PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906898

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906898

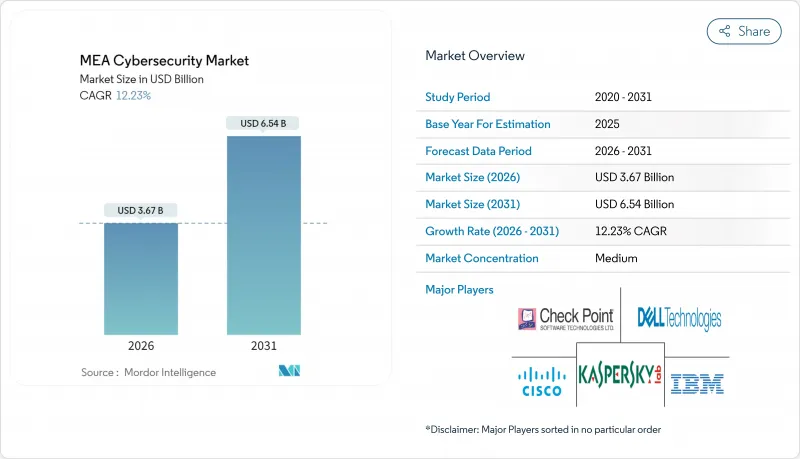

MEA Cybersecurity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Middle East and Africa cybersecurity market size in 2026 is estimated at USD 3.67 billion, growing from 2025 value of USD 3.27 billion with 2031 projections showing USD 6.54 billion, growing at 12.23% CAGR over 2026-2031.

Rapid sovereign-cloud rollouts across the Gulf Cooperation Council, mounting operational-technology (OT) threats to regional oil and gas assets, and explosive mobile-money adoption in Sub-Saharan Africa are converging to lift security spending. Mega-event pipelines such as Expo 2030 and NEOM drive hardening of critical national infrastructure, while cloud-delivered security gains traction as organizations modernize toward zero-trust architectures. Parallel cost pressures from an acute talent shortage and fragmented data-protection laws create openings for managed security service providers to capture share in the Middle East and Africa cybersecurity market.

MEA Cybersecurity Market Trends and Insights

Sovereign-cloud and residency mandates across GCC accelerating SOC investments

Mandates embedded in Saudi Arabia's Essential Cybersecurity Controls 2024 and the UAE National IoT Security Policy require in-country data processing, pushing organizations to build local security operations centers and indigenous talent pipelines. The strategy is reinforced by Qatar's National Cybersecurity Strategy 2024-2030, which targets USD 11 billion market value by 2027 and prioritizes managed security services to offset talent shortages. As a result, local SOC build-outs and managed services adoption are expected to anchor long-term growth in the Middle East and Africa cybersecurity market.

Rapid digital-banking license issuance in KSA and UAE boosting compliance-led security spend

Saudi Arabia's regulatory sandbox programs and the UAE's Personal Data Protection Law compel digital banks to demonstrate robust risk-management frameworks before launch. Multiple regulatory checkpoints-from central banks to commerce ministries-require continuous audits, driving demand for consulting, third-party assessments, and automation platforms. Compliance-driven purchases add momentum to the Middle East and Africa cybersecurity market as license applications surge.

Acute shortage of cybersecurity talent inflating service costs

Eighty-seven percent of UAE enterprises struggle to recruit qualified professionals despite monthly salaries exceeding AED 13,500 for consultants. Qatar records 434.09 cybersecurity roles per 100,000 residents, yet demand continues to outstrip supply, forcing organizations to outsource monitoring and incident response. Higher wage bills lift overall project costs and temper adoption rates, particularly among mid-tier enterprises, constraining the Middle East and Africa cybersecurity market.

Other drivers and restraints analyzed in the detailed report include:

- Escalating OT cyber-attacks on oil and gas assets driving ICS/SCADA security uptake

- Explosive mobile-money adoption in Sub-Saharan Africa requiring endpoint and fraud protection

- Fragmented data-protection laws across African nations raising compliance complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions captured 69.28% of revenue in 2025 as organizations procured endpoint, network, and cloud-security suites in bulk. This dominance shows the purchasing power of large enterprises that still favor on-premise appliances for critical environments. Continued innovation in AI-driven threat detection reinforces solution spend, with vendors like SentinelOne adding security-posture management to defend shadow AI assets. The Middle East and Africa cybersecurity market nevertheless shows rising appetite for managed services, evident in a 14.68% CAGR outlook fueled by acute talent shortages and compliance burdens.

Professional services grow as integrators tailor complex hybrid architectures across sovereign-cloud environments. SMEs in particular gravitate toward SOC-as-a-Service offerings such as Liquid C2, which bundles monitoring, incident response, and regulatory reporting for a predictable fee structure. The shift reallocates share within the Middle East and Africa cybersecurity industry while preserving solution sales for large renovation projects.

On-premises architectures held 61.65% of the Middle East and Africa cybersecurity market size in 2025 due to data-sovereignty rules and legacy SCADA linkages. Yet cloud-delivered security is forecast to expand at 15.43% CAGR as regional providers establish local Points of Presence that meet residency mandates. Cisco's UAE Secure Service Edge node exemplifies cloud localization that lowers latency and aligns to GCC controls.

Hybrid models now dominate migration roadmaps. Organizations retain sensitive workloads in-country while routing analytics and sandboxing tasks to regional clouds. Gartner summit dialogues underscore zero-trust adoption as enterprises decouple identity from perimeter, further propelling cloud uptake within the Middle East and Africa cybersecurity market.

The Middle East and Africa Cybersecurity Market Report Segments the Industry Into by Offering (Solutions, and Services), Deployment Mode (On-Premise, and Cloud), End-User Vertical (BFSI, Healthcare, IT and Telecom, Industrial and Defense, Manufacturing, Retail and E-Commerce, Energy and Utilities, Manufacturing, and Others), End-User Enterprise Size (Small and Medium Enterprises (SMEs), and Large Enterprises), and Geography.

List of Companies Covered in this Report:

- IBM Corporation

- Cisco Systems Inc.

- Palo Alto Networks Inc.

- Fortinet Inc.

- Check Point Software Technologies Ltd.

- Trend Micro Inc.

- Broadcom (Symantec)

- Sophos Ltd.

- Kaspersky Lab

- Microsoft Corp.

- CrowdStrike Holdings Inc.

- Darktrace plc

- Rapid7 Inc.

- Mandiant

- McAfee Corp.

- Splunk Inc.

- LogRhythm Inc.

- Proofpoint Inc.

- BAE Systems Applied Intelligence

- Help AG

- StarLink DMCC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Sovereign-cloud and Residency Mandates across GCC Accelerating SOC Investments

- 4.2.2 Rapid Digital-Banking License Issuance in KSA and UAE Boosting Compliance-led Security Spend

- 4.2.3 Escalating OT Cyber-attacks on Oil and Gas Assets Driving ICS/SCADA Security Uptake

- 4.2.4 Explosive Mobile-Money Adoption in Sub-Saharan Africa Requiring Endpoint and Fraud Protection

- 4.2.5 Mega-Events Pipeline (Expo 2030, Neom, Dubai Airshow) Intensifying Critical-Infrastructure Hardening

- 4.2.6 New National Cyber Regulations (NCA ECC, UAE NESA, Egypt DP Law) Mandating Threat-Intel Sharing

- 4.3 Market Restraints

- 4.3.1 Acute Shortage of Cybersecurity Talent Inflating Service Costs

- 4.3.2 Fragmented Data-Protection Laws across African Nations Raising Compliance Complexity

- 4.3.3 Budget Constraints among African SMEs Prioritising Basic Digitisation over Security

- 4.3.4 Import Dependence on Security Appliances Exposed to Geopolitical Supply-Chain Disruptions

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Key Use Cases and Case Studies

- 4.9 Impact on Macroeconomic Factors of the Market

- 4.10 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Offering

- 5.1.1 Solutions

- 5.1.1.1 Application Security

- 5.1.1.2 Cloud Security

- 5.1.1.3 Data Security

- 5.1.1.4 Identity and Access Management

- 5.1.1.5 Infrastructure Protection

- 5.1.1.6 Integrated Risk Management

- 5.1.1.7 Network Security Equipment

- 5.1.1.8 Endpoint Security

- 5.1.1.9 Other Services

- 5.1.2 Services

- 5.1.2.1 Professional Services

- 5.1.2.2 Managed Services

- 5.1.1 Solutions

- 5.2 By Deployment Mode

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 By End-User Vertical

- 5.3.1 BFSI

- 5.3.2 Healthcare

- 5.3.3 IT and Telecom

- 5.3.4 Industrial and Defense

- 5.3.5 Manufacturing

- 5.3.6 Retail and E-commerce

- 5.3.7 Energy and Utilities

- 5.3.8 Manufacturing

- 5.3.9 Others

- 5.4 By End-User Enterprise Size

- 5.4.1 Small and Medium Enterprises (SMEs)

- 5.4.2 Large Enterprises

- 5.5 By Geography

- 5.5.1 Middle East

- 5.5.1.1 Saudi Arabia

- 5.5.1.2 United Arab Emirates

- 5.5.1.3 Qatar

- 5.5.1.4 Bahrain

- 5.5.1.5 Kuwait

- 5.5.1.6 Oman

- 5.5.1.7 Israel

- 5.5.1.8 Turkey

- 5.5.2 Africa

- 5.5.2.1 South Africa

- 5.5.2.2 Egypt

- 5.5.2.3 Nigeria

- 5.5.2.4 Kenya

- 5.5.2.5 Morocco

- 5.5.2.6 Rest of Africa

- 5.5.1 Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 IBM Corporation

- 6.4.2 Cisco Systems Inc.

- 6.4.3 Palo Alto Networks Inc.

- 6.4.4 Fortinet Inc.

- 6.4.5 Check Point Software Technologies Ltd.

- 6.4.6 Trend Micro Inc.

- 6.4.7 Broadcom (Symantec)

- 6.4.8 Sophos Ltd.

- 6.4.9 Kaspersky Lab

- 6.4.10 Microsoft Corp.

- 6.4.11 CrowdStrike Holdings Inc.

- 6.4.12 Darktrace plc

- 6.4.13 Rapid7 Inc.

- 6.4.14 Mandiant

- 6.4.15 McAfee Corp.

- 6.4.16 Splunk Inc.

- 6.4.17 LogRhythm Inc.

- 6.4.18 Proofpoint Inc.

- 6.4.19 BAE Systems Applied Intelligence

- 6.4.20 Help AG

- 6.4.21 StarLink DMCC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment