PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850959

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850959

Breast Implants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

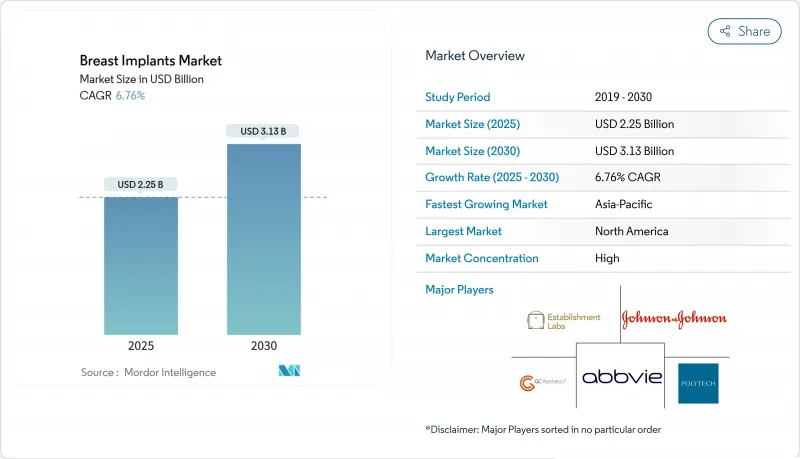

The breast implants market was valued at USD 2.21 billion in 2025 and is projected to grow to USD 3.21 billion by 2030, translating into a 7.77% CAGR for the forecast period.

The expansion reflects a combination of rising post-mastectomy reconstruction volumes, wider social acceptance of cosmetic augmentation, and rapid product innovation. Silicone devices continue to dominate overall unit demand, but structured saline implants are gaining momentum because they eliminate silent-rupture concerns while offering a silicone-like feel. Across regions, Asia Pacific is the fastest-growing arena, powered by medical-tourism hubs, accelerating middle-class spending, and a surge of new approvals, whereas North America preserves its leadership position through mature reimbursement pathways and advanced surgeon expertise. Heightened geopolitical disruptions have exposed raw-material vulnerabilities, prompting manufacturers to earmark 3-5% of annual revenue for supply-chain resiliency, contract flexibility, and dual-sourcing strategies.

Global Breast Implants Market Trends and Insights

High burden of breast cancer

New invasive cancer diagnoses in the United States are expected to reach 316,950 in 2025, a 2% increase from 2024, reinforcing sustained reconstruction demand. Racial and socioeconomic disparities persist-White patients undergo reconstruction at nearly 67% versus 54% for Black women, highlighting untapped growth if access barriers are resolved. Immediate reconstruction enjoys growing popularity despite an 18% higher risk of reoperation, because patients value shorter overall recovery. Insurance mandates in North America further lower out-of-pocket costs, elevating procedure volumes.

Surge in demand for breast surgery

Consumer preference has shifted toward "undetectable" augmentations that mirror natural breast aesthetics. Motiva's SmoothSilk shell and similarly advanced textures reduce capsular-contracture incidence, capturing surgeon endorsement. Simultaneously, breast-lift frequencies rose 6% in the United States during 2024, supported by better skin-tightening technology. Clinics that align implant portfolios with these trends-balancing volume, projection, and tactile authenticity-stand to capture discretionary consumer spend.

Post-procedure complications and risks

Global reporting registers 1,290 confirmed BIA-ALCL cases, mostly linked to textured shells. In 2024 the FDA mandated boxed warnings and patient checklists, elevating compliance costs yet encouraging transparent risk discussion. Smooth-surface implants and nano-texturing techniques address these concerns, but litigation trends elevate surgeon insurance premiums; in some U.S. states premiums rose 15% year-over-year in 2024.

Stringent regulations & fat-grafting alternatives

The European MDR transition compels recertification by 2027, adding audit fees and delaying legacy device sales unless notified-body sign-off is obtained. Concurrently, hybrid fat-transfer techniques lure patients wary of synthetic materials. Device makers counter by bundling implants with acellular dermal matrices (ADM) that support soft-tissue scaffolding, positioning implants as complementary rather than competing with autologous options.

Other drivers and restraints analyzed in the detailed report include:

- Technological advancement in breast implants

- Rise in medical tourism

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Silicone implants retained 85.34% share of the breast implants market in 2024, favored for their cohesive-gel stability and soft-tissue mimicry. The breast implants market size for silicone lines will continue to expand; however, structured saline's 8.81% CAGR indicates accelerating uptake. Structured devices avoid MRI monitoring, appeal to safety-conscious consumers, and allow intra-operative fill adjustment to refine symmetry. Gummy-bear cohesive implants still appeal through shape memory and lower leak risk, but structured saline's transparent rupture profile garners support among revision-surgery candidates.

Manufacturers of silicone devices respond with warranty extensions covering capsule contracture and rupture replacement for the implant's lifetime. Digital breast sizers that overlay 3-D imaging onto patient anatomy improve pre-procedure planning, further reinforcing silicone incumbency despite saline's momentum in the breast implants market.

Round implants owned 79.57% of the breast implants market size in 2024, yet anatomical units will grow more rapidly due to a significantly lower capsular-contracture rate of 3.4% vs. 11.3% for rounds. East-Asian and European patients, who often prefer modest upper-pole projection, gravitate toward teardrop geometrics. Smooth-surface anatomical models launched in 2025 tackle historical rotation concerns, aided by laser-etched texturing that stabilizes pocket positioning without aggressive roughness linked to ALCL risk.

Hybrid gel-fill patents blend dual-viscosity layers-a firmer base for shape and a softer outer layer for palpability-allowing anatomical implants to compete with rounds on tactile authenticity. Promotional campaigns highlight these innovations, propelling surgeon adoption and nudging market share toward anatomical categories.

Breast Implants Market Report is Segmented by Type (Silicone Implants, Cohesive Gel Implants, Saline Implants, Structured Saline Implants and Hydrogel & Other Fillers), Shape (Round and Antomical), Application (Reconstructive Surgery and Cosmetic Surgery), End-User (Hospital, Ambulatory Surgical Centers Clinics, and More), and Geography (North America, Europe and More). The Market and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintained a 32.43% share of the breast implants market in 2024. The FDA's September 2024 approval of Motiva SmoothSilk introduced the first non-textured nano-surface implant in the United States, intensifying device choice competition. Regulatory updates impose black-box warnings on all implants and require patient decision checklists, fostering informed choice yet adding administrative overhead for providers. U.S. surgeons exhibit distinctive practice patterns, often selecting higher-projection implants relative to their European peers, reflecting regional aesthetic ideals.

Asia Pacific is forecast to be the fastest-growing region at a 9.54% CAGR to 2030. Medical-tourism corridors funnel thousands of patients annually into Thailand and South Korea for cut-price augmentations bundled with post-operative spa care. China's NMPA authorization of Motiva implants in late 2024-China's first breast-implant clearance in a decade-unleashes pent-up demand among private-clinic networks. Australia's clinical trials of PCL scaffold-based, fully resorbable implants reported zero major complications at 12-month follow-up, indicating a pipeline of alternatives that could eventually disrupt silicone incumbency. In Indonesia, outbound medical tourism remains prevalent because of limited specialist availability, revealing regional service-capacity gaps that international clinic chains aim to fill.

Europe accounts for a substantial slice of global sales but confronts stricter regulation. The Medical Device Regulation (MDR) compels breast-implant recertification by 2027, and GC Aesthetics met the milestone early by launching the first MDR-approved implant in 2022 gcaesthetics.com. The U.K. tallied 5,202 cosmetic breast procedures in 2024, representing a 6% increase in aesthetic demand despite macroeconomic headwinds. Textured-implant recall aftermath lingers, nudging surgeons toward smooth or micro-textured alternatives. Meanwhile, insurers in Germany and France expanding reimbursement for prophylactic mastectomy with immediate reconstruction support reconstructive volume growth.

Latin America and the Middle East & Africa (MEA) collectively capture a smaller slice yet hold strategic promise. Brazil hosts one of the highest per-capita augmentation rates worldwide, and local manufacturers aggressively price to maintain share. In the Gulf Cooperation Council (GCC) states, premium medical-tourism complexes in Dubai and Doha attract affluent expatriates seeking U.S.-FDA-approved implants without traveling to North America.

- Abbvie

- Johnson & Johnson

- Establishment Labs

- GC Aesthetics

- Polytech Health & Aesthetics

- Tiger Aesthetics Medical, LLC (Sientra Inc.)

- Silimed Industria de Implantes Ltda.

- Groupe Sebbin

- Laboratoires Expanscience

- HansBiomed Co. Ltd.

- Bimini Health Tech

- Cereplas SAS

- Shanghai Kangning Medical Device Co.

- Wanhe Plastic Materials Co.

- Anita Dr. Helbig GmbH

- Pofam Poznan Sp.z.o.o

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Burden of Breast Cancer

- 4.2.2 Surge in Demand for Breast Surgery

- 4.2.3 Technological Advancement in Breast Implants

- 4.2.4 3-D Imaging & Simulation Tools Raising Patient Conversion Rates

- 4.2.5 Rise in Medical Tourism for Breast Surgeries in Different Countries Coupled with Increased Awareness and Acceptance for Breast Surgery

- 4.2.6 Accelerating the Adoption of Advanced Implants and Direct-to-consumer Marketing Influencing Demand

- 4.3 Market Restraints

- 4.3.1 Post Complications and Risks Associated with Breast Implant

- 4.3.2 Supply Shortages for Medical Grade Material

- 4.3.3 Stringent Regulations and Availability for Alternatives such as Fat Grafting and others

- 4.3.4 Rise in Product-Liability Insurance Premiums for Surgeons

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Type

- 5.1.1 Silicone Implants

- 5.1.2 Cohesive Gel (Form-Stable) Implants

- 5.1.3 Saline Implants

- 5.1.4 Structured Saline Implants

- 5.1.5 Hydrogel & Other Fillers

- 5.2 By Shape

- 5.2.1 Round

- 5.2.2 Anatomical (Teardrop)

- 5.3 By Application

- 5.3.1 Reconstructive Surgery

- 5.3.2 Cosmetic (Augmentation) Surgery

- 5.4 By End-user

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgical Centers

- 5.4.3 Cosmetology Clinics & Medical Spas

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AbbVie Inc. (Allergan Aesthetics)

- 6.4.2 Johnson & Johnson

- 6.4.3 Establishment Labs S.A.

- 6.4.4 GC Aesthetics

- 6.4.5 Polytech Health & Aesthetics GmbH

- 6.4.6 Tiger Aesthetics Medical, LLC (Sientra Inc.)

- 6.4.7 Silimed Industria de Implantes Ltda.

- 6.4.8 Groupe Sebbin SAS

- 6.4.9 Laboratories Arion

- 6.4.10 HansBiomed Co. Ltd.

- 6.4.11 Bimini Health Tech

- 6.4.12 Cereplas SAS

- 6.4.13 Shanghai Kangning Medical Device Co.

- 6.4.14 Wanhe Plastic Materials Co.

- 6.4.15 Anita Dr. Helbig GmbH

- 6.4.16 Pofam Poznan Sp.z.o.o

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment