEN DATA CENTER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 246 REST OF LATIN AMERICA: GREEN DATA CENTER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 247 REST OF LATIN AMERICA: GREEN DATA CENTER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 248 OVERVIEW OF STRATEGIES ADOPTED BY KEY VENDORS

- TABLE 249 MARKET SHARE OF KEY VENDORS, 2024

- TABLE 250 GREEN DATA CENTER MARKET: REGION FOOTPRINT

- TABLE 251 GREEN DATA CENTER MARKET: COMPONENT FOOTPRINT

- TABLE 252 GREEN DATA CENTER MARKET: DATA CENTER TYPE FOOTPRINT

- TABLE 253 GREEN DATA CENTER MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 254 GREEN DATA CENTER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 255 GREEN DATA CENTER MARKET: PRODUCT LAUNCHES, JANUARY 2022-AUGUST 2025

- TABLE 256 GREEN DATA CENTER MARKET: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 257 GREEN DATA CENTER MARKET: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 258 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 259 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

- TABLE 261 SCHNEIDER ELECTRIC: DEALS

- TABLE 262 VERTIV: COMPANY OVERVIEW

- TABLE 263 VERTIV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 264 VERTIV: PRODUCT LAUNCHES

- TABLE 265 VERTIV: DEALS

- TABLE 266 EATON: COMPANY OVERVIEW

- TABLE 267 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 268 EATON: PRODUCT LAUNCHES

- TABLE 269 EATON: DEALS

- TABLE 270 DAIKIN: COMPANY OVERVIEW

- TABLE 271 DAIKIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 272 DAIKIN: PRODUCT LAUNCHES

- TABLE 273 DAIKIN: DEALS

- TABLE 274 ABB: COMPANY OVERVIEW

- TABLE 275 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 276 ABB: PRODUCT LAUNCHES

- TABLE 277 ABB: DEALS

- TABLE 278 DELTA ELECTRONICS: COMPANY OVERVIEW

- TABLE 279 DELTA ELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 280 DELTA ELECTRONICS: PRODUCT LAUNCHES

- TABLE 281 DELTA ELECTRONICS: DEALS

- TABLE 282 DELTA ELECTRONICS: EXPANSIONS

- TABLE 283 CARRIER: COMPANY OVERVIEW

- TABLE 284 CARRIER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 CARRIER: PRODUCT LAUNCHES

- TABLE 286 CARRIER: DEALS

- TABLE 287 SIEMENS: COMPANY OVERVIEW

- TABLE 288 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 SIEMENS: PRODUCT LAUNCHES

- TABLE 290 SIEMENS: DEALS

- TABLE 291 GE VERNOVA: COMPANY OVERVIEW

- TABLE 292 GE VERNOVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 293 GE VERNOVA: PRODUCT LAUNCHES

- TABLE 294 GE VERNOVA: DEALS

- TABLE 295 STULZ GMBH: COMPANY OVERVIEW

- TABLE 296 STULZ GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 297 STULZ GMBH: PRODUCT LAUNCHES

- TABLE 298 STULZ GMBH: DEALS

- TABLE 299 STULZ GMBH: EXPANSIONS

- TABLE 300 DATA CENTER COOLING MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 301 DATA CENTER COOLING MARKET, BY COMPONENT, 2025-2032 (USD BILLION)

- TABLE 302 DATA CENTER SOLUTIONS MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 303 DATA CENTER SOLUTIONS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

List of Figures

- FIGURE 1 GREEN DATA CENTER MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 GREEN DATA CENTER MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF GREEN DATA CENTER VENDORS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - (SUPPLY SIDE): ILLUSTRATION OF VENDOR REVENUE ESTIMATION

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM OFFERINGS

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): GREEN DATA CENTER MARKET

- FIGURE 9 GLOBAL GREEN DATA CENTER MARKET TO WITNESS SIGNIFICANT GROWTH

- FIGURE 10 FASTEST-GROWING SEGMENTS IN GREEN DATA CENTER MARKET, 2025-2030

- FIGURE 11 GREEN DATA CENTER MARKET: REGIONAL SNAPSHOT

- FIGURE 12 RISING SUSTAINABILITY DEMANDS AND AI WORKLOADS TO ACCELERATE MARKET GROWTH

- FIGURE 13 INFRASTRUCTURE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 14 LARGE & HYPERSCALE DATA CENTERS (50 MW & ABOVE) SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 CLOUD & HYPERSCALE DATA CENTERS TO HOLD SIGNIFICANT SHARE DURING FORECAST PERIOD

- FIGURE 16 TECHNOLOGY & SOFTWARE SEGMENT TO HOLD SIGNIFICANT SHARE DURING FORECAST PERIOD

- FIGURE 17 NORTH AMERICA TO EMERGE AS LARGEST MARKET FOR NEXT FIVE YEARS

- FIGURE 18 GREEN DATA CENTER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 GREEN DATA CENTER ECOSYSTEM

- FIGURE 20 GREEN DATA CENTER MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 21 GREEN DATA CENTER MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 23 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 24 PRICING RANGE OF DATA-CENTER UPS FOR HYPERSCALE DEPLOYMENTS, BY KEY PLAYER, 2024

- FIGURE 25 NUMBER OF PATENTS GRANTED IN LAST 10 YEARS, 2015-2025

- FIGURE 26 EXPORT SCENARIO FOR HS CODE 8419, BY COUNTRY, 2022-2024 (USD THOUSAND)

- FIGURE 27 IMPORT SCENARIO FOR HS CODE 8419, BY COUNTRY, 2022-2024 (USD THOUSAND)

- FIGURE 28 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 29 MARKET POTENTIAL OF GENERATIVE AI IN ENHANCING GREEN DATA CENTER ACROSS KEY USE CASES

- FIGURE 30 GREEN DATA CENTER MARKET: INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- FIGURE 31 INFRASTRUCTURE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 32 LARGE & HYPERSCALE DATA CENTER SEGMENT TO HOLD MAJOR MARKET SHARE

- FIGURE 33 CLOUD & HYPERSCALE DATA CENTER SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 34 BFSI SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 35 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 37 EUROPE: MARKET SNAPSHOT

- FIGURE 38 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 39 MIDDLE EAST & AFRICA: MARKET SNAPSHOT

- FIGURE 40 LATIN AMERICA: MARKET SNAPSHOT

- FIGURE 41 REVENUE ANALYSIS OF KEY VENDORS, 2020-2024

- FIGURE 42 GREEN DATA CENTER MARKET: MARKET SHARE ANALYSIS, 2024

- FIGURE 43 GREEN DATA CENTER MARKET: VENDOR PRODUCT/BRAND COMPARISON

- FIGURE 44 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 45 GREEN DATA CENTER MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 46 GREEN DATA CENTER MARKET: COMPANY FOOTPRINT

- FIGURE 47 EVALUATION MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 48 GREEN DATA CENTER MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 49 COMPANY VALUATION OF KEY VENDORS

- FIGURE 50 FINANCIAL METRICS OF KEY VENDORS

- FIGURE 51 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 52 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 53 VERTIV: COMPANY SNAPSHOT

- FIGURE 54 EATON: COMPANY SNAPSHOT

- FIGURE 55 DAIKIN: COMPANY SNAPSHOT

- FIGURE 56 ABB: COMPANY SNAPSHOT

- FIGURE 57 DELTA ELECTRONICS: COMPANY SNAPSHOT

- FIGURE 58 CARRIER: COMPANY SNAPSHOT

- FIGURE 59 SIEMENS: COMPANY SNAPSHOT

- FIGURE 60 GE VERNOVA: COMPANY SNAPSHOT