PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850975

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850975

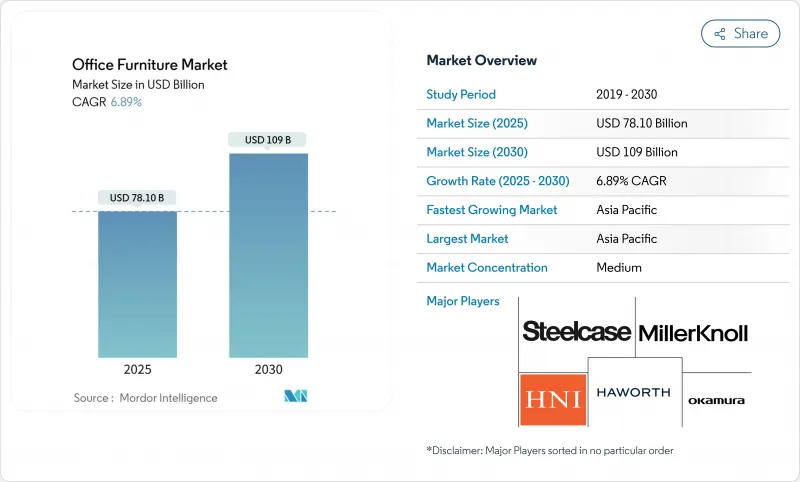

Office Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The office furniture market is valued at USD 78.10 billion in 2025 and is forecast to climb to USD 109.00 billion by 2030, reflecting a 6.89% CAGR.

Rising hybrid work adoption, sustained commercial real-estate activity in high-growth economies, and mounting employee-wellness expectations are keeping demand steady despite economic volatility. Employers are offering refreshing layouts to entice staff back on-site, often prioritizing high-quality, space-efficient fixtures that integrate technology and ergonomic features. Sustainability mandates and circular-economy goals are accelerating the shift to certified wood, recycled plastics, and low-VOC finishes, underpinning a premiumization trend in the office furniture market. Digital procurement portals are broadening vendor access while compressing price transparency, intensifying competition, and nudging manufacturers toward direct-to-consumer models.

Global Office Furniture Market Trends and Insights

Expansion of Co-Working Networks and Hybrid Work Models Spurring Demand

Hybrid work has solidified its place in corporate real estate strategies, as highlighted by the 2023-2024 Global Office Occupier Sentiment Survey from Coldwell Banker Richard Ellis (CBRE). The survey, which tapped into the perspectives of over 400 corporate real estate executives from both multinational and domestic organizations worldwide, found that a mere 6% of companies now require full-time office attendance. Furthermore, since 2021, there has been a notable 30% uptick in space-sharing practices, signaling a decisive move towards flexible and efficient workspace use. Many organizations report up to 30% real-estate cost savings after reconfiguration, yet per-employee furniture spending has risen as premium ergonomic solutions gain priority. The office furniture market thus benefits from lower unit volumes but higher price points, particularly in metropolitan hubs where co-working occupiers require frequent refresh cycles.

Rising Employment Rates Boost Furniture Purchases

Headcount expansion feeds directly into new workstation demand, especially in knowledge sectors where average wage growth is outpacing inflation. In 2024, the International Labour Organization (ILO) estimated that around 3.56 billion people were employed globally, up from 3.27 billion in 2020. As labor markets tighten, companies view furniture upgrades as an economical retention lever relative to salary increments. Height-adjustable desks and advanced lumbar-support chairs are becoming baseline requisites, reinforcing the office furniture market's pivot toward health-centered design. Vendors equipped with certification benchmarks (BIFMA-LEVEL, GREENGUARD) are gaining share because HR teams link such credentials to wellbeing and ESG commitments.

Volatility in Raw-Material Prices and Shortages

Prices of key raw materials like wood, metal, and upholstery fabrics can swing unpredictably, often due to external influences such as geopolitical tensions, trade tariffs, and shifting supply chain dynamics. Between October 2023 and March 2025, prices for wood, steel, and petroleum-derived plastics experienced double-digit swings, contributing to a 4% year-on-year rise in average fit-out costs across the EMEA region. According to Cushman & Wakefield's April 2024 EMEA Office Fit-Out Cost Guide, raw lumber prices surged by 14.3%, steel components fluctuated by as much as 17.8%, and materials derived from petroleum saw a price hike of 12.6%. Manufacturers preserve margins by hedging commodities and redesigning components for interchangeability so production can pivot to available inputs. However, longer prototype cycles and safety-certification retesting introduce cost and schedule risks that compress smaller vendors. Buyers face budget uncertainty and may postpone large-scale refreshments, tempering near-term growth in the office furniture market.

Other drivers and restraints analyzed in the detailed report include:

- Commercial Real-Estate Growth Fuels Fit-Out Spending

- Eco-Friendly Furniture Gains Traction Amid ESG Goals

- Supply-Chain Disruptions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The chair category generated 33% of 2024 sales and is forecast to log a 7.9% CAGR, underscoring management's heightened focus on posture-related health claims in the office furniture market. Enhanced lumbar adjustments, pressure-balanced foams, and intuitive synchronized tilts are now mainstream, pushing former luxury attributes into entry-level models. Vendors such as Herman Miller are piloting AI-enabled chairs that learn user micro-movements and automatically recalibrate tension zones, signaling an innovation race anchored in data analytics. The office furniture market size for seating is projected to expand steadily as employers refresh fleets to comply with evolving ergonomic standards.

Conference tables, height-adjustable desks, and benching systems comprise the second-largest revenue pool, driven by technology accommodation needs such as integrated charging ports and cable-free power modules. Storage units continue to shrink in footprint as cloud adoption reduces paper volume, while soft seating registers renewed interest for social zones that support agile teamwork. Emerging acoustic pods and modular divider panels satisfy privacy requirements without permanent walls, aligning with flexible lease terms common in co-working sites. Although unit volumes across desk systems may plateau, higher specification levels and embedded electronics sustain value growth in the office furniture market.

Wood products accounted for 48% of the money spent in 2024, due to wood products' warmth and design versatility. Yet new deforestation rules are altering sourcing norms; FSC-certified lumber uptake is accelerating, and engineered composites with traceable feedstock are replacing legacy veneers. Metal furniture, growing at 7.2% CAGR, benefits from recyclability and compatibility with slim-profile aesthetics prized in technology and creative sectors. Powder-coated aluminum frames paired with recyclable PET felt screens reduce total weight, aiding freight efficiency and carbon reporting.

Recycled plastics and bio-polymer hybrids are moving from experimental to scalable, creating an incremental share in the office furniture market. Manufacturer Sister Bay employs 100% post-consumer HDPE for outdoor-rated break-area seating, addressing corporate carbon accounting expectations. Laminates infused with rapidly renewable bamboo fibers are also penetrating, particularly in Asia-Pacific, where material proximity lowers cost.

The Office Furniture Market Report is Segmented by Product (Chairs, Tables, and More), Material (Wood, Metal, and More), Price Range (Economy, Mid-Range, Premium), End-User (Corporate Offices, Healthcare Offices, and More), Distribution Channel (B2C/Retail, and B2B/Directly From Manufacturers), and Geography (North America, South America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific steers the office furniture market with a 43.7% revenue share in 2025 and a projected 7.5% CAGR to 2030. Emerging economies such as India and Vietnam are scaling Grade-A office stock rapidly, supported by favorable demographic profiles and foreign direct investment flows. Local manufacturing clusters benefit from lower labor costs and proximity to raw-material suppliers, ensuring competitive pricing even after factoring in the 12-18% sustainability premium reported by JLL. Governments are simultaneously introducing green-building incentives, accelerating the uptake of low-VOC lacquer substitutes and recycled-content panels in the office furniture market.

North America ranks second and is characterized by stringent safety and environmental standards that shape product engineering. BIFMA, LEED, and WELL accreditation frameworks heavily influence buyer shortlists, directly affecting the office furniture market size for certified products. With the sublease glut abating, as vacancy peaked in early 2024, landlords are upgrading spec suites with smart, modular furnishings to attract tenants on shorter lease cycles. Manufacturers able to supply quick-ship configurations gain an edge as brokers push speed to occupancy.

Europe follows with a distinct regulatory landscape. The EU Deforestation Regulation compels full traceability on timber origin, creating compliance overhead but also reinforcing competitive advantage for suppliers with transparent chains. Circularity targets under the European Green Deal incentivize refurbishing ready furniture; thus, refurbished chair sales are rising, echoing Humanscale's dedicated online store launch in 2024. Price pressure from energy costs is partly offset by clients' willingness to pay for demonstrable carbon reductions, keeping premium sustainable lines buoyant in the office furniture market.

The Middle East and Africa, although smaller, post double-digit growth in Gulf Cooperation Council states, where mega-projects such as Saudi Vision 2030 spawn large volumes of office fit-outs. Preference for American hardwoods, underscored by the American Hardwood Export Council's promotion campaigns, supports higher-value wood imports. South America's rebound hinges on Brazil, where economic stabilization and tech-sector clustering are driving incremental demand for flexible workspace solutions. Regional manufacturers are partnering with North American brands under license to localize production and sidestep import tariffs, modestly lifting the office furniture market share of domestic players.

- Steelcase Inc.

- MillerKnoll Inc.

- Haworth Inc.

- HNI Corporation

- Okamura Corporation

- KOKUYO Co., Ltd.

- Teknion Corporation

- Kimball International

- Global Furniture Group

- ACTIU Berbegal y Formas S.A.

- Godrej Interio

- Nowy Styl Group

- KI (Krueger International)

- Vitra International AG

- Sedus Stoll AG

- Wilkhahn

- Bene GmbH

- AIS, Inc.

- Workrite Ergonomics

- Geeken Seating Collection Private Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of Co-Working Networks and Hybrid Work Models Spurring Office Furniture Demand

- 4.2.2 Rising Employment Rates Boost Demand for Furniture

- 4.2.3 Commercial Real Estate Growth Fuels Furniture Fit-Out Needs

- 4.2.4 Eco-Friendly Furniture Gains Traction Amid Sustainability and ESG Goals

- 4.2.5 Workplace Ergonomics and Employee Wellness Take Center Stage

- 4.2.6 Digital Procurement Processes Broaden Market Accessibility

- 4.3 Market Restraints

- 4.3.1 Volatility in Raw Material Prices and Shortages

- 4.3.2 Supply Chain Disruptions

- 4.3.3 Environmental and Regulatory Challenges

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

- 4.8 Insights on Regulatory Framework and Industry Standards for Office Furniture

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Chairs

- 5.1.1.1 Employee Chairs

- 5.1.1.2 Meeting Chairs

- 5.1.1.3 Guest Chairs

- 5.1.2 Tables

- 5.1.2.1 Conference Tables

- 5.1.2.2 Desks

- 5.1.2.3 Other Tables

- 5.1.3 Storage Units

- 5.1.3.1 Filing Cabinets

- 5.1.3.2 Bookcases & Shelving

- 5.1.4 Sofas/Soft Seating

- 5.1.5 Booths and Office Dividers

- 5.1.6 Other Office Furniture (Stools, Reception Area Furniture, Accessories, Others)

- 5.1.1 Chairs

- 5.2 By Material

- 5.2.1 Wood

- 5.2.2 Metal

- 5.2.3 Plastic & Polymer

- 5.2.4 Other Materials

- 5.3 By Price Range

- 5.3.1 Economy

- 5.3.2 Mid-range

- 5.3.3 Premium

- 5.4 By End-user

- 5.4.1 Corporate Offices

- 5.4.2 Healthcare Offices

- 5.4.3 Educational Institutions

- 5.4.4 Government & Public Offices

- 5.4.5 Hospitality & Retail Back-office

- 5.4.6 Others

- 5.5 By Distribution Channel

- 5.5.1 B2C/Retail

- 5.5.1.1 Home Centers

- 5.5.1.2 Specialty Furniture Stores

- 5.5.1.3 Online

- 5.5.1.4 Other Distribution Channels

- 5.5.2 B2B/Directly from Manufacturers

- 5.5.1 B2C/Retail

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 Canada

- 5.6.1.2 United States

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Peru

- 5.6.2.3 Chile

- 5.6.2.4 Argentina

- 5.6.2.5 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Spain

- 5.6.3.5 Italy

- 5.6.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.6.3.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.6.3.8 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 India

- 5.6.4.2 China

- 5.6.4.3 Japan

- 5.6.4.4 Australia

- 5.6.4.5 South Korea

- 5.6.4.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines)

- 5.6.4.7 Rest of Asia-Pacific

- 5.6.5 Middle East And Africa

- 5.6.5.1 United Arab of Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 South Africa

- 5.6.5.4 Nigeria

- 5.6.5.5 Rest of Middle East And Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Steelcase Inc.

- 6.4.2 MillerKnoll Inc.

- 6.4.3 Haworth Inc.

- 6.4.4 HNI Corporation

- 6.4.5 Okamura Corporation

- 6.4.6 KOKUYO Co., Ltd.

- 6.4.7 Teknion Corporation

- 6.4.8 Kimball International

- 6.4.9 Global Furniture Group

- 6.4.10 ACTIU Berbegal y Formas S.A.

- 6.4.11 Godrej Interio

- 6.4.12 Nowy Styl Group

- 6.4.13 KI (Krueger International)

- 6.4.14 Vitra International AG

- 6.4.15 Sedus Stoll AG

- 6.4.16 Wilkhahn

- 6.4.17 Bene GmbH

- 6.4.18 AIS, Inc.

- 6.4.19 Workrite Ergonomics

- 6.4.20 Geeken Seating Collection Private Limited

7 Market Opportunities & Future Outlook

- 7.1 Smart Furniture Integration Boosts Workplace Efficiency and User Experience

- 7.2 Sustainable and Circular Furniture Solutions

- 7.3 Expansion of Acoustic and Privacy-Centric Furniture Designs

- 7.4 Scalable Customization and Personalization in Office Furniture