PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850024

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850024

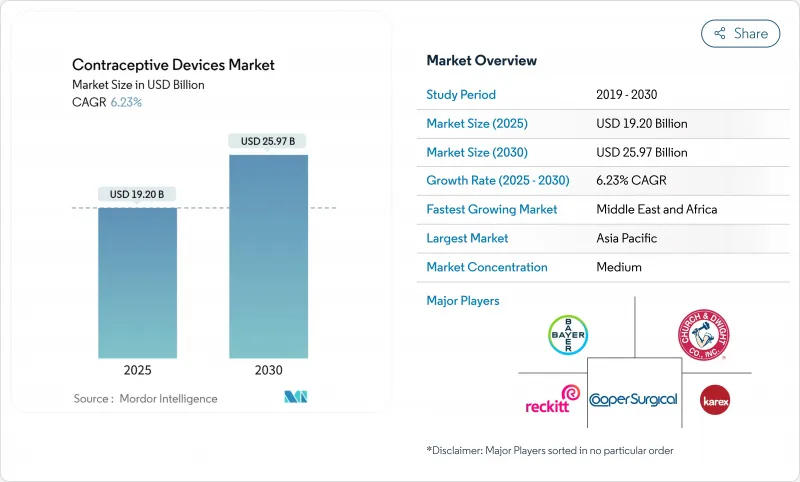

Contraceptive Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The contraceptive devices market stands at USD 19.20 billion in 2025 and is projected to reach USD 25.97 billion by 2030, advancing at a 6.23% CAGR.

Demand gains pace as governments broaden family-planning programs, digital health tools expand access, and dual-protection products answer the twin challenges of unintended pregnancy and sexually transmitted infections. Long-acting reversible contraceptives (LARCs) post robust uptake, online direct-to-consumer models compress time between intent and purchase, and material innovation responds to latex-sensitivity concerns. Technology platforms that integrate wireless control, real-time monitoring, and personalized dosing reshape user expectations, while policy moves that lift cost-sharing hurdles spur broader coverage. Competitive intensity rises as multinational device makers and emerging FemTech firms race to close white spaces in non-hormonal, smart, and multipurpose prevention technologies, elevating product diversity within the contraceptive devices market.

Global Contraceptive Devices Market Trends and Insights

Growing Preference for Long-Acting Reversible Contraceptives (LARC)

LARC usage in the United States climbed from 2% in 2002 to 16% by 2019 and continues to rise through 2025, reflecting superior efficacy and convenience. Health-system initiatives that authorize nurses to place implants and IUDs in single-visit encounters remove access frictions and lower unintended pregnancy costs. Medicaid reimbursement reforms in 37 states cover same-day insertions, reducing high upfront outlays for low-income users. Training curricula covering counseling and insertion techniques now appear in 65% of medical schools, narrowing provider knowledge gaps. Economic studies suggest that every percentage-point shift from short-acting methods to LARCs yields measurable savings by preventing costly unplanned births. These factors elevate LARC penetration, thereby underpinning revenue expansion within the contraceptive devices market.

High Burden of Sexually Transmitted Disease and Rising Awareness

Surveillance in New York City showed upticks in chlamydia and gonorrhea cases in 2023, most pronounced among Black and Latina youth.The epidemiological pattern drives interest in multipurpose prevention technologies that block infection and pregnancy in one device. Prototypes include female condoms imbued with antimicrobial agents and vaginal rings releasing antiviral compounds alongside hormones, now progressing through trials under WHO coordination who.int. Public-health campaigns that spotlight dual-protection benefits boost condom and barrier sales, while research grants stimulate agile startups developing microbicidal coatings. Heightened risk perception therefore accelerates demand, enlarging the contraceptive devices market.

Cultural and Religious Opposition to Sterile Barrier Methods

Modern contraceptive uptake in Saudi Arabia reached 46% in 2023, yet community norms still discourage barrier methods for married women, limiting condom and diaphragm penetration.Recent legal reforms that prohibit marriage under 18 signal gradual attitudinal shifts, but long-standing beliefs continue to impede adoption across parts of the Middle East & Africa. Faith-based organizations often wield influence over reproductive choices, necessitating culturally tailored advocacy to recalibrate perceptions. Without such engagement, usage gaps persist, tempering growth prospects in these high-population markets within the contraceptive devices market.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advancements and Product Innovation

- Rapid Adoption of Telemedicine & Subscription-Based Direct-to-Consumer Platforms

- Lower Physician Confidence for Certain Contraceptive Options

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Male condoms captured 40.9% of the contraceptive devices market share in 2024 thanks to affordability, accessibility, and dual-protection features.[3] Perfect use offers 98% efficacy, but real-world effectiveness drops to 87% due to inconsistent or incorrect application. Nevertheless, rising latex-allergy awareness, interest in enhanced sensation, and digital ordering conveniences sustain steady volume. In parallel, implant sales climb at a 9.8% CAGR to 2030, underpinning a notable slice of the contraceptive devices market size for long-acting methods. Wireless-enabled implants and biodegradable variants reduce clinic visits, encourage first-time adoption, and mitigate removal barriers, reinforcing their growth momentum.

Development pipelines underscore broadening choices. Hormonal IUDs deliver non-contraceptive benefits such as lighter bleeding, bolstering uptake among women who previously avoided device-based options. Single-handed inserters launched in 2024 streamline placement, decreasing procedure time and pain signals. Vaginal rings advance through trials with both hormonal and non-hormonal compositions; the investigational monthly Ovaprene ring demonstrated strong post-coital reductions in motile sperm. Each innovation diversifies method mix, cushioning revenue streams across the contraceptive devices market.

The male cohort accounted for 54.2% of 2024 sales, yet condom usage among European adolescents slipped to 61% in the latest WHO survey, hinting at plateauing penetration.The female segment is forecast to outpace at a 7.4% CAGR, reflecting greater decision autonomy, discreet options, and device personalization. Smart rings that pair with apps for dosage tracking and biodegradable implants, appealing to long-term planners, broaden method portfolios. Multipurpose prevention devices that marry pregnancy avoidance with antimicrobial protections resonate with women prioritizing holistic sexual health, enlarging the contraceptive devices market size for female-targeted products.

Emergent FemTech solutions enable self-administration and real-time data capture, compelling insurers to recognize patient-generated metrics in coverage decisions. As urbanization and workforce participation rates climb, the convenience value of low-maintenance methods rises, further lifting female segment revenues within the contraceptive devices market.

The Contraceptive Devices Market Report is Segmented by Type (Male Condoms, Female Condoms, Intra-Uterine Device, Contraceptive Implants, and More), Gender (Male and Female), Material (Latex and Non-Latex), Distribution Channel (Hospital and Specialty Clinics, Retail Pharmacies and Drug Stores and More) and Geography (North America, Europe, Asia-Pacific and More). The Market and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 31.8% of revenues in 2024, propelled by large reproductive-age populations, declining fertility intentions, and strengthened public health budgets. Country programs in China, India, and Indonesia deploy postpartum LARC initiatives, rural outreach, and digital education campaigns, narrowing urban-rural usage gaps. However, disparities linger among adolescents and marginalized groups, creating addressable pockets of unmet need that extend runway for the contraceptive devices market.

The Middle East and Africa region is forecast to grow at an 8.7% CAGR through 2030. Saudi Arabia's adolescent birth rate fell from 8.65 per 1,000 in 2009 to 8.28 in 2021 after education and youth empowerment investments. Partnerships such as Bayer and UNFPA Egypt target 810,000 women by 2028 with modern devices, illustrating how multilateral funding accelerates adoption. Despite cultural constraints, improving female literacy and employment weave a supportive backdrop for the contraceptive devices market.

North America and Europe exhibit high method diversity, favorable reimbursement, and rapid uptake of innovative devices. FDA approvals of single-handed IUD inserters and ongoing subsidy expansions under the Affordable Care Act elevate accessibility. Latin America faces persistent adolescent pregnancy costs estimated at USD 15.3 billion per year, catalyzing national health ministries to promote LARC usage among teenagers. Region-wide campaigns that highlight over-99% efficacy of IUDs and implants aim to curb unintended births, bolstering the contraceptive devices market.

- AbbVie plc (Allergan)

- Bayer

- The Cooper Companies

- Viatris

- Amneal Pharmaceuticals

- DKT International

- Pregna International Ltd.

- Reckitt Benckiser Group

- Karex Berhad

- Church & Dwight

- Okamoto Industries Inc.

- HLL Lifecare Ltd.

- KESSEL medintim GmbH

- Mithra Pharmaceuticals SA

- Mayer Laboratories

- LifeStyles Healthcare Pte Ltd.

- KESSEL medintim GmbH

- Femcap Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Preference for Long-Acting Reversible Contraceptives (LARC)

- 4.2.2 High Burden of Sexually Transmitted Disease (STD) and Rising Awareness About STD

- 4.2.3 Initiatives Taken By Government and Private Firms

- 4.2.4 Technological Advancements and Product Innovation

- 4.2.5 High Rate of Unintended Pregnancies and Delayed Family Planning

- 4.2.6 Rapid Adoption of Telemedicine & Subscription-Based Direct-to-Consumer Platforms

- 4.3 Market Restraints

- 4.3.1 Cultural & Religious Opposition to Sterile Barrier Methods

- 4.3.2 Lower Physician Confidence for Certain Contraceptive Options

- 4.3.3 Product Litigation Issues

- 4.3.4 Stringent Regulatory Scenario

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 Non-Latex (Polyurethane, Poly-isoprene and others)

- 5.1.1 Female Condoms

- 5.1.2 Intra-Uterine Devices (IUD)

- 5.1.2.1 Hormonal IUD

- 5.1.2.2 Copper IUD

- 5.1.3 Contraceptive Implants

- 5.1.4 Vaginal Rings

- 5.1.5 Diaphragms and Cervical Caps

- 5.1.6 Contraceptive Sponges

- 5.2 By Gender

- 5.2.1 Male

- 5.2.2 Female

- 5.3 By Material

- 5.3.1 Latex

- 5.3.2 Non-Latex

- 5.4 By Distribution Channel

- 5.4.1 Hospital and Specialty Clinics

- 5.4.2 Retail Pharmacies and Drug Stores

- 5.4.3 Online Pharmacies and D2C Platforms

- 5.4.4 NGO and Government Programmes

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AbbVie plc (Allergan)

- 6.4.2 Bayer AG

- 6.4.3 Cooper Surgical Inc.

- 6.4.4 Viatris Inc.

- 6.4.5 Amneal Pharmaceuticals LLC

- 6.4.6 DKT International

- 6.4.7 Pregna International Ltd.

- 6.4.8 Reckitt Benckiser Group plc

- 6.4.9 Karex Berhad

- 6.4.10 Church & Dwight Co. Inc.

- 6.4.11 Okamoto Industries Inc.

- 6.4.12 HLL Lifecare Ltd.

- 6.4.13 KESSEL medintim GmbH

- 6.4.14 Mithra Pharmaceuticals SA

- 6.4.15 Mayer Laboratories Inc.

- 6.4.16 LifeStyles Healthcare Pte Ltd.

- 6.4.17 KESSEL medintim GmbH

- 6.4.18 Femcap Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment