PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850200

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850200

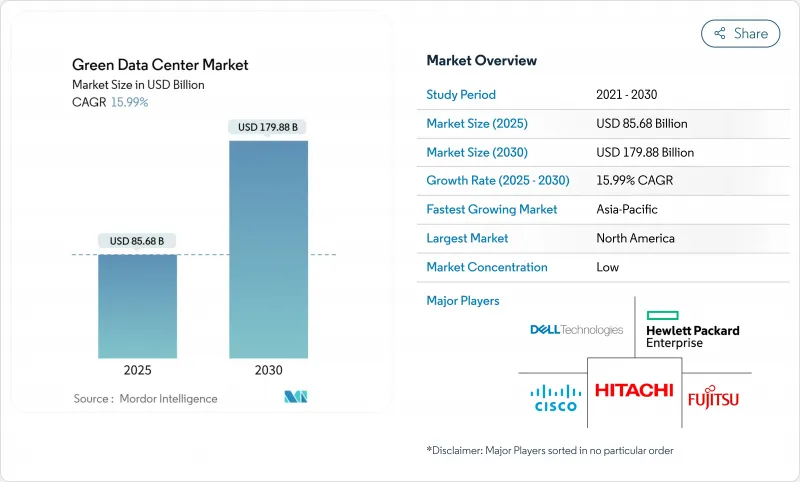

Green Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The green data center market stood at USD 85.68 billion in 2025 and is on track to reach USD 179.88 billion by 2030, reflecting a 15.99% CAGR.

Operators are accelerating capital deployment into renewable power purchase agreements, liquid-to-chip cooling, and AI-enabled energy-management software to curb escalating electricity costs while meeting tightening ESG mandates. Hyperscale cloud providers influence technology standards by pre-booking multi-gigawatt renewable portfolios and publishing open-source liquid-cooling reference designs that colocation players later adopt. Regulatory bodies in OECD economies now benchmark facilities to a <=1.3 PUE, prompting rapid retrofits and new-build designs that integrate waste-heat reuse and hydrogen-ready power systems. Investment appetite also benefits from premium pricing of location-based renewable-energy credits, which offsets a portion of up-front capital premiums for green builds, while AI workload growth sustains demand for high-density campuses equipped with low-GWP refrigerants.

Global Green Data Center Market Trends and Insights

Hyperscale Cloud Build-outs Shifting to 100% Renewable Power

The green data center market is benefiting from hyperscale operators that now contract for wind, solar, and battery-hybrid projects sized well beyond their direct consumption. Amazon achieved company-wide 100% renewable energy in 2024, Microsoft has pledged carbon-negative operations by 2030, and Google channels surplus renewable power into municipal district-heating projects that further monetise waste heat. These strategies help operators lock in price-stable electricity, create hedging income through renewable-energy credit sales, and establish procurement templates that colocation landlords subsequently follow

Regulatory Push for PUE <= 1.3 Across OECD Economies

New directives in the EU and updated U.S. energy codes require transparent reporting of PUE, water-usage effectiveness, and carbon intensity. Germany's Energy Efficiency Act mandates cooling-efficiency disclosures, while AWS reported a global PUE of 1.15 in 2024, proving compliance is feasible when AI-based workload scheduling and liquid cooling are combined. Operators that retrofit early capture cost savings from lower fan energy and reduced mechanical redundancy, improving competitiveness during colocation contract renewals. Penalties for non-compliance increase each fiscal year, creating a near-term rush to commission energy-efficient equipment.

Up-front CAPEX Premium (30-40%) Versus Brownfield Retrofits

High-performance insulation, structured cabling rated for immersion-cooled racks, and on-site solar plus storage systems inflate build costs by as much as 40% relative to conventional shells. Construction inputs such as low-carbon concrete and phase-change thermal walls remain supply-constrained in 2025, adding schedule risk to green data center market deployments. Smaller operators often pivot to incremental efficiency retrofits instead of full green builds, slowing overall capacity additions until component prices normalise.

Other drivers and restraints analyzed in the detailed report include:

- On-site Hydrogen Fuel-Cell Pilots in Greater than 10 MW Campuses (2025-2028)

- AI-workload Waste-Heat Reuse for District Heating Networks

- Limited Green-Power Grid Capacity in Emerging Economies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions generated 63.2% of 2024 revenue, underpinning the green data center market size leadership in capital intensity. Operators prioritised power-conditioning gear, heat-recovery chillers, and artificial-intelligence DCIM software to satisfy efficiency mandates, while liquid-to-chip cooling lines experienced double-digit unit shipment growth. Services, though smaller in absolute value, are forecast for 15.7% CAGR as facility owners engage specialists for lifecycle sustainability audits, AI-driven workload orchestration, and ESG reporting.

Power-train upgrades, including 98%-efficient UPS modules and smart grid interfaces, strengthened resilience and trimmed operating costs. Cooling solutions shifted from raised-floor air handlers to rear-door heat exchangers coupled with warm-water loops. On the services side, integration partners now bundle carbon accounting dashboards and renewable-certificate trading platforms. This professionalisation of sustainability management marks a structural uplift in the green data center industry.

Colocation firms held 37.2% of 2024 spending as enterprises continued outsourcing strategies, yet hyperscalers outpaced the field with a 16.5% CAGR, enlarging the overall green data center market size for self-owned capacity. Their billion-dollar renewable PPAs and custom-designed immersion systems set technology adoption curves that trickle down into retail colocation suites.

Enterprise operators remained steady, refreshing brownfield assets with containment pods and modular battery storage to meet board-level emissions targets. Edge micro-facilities, though nascent, adopted passive cooling and solar-powered UPS to support 5G cell-site processing. The procurement heft of cloud majors keeps component suppliers' cost curves descending, indirectly lowering barriers for second-tier providers.

Green Data Center Market is Segmented by Component (Service, Solution), Data Center Type (Colocation Providers, Hyperscalers/Cloud Service Providers, Enterprise, and Edge), Tier Type (Tier 1 and 2, Tier 3, Tier 4), Industry Vertical (Healthcare, BFSI, Government and More) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 26.5% revenue in 2024, buttressed by reliable renewable generation, robust tax incentives, and hyperscale activity clustering around Virginia, Oregon, and Texas. State regulators impose granular ESG disclosures, prompting early adoption of AI-based energy management that pushes the regional green data center market ahead in technology maturity.

Asia Pacific is forecast for a 23.4% CAGR through 2030 as Japan's carbon-neutral data center initiative, India's data-sovereignty policy, and Australia's renewable energy zones catalyse new builds. Grid bottlenecks in Southeast Asia have spurred private-wire solar plus battery deals, positioning the region for leap-frog efficiency gains once interconnect upgrades materialise.

Europe maintains a central role through unified policy such as the Climate Neutral Data Centre Operator Pact. Nordic campuses leverage near-free cooling and ample hydropower, exporting heat into municipal networks and thereby lowering effective PUE to 1.1. Southern Europe accelerates solar-hybrid projects, and Germany's corporate PPAs fuel multicloud adoption in Frankfurt. Collectively, regional policy coherence sustains investment momentum within the green data center market

- Fujitsu Ltd

- Cisco Systems Inc.

- Hewlett Packard Enterprise Co.

- Dell Technologies Inc.

- Hitachi Ltd

- Schneider Electric SE

- IBM Corporation

- Eaton Corporation

- Vertiv Holdings Co

- Equinix Inc.

- Digital Realty Trust Inc.

- NTT Communications Corp.

- Amazon Web Services Inc.

- Microsoft Corp.

- Google LLC

- Huawei Technologies Co. Ltd

- Rittal GmbH and Co. KG

- Siemens AG

- Vapor IO Inc.

- Iron Mountain Inc.

- QTS Realty Trust Inc.

- Keppel Data Centres

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Hyperscale cloud build-outs shifting to 100 % renewable power

- 4.2.2 Regulatory push for PUE Less than or Equal to 1.3 across OECD economies

- 4.2.3 On-site hydrogen fuel-cell pilots in Greater Than 10 MW campuses (2025-2028)

- 4.2.4 AI-workload waste-heat reuse for district heating networks

- 4.2.5 Location-based renewable-energy credits monetization

- 4.2.6 Liquid-cooling turnkey ecosystems from server-OEM alliances

- 4.3 Market Restraints

- 4.3.1 Up-front CAPEX premium (30-40 %) versus brownfield retrofits

- 4.3.2 Limited green-power grid capacity in emerging economies

- 4.3.3 Scarcity of recycled-water rights near urban cores

- 4.3.4 Supply-chain volatility for low-GWP refrigerants (R-718, R-1234yf)

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitute Products

- 4.8 Assesment of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 By Service

- 5.1.1.1 System Integration

- 5.1.1.2 Monitoring Services

- 5.1.1.3 Professional Services

- 5.1.1.4 Other Services

- 5.1.2 By Solution

- 5.1.2.1 Power

- 5.1.2.2 Cooling

- 5.1.2.3 Servers

- 5.1.2.4 Networking Equipment

- 5.1.2.5 Management Software

- 5.1.2.6 Other Solutions

- 5.1.1 By Service

- 5.2 By Data Center Type

- 5.2.1 Colocation Providers

- 5.2.2 Hyperscalers/Cloud Service Providers

- 5.2.3 Enterprise and Edge

- 5.3 By Tier Type

- 5.3.1 Tier 1 and 2

- 5.3.2 Tier 3

- 5.3.3 Tier 4

- 5.4 By Industry Vertical

- 5.4.1 Healthcare

- 5.4.2 BFSI

- 5.4.3 Government

- 5.4.4 Telecom and IT

- 5.4.5 Manufacturing

- 5.4.6 Media and Entertainment

- 5.4.7 Other Verticals

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Netherlands

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia_Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Fujitsu Ltd

- 6.4.2 Cisco Systems Inc.

- 6.4.3 Hewlett Packard Enterprise Co.

- 6.4.4 Dell Technologies Inc.

- 6.4.5 Hitachi Ltd

- 6.4.6 Schneider Electric SE

- 6.4.7 IBM Corporation

- 6.4.8 Eaton Corporation

- 6.4.9 Vertiv Holdings Co

- 6.4.10 Equinix Inc.

- 6.4.11 Digital Realty Trust Inc.

- 6.4.12 NTT Communications Corp.

- 6.4.13 Amazon Web Services Inc.

- 6.4.14 Microsoft Corp.

- 6.4.15 Google LLC

- 6.4.16 Huawei Technologies Co. Ltd

- 6.4.17 Rittal GmbH and Co. KG

- 6.4.18 Siemens AG

- 6.4.19 Vapor IO Inc.

- 6.4.20 Iron Mountain Inc.

- 6.4.21 QTS Realty Trust Inc.

- 6.4.22 Keppel Data Centres

7 MARKET OPPORTUNITIES and FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment