PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849951

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849951

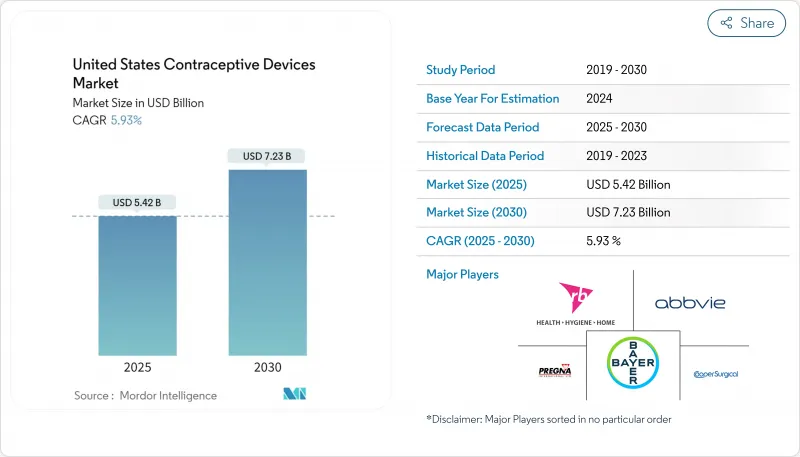

U.S. Contraceptive Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United States contraceptive devices market is valued at USD 5.39 billion in 2025 and is on track to hit USD 7.12 billion by 2030, supported by a 5.71% CAGR during the forecast period.

Growth holds steady despite post-Dobbs regulatory turbulence as consumers place higher priority on reproductive autonomy, Medicaid reimbursement expands, and employer-sponsored benefits add momentum. Long-acting reversible contraceptives (LARCs) gain popularity because of superior efficacy and convenience, while direct-to-consumer channels and telehealth streamline access and limit the need for in-person visits. Technology upgrades, such as less-painful IUD insertion tools, address historic barriers to uptake and broaden appeal beyond traditional demographics. Parallel investment in male contraceptive R&D signals an evolving view of shared responsibility, and retail pharmacies solidify their role as pivotal access points even as online platforms post the fastest growth. Ongoing litigation linked to IUD adverse events and cultural pushback in select regions temper, but do not derail, overall demand.

U.S. Contraceptive Devices Market Trends and Insights

Expansion of Medicaid Reimbursement Drives Equitable Access

The August 2024 CMS bulletin obliges states to cover family-planning services without cost-sharing, smoothing the path to LARC uptake. A JAMA Health Forum study linked separate postpartum LARC reimbursement with a 1.58 percentage-point jump in overall LARC use within 60 days after delivery, underscoring how policy shifts remove long-standing cost barriers for underserved groups.

LARCs Gain Momentum as Preferred Contraceptive Choice

Post-Dobbs demand for longer-term protection pushes more consumers toward IUDs and implants. The Bixby Center reported higher LARC requests, while Tulsa County's Take Control Initiative distributed 2,855 IUDs and implants in 2024, reflecting heightened awareness of cost-effectiveness and reliability.

Post-Dobbs Regulatory Uncertainty Creates Access Challenges

States with full abortion bans saw a 65% plunge in emergency contraceptive fills one year after Dobbs, along with a 25.6% fall in oral contraceptive prescriptions, stoking confusion among providers about legal parameters and hindering timely dispensing.

Other drivers and restraints analyzed in the detailed report include:

- Technological Innovation Enhances User Experience

- Telehealth Transforms Contraceptive Access

- IUD Litigation Dampens Market Confidence

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Condoms retain the largest single-device foothold at 31.36%, yet hormonal IUDs deliver the highest projected growth at 8.43% CAGR through 2030 as users shift toward longer-term solutions. The United States contraceptive devices market size for IUDs is expanding as CDC's 2024 practice recommendations streamline placement protocols and emphasize equitable care. Copper IUD innovation accelerates with Sebela's MIUDELLA, the first hormone-free system cleared in four decades. Niche barrier devices such as diaphragms and cervical caps serve consumers seeking on-demand, non-hormonal protection, while Evofem's Phexxi gel re-energizes interest in hormone-free vaginal options.

Non-hormonal methods preserved a 54.56% lead in 2024, anchored by condom ubiquity and copper-based devices. Hormonal alternatives, however, are climbing at 7.98% CAGR as advanced delivery systems lower systemic exposure and side-effects. Bayer and Dare's ferrous gluconate ring exemplifies innovation aimed at combining convenience with lower hormonal loads. Meanwhile, research into shape-adaptive IUD frames crafted from zinc or iron reflects the market's appetite for hormone-free designs that still guarantee robust contraception.

U. S. Contraceptive Devices Market is Segmented by Device Type (Condoms, Intra-Uterine Devices, Vaginal Rings, Subdermal Implants and More), Technology (Hormonal Devices and Non-Hormonal Devices), Gender (Male and Female), End User (Home-Care / Individual Users, Hospitals and More) and Distribution Channel (Retail Pharmacies & Drug Stores, Hospital Pharmacies and More). The Market and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- The Cooper Companies

- Bayer

- Teva Pharmaceutical Industries

- Church & Dwight Co., Inc. (Trojan)

- Reckitt Benckiser Group plc (Durex)

- Abbvie

- Pfizer

- Viatris

- Pregna International Ltd.

- DKT International

- Evofem Biosciences, Inc.

- Agile Therapeutics, Inc.

- Perrigo(HRA Pharma)

- Veru

- HLL Lifecare Ltd.

- Femcap Inc.

- Okamoto Industries, Inc.

- Mayne Pharma Commercial LLC

- Amneal Pharmaceuticals

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of Medicaid Reimbursement for Contraceptive Devices Coupled with Employer-Sponsored Contraception Benefits Expansion (Post-2023)

- 4.2.2 Accelerating Adoption of Long-Acting Reversible Contraceptives (LARC)

- 4.2.3 Technological Advancements in IUD Insertion & Delivery Systems

- 4.2.4 Direct-to-Consumer & Telehealth Platforms Boosting Device Sales

- 4.2.5 Campaigns Targeting Teen Pregnancy Prevention and Unwanted Pregnancy

- 4.2.6 Increasing Focus on Women's Health and Growing male Contraceptive R&D

- 4.3 Market Restraints

- 4.3.1 Regulatory Uncertainty After Dobbs Decision Affecting Access

- 4.3.2 Recalls and Litigation Linked to IUD Adverse Events

- 4.3.3 Cultural and Religious Opposition in Specific Demographics

- 4.3.4 Limited Insurance Coverage for New and Premium Contraceptive Devices

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Device Type

- 5.1.1 Condoms

- 5.1.2 Intra-Uterine Devices (Copper IUD, Hormonal IUD)

- 5.1.3 Vaginal Rings

- 5.1.4 Subdermal Implants

- 5.1.5 Diaphragms

- 5.1.6 Cervical Caps

- 5.1.7 Sponges

- 5.1.8 Other Devices (Patches, Gel-Based Barriers)

- 5.2 By Technology

- 5.2.1 Hormonal Devices

- 5.2.2 Non-Hormonal Devices

- 5.3 By Gender

- 5.3.1 Male

- 5.3.2 Female

- 5.4 By End User

- 5.4.1 Home-care / Individual Users

- 5.4.2 Hospitals

- 5.4.3 Clinics and Community Health Centers

- 5.4.4 Specialty and Ambulatory Surgery Centers

- 5.5 By Distribution Channel

- 5.5.1 Retail Pharmacies and Drug Stores

- 5.5.2 Hospital Pharmacies

- 5.5.3 Online Channels and Direct-to-Consumer Platforms

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 CooperSurgical Inc.

- 6.4.2 Bayer AG

- 6.4.3 Teva Pharmaceutical Industries Ltd

- 6.4.4 Church & Dwight Co., Inc. (Trojan)

- 6.4.5 Reckitt Benckiser Group plc (Durex)

- 6.4.6 AbbVie Inc.

- 6.4.7 Pfizer Inc.

- 6.4.8 Viatris Inc.

- 6.4.9 Pregna International Ltd.

- 6.4.10 DKT International

- 6.4.11 Evofem Biosciences, Inc.

- 6.4.12 Agile Therapeutics, Inc.

- 6.4.13 Perrigo(HRA Pharma)

- 6.4.14 Veru Inc.

- 6.4.15 HLL Lifecare Ltd.

- 6.4.16 Femcap Inc.

- 6.4.17 Okamoto Industries, Inc.

- 6.4.18 Mayne Pharma Commercial LLC

- 6.4.19 Amneal Pharmaceuticals Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment