PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849960

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849960

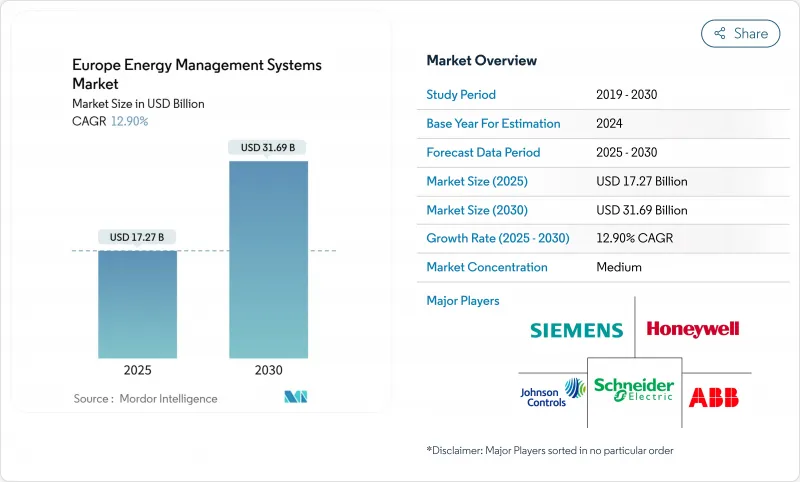

Europe Energy Management Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe energy management systems market reached USD 17.27 billion in 2025 and is projected to attain USD 31.69 billion by 2030, reflecting a 12.9% CAGR.

Digital-first grid upgrades, Fit-for-55 mandates, and accelerating corporate net-zero targets collectively underpin this expansion, moving the technology from discretionary spend to infrastructure necessity. Rapid smart-grid modernization, worth EUR 584 billion in planned electricity investments, is triggering widespread demand for software-centric optimization platforms. Building-level artificial-intelligence tools are unlocking 30% energy-intensity cuts, turning facilities into active grid nodes. Germany anchors early adoption on the back of 80% renewable-power goals, while Spain's smart-home boom sets the pace for residential scale-up. Competitive intensity is rising as vendors race to integrate predictive analytics and cybersecurity by design.

Europe Energy Management Systems Market Trends and Insights

Growing deployment of smart-grid infrastructure

EU utilities plan EUR 584 billion of grid spending by 2030, with EUR 170 billion earmarked for digitalization that depends on robust EMS platforms. Distributed renewables, vehicle-to-grid flows, and virtual substations require real-time orchestration, elevating EMS from cost-saver to grid-critical asset. Schneider Electric's Virtual Substation rollout at Enlit 2024 illustrates vendor positioning for two-way power architectures. Buildings now supply flexibility services, creating reciprocal data loops between HEMS and distribution system operators. GridX forecasts an 11-fold expansion of European residential EMS by 2030 as interoperability standards mature via-tt.com.

EU "Fit-for-55" energy-efficiency mandates

The revised Energy Performance of Buildings Directive enforces zero-emission construction by 2030 and stepwise upgrades for worst-performing stock, making EMS functionality a compliance prerequisite. Mandatory whole-life-carbon assessments drive integrated monitoring across HVAC, lighting, and on-site renewables. Spain's transposition through its National Integrated Energy and Climate Plan is already lifting building-automation software 17.21% annually, translating regulatory urgency directly into sales pipelines. Solutions that bundle data logging, analytics, and reporting shorten audit cycles and de-risk certification.

Fragmented country-level building codes

Despite an EU-level directive, divergent national rules compel suppliers to customise certifications and interfaces, inflating project lifecycles. Germany's standards depart materially from those in Spain and Italy, compelling multi-country vendors to run parallel development tracks. The voluntary Code of Conduct for Energy Smart Appliances seeks to align protocols yet lacks enforcement teeth. Smaller firms without regulatory specialists can struggle to compete, nudging consolidation.

Other drivers and restraints analyzed in the detailed report include:

- Corporate net-zero targets accelerating EMS adoption

- Building-level AI/ML optimization of HVAC loads

- Skill-set shortage for advanced analytics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Building Energy Management Systems (BEMS) captured 45.3% of the Europe energy management systems market share in 2024, reflecting mandated zero-emission targets for commercial real estate. The Europe energy management systems market size tied to BEMS is expected to climb steadily as office and retail chains retrofit HVAC, lighting, and on-site storage for grid services. Vendors bundle demand-response modules with supervisory controls, positioning buildings as flexibility assets. Home Energy Management Systems (HEMS) post the swiftest 13.1% CAGR, propelled by Spain's plan to make 3.8 million homes smart by 2025. AI-ready dashboards and mobile apps drive consumer uptake, and utility rebates further sweeten paybacks. GridX's projection of 11-fold HEMS expansion by 2030 dovetails with EU prosumer incentives, underlining residential disruption potential.

The industrial EMS niche grows off a smaller base, serving energy-intensive sectors chasing scope 1 abatements. Data-center EMS and smart-city platforms populate the "others" bucket, where latency-sensitive optimisation gains traction. Cross-segment convergence is visible; BEMS suppliers integrate microgrid controllers while HEMS apps expose EV-to-home and VPP participation features.

Hardware claimed 42.7% of 2024 revenue, underlining the need for meters, gateways, and controllers before analytics can flourish. Yet software leads growth at 14.3% CAGR, mirroring the Europe energy management systems market's pivot to cloud and AI value layers. Fast-evolving SaaS packages unlock predictive maintenance, carbon accounting, and tariff-adaptive scheduling. The Europe energy management systems market size attached to software is forecast to broaden as subscription models replace perpetual licences, easing capital constraints.

Services installation, retro-commissioning, and managed optimisation fill the talent void discussed earlier. Vendors cross-sell advisory offerings to sustain margins as hardware commoditises. Johnson Controls' analytics-heavy Metasys 14.0 exemplifies the move from static dashboards to continuous-improvement engines, blurring the line between software and service.

Europe Energy Management Systems Market is Segmented by Solution Type (Building Energy Management Systems (BEMS), Home Energy Management Systems (HEMS), and More), Component (Hardware, Software, and Services), Deployment Mode (On-Premises and Cloud-Based), End-User (Commercial and Retail, Residential, and More), and by Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Schneider Electric SE

- Siemens AG

- Honeywell International Inc.

- ABB Ltd

- Johnson Controls International plc

- Panasonic Holdings Corp.

- Enel X S.r.l.

- Uplight Inc.

- SAP SE

- British Gas Services (Centrica plc)

- Green Energy Options Ltd

- Efergy Technologies SL

- Cisco Systems Inc.

- IBM Corporation

- Eaton Corporation plc

- Rockwell Automation Inc.

- ENGIE Digital

- Landis+Gyr AG

- Delta Electronics Inc.

- Trane Technologies plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing deployment of smart-grid infrastructure

- 4.2.2 EU Fit-for-55" energy-efficiency mandates"

- 4.2.3 Corporate net-zero targets accelerating EMS adoption

- 4.2.4 Building-level AI/ML optimisation of HVAC loads

- 4.2.5 Rise of flexibility markets and demand-response revenues

- 4.2.6 Edge-to-cloud cybersecurity toolkits reducing project risk

- 4.3 Market Restraints

- 4.3.1 Fragmented country-level building codes

- 4.3.2 Skill-set shortage for advanced analytics

- 4.3.3 Inter-operability gaps across legacy BMS protocols

- 4.3.4 Inflation-driven capex deferrals in SMB segment

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

- 4.8 Assesment of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Solution Type

- 5.1.1 Building Energy Management Systems (BEMS)

- 5.1.2 Home Energy Management Systems (HEMS)

- 5.1.3 Industrial/Manufacturing EMS (IEMS)

- 5.1.4 Others

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.3 By Deployment Mode

- 5.3.1 On-premise

- 5.3.2 Cloud-based

- 5.4 By End-User

- 5.4.1 Commercial and Retail

- 5.4.2 Residential

- 5.4.3 Industrial Facilities

- 5.4.4 Healthcare

- 5.4.5 Others

- 5.5 By Country

- 5.5.1 United Kingdom

- 5.5.2 Germany

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Benelux

- 5.5.7 Nordics

- 5.5.8 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Schneider Electric SE

- 6.4.2 Siemens AG

- 6.4.3 Honeywell International Inc.

- 6.4.4 ABB Ltd

- 6.4.5 Johnson Controls International plc

- 6.4.6 Panasonic Holdings Corp.

- 6.4.7 Enel X S.r.l.

- 6.4.8 Uplight Inc.

- 6.4.9 SAP SE

- 6.4.10 British Gas Services (Centrica plc)

- 6.4.11 Green Energy Options Ltd

- 6.4.12 Efergy Technologies SL

- 6.4.13 Cisco Systems Inc.

- 6.4.14 IBM Corporation

- 6.4.15 Eaton Corporation plc

- 6.4.16 Rockwell Automation Inc.

- 6.4.17 ENGIE Digital

- 6.4.18 Landis+Gyr AG

- 6.4.19 Delta Electronics Inc.

- 6.4.20 Trane Technologies plc

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK