PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851272

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851272

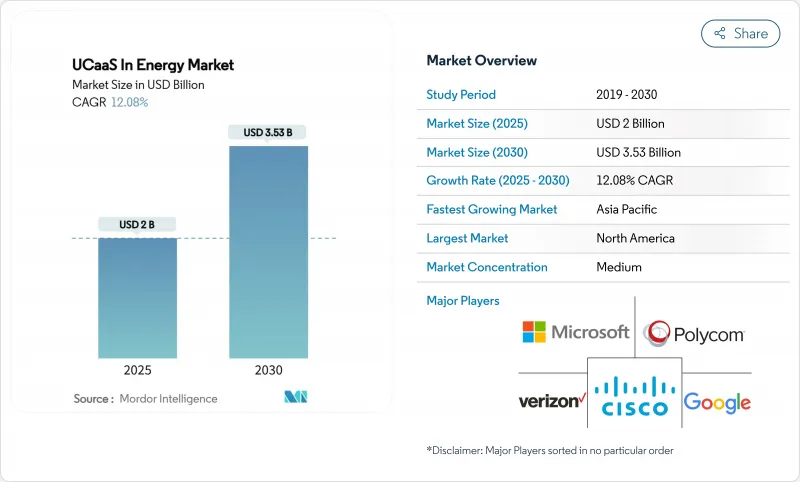

UCaaS In Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The UCaaS in energy market size stood at USD 2 billion in 2025 and is forecast to reach USD 3.53 billion by 2030, translating into a 12.08% CAGR over 2025-2030.

Rapid digitalization, rising field-worker collaboration needs and the fusion of operational technology with information technology are accelerating adoption. Utilities are modernizing grids, oil and gas operators are digitizing wells, and renewable asset owners are deploying cloud-native tools, all of which demand unified communications that operate reliably across harsh, distributed environments. Edge architectures, private-5G connectivity and consumption-based pricing lower total cost of ownership, while cyber-resilience mandates push firms to standardize on secure, unified voice and video platforms. Competitive intensity is moderate; large telecom groups, cloud vendors and energy-focused specialists seek share through hybrid deployments and domain-specific features. Although integration complexity and data-sovereignty rules slow some projects, regulatory support for modern, AI-enabled communications continues to unlock opportunities across segments and regions.

Global UCaaS In Energy Market Trends and Insights

Proliferation of Cloud-Native Energy IT Ecosystems

Major operators such as Aramco are rolling out industrial distributed clouds that bring compute and storage closer to assets, enabling real-time analytics that demand equally agile communications . Cloud-native UCaaS platforms integrate via open APIs, streamline provisioning and allow energy firms to spin up new voice, video and messaging services alongside edge workloads. Shifting from on-premises PBXs to scalable, cloud-centric systems also helps reduce lifecycle costs while satisfying regulatory patch-management requirements. As more operational applications become container-based, unified communications embedded within those micro-services enable seamless data flow between control rooms and field teams, driving a tangible uplift in productivity and safety.

Edge-Enabled Remote Asset Collaboration

Chevron and Shell deploy edge gateways that monitor wellhead sensors and instantly trigger voice or video calls when anomalies surface, lowering downtime and travel costs. Augmented-reality headsets let technicians overlay schematics while receiving expert guidance through UCaaS video streams that stay local when connectivity falters. Low-latency processing at the edge ensures critical alerts route through redundant channels, preserving safety compliance even in offshore or desert sites. Edge-enabled workflows therefore upgrade collaboration quality without overloading backhaul links, strengthening the business case for unified communications embedded at site level.

OT-IT Integration Complexity in Legacy Assets

Refineries still depend on decades-old SCADA and DCS platforms that run proprietary protocols and isolate themselves from corporate networks for safety reasons. Introducing cloud-based UCaaS requires secure gateways, protocol converters and rigorous change-management, all of which extend roll-out timelines. Resistance also stems from plant engineers who prioritize uptime over new features, forcing phased deployments that blend on-premises voice with modern cloud functions. High consulting and cybersecurity costs therefore curb short-term uptake, particularly among mid-sized asset owners.

Other drivers and restraints analyzed in the detailed report include:

- 5G Private Networks in Oilfields and Plants

- Vendor Shift to Consumption-Based Pricing

- Persistent Data-Sovereignty Hurdles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Telephony retained the biggest slice of the UCaaS in energy market share at 37.5% in 2024, supported by voice-centric safety protocols across plants and pipelines . Yet Contact-Center-as-a-Service (CCaaS) is projected to post a 17.86% CAGR through 2030 as utilities deploy AI chatbots and omnichannel interfaces to handle outage reports and billing queries. This pivot improves satisfaction scores while trimming call-handling costs.

Beyond front-office gains, CCaaS also integrates with outage-management systems and smart-meter data, letting agents proactively alert customers during grid events. Collaboration suites, unified messaging and conferencing tools meanwhile serve internal teams by unifying desktop, mobile and field devices. Across the forecast, the UCaaS in energy market size attributable to "other services" such as API integrations will expand steadily as operators embed communications within IoT and maintenance workflows.

Public cloud instances commanded 60.4% of the UCaaS in energy market size in 2024 due to rapid spin-up times and minimal hardware needs. However enterprises seeking local data residency for SCADA conversations or incident recordings are driving hybrid models toward a 21.2% CAGR. Hybrid designs route low-risk traffic via hyperscale regions while anchoring sensitive streams in on-premises or edge nodes.

This architecture balances agility with compliance and has become popular among European utilities navigating strict privacy statutes. Private deployments remain vital for nuclear plants and offshore rigs where full isolation is mandatory, yet rising maintenance costs encourage gradual migration of non-critical workloads to cloud touchpoints, underscoring hybrid's long-term appeal.

The Unified Communication As-A-Service in Energy Market Report Segments the Industry Into by Component (Telephony, Collaboration Tools, Unified Messaging, Conferencing, and More), Deployment Model (Private, Public, and Hybrid), Enterprise Size (Large Enterprise, and Small and Medium Enterprise), Energy Subsector (Oil and Gas, Power Generation, and More), and Geography.

Geography Analysis

North America's 44.3% 2024 revenue share reflects a large installed base of digital oilfields, smart-grid pilots and mature cloud infrastructure. Federal stimulus for grid resilience coupled with private-5G pilots in shale basins underpin continued demand. The UCaaS in energy market size attributable to utilities alone is set to climb as investor-owned firms upgrade contact centers to manage electrification queries.

Asia-Pacific will expand at a 19.8% CAGR through 2030 as China accelerates AI-based power-sector reforms and India opens renewable corridors that require cloud-integrated communications . Regional governments endorse domestic data hosting, spurring hybrid models and local edge nodes. Japanese gas distributors and Australian LNG exporters likewise integrate UCaaS to oversee remote assets and meet workforce-safety mandates.

Europe maintains steady momentum driven by Fit-for-55 regulations demanding cyber-secure, interoperable grids. Cross-border energy exchanges and offshore wind clusters necessitate real-time coordination among TSOs and service vessels. Eastern European grids, seeking to reduce Russian gas dependency, invest in cloud-native dispatch tools. Meanwhile, Middle East and Africa embrace private-LTE and 5G for mega-projects, yet connectivity gaps in rural production sites restrain full-scale adoption. Across all regions, regulatory clarity and reliable broadband remain key determinants of rollout pace.

- Verizon Communications Inc.

- Microsoft Corporation

- Cisco Systems, Inc.

- RingCentral, Inc.

- Google LLC

- 8x8, Inc.

- Zoom Video Communications, Inc.

- Avaya LLC

- BT Group plc

- Vodafone Group Plc

- AT&T Inc.

- Vonage Holdings Corp.

- Genesys Telecommunications Laboratories, Inc.

- Twilio Inc.

- Mitel Networks Corporation

- NEC Corporation

- ALE International SAS

- West Technology Group, LLC

- Plantronics, Inc.

- Fuze, Inc.

- Tata Communications Limited

- Orange SA

- GoTo Group, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of cloud-native energy IT ecosystems

- 4.2.2 Edge-enabled remote asset collaboration

- 4.2.3 5G private networks in oilfields and plants

- 4.2.4 Vendor shift to consumption-based pricing

- 4.2.5 O-RAN integration with UCaaS for field comms

- 4.2.6 Cyber-resilient voice/video mandates by regulators

- 4.3 Market Restraints

- 4.3.1 OT-IT integration complexity in legacy assets

- 4.3.2 Persistent data-sovereignty hurdles

- 4.3.3 Volatile energy prices delaying IT cap-ex

- 4.3.4 Limited last-mile connectivity in remote sites

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Key Use Cases and Case Studies

- 4.9 Impact on Macroeconomic Factors of the Market

- 4.10 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Telephony

- 5.1.2 Collaboration Tools

- 5.1.3 Unified Messaging

- 5.1.4 Conferencing

- 5.1.5 Contact-Center-as-a-Service

- 5.1.6 Other Services

- 5.2 By Deployment Model

- 5.2.1 Public

- 5.2.2 Private

- 5.2.3 Hybrid

- 5.3 By Enterprise Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises

- 5.4 By Energy Sub-Sector

- 5.4.1 Oil and Gas

- 5.4.2 Power Generation

- 5.4.3 Utilities (TandD)

- 5.4.4 Renewable Energy Assets

- 5.4.5 Mining and Extraction

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Verizon Communications Inc.

- 6.4.2 Microsoft Corporation

- 6.4.3 Cisco Systems, Inc.

- 6.4.4 RingCentral, Inc.

- 6.4.5 Google LLC

- 6.4.6 8x8, Inc.

- 6.4.7 Zoom Video Communications, Inc.

- 6.4.8 Avaya LLC

- 6.4.9 BT Group plc

- 6.4.10 Vodafone Group Plc

- 6.4.11 AT&T Inc.

- 6.4.12 Vonage Holdings Corp.

- 6.4.13 Genesys Telecommunications Laboratories, Inc.

- 6.4.14 Twilio Inc.

- 6.4.15 Mitel Networks Corporation

- 6.4.16 NEC Corporation

- 6.4.17 ALE International SAS

- 6.4.18 West Technology Group, LLC

- 6.4.19 Plantronics, Inc.

- 6.4.20 Fuze, Inc.

- 6.4.21 Tata Communications Limited

- 6.4.22 Orange SA

- 6.4.23 GoTo Group, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment