PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850353

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850353

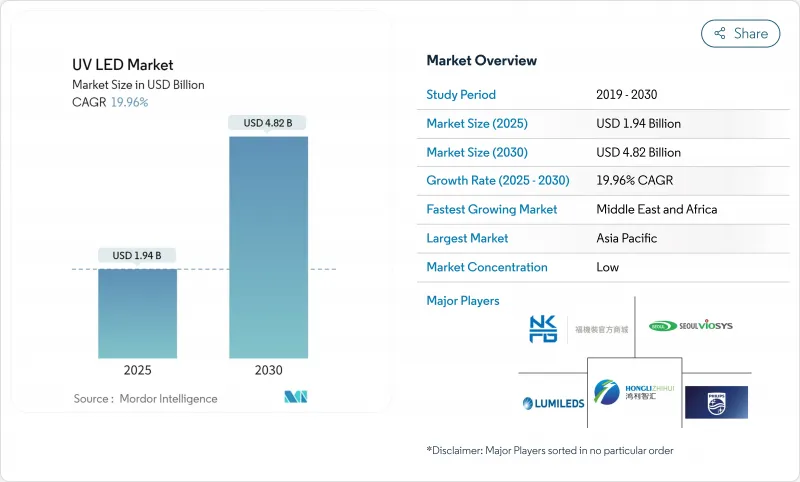

UV LED - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The UV LED market is valued at USD 1.94 billion in 2025 and is forecast to reach USD 4.82 billion by 2030, reflecting a 19.96% CAGR.

Growth is powered by global mercury-lamp bans, surging demand for energy-efficient curing solutions, and rapid gains in chip quantum efficiency. Regulatory timelines under the Minamata Convention, EU RoHS, and Canadian mercury rules converge in 2027-2025, pushing end users toward UV LED adoption, Parallel advances in AlGaN epitaxy, flip-chip structures, and thermal management have lifted external quantum efficiency for deep-UV devices to 9.19% at 250 mA, closing the performance gap with legacy mercury lamps. Strong replacement momentum in printing, packaging, and water treatment is reinforcing supplier revenue visibility through 2030.

Global UV LED Market Trends and Insights

Stringent Mercury-Lamp Phase-Out Policies Accelerating UV LED Adoption

Global regulation is eliminating mercury sources in lighting. The Minamata Convention aligned 147 signatories on a 2027 fluorescent exit. The EU RoHS Directive already caps mercury content at 5 mg per lamp, with full bans expected after 2027. Canada's 2025 rules mirror this direction. As users transition, printing lines report 85% lower energy use after swapping mercury lamps for solid-state arrays. Vendors that pre-qualified UV LED equipment are therefore securing long-term retrofit contracts.

Surge in Point-of-Use Water Disinfection Demand Across Asia

Rapid urbanisation stresses central water grids in India, Indonesia, and coastal China. Field trials in Norway demonstrated 3-log coliform removal at 545 m3/day using LED reactors, validating the technology's viability for municipal flows. Compact form factors allow embedding UV-C emitters in home dispensers, small factories, and rural clinics. Asian equipment makers are scaling integrated modules that operate on solar micro-grids, accelerating off-grid water-safety rollouts.

Quantum Efficiency Ceiling Limiting High-Power Applications

Deep-UV LEDs below 280 nm typically deliver <5% wall-plug efficiency, far below the 20-30% of low-pressure mercury lamps.Water utilities needing kilowatt-scale output must deploy large LED arrays, inflating capital costs. Research now focuses on quantum dots, super-lattices, and transparent substrates to improve hole injection and light extraction. AlGaN super-lattice designs boosted EQE to 8.6% at 35 mW, yet mass manufacturing at such performance remains years away.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Shift to Low-Migration UV LED Inks in Flexible Packaging

- Energy Price Inflation Favouring Low-Power UV LED Curing Lines

- Royalty-Heavy IP Landscape Raising Cost Barriers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

UV-A systems held 72% revenue share in 2024, retaining dominance in graphic-arts curing and counterfeit detection. UV-C, however, is set for a 22.5% CAGR as healthcare and municipal users deploy mercury-free germicidal solutions. ams OSRAM's OSLON(TM) UV 3535 delivers 115 mW at 265 nm with 20,000-hour life, a key milestone for reliable water and air reactors. The UV-B niche addresses phototherapy and agricultural photomorphogenesis, carving specialised demand pockets.

Adoption dynamics vary by region. Europe is standardising 255-275 nm emitters in food-processing pipelines, while Japan explores 308 nm UV-B for dermatology. As quantum-efficiency gains continue, the UV LED market size for UV-C modules targeting medical air sterilisation is projected to grow at double the sector average through 2030. Breakthroughs in far-UVC 222 nm excimer emitters promise human-safe continuous disinfection of occupied spaces, further widening the use-case frontier.

Modules retained the largest 42% slice of 2024 revenue due to integration ease. Chips, though, will post a 23.7% CAGR, reflecting demand for custom optical engines in consumer devices and lab instruments. GaN-on-SiC substrates cut thermal resistance, enabling chip-level powers of 100 mW in 2025 prototypes. The lamps sub-segment serves retrofit sockets but faces gradual volume decline as arrays gain traction.

Ultra-miniaturised chips underpin emerging biosensors and lab-on-a-chip devices. Researchers have demonstrated nano-scale perovskite LEDs with 20% EQE at 90 nm dimensions. As packaging shifts from ceramic to moulded composites, median cost per milliwatt is falling, stimulating design-in across portable sterilisation gadgets. Consequently, the UV LED market share of chip-level sales is forecast to rise to 35% by 2030.

The UV LED Market Report is Segmented by Technology (Wavelength) (UV-A, UV-B, and UV-C), Product/Form Factor (Lamps, Modules, and More), Power Output (Low Power, Medium Power, and More), Application (Curing, Disinfection and Sterilization, and More), End-User Industry (Healthcare and Life Sciences, Printing and Packaging, Automotive and Aerospace, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific held a commanding 55% share of UV LED market revenue in 2024. China's self-reliance push is spawning local epitaxy suppliers and captive device packaging lines. Japan and South Korea add high-precision fabrication know-how, while Taiwan specialises in gallium-nitride substrates for deep-UV chips. Rising public-health budgets channel demand for UV-based water and air purification across megacities, cementing regional dominance.

North America ranks second. California's accelerated mercury-lamp phase-out, coupled with federal funding for domestic chip capacity, drives adoption in healthcare and advanced manufacturing. However, a dense patent thicket and higher labour costs temper the expansion pace. Europe follows closely, powered by energy-efficiency mandates. Ecodesign rules forecast that 96% of installed lamps will be LEDs by 2030, creating a receptive environment for UV solutions.

The Middle East & Africa is the fastest-growing area, showing a 20.4% CAGR as desalination plants and new hospitals incorporate LED reactors. Gulf states fund smart-city programmes that specify mercury-free lighting. South America sees momentum in beverage bottling and aquaculture, though municipal water projects move slowly due to certification cycles. Across all geographies, simultaneous regulation and technology maturation keep the UV LED market on a convergent uplift path.

- ams OSRAM AG

- Signify N.V.

- Nichia Corporation

- Seoul Viosys Co., Ltd.

- Crystal IS Inc. (Asahi Kasei)

- Lumileds Holding B.V.

- Nikkiso Co., Ltd. (UV Business)

- LG Innotek Co., Ltd.

- LITE-ON Technology Corp.

- Honlitronics (Hongli Zhihui Group)

- Stanley Electric Co., Ltd.

- SemiLEDs Corporation

- Violumas Inc.

- DOWA Electronics Materials Co., Ltd.

- Nordson Corporation

- Luminus Devices, Inc.

- Heraeus Holding GmbH (Noblelight)

- Phoseon Technology (Excelitas)

- Sensor Electronic Technology Inc. (SETi)

- Bolb Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent Mercury Lamp Phase-Out Policies in EU and California Accelerating UV-LED Adoption

- 4.2.2 Surge in Point-of-Use Water Disinfection Demand Post-COVID-19 Across Asia

- 4.2.3 Rapid Shift to Low-Migration UV LED Inks in Flexible Packaging for Food Safety Compliance

- 4.2.4 Energy Price Inflation in Europe Favouring Low-Power UV-LED Curing Lines

- 4.2.5 Mini-LED Backlighting Roadmaps Driving Deep-UV Inspection Tools Adoption in Semiconductor Fabs

- 4.2.6 Growing Acceptance of Far-UVC (222 nm) for Occupied-Space Air Sanitisation in Airports and Hospitals

- 4.3 Market Restraints

- 4.3.1 Quantum Efficiency Ceiling (<5 %) of AlGaN-Based UVC Chips Limits High-Power Applications

- 4.3.2 Royalty-Heavy IP Landscape Raising Cost Barriers for New Entrants in North America

- 4.3.3 Thermal Management Challenges in High-Density UV LED Arrays for Industrial Curing Lines

- 4.3.4 Slow Certification Cycles (NSF/ANSI 55-2022) Delaying Municipal Water Projects in Emerging Economies

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Technology (Wavelength)

- 5.1.1 UV-A

- 5.1.2 UV-B

- 5.1.3 UV-C

- 5.2 By Product/Form Factor

- 5.2.1 Lamps

- 5.2.2 Modules

- 5.2.3 Arrays

- 5.2.4 Chips

- 5.3 By Power Output

- 5.3.1 Low Power (<10 mW)

- 5.3.2 Medium Power (10-100 mW)

- 5.3.3 High Power (>100 mW)

- 5.4 By Application

- 5.4.1 Curing (Inks, Coatings and Adhesives)

- 5.4.2 Disinfection and Sterilization

- 5.4.3 Sensing and Instrumentation

- 5.4.4 Medical and Phototherapy

- 5.4.5 Counterfeit Detection and Security

- 5.4.6 Horticulture and Indoor Farming

- 5.4.7 Other Niche Applications (3-D Printing, Lithography)

- 5.5 By End-user Industry

- 5.5.1 Healthcare and Life Sciences

- 5.5.2 Printing and Packaging

- 5.5.3 Electronics and Semiconductors

- 5.5.4 Water and Wastewater Utilities

- 5.5.5 Food and Beverage Processing

- 5.5.6 Automotive and Aerospace

- 5.5.7 Residential and Commercial Buildings

- 5.5.8 Industrial Manufacturing

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 South Korea

- 5.6.3.4 India

- 5.6.3.5 South East Asia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ams OSRAM AG

- 6.4.2 Signify N.V.

- 6.4.3 Nichia Corporation

- 6.4.4 Seoul Viosys Co., Ltd.

- 6.4.5 Crystal IS Inc. (Asahi Kasei)

- 6.4.6 Lumileds Holding B.V.

- 6.4.7 Nikkiso Co., Ltd. (UV Business)

- 6.4.8 LG Innotek Co., Ltd.

- 6.4.9 LITE-ON Technology Corp.

- 6.4.10 Honlitronics (Hongli Zhihui Group)

- 6.4.11 Stanley Electric Co., Ltd.

- 6.4.12 SemiLEDs Corporation

- 6.4.13 Violumas Inc.

- 6.4.14 DOWA Electronics Materials Co., Ltd.

- 6.4.15 Nordson Corporation

- 6.4.16 Luminus Devices, Inc.

- 6.4.17 Heraeus Holding GmbH (Noblelight)

- 6.4.18 Phoseon Technology (Excelitas)

- 6.4.19 Sensor Electronic Technology Inc. (SETi)

- 6.4.20 Bolb Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment