PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851042

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851042

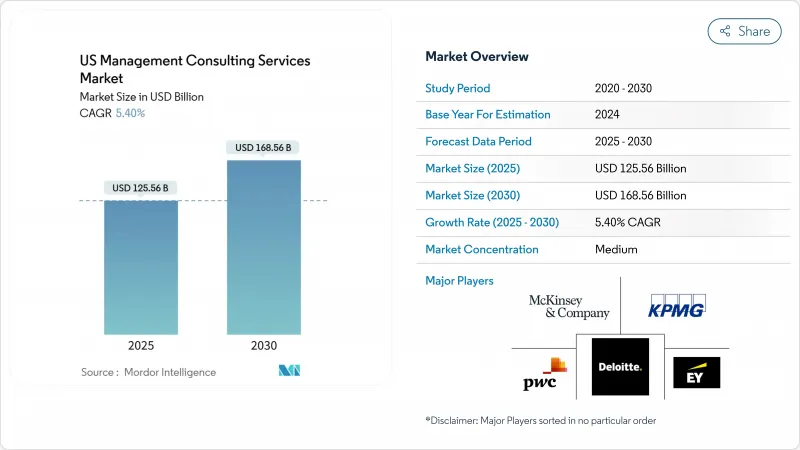

US Management Consulting Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The US management consulting services market size is estimated at USD 125.56 billion in 2025 and is forecast to reach USD 168.56 billion by 2030, translating to a 5.40% CAGR.

Continued expansion rests on enterprises modernizing their technology stacks, meeting tightening regulatory requirements, and adopting generative AI as a growth lever. Demand is strongest where digital-first mandates intersect with operational excellence programs, while generative AI is opening new advisory white-space even as it automates routine consulting tasks. Adoption of outcome-based pricing is reshaping traditional billing structures and increasing pressure on consulting profit margins. Rivalry is intensifying as large firms trim junior headcount yet invest heavily in AI partnerships to defend their share against emerging disruptors.

US Management Consulting Services Market Trends and Insights

Digital-First Transformation Demand

Manufacturing enterprises are restructuring supplier bases through nearshoring and dual-sourcing, increasing the pull for operational consulting as they aim to harden supply chains against disruption. Legislation such as the CHIPS Act and Inflation Reduction Act has driven sizable private manufacturing investment, which in turn stimulates advisory demand. As 75% of knowledge workers in 2025 actively use AI-enabled tools, organizations seek change-management guidance to ensure workforce adoption while safeguarding data. These dynamics underpin sustained spending on enterprise architecture, cloud migration, and process re-engineering. Consulting firms that integrate AI with traditional ERP programs are positioned to capture the next wave of transformation budgets.

Generative-AI Copilots Creating Advisory White-Space

Accenture has allocated USD 3 billion to Data & AI and plans to double its AI workforce, underlining the scale of investment channeled into intelligent platforms. Despite heavy hype, only 38% of legal, finance, and accounting professionals actively use sector-specific GenAI tools, largely due to privacy and customization constraints. This adoption gap fuels advisory opportunities in AI governance, responsible-use policy design, and domain-specific model tuning. Meanwhile, AI agents that draft presentations and proposals are compressing junior consultant workflows, prompting firms to shift hiring toward experienced talent who can supervise human-AI teams.

Consulting Talent Wage Inflation

Compensation for experienced consultants has risen sharply since 2024, reflecting fierce competition for digital and analytics skill sets in coastal and fast-growing southern metros. Wage pressure squeezes margins because firms cannot fully pass higher labor costs through to outcome-linked contracts. Employers are leaning more on contingent labor and specialist contractors to smooth project staffing and keep fixed costs low. Hybrid work remains a retention lever, yet it challenges knowledge transfer and team cohesion, especially for junior staff who rely on in-person apprenticeship. Leading firms responded by trimming associate ranks while preserving partner pipelines, a strategy that lowers cost but risks diluting long-term succession depth.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory-Driven Advisory Spend

- Outcome-Based Pricing Uptake

- Client In-House Consulting Build-Outs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Operations Consulting contributed 25.3% of the US management consulting services market in 2024 and remains central because enterprises are optimizing cost structures while fortifying supply chains against geopolitical risk. The push for nearshoring and smart factory adoption sustains robust demand for process re-engineering and Lean Six Sigma programs. Strategy Consulting sits second by revenue as C-suites seek integrated digital and AI roadmaps that balance growth with risk mitigation. Financial Advisory continues to draw steady assignments linked to regulatory capital planning, valuation, and post-merger integration. Technology Advisory is achieving mid-single-digit growth as cloud migration and AI stack modernization initiatives accelerate. HR Consulting faces headwinds from automated sourcing tools and internal talent functions, yet new mandates around AI workforce planning create specialist niches. Risk and Compliance Consulting is buoyed by evolving ESG disclosure rules and cybersecurity threats. Sustainability Consulting is the fastest-expanding service line, growing at 7.2% CAGR through 2030 as companies pursue net-zero commitments and transparent reporting.

Operations Consulting is forecast to widen its lead as industrial capital expenditure rises under the CHIPS Act, delivering a stable anchor for the US management consulting services market. Strategy practices will increasingly bundle AI operating-model design with governance frameworks to offset commoditization of baseline strategic analysis. Financial Advisory is projected to benefit from a cyclical uptick in distressed mergers and acquisitionsopportunities, while Technology Advisory is poised for double-digit demand spikes in data-platform re-architecture. Sustainability Consulting will capture share by embedding carbon-accounting toolkits into operational workstreams. Through 2030, the service-mix evolution is expected to keep the US management consulting services market size on a mid-single-digit growth path, with margin upsides accruing to firms that cross-sell multi-disciplinary offerings.

Large Enterprises generated 65.72% of the US management consulting services market size in 2024 because of their extensive transformation budgets and complex compliance obligations. Multi-year digital enablement and regulatory remediation programs keep these clients engaged across several practice lines. Yet start-ups show the highest growth, advancing at a 5.9% CAGR as venture-backed firms seek outside expertise to scale operations, navigate regulatory filings, and integrate AI responsibly. Small and Medium Enterprises continue outsourcing niche projects where internal skill gaps are acute, particularly in cybersecurity and cloud migration.

In the forecast period, some large corporations will cap external spend once internal consulting hubs mature, trimming addressable revenue yet creating opportunities for firms that supply specialized accelerators, benchmarks, and advanced analytics assets. Start-ups will widen their share because outcome-based pricing makes premium advice more attainable by linking fees to fundraising milestones or revenue growth. For the US management consulting services market, a blended client mix stabilizes revenue flows and cushions cyclicality tied to large enterprise budget resets.

US Management Consulting Services Market is Segmented by Service Type (Operations Consulting, Strategy Consulting, and More), Client Organization Size (Large Enterprises and Small and Medium Enterprises), Consulting Domain (Enterprise Strategy, Front-Office Transformation, and More), and End-User Industry (BFSI, Life Sciences and Healthcare, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Deloitte

- PwC

- Accenture

- McKinsey and Company

- EY

- KPMG

- Boston Consulting Group

- Bain and Company

- Booz Allen Hamilton

- Kearney

- IBM Consulting

- Cognizant Consulting

- Grant Thornton

- Oliver Wyman

- Protiviti

- Alvarez and Marsal

- L.E.K. Consulting

- Huron Consulting Group

- Guidehouse

- Slalom

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Digital-first transformation demand

- 4.2.2 Regulatory-driven advisory spend

- 4.2.3 Cost-out and operational excellence focus

- 4.2.4 Generative-AI copilots creating advisory white-space

- 4.2.5 Outcome-based pricing uptake

- 4.2.6 Mid-market talent gaps outsourcing to consultants

- 4.3 Market Restraints

- 4.3.1 Consulting talent wage inflation

- 4.3.2 Client in-house consulting build-outs

- 4.3.3 Big-4 antitrust scrutiny and audit/consulting split risk

- 4.3.4 GenAI commoditising research-heavy tasks

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of Impact of Macro-Economic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 Operations Consulting

- 5.1.2 Strategy Consulting

- 5.1.3 Financial Advisory

- 5.1.4 Technology Advisory

- 5.1.5 HR Consulting

- 5.1.6 Risk and Compliance Consulting

- 5.1.7 Others

- 5.2 By Client Organisation Size

- 5.2.1 Large Enterprises

- 5.2.2 Small and Medium Enterprises

- 5.3 By Consulting Domain

- 5.3.1 Enterprise Strategy

- 5.3.2 Front-Office Transformation

- 5.3.3 Supply-Chain and Operations

- 5.3.4 Digital Transformation

- 5.3.5 Cyber-Risk and Regulation

- 5.3.6 MandA and Restructuring

- 5.3.7 Others

- 5.4 By End-User Industry

- 5.4.1 BFSI

- 5.4.2 Life Sciences and Healthcare

- 5.4.3 IT and Telecommunications

- 5.4.4 Manufacturing and Industrial

- 5.4.5 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Deloitte

- 6.4.2 PwC

- 6.4.3 Accenture

- 6.4.4 McKinsey and Company

- 6.4.5 EY

- 6.4.6 KPMG

- 6.4.7 Boston Consulting Group

- 6.4.8 Bain and Company

- 6.4.9 Booz Allen Hamilton

- 6.4.10 Kearney

- 6.4.11 IBM Consulting

- 6.4.12 Cognizant Consulting

- 6.4.13 Grant Thornton

- 6.4.14 Oliver Wyman

- 6.4.15 Protiviti

- 6.4.16 Alvarez and Marsal

- 6.4.17 L.E.K. Consulting

- 6.4.18 Huron Consulting Group

- 6.4.19 Guidehouse

- 6.4.20 Slalom

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment