PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850973

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850973

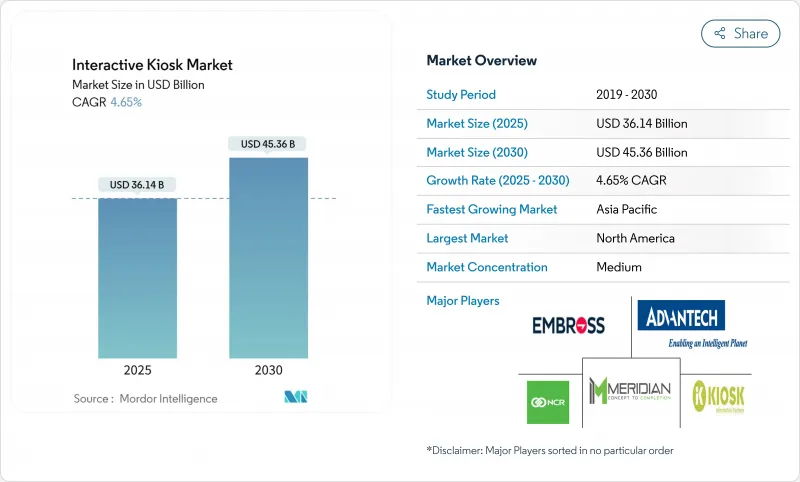

Interactive Kiosk - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The interactive kiosk market size stands at USD 36.14 billion in 2025 and is forecast to reach USD 45.36 billion by 2030, advancing at a 4.65% CAGR.

Stable retail demand, post-pandemic preference for contactless transactions, and cloud-managed fleet roll-outs keep investment levels high even as hardware costs fluctuate. Ticketing, healthcare check-in, and smart-city wayfinding accelerate revenue diversification, while AI-driven personalization and biometric security broaden use cases beyond traditional ATM deployments. North American operators concentrate on software upgrades and managed services, whereas Asia-Pacific providers scale new installations in transportation hubs and government service centers. Market-wide innovation now focuses on energy-efficient ARM processors, fanless enclosures, and haptic touch interfaces that lower total cost of ownership and expand outdoor application viability.

Global Interactive Kiosk Market Trends and Insights

Surge in Cloud-Managed Kiosk Fleets

Operators now favor cloud dashboards that push content, run diagnostics, and trigger predictive maintenance from a single console. Advanced Kiosks' remote-access platform demonstrates service-call reductions that cut lifetime support costs by double-digit percentages. Multi-carrier SIM bundles from POND IoT ensure high uptime even at remote gasoline stations and outdoor transit shelters. As a result, enterprises deploy larger fleets without proportional staff increases, reinforcing ROI and accelerating refresh cycles.

More Kiosks in Growing Cities and Transport Hubs for Public Services

Governments digitize passenger processing and citizen services to manage swelling urban populations. Jamaica's passport agency ordered 100 biometric kiosks for two international airports, targeting peak-season throughput gains. Seattle approved a revenue-sharing model that funds up to 80 information kiosks downtown, pairing civic content with paid advertising. These municipal pilots prove public-private structures that de-risk taxpayer funds and create recurring revenue, encouraging replication across emerging markets.

Escalating Cyber-Security and Privacy Compliance Cost

The proposed American Privacy Rights Act pushes stronger encryption, breach-reporting, and data-minimization mandates that drive security tooling budgets higher, especially for operators handling medical or financial data. Multi-jurisdiction fleets juggle divergent obligations, inflating legal and audit overhead. Larger vendors with in-house security practices absorb these hurdles, widening the gap between incumbents and start-ups.

Other drivers and restraints analyzed in the detailed report include:

- Biometric-Enabled KYC Compliance Kiosks

- Energy-Efficient Fanless ARM Kiosk Economics

- High CAPEX for Multi-Site Fleets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

ATM kiosks held 32.1% of the interactive kiosk market in 2024. The installed base of 600,000 units that NCR Atleos services anchors recurring cash-handling demand even as mobile banking grows. Ticketing kiosks, however, lead growth with a 5.4% CAGR to 2030, fueled by airport expansion and rail modernization across Asia-Pacific. Information and patient-interactive kiosks attract healthcare budgets that seek faster intake processes, while crypto-exchange and government-service kiosks enter the long-tail.

Airports prefer biometric gates that combine boarding pass validation and immigration checks, cutting per-passenger processing time and freeing staff for exception-handling. Stadiums and theme parks adopt QR-based ticket prints to reduce fraud. These dynamics keep manufacturers investing in more modular designs that swap printers or scanners without full system swaps, prolonging asset life and raising aftermarket revenue.

Hardware secured 56.1% revenue in 2024, yet pricing pressure and chipset volatility erode margins. The interactive kiosk market size for services is forecast to rise at 4.7% CAGR, as operators outsource monitoring, firmware patching, and content scheduling to managed-service specialists. Software sits between, riding AI personalization and voice-assistant interfaces that deepen engagement times.

Touch panel costs soften when capacity builds in China, but replacement cycles remain seven years or longer, motivating vendors to push annuity-style cloud dashboards. Fleet owners increasingly sign multi-year service-level agreements that bundle 24X7 uptime commitments and analytics insights. This shift realigns revenue mix from 70:30 hardware-first toward a balanced profile by decade-end.

Interactive Kiosk Market is Segmented by Type (ATM Kiosks, Information Kiosks, and More), Component (Hardware, Software, and Services), Deployment (Indoor Kiosks and Outdoor Kiosks), End-User Industry (Retail, BFSI, and More), by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controls 35.8% of 2024 revenue, driven by entrenched self-checkout culture, card-present payment infrastructure, and robust cybersecurity frameworks. Operators focus on software overhauls that layer loyalty enrollment and digital wallets onto existing kiosks. Smart-city projects such as Seattle's digital wayfinding plan keep outdoor momentum alive despite heritage zoning hurdles. Regulatory clarity around ADA accessibility further influences design specifications and supplier selection.

Asia-Pacific stands out as the fastest-growing region with a 5.7% CAGR through 2030. Rapid urbanization in India and Southeast Asia triggers airport and metro station upgrades that specify ticketing and information kiosks as standard elements. Domestic manufacturing concentration allows shorter lead times and cost advantages, though component shortages periodically disrupt shipping schedules. Case studies like Taiwan's theme park adoption of Advantech units highlight regional suppliers' ability to bundle hardware, software, and maintenance into turnkey deals.

Europe maintains steady demand underpinned by GDPR-compliant solutions and tourism-anchored deployments in rail and hospitality. Operators invest in biometric boarding and digital VAT refund kiosks that serve international travelers. The Middle East and Africa expand from a smaller base, prioritizing government-service terminals and mall-based retail kiosks. Latin America invests in urban mobility kiosks tied to bus rapid transit corridors, though currency volatility occasionally slows procurement cycles.

- NCR Corporation

- Diebold Nixdorf

- KIOSK Information Systems

- Advantech Co. Ltd

- Olea Kiosks Inc.

- Slabb Inc.

- RedyRef Interactive Kiosks

- Meridian Kiosks LLC

- Embross Ltd

- Source Technologies

- IER SAS

- Shenzhen Zhengtong Electronics

- Pyramid Computer GmbH

- Fujitsu Ltd

- Toshiba Global Commerce Solutions

- Samsung Electronics (Kiosk Solutions)

- IBM Corp. (Self-Service kiosks)

- Diebold Self-Service GmbH

- Glory Global Solutions

- NEC Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising preference for unattended self-service

- 4.2.2 Surge in cloud-managed kiosk fleets

- 4.2.3 More kiosks being installed in growing cities and transport hubs for public services

- 4.2.4 Biometric-enabled KYC compliance kiosks

- 4.2.5 Smart-city curbside digital way-finding roll-outs

- 4.2.6 Energy-efficient fan-less ARM kiosk economics

- 4.3 Market Restraints

- 4.3.1 Escalating cyber-security and privacy compliance cost

- 4.3.2 High CAPEX for multi-site fleets

- 4.3.3 Volatile supply of greater than 32 industrial touchscreens"

- 4.3.4 Urban heritage bans on outdoor ad-kiosks

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Force Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Assesment of Macroeconomic Trends on Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 ATM Kiosks

- 5.1.2 Information Kiosks

- 5.1.3 Ticketing Kiosks

- 5.1.4 Patient Interactive Kiosks

- 5.1.5 Other Types

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.3 By Deployment

- 5.3.1 Indoor Kiosks

- 5.3.2 Outdoor Kiosks

- 5.4 By End-user Industry

- 5.4.1 Retail

- 5.4.2 BFSI

- 5.4.3 Healthcare

- 5.4.4 Transportation (Airports, Rail, Bus)

- 5.4.5 Hospitality

- 5.4.6 Government and Public Sector

- 5.4.7 Others (Education, Entertainment)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 Turkey

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 NCR Corporation

- 6.4.2 Diebold Nixdorf

- 6.4.3 KIOSK Information Systems

- 6.4.4 Advantech Co. Ltd

- 6.4.5 Olea Kiosks Inc.

- 6.4.6 Slabb Inc.

- 6.4.7 RedyRef Interactive Kiosks

- 6.4.8 Meridian Kiosks LLC

- 6.4.9 Embross Ltd

- 6.4.10 Source Technologies

- 6.4.11 IER SAS

- 6.4.12 Shenzhen Zhengtong Electronics

- 6.4.13 Pyramid Computer GmbH

- 6.4.14 Fujitsu Ltd

- 6.4.15 Toshiba Global Commerce Solutions

- 6.4.16 Samsung Electronics (Kiosk Solutions)

- 6.4.17 IBM Corp. (Self-Service kiosks)

- 6.4.18 Diebold Self-Service GmbH

- 6.4.19 Glory Global Solutions

- 6.4.20 NEC Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment