PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851083

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851083

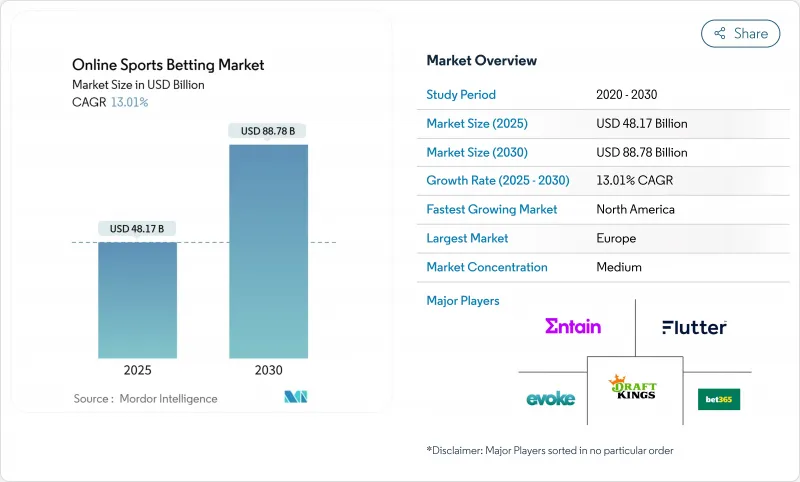

Online Sports Betting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

By 2030, the online sports betting market is projected to surge to USD 88.78 billion, up from USD 48.17 billion in 2025, marking a CAGR of 13.01%.

Key drivers of this growth include a wave of global market legalizations, the ubiquity of smartphones, and the rise of real-time data feeds that enhance live betting. As firms pivot from desktop to mobile-centric platforms, many are also leveraging blockchain for secure and efficient transactions. Furthermore, the use of advanced analytics and AI is crafting tailored user experiences, which in turn bolsters both customer loyalty and betting frequency. Established players are accelerating tech adoption through strategic mergers and acquisitions. Meanwhile, fresh entrants from the media and cryptocurrency realms are reshaping the landscape with their novel betting platforms and experiences.

Global Online Sports Betting Market Trends and Insights

Advertising and Promotional Activities by the Operators

Operators have shifted their focus in sports betting advertising from mere brand awareness to intricate customer acquisition strategies, now dedicating 35-40% of their marketing budgets to performance-driven campaigns. This evolution underscores the market's maturation, prioritizing tangible returns over mere visibility. The American Gaming Association (AGA) reports that in 2024, Americans legally wagered over USD 147 billion on sports, marking a 23% increase from 2023 and setting the stage for cutting-edge promotional tactics. The legalization of sports betting in additional states has further fueled this growth, expanding the addressable market for operators. DraftKings' Q1 2025 figures underscore the potency of these strategies: revenue surged 20% to USD 1.41 billion, and Monthly Unique Players jumped 28% to 4.3 million, even amidst challenges like 'customer-friendly' outcomes during March Madness. Regional disparities in promotional effectiveness are pronounced, with North American operators achieving conversion rates 2.3 times the global average, driven by the market's relative infancy, pent-up demand, and the increasing adoption of mobile betting platforms, which have streamlined user experiences and boosted engagement.

Data Analytics and Personalization Benefitting Betting Experience

Operators are now harnessing customer data, owing to advanced analytics, to craft hyper-personalized betting experiences that boost engagement. This goes beyond mere recommendations; it's about adjusting odds dynamically, tailored to individual betting habits and preferences. The World Lottery Association notes that the online sports betting market surged, especially during the pandemic, fueled by better mobile access, digitalization, and the United States's move to legalize sports betting. Technologies like AI, machine learning, and real-time analytics are reshaping the betting world, paving the way for in-game betting and richer user experiences. Additionally, blockchain technology is emerging as a key enabler, ensuring transparency and security in transactions, which is critical for building trust among users. Market leaders, recognizing the competitive edge from adept data use, are channeling significant portions of their tech budgets into analytics. The rising commercial value of data is underscored by major partnerships, like Genius Sports' USD 120 million annual deal with the NFL, spotlighting the growing significance of data rights in sports betting. Furthermore, the increasing adoption of cloud computing is facilitating the scalability and efficiency of data processing, enabling operators to handle vast amounts of real-time data seamlessly.

Regulatory Uncertainty and Compliance Cost

Online sports betting operators grapple with a fragmented regulatory landscape, facing significant operational challenges. In multi-jurisdiction operations, compliance costs can consume a substantial portion of their budgets. This complexity isn't limited to just licensing; it spans advertising restrictions, data protection mandates, and responsible gambling obligations, all of which can vary widely from one market to another. Addressing these challenges, the SBC Summit Malta 2025 will spotlight Europe's regulatory landscape, delving into the legal and compliance intricacies of the gambling industry. Set for June 11, the summit will host discussions centered on major markets such as the United Kingdom, Germany, and Italy, with an emphasis on licensing reforms and compliance practices. Meanwhile, in the United States, the sports betting landscape has transformed into a multi-billion-dollar industry. This surge follows the Supreme Court's 2018 decision to overturn PASPA, leading to 38 states now permitting sports betting. However, these regulatory uncertainties not only delay market entry strategies but also inflate operational costs. Smaller operators, in particular, find themselves at a disadvantage, struggling to allocate the resources needed to navigate this intricate compliance maze.

Other drivers and restraints analyzed in the detailed report include:

- Affiliate Marketing and Sponsorship Deals

- Gamification and User Experience Innovations

- Increasing Fruadulent Cases

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, football captures a commanding 36.58% share of the online sports betting market, underscoring its global appeal and the media spotlight that continually fuels betting opportunities. Bettors, whether novices or veterans, are captivated by football's mix of predictable statistics and real-time unpredictability. This blend not only keeps them engaged but also highlights the sport's structured nature, making it a prime target for AI-driven analytics that reshape the modeling of performance variables and outcome probabilities.

Tennis is on a rapid ascent, eyeing a projected CAGR of 13.55% from 2025 to 2030. The sport's year-round global calendar, combined with the fast-paced nature of point-by-point betting, drives this growth. Tennis's structured format ensures consistent engagement between major tournaments and positions it as a favored choice for in-play betting. Further underscoring tennis's rising prominence in the betting landscape, Sportradar's March 2025 acquisition of IMG ARENA strengthens its portfolio, with a keen focus on tennis, soccer, and basketball. Tennis's global appeal, its rich statistical landscape, and the explosion of streaming options-allowing bettors to watch live matches-are propelling the sport's betting surge.

The Online Sports Betting Market Report Segments the Industry Into Sport Type (Football, Basketball, Horse Racing, Baseball, Tennis, Other Sport Types), End User (Desktop, Mobile), Betting Type (Pre-Match/Fixed-Odds and Live/In-Play), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). Market Sizing is Presented in USD Value Terms for all the Abovementioned Segments.

Geography Analysis

In 2024, Europe commands a dominant 49.88% share of the online sports betting market, bolstered by established regulatory frameworks and a robust betting culture in key markets such as the United Kingdom, Germany, and Italy. With its mature market status, operators in Europe are prioritizing product differentiation and customer retention over mere acquisition, leaning heavily on personalization and gamification as competitive strategies. Regulatory shifts are pivotal, as highlighted by the SBC Summit Malta 2025, which will delve into Italy's new gambling license regime, the UK's regulatory nuances, and Germany's channelization hurdles. Additionally, the summit will shed light on Malta's compliance updates and Curacao's fresh licensing framework, all while emphasizing the global regulatory volatility that operators face in Europe.

North America is on track to be the fastest-growing region, boasting a projected CAGR of 14.87% from 2025 to 2030. This surge is largely attributed to the widespread legalization of sports betting across the United States, a movement ignited by the 2018 Supreme Court's decision to overturn PASPA. By 2025, sports betting will have gained legal status in 38 states, Washington, D.C., and Puerto Rico. Notably, Missouri has recently come on board, with several other states actively contemplating their regulatory approaches. This shift has led vendors to increasingly collaborate with software suppliers, notably Evolution Gaming, to enhance the consumer gaming experience. With licensed operators and platforms at the helm, users can effortlessly place bets through computers, smartphones, and other internet-enabled devices. This trajectory accentuates the burgeoning appeal of online gambling in the U.S., a trend significantly amplified by digital advancements. Supporting this narrative, data from the American Gaming Association reveals that in 2024, 55% of American adults participated in some form, with 28% frequenting physical casinos and 21% engaging in sports betting.

The online sports betting market in Asia-Pacific, Middle East and Africa, and South America continues to expand through enhanced internet accessibility, increased smartphone adoption, and regulatory developments. Asia-Pacific demonstrates the highest market penetration, with India and the Philippines reporting substantial mobile betting transactions. In the Middle East and Africa region, Nigeria and South Africa have established themselves as primary markets, supported by digital payment infrastructure and increased sports consumption among the younger demographic. South America's market development accelerated following Brazil's implementation of online sports betting regulations in 2023, creating market entry opportunities for operators. These regions exhibit significant market potential as technological infrastructure advances and market acceptance increases.

- Flutter Entertainment plc

- Entain plc

- Bet365 Group Ltd

- DraftKings Inc.

- Evoke Plc

- Kindred Group

- Betsson AB

- Penn Entertainment Inc.

- PointsBet Holdings Ltd.

- MGM Resorts International (BetMGM JV)

- Caesars Entertainment, Inc

- Sportradar Group AG

- Kambi Group plc

- Fanatics, Inc.

- Super Group Ltd. (Betway)

- Mozzart Limited

- Marikit Holdings Casinos company (22bet)

- SportPesa

- Intralot SA

- Smarkets (Malta) Limited

- Pinnacle Sports Group

- Parimatch Tech

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Advertising and Promotional Activities by the Operators

- 4.2.2 Data Analytics & Personalization Benefitting Betting Experience

- 4.2.3 Affiliate Marketing & Sponsorship Deals

- 4.2.4 Gamification & User Experience Innovations

- 4.2.5 Integration of Digital Payment Solutions

- 4.2.6 Technological Advancements in Live Betting

- 4.3 Market Restraints

- 4.3.1 Regulatory Uncertainty and Compliance Cost

- 4.3.2 Increasing Fruadulent Cases

- 4.3.3 Growing Concerns about Gambling Addiction

- 4.3.4 Competition from Illegal Betting Platforms

- 4.4 Technology Outlook

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Sports Type

- 5.1.1 Football

- 5.1.2 Basketball

- 5.1.3 Horse Racing

- 5.1.4 Baseball

- 5.1.5 Tennis

- 5.1.6 Other Sports Type

- 5.2 By End User

- 5.2.1 Desktop

- 5.2.2 Mobile

- 5.3 By Betting Type

- 5.3.1 Pre-Match/Fixed-Odds

- 5.3.2 Live/In-Play

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Spain

- 5.4.2.5 Netherlands

- 5.4.2.6 Italy

- 5.4.2.7 Sweden

- 5.4.2.8 Poland

- 5.4.2.9 Belgium

- 5.4.2.10 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Indonesia

- 5.4.3.7 Thailand

- 5.4.3.8 SIngapore

- 5.4.3.9 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Chile

- 5.4.4.5 Peru

- 5.4.4.6 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 South Africa

- 5.4.5.3 Nigeria

- 5.4.5.4 Saudi Arabia

- 5.4.5.5 Egypt

- 5.4.5.6 Morocco

- 5.4.5.7 Turkey

- 5.4.5.8 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Flutter Entertainment plc

- 6.4.2 Entain plc

- 6.4.3 Bet365 Group Ltd

- 6.4.4 DraftKings Inc.

- 6.4.5 Evoke Plc

- 6.4.6 Kindred Group

- 6.4.7 Betsson AB

- 6.4.8 Penn Entertainment Inc.

- 6.4.9 PointsBet Holdings Ltd.

- 6.4.10 MGM Resorts International (BetMGM JV)

- 6.4.11 Caesars Entertainment, Inc

- 6.4.12 Sportradar Group AG

- 6.4.13 Kambi Group plc

- 6.4.14 Fanatics, Inc.

- 6.4.15 Super Group Ltd. (Betway)

- 6.4.16 Mozzart Limited

- 6.4.17 Marikit Holdings Casinos company (22bet)

- 6.4.18 SportPesa

- 6.4.19 Intralot SA

- 6.4.20 Smarkets (Malta) Limited

- 6.4.21 Pinnacle Sports Group

- 6.4.22 Parimatch Tech

7 Market Opportunities & Future Outlook